Wheat Germ Oil Market Size (2024 – 2030)

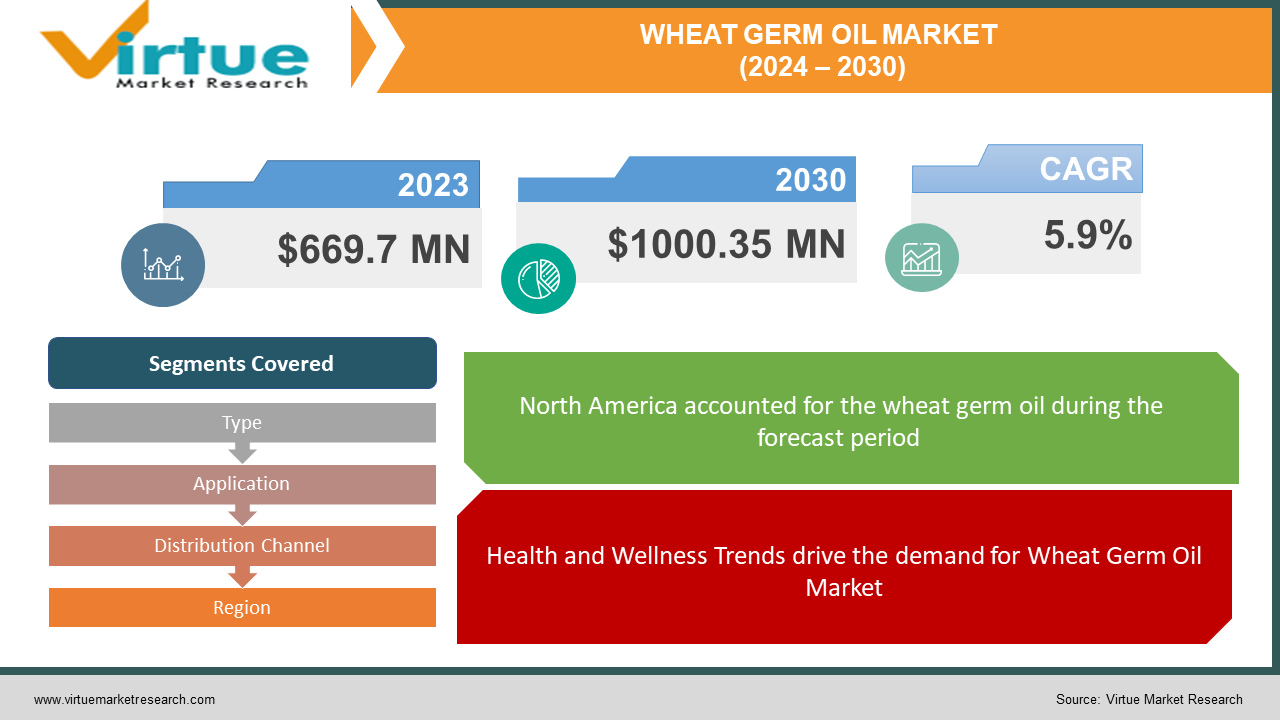

The Global Wheat Germ Oil Market was valued at USD 669.7 million and is projected to reach a market size of USD 1000.35 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Wheat germ oil is derived from the germ (embryo) of the wheat kernel. Wheat germ oil is known for its high nutritional content. Wheat germ oil has an abundance of vitamin E, omega-3 fatty acids, and other beneficial compounds. Wheat germ oil is a natural supplement due to its potential health benefits such as antioxidant properties, support for heart health, and skin benefits. The Wheat Germ Oil Market is expected to grow significantly in the coming years due to growing interest in health and wellness. The major well-established players in the Wheat Germ Oil Market are NOW Foods, Nature's Way, Swanson Health Products, Solgar, and Jarrow Formulas.

Key Market Insights:

Health and wellness trends, rising demand for natural and organic products, expansion of the cosmetic industry, growing interest in functional foods, and increasing consumer awareness of nutritional supplements are propelling the Wheat Germ Oil Market. The restraints to the Wheat Germ Oil Market include limited awareness, high price points, availability of substitutes, storage and shelf life concerns, regulatory constraints, supply chain vulnerabilities, and competitive landscape. North America occupies the highest share of the Wheat Germ Oil Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Wheat Germ Oil Market Drivers:

Health and Wellness Trends drive the demand for Wheat Germ Oil Market

The trend towards health and wellness is a significant driver in the wheat germ oil market. Consumers are prioritizing health-conscious choices in their diets. Wheat germ oil is known for its rich nutritional content. Wheat germ oil contains vitamin E, omega-3 fatty acids, and antioxidants. This perfectly aligns well with this trend. Individuals are becoming more aware of the importance of nutrient-rich foods and supplements. The demand for wheat germ oil as a natural source of essential nutrients continues to rise in the coming years. This is fueled by growing concerns about chronic health conditions.

Rising Demand for Natural and Organic Products is propelling the Wheat Germ Oil Market

There has been a surge in demand for natural and organic products across various industries, such as food, skincare, and personal care. Wheat germ oil is derived from the germ of the wheat kernel without synthetic additives or processing. Consumers are seeking out products that are free from artificial ingredients. They are seeking natural alternatives that are safer and more environmentally friendly. Wheat germ oil has gained popularity as an ingredient in organic food products, natural skincare formulations, and organic supplements. There is a growing awareness of the potential health and environmental benefits associated with organic agriculture. The desire to make more sustainable purchasing choices is growing among consumers.

Wheat Germ Oil Market Restraints and Challenges

The major challenge faced by the Wheat Germ Oil Market is the limited awareness among consumers about its benefits and applications. Another challenge is the high cost compared to other vegetable oils. This is mainly due to its extraction process and the relatively low yield of oil from wheat germ. The higher price point deters price-sensitive consumers from purchasing wheat germ oil. The other restraints to the Wheat Germ Oil Market include the availability of substitutes, storage and shelf life concerns, regulatory constraints, supply chain vulnerabilities, and competitive landscape.

Wheat Germ Oil Market Opportunities:

The Wheat Germ Oil Market has various opportunities in the market. Expanding cosmetic and skincare industry applications present a significant opportunity. There is a growing demand for natural and organic products. This creates favorable conditions for the expansion of the wheat germ oil market. There is an increasing consumer interest in health supplements. This offers a promising opportunity for the wheat germ oil market. Advancements in extraction technology enable the exploration of new production methods and enhance efficiency. Other Opportunities in the Wheat Germ Oil Market include diversification into new product formulations and applications. This allows the wheat germ oil market to cater to evolving consumer preferences and emerging trends.

WHEAT GERM OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

NOW Foods, Nature's Way, Swanson Health Products, Solgar, Jarrow Formulas, Barlean's, Spectrum Naturals, Aromatika, Daabon Organic, Zongle Therapeutics |

Wheat Germ Oil Market Segmentation: By Type

-

Cold-Pressed Wheat Germ Oil

-

Hexane-Extracted Wheat Germ Oil

-

Organic Wheat Germ Oil

-

Conventional Wheat Germ Oil

-

Refined Wheat Germ Oil

In 2023, based on market segmentation by type, Refined Wheat Germ Oil occupies the highest share of the Wheat Germ Oil Market. This is mainly due to its widespread use in various industries, including food, cosmetics, and pharmaceuticals. Its versatility and relatively lower cost compared to specialty variants make it a popular choice.

However, Organic wheat germ oil is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 12%. This is due to increasing consumer demand for organic and natural products. Consumers are becoming more health-conscious. They are willing to pay a premium for products perceived as healthier and environmentally friendly.

Wheat Germ Oil Market Segmentation: By Application

-

Nutritional Supplements

-

Cosmetics and Skincare

-

Food Industry (e.g., salad dressings, baked goods)

-

Pharmaceutical Industry

In 2023, based on market segmentation by Application, the nutritional supplements segment occupies the highest share of the Wheat Germ Oil Market. This is mainly due to its high nutritional content, including vitamin E, omega-3 fatty acids, and antioxidants. Consumers are increasingly turning to supplements to support their overall health and well-being.

However, cosmetics and skincare are the fastest-growing segment during the forecast period. This is mainly due to the rising demand for natural and organic ingredients in beauty products. Wheat germ oil is popular in the cosmetic industry for its moisturizing properties, high vitamin E content, and potential benefits for skin health.

Wheat Germ Oil Market Segmentation: By Distribution Channel

-

Online Retail

-

Offline Retail

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Pharmacies/Drugstores

-

Health Food Stores

-

In 2023, based on market segmentation by the Distribution Channel, the Offline retail segment occupies the highest share of the Wheat Germ Oil Market. This is mainly due to the widespread availability and convenience it offers to consumers.

However, online retail is the fastest-growing segment during the forecast period. This growth is due to the increasing internet penetration, convenience of shopping from home, wider product selection, and often competitive pricing. Consumers are increasingly turning to online platforms to purchase wheat germ oil.

Wheat Germ Oil Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Wheat Germ Oil Market. It has a market share of 45%. This growth is due to the high demand for natural and functional food products. North America is a developed region with well-established health and wellness industries. The presence of key players, extensive distribution networks, and a strong economy further contribute to the dominance of North America. The region has a significant consumer base that is increasingly interested in products offering health benefits, including wheat germ oil. Countries like the United States and Canada have higher Wheat Germ Oil market growth.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the rising disposable incomes, changing dietary preferences towards healthier options, and an increasing awareness of the health benefits associated with wheat germ oil. Countries like China, India, and Japan has significant market share due to increasing populations with a growing middle class that is willing to spend on health and wellness products. The expanding cosmetics, skincare, and nutraceutical industries in the Asia Pacific region also contribute to its fastest growth.

COVID-19 Impact Analysis on the Global Wheat Germ Oil Market:

The COVID-19 pandemic had a significant impact on the Wheat Germ Oil Market. There were lockdowns, restrictions on transportation, workforce challenges and safety restrictions. This disrupted global supply chains, affecting the production and distribution of various goods, including raw materials for wheat germ oil. The pandemic heightened focus on health and wellness. This positively impacted the market as consumers seek products with potential health benefits. Increased interest in health and immunity driven demand for wheat germ oil in nutritional supplements. During the pandemic, there has been a notable shift towards online retail. Thus, the pandemic accelerated certain trends in the Wheat Germ Oil Market.

Latest Trends/ Developments:

Consumers are increasingly seeking natural and organic alternatives in their food, skincare, and healthcare products. The global focus on health and wellness has led to increased consumption of nutritional supplements and functional foods. Wheat germ oil finds applications due to its rich nutritional profile, including high levels of vitamin E and omega-3 fatty acids. Wheat germ oil is gaining popularity as an ingredient in cosmetic and skincare products. This is due to its moisturizing properties and high vitamin E content. There is a growing focus on sustainable and ethical sourcing practices across industries, including the production of wheat germ oil.

Key Players:

-

NOW Foods

-

Nature's Way

-

Swanson Health Products

-

Solgar

-

Jarrow Formulas

-

Barlean's

-

Spectrum Naturals

-

Aromatika

-

Daabon Organic

-

Zongle Therapeutics

Market News:

-

In January 2024, AWB Limited, a prominent grain marketing organization based in Australia, disclosed its acquisition of Agrium Inc., a renowned producer and distributor of agricultural products and services, for a sum of US$ 1.2 billion. The acquisition was anticipated to establish a global leader in the wheat and crop inputs industry, boasting a diversified portfolio encompassing wheat germ oil and other value-added products.

-

In December 2023, Amazon.in, the Indian e-commerce giant, unveiled a fresh lineup of wheat germ oil products under its proprietary brand, Urbanorganics. This range comprised wheat germ essential oil, wheat germ massage oil, wheat germ hair oil, and wheat germ face serum. The products purported to offer diverse benefits for hair, skin, and overall health, strategically priced to allure online shoppers.

-

In November 2023, Now Foods, a leading manufacturer and distributor of natural health products, launched a novel offering, Wheat Germ Nutritional Oil, in the Indian market. This dietary supplement featured 100% pure and cold-pressed wheat germ oil, abundant in vitamin E, omega-3 fatty acids, and other essential nutrients. The product aims to bolster cardiovascular health, immune system function, and skin health.

Chapter 1. Wheat Germ Oil Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wheat Germ Oil Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wheat Germ Oil Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wheat Germ Oil Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wheat Germ Oil Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wheat Germ Oil Market – By Type

6.1 Introduction/Key Findings

6.2 Cold-Pressed Wheat Germ Oil

6.3 Hexane-Extracted Wheat Germ Oil

6.4 Organic Wheat Germ Oil

6.5 Conventional Wheat Germ Oil

6.6 Refined Wheat Germ Oil

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Wheat Germ Oil Market – By Application

7.1 Introduction/Key Findings

7.2 Nutritional Supplements

7.3 Cosmetics and Skincare

7.4 Food Industry (e.g., salad dressings, baked goods)

7.5 Pharmaceutical Industry

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Wheat Germ Oil Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online Retail

8.3 Offline Retail

8.4 Supermarkets/Hypermarkets

8.5 Specialty Stores

8.6 Pharmacies/Drugstores

8.7 Health Food Stores

8.8 Y-O-Y Growth trend Analysis By Distribution Channel

8.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Wheat Germ Oil Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Wheat Germ Oil Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 NOW Foods

10.2 Nature's Way

10.3 Swanson Health Products

10.4 Solgar

10.5 Jarrow Formulas

10.6 Barlean's

10.7 Spectrum Naturals

10.8 Aromatika

10.9 Daabon Organic

10.10 Zongle Therapeutics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wheat Germ Oil Market was valued at USD 669.7 million and is projected to reach a market size of USD 1000.35 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Health and wellness trends, rising demand for natural and organic products, expansion of the cosmetic industry, growing interest in functional foods, and increasing consumer awareness of nutritional supplements are the market drivers of the Global Wheat Germ Oil Market.

Cold-Pressed Wheat Germ Oil, Hexane-Extracted Wheat Germ Oil, Organic Wheat Germ Oil, Conventional Wheat Germ Oil, Refined Wheat Germ Oil are the segments under the Global Wheat Germ Oil Market by type .

North America is the most dominant region for the Global Wheat Germ Oil Market.

NOW Foods, Nature's Way, Swanson Health Products, Solgar, and Jarrow Formulas are the key players in the Global Wheat Germ Oil Market.