Wheat Protein Market Size (2025 – 2030)

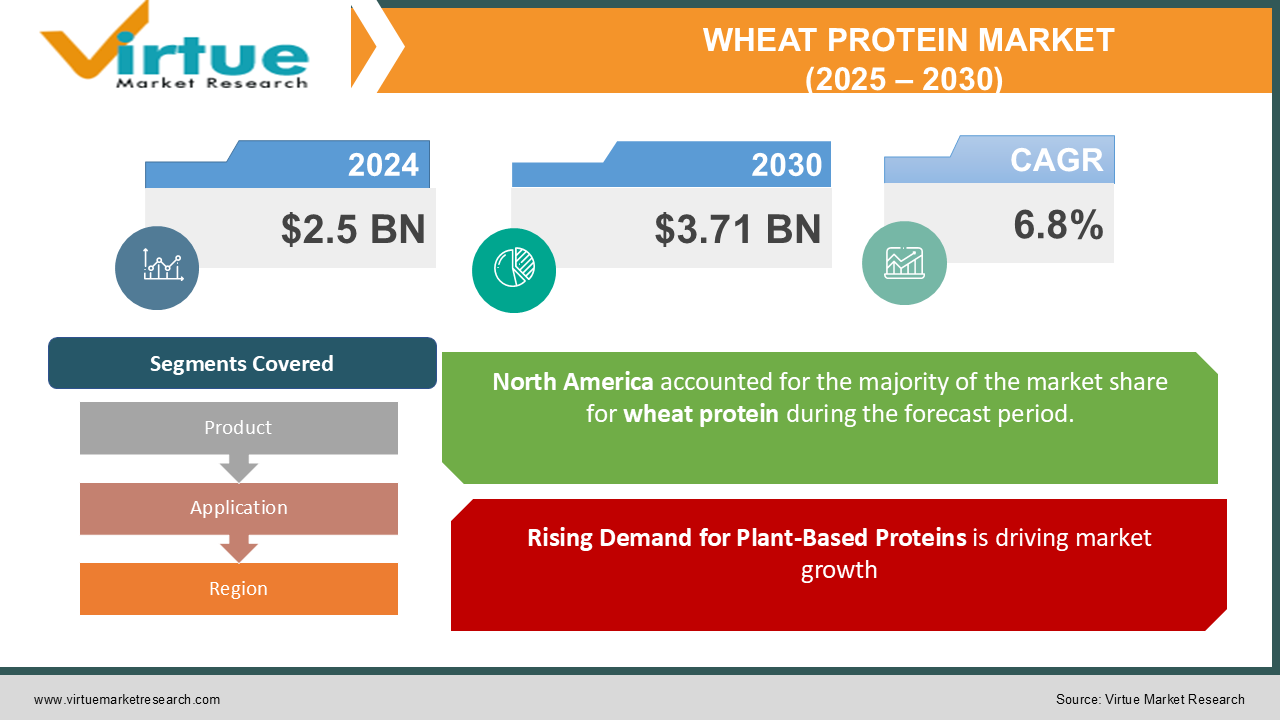

The Global Wheat Protein Market was valued at USD 2.5 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. By 2030, the market is projected to reach USD 3.71 billion.

Wheat protein is a plant-based protein derived from wheat that is widely used in food and beverage formulations due to its functional properties, such as elasticity and water absorption. It is a popular choice for applications in bakery products, meat alternatives, and nutritional supplements. Increasing consumer preference for plant-based diets, coupled with rising demand for clean-label and allergen-free products, is driving the growth of the wheat protein market.

Key Market Insights

Hydrolyzed wheat protein is emerging as a preferred ingredient in personal care products, projected to grow at a CAGR of 7.5% from 2025 to 2030.

The Asia-Pacific region witnessed the fastest growth in 2024, with China and India leading due to their expanding processed food markets and growing health-conscious population.

Increased adoption of wheat protein in sports nutrition products is attributed to its high amino acid content and easy digestibility, with the segment expected to grow by 8% CAGR through 2030.

North America held the largest market share in 2024, contributing 38% of global revenue, owing to the region's established plant-based food market and strong consumer awareness of protein-enriched diets.

Global Wheat Protein Market Drivers

Rising Demand for Plant-Based Proteins is driving market growth:

The growing popularity of plant-based diets has significantly boosted the demand for wheat protein as a sustainable and versatile protein source. Increasing awareness about environmental sustainability and animal welfare is leading consumers to seek plant-based alternatives to meat and dairy. Wheat protein, especially wheat gluten and vital wheat gluten, is extensively used in meat substitutes due to its ability to replicate the texture and mouthfeel of animal-based proteins. The rise in vegan and flexitarian diets worldwide is expected to continue driving demand for wheat protein in various food applications, including ready-to-eat meals, snacks, and bakery products.

Expanding Application in the Food and Beverage Industry is driving market growth:

Wheat protein has become a staple ingredient in the food and beverage industry due to its functional and nutritional properties. In bakery applications, wheat protein provides elasticity and strength, essential for the production of bread, pastries, and pizza dough. In beverages, wheat protein is used in protein shakes and fortified drinks to enhance nutritional profiles. With the rising trend of protein-enriched and clean-label products, wheat protein is finding applications in innovative food formulations, including gluten-free and low-carb offerings. The ability of wheat protein to serve as a cost-effective and allergen-free alternative to other plant-based proteins further enhances its appeal in the market.

Growing Adoption in Sports Nutrition and Health Supplements is driving market growth:

The health and fitness trend has accelerated the adoption of wheat protein in sports nutrition and dietary supplements. Wheat protein, particularly in hydrolyzed form, is favored for its high digestibility and amino acid profile, which supports muscle recovery and growth. As consumers increasingly prioritize fitness and protein-rich diets, wheat protein-based powders and bars are gaining popularity. Additionally, the market benefits from the growing inclination towards natural and plant-based ingredients in supplements, catering to the needs of athletes, fitness enthusiasts, and health-conscious individuals.

Global Wheat Protein Market Challenges and Restraints

Competition from Alternative Plant-Based Proteins is restricting market growth:

The wheat protein market faces stiff competition from other plant-based proteins, such as soy, pea, and rice proteins, which are gaining traction due to their diverse nutritional profiles and versatility. While wheat protein offers excellent functional properties, it lacks the complete amino acid profile of some alternatives, which can limit its use in certain applications. Additionally, the increasing consumer demand for gluten-free products poses a challenge to wheat protein, as it is inherently not gluten-free. Manufacturers need to invest in product diversification and innovation to address these challenges and retain market share.

Price Volatility of Raw Materials is restricting market growth:

Fluctuations in wheat prices, driven by factors such as climate change, crop yield variations, and geopolitical instability, can significantly impact the cost of wheat protein production. High raw material costs can lead to increased product prices, affecting the affordability and competitiveness of wheat protein in the market. For manufacturers operating in price-sensitive markets, maintaining a balance between quality and cost efficiency is a critical challenge. To mitigate this issue, companies are exploring partnerships with suppliers and investments in sustainable sourcing practices.

Market Opportunities

The wheat protein market offers substantial growth opportunities, particularly in emerging economies where the demand for processed and plant-based foods is rapidly increasing. In countries like China, India, and Brazil, the rising middle class, coupled with growing health consciousness, is driving the adoption of protein-enriched diets. This trend is creating lucrative opportunities for manufacturers to introduce wheat protein-based products tailored to local tastes and preferences. Additionally, the personal care industry represents an untapped market for wheat protein, with its hydrolyzed form gaining popularity in hair and skin care formulations due to its moisturizing and strengthening properties. Innovations in wheat protein extraction and processing technologies are expected to open new avenues for high-value applications, including pharmaceutical and nutraceutical industries.

WHEAT PROTEIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Cargill Inc., Roquette Frères, Manildra Group, Tereos, MGP Ingredients Inc., Crespel & Deiters Group, Kröner-Stärke GmbH, Glico Nutrition Co. Ltd., AGRANA Beteiligungs-AG |

Wheat Protein Market Segmentation - By Product

-

Wheat Gluten

-

Hydrolyzed Wheat Protein

-

Textured Wheat Protein

-

Others

Wheat gluten dominates the product segment, accounting for over 45% of the market revenue in 2024, driven by its widespread use in bakery and meat substitute applications.

Wheat Protein Market Segmentation - By Application

-

Food and Beverages

-

Animal Feed

-

Sports Nutrition

-

Personal Care

-

Others

The food and beverages segment remains dominant, contributing 55% of the market share in 2024, primarily due to the high demand for wheat protein in bakery and plant-based food products.

Wheat Protein Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America leads the global wheat protein market, accounting for 38% of total revenue in 2024. The region's dominance is attributed to its strong plant-based food market, consumer awareness about protein-enriched diets, and extensive application of wheat protein in sports nutrition and clean-label products. The United States remains the largest contributor in the region, driven by advanced food processing technologies and a growing vegan population. Furthermore, the presence of major market players and a robust distribution network enhances the region's market position.

COVID-19 Impact Analysis on the Wheat Protein Market

The COVID-19 pandemic had a mixed impact on the wheat protein market. In the early stages, the market faced challenges due to disruptions in the supply chain, resulting in raw material shortages and delayed production. However, as the pandemic progressed, consumer focus shifted towards health and wellness, which drove increased demand for protein-enriched and plant-based foods, benefiting the wheat protein sector. The rise in home cooking trends during lockdowns also played a role in boosting wheat protein demand, as consumers sought ingredients for homemade meals, particularly in the baking sector. The consumption of bakery products, including bread and other baked goods, surged, further contributing to the growth of the wheat protein market. As the world recovered from the pandemic, the wheat protein market experienced a strong rebound. The post-pandemic phase has seen a renewed emphasis on sustainability and clean-label products, which align with growing consumer preferences for transparent and environmentally friendly food choices. This shift has spurred investments in innovations in wheat protein, as manufacturers aim to meet the demand for high-quality, sustainable protein sources.

Latest Trends/Developments

The wheat protein market is evolving with several emerging trends that are shaping its future growth. One significant development is the innovation in gluten-free wheat protein formulations, which cater to the growing number of gluten-intolerant consumers. These formulations are expanding the market’s reach, allowing wheat protein to become a viable option for those with dietary restrictions. As the demand for gluten-free products continues to rise, wheat protein is positioned to capitalize on this shift in consumer preferences. Another noteworthy trend is the increasing popularity of hybrid protein blends, which combine wheat protein with other plant-based proteins. These blends are designed to meet diverse nutritional requirements, offering a balanced amino acid profile and appealing to a broader range of consumers. The versatility of these blends is helping drive the adoption of wheat protein across various food and beverage categories, from meat alternatives to protein bars and plant-based dairy products. Sustainability is another key factor influencing the wheat protein market. As consumers become more environmentally conscious, the demand for organic and non-GMO wheat protein products is increasing. Manufacturers are responding by focusing on eco-friendly sourcing and production practices, which align with consumer values and contribute to the overall growth of the market. The use of wheat protein in fortified snacks and functional beverages is gaining momentum, particularly among health-conscious millennials and Gen Z consumers. These groups are increasingly seeking products that support their active lifestyles and provide additional health benefits. Wheat protein is becoming a popular ingredient in these products due to its high nutritional value and functional properties. These innovations are unlocking new applications in industries beyond food, such as personal care, pharmaceuticals, and nutraceuticals, further broadening the market’s potential.

Key Players

-

Archer Daniels Midland Company

-

Cargill Inc.

-

Roquette Frères

-

Manildra Group

-

Tereos

-

MGP Ingredients Inc.

-

Crespel & Deiters Group

-

Kröner-Stärke GmbH

-

Glico Nutrition Co. Ltd.

-

AGRANA Beteiligungs-AG

Chapter 1. Wheat Protein Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wheat Protein Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wheat Protein Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wheat Protein Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wheat Protein Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wheat Protein Market – By Product

6.1 Introduction/Key Findings

6.2 Wheat Gluten

6.3 Hydrolyzed Wheat Protein

6.4 Textured Wheat Protein

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. Wheat Protein Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Animal Feed

7.4 Sports Nutrition

7.5 Personal Care

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Wheat Protein Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wheat Protein Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Cargill Inc.

9.3 Roquette Frères

9.4 Manildra Group

9.5 Tereos

9.6 MGP Ingredients Inc.

9.7 Crespel & Deiters Group

9.8 Kröner-Stärke GmbH

9.9 Glico Nutrition Co. Ltd.

9.10 AGRANA Beteiligungs-AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wheat Protein Market was valued at USD 2.5 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. By 2030, the market is projected to reach USD 3.71 billion.

Key drivers include the rising demand for plant-based proteins, expanding application in the food and beverage industry, and growing adoption in sports nutrition and health supplements.

The market is segmented by product (Wheat Gluten, Hydrolyzed Wheat Protein, Textured Wheat Protein, Others) and by application (Food and Beverages, Animal Feed, Sports Nutrition, Personal Care, Others).

North America is the most dominant region, contributing 38% of the global revenue in 2024, driven by advanced food processing technologies and strong consumer demand for plant-based diets.

Leading players include Archer Daniels Midland Company, Cargill Inc., Roquette Frères, Manildra Group, and Tereos.