Wheel Hub and Bearings Market Size (2024 – 2030)

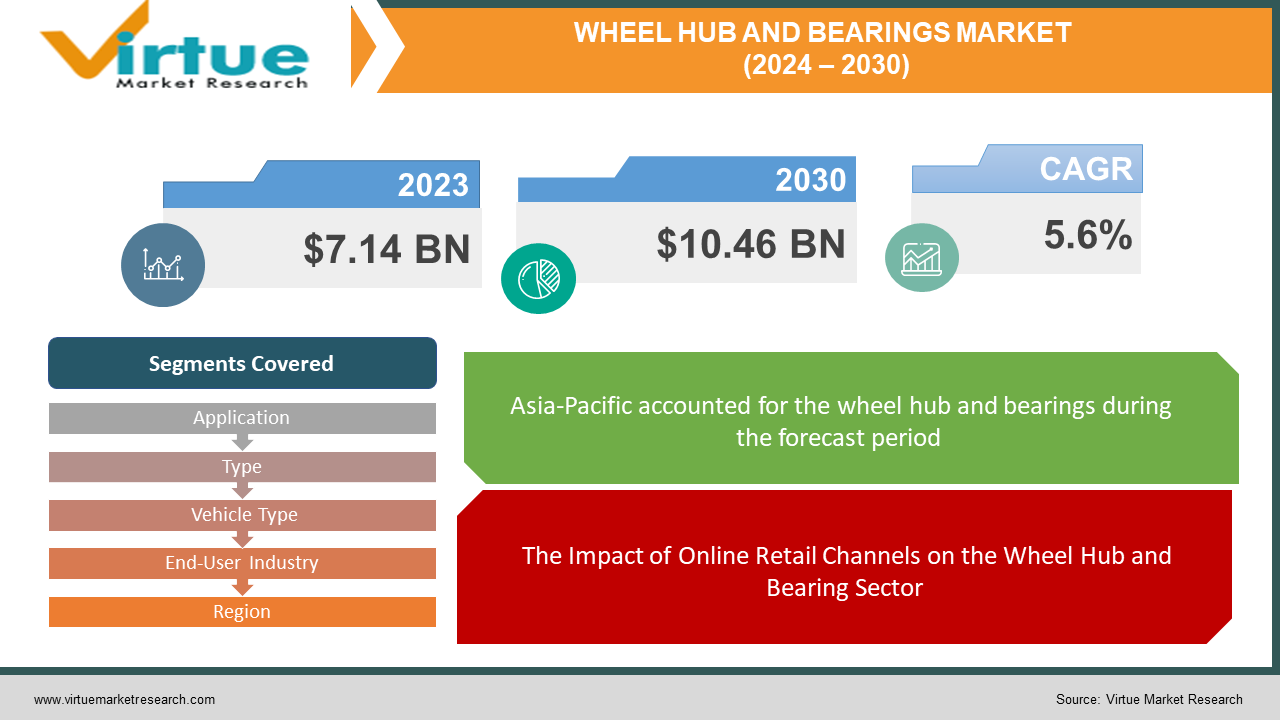

The Wheel Hub and Bearing for power system operations market is predicted to expand from its estimated size of USD 7.14 billion in 2023 to USD 10.46 billion by the end of 2030. Between 2024 and 2030, the market is expected to increase at a compound annual growth rate (CAGR) of 5.6%.

The global wheel hub and bearings market is experiencing strong growth due to technology advancements and the growing demand for cars that are efficient and high-performing. The market offers a wide range of items, such as various wheel hub materials and bearing types, and is split into segments based on vehicle types and sales channels. Areas including North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa have an impact on the market's geographic variety. The industry's commitment to innovation is particularly evident in the incorporation of sensor- and smart-embedded bearings. Despite challenges such as raw material price fluctuation, the market is anticipated to expand at a 6.5% CAGR, indicating a promising future propelled by the demand for trustworthy automotive solutions.

Key Market Insights:

The market for wheel hubs and bearings is being influenced by notable advancements and trends. An important trend in wheel hub production is the growing need for robust, lightweight materials, particularly aluminum alloys. In addition, advances in bearing technology—such as the incorporation of smart sensors for real-time monitoring—are transforming the bearing industry. Growing sales of electric cars drive market growth and necessitate the usage of sophisticated wheel hubs and bearing systems. The market is anticipated to expand at a 6.5% CAGR, propelled by demands from the aftermarket and worldwide auto manufacturing. The market places a strong focus on how essential these parts are to preserving the best possible vehicle performance and safety.

Additionally, by providing customers with an easy way to purchase wheel hub and bearing solutions, the shift in the aftermarket segment towards online retail channels has a significant impact on market dynamics. Regional variations in consumer tastes, legal frameworks, and auto manufacturing lead to a diverse market. To tackle challenges like unstable raw material costs and intense market competition, industry participants must focus on economical manufacturing processes and innovative solutions. As the industry adopts Industry 4.0 concepts, ongoing technological advancements will be crucial in shaping the future landscape of the wheel hub and bearings market. By doing this, the market will be protected and able to adjust to emerging trends in cars

Wheel Hub and Bearings Market Drivers:

Changing Access: The Impact of Online Retail Channels on the Wheel Hub and Bearing Sector.

The emergence of online purchasing channels has caused a significant transformation in the wheel hub and bearings business. Thanks to this shift in distribution methods, customers now have unrivaled access to a wide choice of wheel hub and bearing solutions from the comfort of their homes. Using e-commerce platforms, customers may peruse a variety of products, evaluate features, and make informed decisions. The convenience of online buying is not only revolutionising the aftermarket sector but also beginning to significantly contribute to its growth. As the automotive industry embraces digital trends, online retail channels play a critical role in expanding its market reach and providing easy access to necessary automotive components.

Moving Forward: Factors Supporting the Automotive Industry's Steady Development.

Several significant factors have come together to cause the automobile industry to be going through an unprecedented period of growth. The industry is setting the standard for radical transformation thanks to electrification, increased focus on sustainability, and technological breakthroughs. The increasing demand for cars globally, particularly in emerging economies, is one factor contributing to a rise in production volumes. Stricter emission laws and the introduction of electric and autonomous vehicles have also led to the sector's expansion into new regions. As the automotive sector evolves, this continual growth presents opportunities for innovation and market expansion in addition to challenges.

Getting Around: Requirements for Fuel Efficiency Accelerate the Evolution of the Automotive Industry.

The automotive industry is undergoing a paradigm transition due to its unwavering pursuit of fuel efficiency. Demand for cars with reduced fuel and pollution levels is driving automakers to create innovative new technology. Modern cars are expected to be more efficient, however, the automotive industry is modifying this demand with lightweight materials like aluminium alloys and advanced engine technologies. The global commitment to sustainability and the tightening of environmental regulations are driving automakers to select fuel-efficient technologies and promoting a culture of continuous improvement. As consumers select eco-friendly solutions more and more, the automobile industry's response to fuel efficiency requirements not only alters the driving experience but also indicates a commitment to a cleaner automotive future.

Wheel Hub and Bearings Market Restraints and Challenges:

Wheel Hub and Bearings Market Faces Global Supply Chain Disruptions in Navigating Turbulence.

Disruptions to the global supply chain pose a serious risk to the wheel hub and bearings business. The intricate supply networks that support this company have vulnerabilities that have been made clear by natural disasters, geopolitical instability, and the effects of recent pandemics. These disruptions affect the timely sourcing of raw materials and components that are necessary for manufacturing. With manufacturing and logistics uncertainties plaguing the industry, manufacturers need to re-evaluate and fortify their supply chain plans. The ability to swiftly adapt to these challenges becomes critical to preserving market balance and ensuring a continuous and reliable supply of wheel hubs and bearings to meet global automotive demands.

Act of Balancing: Variations in Raw Material Prices Dynamics of the Strain Wheel Hub and Bearings Market.

The market for wheel hubs and bearings is seriously hampered by the price instability of raw materials. Variations in the cost of raw materials, especially metals like steel and aluminium, contribute to some degree of volatility in manufacturing prices. The majority of these materials are used to make wheel hubs and bearings, therefore the industry must handle the complexities of price variations. Manufacturers need to make sure that their products are of high quality while also managing manufacturing costs in an educated manner during these uncertain times for the market. The capacity to develop flexible pricing strategies and look into substitute materials becomes crucial to decrease the impact of changes in raw material prices on the stability of the market as a whole.

Wheel Hub and Bearings Market Opportunities:

Industry 4.0 Integration is reshaping the production of wheel hubs and bearings, revolutionising manufacturing.

The wheel hub and bearing industry is undergoing a revolution thanks to the use of Industry 4.0 principles. From automation and artificial intelligence to real-time data analytics, manufacturers are leveraging state-of-the-art technologies to improve their manufacturing processes. When producing wheel hubs and bearings, the use of smart manufacturing techniques ensures accuracy, reduces downtime, and boosts productivity. The shift to Industry 4.0 streamlines procedures and facilitates predictive maintenance, allowing manufacturers to foresee issues before they materialise. Since the industry is driving this technological transformation, the implementation of Industry 4.0 concepts is promoting innovation and elevating the standard for the performance and quality of wheel hub and bearing solutions.

Electrifying Prospects: Growing Adoption of Electric Vehicles Drives Change in Wheel Hub and Bearings Market.

The growing popularity of electric vehicles (EVs) is causing a paradigm shift in the wheel hub and bearings business. As the car industry embraces sustainability, manufacturers have unprecedented opportunities to satisfy the unique requirements of electric vehicles. Specialised wheel hubs and bearing systems that can handle the special requirements of electric propulsion are becoming more and more necessary. Manufacturers are at the forefront of developing innovative solutions, from ensuring maximum efficiency to managing weight considerations. The growing popularity of electric vehicles not only signifies a dramatic shift in the automotive sector but also opens up new avenues for growth and innovation in the wheel hub and bearings sector.

WHEEL HUB AND BEARINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Application, Type, Vehicle Type, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

NTN, NSK, Schaeffler, SKF, ILJIN, Wanxiang, JTEKT Shuanglin NTP, TIMKEN, ZheJiang ZhaoFeng |

Wheel Hub and Bearings Market Segmentation: By Type

-

Tradiotional Bearings

-

Smart Bearings

-

Sensor-Embedded Bearings

The wheel hub and bearings market is split into three segments based on the types of bearings used: sensor-embedded bearings, smart bearings, and traditional bearings. The conventional foundation is provided by conventional bearings, which depend on tried-and-true mechanics. Smart bearings incorporate cutting-edge technologies to enhance monitoring and performance. Sensor-embedded bearings, on the other hand, represent the ultimate innovation since they provide real-time data for status monitoring and predictive maintenance. This division symbolises the industry's shift from traditional to technologically advanced solutions, meeting a wide variety of customer demands and aligning with the broader trend of digitalization in the automotive sector.

Among the various types of segmented bearings, sensor-embedded bearings are the most innovative and successful development in the wheel hub and bearings business. The sensor technologies integrated into these bearings enable real-time parameter monitoring and furnish crucial insights into the component's general health and function. Sensor-embedded bearings allow predictive maintenance, which increases dependability and reduces downtime. Preemptively detecting potential issues enhances the overall efficiency, safety, and performance of vehicles. This innovative technique is in line with the industry's goal of greater efficiency and safety, which makes sensor-embedded bearings an important advancement for the wheel hub and bearings business.

Wheel Hub and Bearings Market Segmentation: By Application

-

Chassis Systems

-

Powertrain Systems

-

Drivetrain Systems

-

Others

Based on application, the wheel hub and bearing market is extremely fragmented, encompassing a wide range of automotive systems. These include different applications, chassis systems, drivetrain systems, and powertrain systems. The components that make up a car's chassis are crucial to its handling and structural soundness. The transmission and power generation components of powertrain systems have an impact on performance. Drivetrain systems are primarily concerned with the mechanisms that transfer power to the wheels. The "Others" category lists additional uses and illustrates the extent to which wheel hubs and bearings are utilised in various automotive subsystems. Producers may be able to better understand the market and create tailored tactics that cater to certain automobile applications as a result of this segmentation.

Powertrain Systems are one of the most important classified applications in the wheel hub and bearings market. The powertrain, which consists of the engine and transmission, is an important factor in determining an automobile's performance. The effective performance of wheel hubs and bearings directly affects the overall efficiency, speed, and responsiveness of powertrain systems. The advancement of automobiles, especially with the integration of electric drivetrains, has led to a growing demand for high-performance wheel hubs and bearings in this essential portion. Manufacturers who focus on innovations created especially for Powertrain Systems are strategically positioned to gain from the growing consumer interest in eco-friendly and efficient automotive solutions.

Wheel Hub and Bearings Market Segmentation: By Vehicle Type

-

Compact Cars

-

Mid-size Cars

-

Luxury Cars

-

Sports Cars

The wheel hub and bearings market is divided based on the kinds of vehicles in order to satisfy the different needs of the automotive industry. This division includes luxury automobiles, sports cars, compact cars, and mid-size cars. Compact cars are known for their maneuverability and economy of fuel, thus certain wheel hubs and bearings are necessary. Because their size and performance are intended to be balanced, mid-size cars need parts that enhance comfort and handling. High-end amenities and comfort are given priority in luxurious cars, which means that complex wheel hubs and bearings are needed to guarantee a smooth ride. Sports cars require high-performance components, thus accurate and durable wheel hub and bearing systems are essential. This division of labour acknowledges the distinct requirements of various vehicle types.

Among the vehicle categories that are categorised, sports cars are the one that has the biggest influence on the wheel hub and bearings industry. Because they are designed for high-performance driving, sports vehicles require precision engineering and state-of-the-art materials in their wheel hub and bearing systems. The efficacy, durability, and dependability of these components significantly affect the overall performance and safety of sports cars. Manufacturers who focus on innovations created especially for sports vehicles are strategically positioned to meet the specific needs of this niche market, where responsiveness and better handling are essential. The wheel hub and bearings business may benefit from the rising demand for sports cars if it produces excellent and specialist products.

Wheel Hub and Bearings Market Segmentation: By End-User Industry

-

Automotive Industry

-

Aerospace Industry

-

Industrial Machinery

-

Others

The end-user industries, which include the automotive, aerospace, industrial machinery, and other sectors, are the divisions of the market for wheel hubs and bearings. The automotive sector, which needs a wide range of wheel hub and bearing solutions for various vehicle types, is one of the primary drivers. In the aerospace sector, precision parts are essential for a number of aircraft systems, most notably landing gear. Industrial machinery finds application in the incorporation of robust wheel hubs and bearings into a range of production devices. By extending its use into other industries, the "Others" category demonstrates the versatility of wheel hubs and bearings. Because of this, manufacturers are able to tailor their products to satisfy the specific needs of different end-user industries.

Of the several end-user sectors, the automobile sector is the most productive and important one for wheel hubs and bearings. The automobile industry is one of the major consumers of these components due to the increasing number of cars produced worldwide. The need for durable, trustworthy wheel hubs and bearings in passenger cars, commercial vehicles, and emerging electric vehicles has placed the automotive sector as a key driver of market expansion. Producers who focus on novel ideas and solutions tailored to the specific requirements of the automotive sector are well-positioned to capitalise on the sector's substantial market share and continuous demand.

Wheel Hub and Bearings Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Wheel hub and bearing sales are highly regionally concentrated, with Asia-Pacific accounting for a sizable 46% of the market in 2023. Strong demand is a result of the sheer volume of vehicles manufactured as well as the Asia-Pacific region's continuously expanding automotive aftermarket, which is home to some of the largest automotive production hubs in the world. Because of the presence of large corporations, the region's economic growth, and the expanding demand for vehicles, Asia-Pacific is positioned to dominate the worldwide wheel hub and bearings market.

Europe trails Asia-Pacific in market share, coming in at 21%. The European market is characterised by leading automakers and a strong emphasis on technological breakthroughs, reinforced by the region's stringent laws and commitment to sustainability. North America holds a significant 17% of the market, which can be ascribed to its advanced automotive industry, technological advancements, and consistent demand for wheel hub and bearing solutions. The global car industry is influenced by many geographic factors that affect market shares. Each of the Middle East and Africa and South America accounts for 8% of the total, suggesting that these growing economies have significant potential.

COVID-19 Impact Analysis on the Global Wheel Hub and Bearings Market:

The COVID-19 epidemic caused significant disruptions in the automotive industry and had a significant impact on the global wheel hub and bearings market. Throughout the first phase, supply chain interruptions, lockdowns, and overall economic instability caused a sharp decline in vehicle production and sales. This consequently affected the market for wheel hub and bearing components. But when the market gradually adapted to new norms and governments implemented measures to control the virus, the market started to show signs of recovery. During the pandemic, there was an increase in demand for replacement components, speedier digitization, and a renewed focus on internet retail channels. The market had opportunities as a result of these events to bounce back and realign itself for the post-pandemic era.

Despite these challenges, the COVID-19 effect brought to light the critical importance of flexibility and resilience to the wheel hub and bearings sector. These days, manufacturers are reevaluating their supply chain strategies, giving digital transformation a lot of attention, and incorporating the knowledge they learned from the pandemic into their upcoming business plans. The recovery period has also offered opportunities for innovation and collaboration as the industry transitions to a more technologically sophisticated and sustainable future.

Latest Trends/Developments:

The wheel hub and bearings market is changing due to concerns about sustainability, advancements in technology, and changing consumer preferences. One noteworthy development is the increasing fusion of sensor-embedded bearings with smart technologies. This innovation facilitates real-time component health monitoring, which supports predictive maintenance techniques and enhances overall vehicle performance and safety. As the automotive industry continues to shift towards electric and hybrid vehicles, there is a growing demand for the specialised wheel hub and bearing solutions. This can be attributed to an increased emphasis on lightweight materials and energy-efficient designs.

In addition, there's a noticeable shift in the business towards using sustainable materials and manufacturing practices. Manufacturers are investigating ecologically suitable substitutes, like recycled and lightweight materials, to meet stringent environmental regulations and consumer demands for more eco-friendly solutions. The emergence of online retail channels, which provide consumers with simple access to a range of wheel hub and bearing solutions and are altering conventional distribution systems, is another significant trend in the automotive aftermarket. When combined, these trends show a dynamic and forward-thinking industry prepared to face the challenges and opportunities presented by the rapidly evolving automotive landscape.

Key Players:

-

NTN

-

NSK

-

Schaeffler

-

SKF

-

ILJIN

-

Wanxiang

-

JTEKT

-

Shuanglin NTP

-

TIMKEN

-

ZheJiang ZhaoFeng

Chapter 1. Wheel Hub and Bearings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wheel Hub and Bearings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wheel Hub and Bearings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wheel Hub and Bearings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wheel Hub and Bearings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wheel Hub and Bearings Market – By Application

6.1 Introduction/Key Findings

6.2 Chassis Systems

6.3 Powertrain Systems

6.4 Drivetrain Systems

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Wheel Hub and Bearings Market – By Type

7.1 Introduction/Key Findings

7.2 Tradiotional Bearings

7.3 Smart Bearings

7.4 Sensor-Embedded Bearings

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Wheel Hub and Bearings Market – By Vehicle Type

8.1 Introduction/Key Findings

8.2 Compact Cars

8.3 Mid-size Cars

8.4 Luxury Cars

8.5 Sports Cars

8.6 Y-O-Y Growth trend Analysis End-Use Industry

8.7 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Wheel Hub and Bearings Market – By End-User Industry

9.1 Introduction/Key Findings

9.2 Automotive Industry

9.3 Aerospace Industry

9.4 Industrial Machinery

9.5 Others

9.6 Y-O-Y Growth trend Analysis By End-User Industry

9.7 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 10. Wheel Hub and Bearings Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Application

10.1.2.1 By Type

10.1.3 By Vehicle Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Application

10.2.3 By Type

10.2.4 By Vehicle Type

10.2.5 By End-User Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Application

10.3.3 By Type

10.3.4 By Vehicle Type

10.3.5 By End-User Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Application

10.4.3 By Type

10.4.4 By Vehicle Type

10.4.5 By End-User Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Application

10.5.3 By Type

10.5.4 By Vehicle Type

10.5.5 By End-User Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Wheel Hub and Bearings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 NTN

11.2 NSK

11.3 Schaeffler

11.4 SKF

11.5 ILJIN

11.6 Wanxiang

11.7 JTEKT

11.8 Shuanglin NTP

11.9 TIMKEN

11.10 ZheJiang ZhaoFeng

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Wheel Hub and Bearing for power system operations market is predicted to expand from its estimated size of USD 7.14 billion in 2023 to USD 10.46 billion by the end of 2030. Between 2024 and 2030, the market is expected to increase at a compound annual growth rate (CAGR) of 5.6%.

The primary drivers of the global wheel hub and bearings market are advancements in technology, the increasing need for vehicles with high performance and low fuel consumption, and the continuous growth of the automotive sector.

The vehicle type sector, particularly for passenger cars, dominates the global market for wheel hubs and bearings.

Asia Pacific dominated the wheel hub and bearing market. The region is a hub of technological innovation and advancement.

The electric vehicle category is expected to have the biggest influence on the growth of the wheel hub and bearing market as the automotive industry electrifies.

NTN, NSK, Schaeffler, SKF, ILJIN, Wanxiang, JTEKT, and Shuanglin NTP are few of the Key Players.