Wet Vacuum Cleaner Market Size (2024 – 2030)

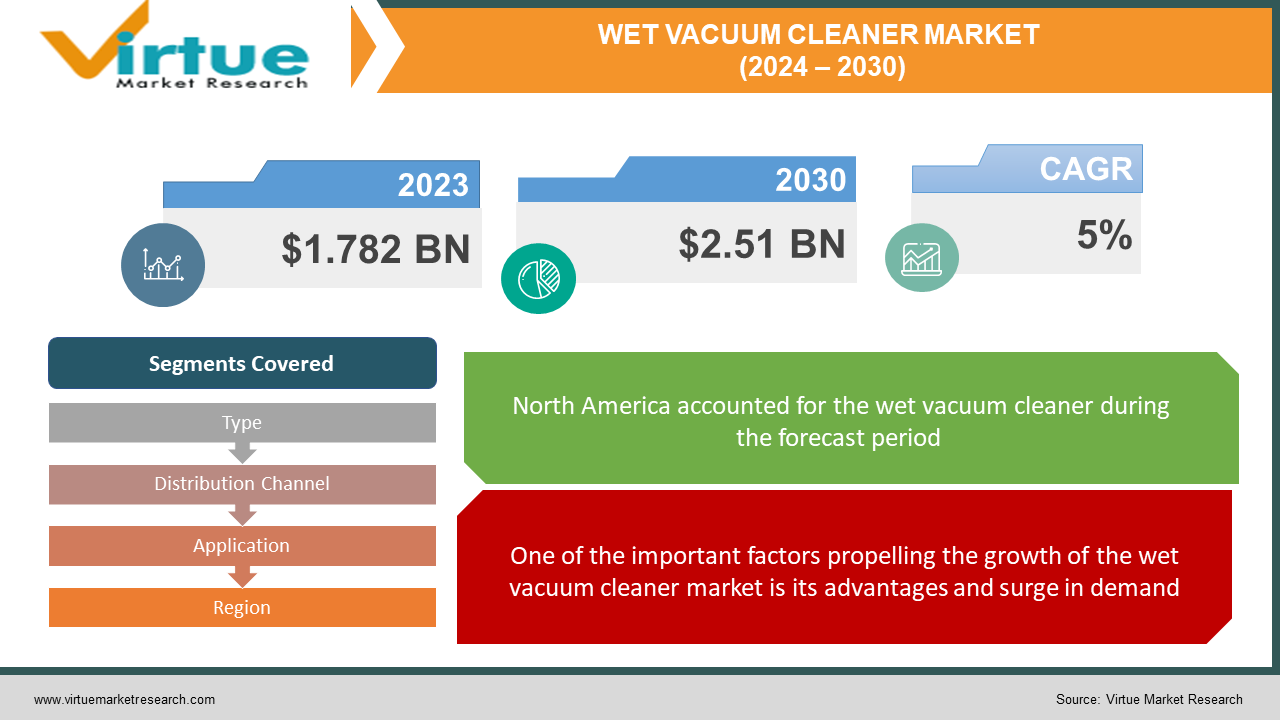

The global wet vacuum cleaner market was valued at USD 1.782 billion and is projected to reach a market size of USD 2.51 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5%.

Wet vacuum cleaners are a particular type of drum/cylinder vacuum that is made specifically to be used both indoors and outdoors and to collect wet dirt. These are used to clean up spills of moist liquid. One of the main reasons propelling the development of the wet vacuum cleaner market is the increase in internet channels worldwide. Market expansion is accelerated by the manufacturers' increasing efforts through R&D to create low-weight, compact products and by expanding the variety of commercial spaces. The industry is also influenced by the growing emphasis on creating HEPA filters that are easily accessible in the aftermarket and the introduction of wet vacuum cleaners that can be started quickly and/or automatically using a remote control or a Bluetooth battery pack. The wet vacuum cleaner market is also favorably impacted by rising disposable income, shifting consumer preferences, urbanization, digitization, and the growth of e-commerce. Additionally, during the forecast period, technical advances in Hoover cleaners offer lucrative prospects to market competitors. However, it is anticipated that the high startup expenses and high cost of large-capacity wet vacuum cleaners will hinder market expansion. Throughout the forecast period, allergen exposure concerns are anticipated to pose a challenge to the wet vacuum cleaner market.

Key Market Insights:

One of the main trends driving the wet vacuum cleaner market expansion is the rise in non-residential buildings. Since offices and retail establishments are the primary end-users of vacuum cleaners, particularly wet vacuum cleaners, a substantial portion of expenditures made in the wet vacuum cleaner market went towards these types of commercial ventures. The demand for wet hoover cleaners is predicted to be significantly impacted by the expansion of the commercial repair and maintenance services sector, particularly in China and other growing Asia-Pacific nations. Some of the key drivers driving up construction activity are the creation of jobs, a rise in leasing activity, the expansion of retail and corporate operations, and the improvement of the housing market. Sales are therefore anticipated to rise during the predicted year as the building estate sector's residential, hospital, retail, and other commercial industries see growth.

Global Wet Vacuum Cleaner Market Drivers:

One of the important factors propelling the growth of the wet vacuum cleaner market is its advantages and surge in demand.

Wet vacuums have a structure that may accommodate customer needs and require less upkeep. Wet Hoover cleaners don't need to be maintained frequently because their shock components are changeable. Additionally, these gadgets are frequently made with premium components and provide optimal performance for extended periods. Compared to physical labor and standard Hoover cleaners, wet Hoover cleaners can achieve significantly higher productivity. Wet vacuums are capable of continuously doing cleaning tasks around the clock. Throughout the projected period, the wet vacuum cleaners' advantageous characteristics will propel the growth of the vacuum cleaner market. Wet Hoover sales are rising significantly due to changing end-user preferences, rising DIY applications, growing concerns about hygiene in both residential and commercial settings, and the necessity of maintaining cleanliness, particularly in commercial settings. Although its limited usage for business-related fine tasks has historically caused sales issues, manufacturers are already seeing a possible recovery. Wet Hoover sales appear to be on a good trend since this development is linked to technological advancements that enable more complex capabilities and the availability of smaller models.

Global Wet Vacuum Cleaner Market Restraints and Challenges:

Europe's regulatory issues are a major barrier to the wet hoover cleaner market's expansion. Stricter laws are the result of the European Union's commitment to decreasing energy use in response to climate change. These laws, which have been in effect, require the sale of Hoover cleaners with motor capacities larger than 900W to be halted. The new regulations also seek to lower energy capacity from 1600W to 900W and set an 80 dB operational noise restriction. Wet Hoover's performance could be negatively impacted by adhering to eco-design regulations, which could force manufacturers to leave the European Union. As such, it is expected that manufacturers will face challenges in creating efficient wet hoover cleaners shortly.

Global Wet Vacuum Cleaner Market Opportunities:

Wet Hoover sales have developed at one of the fastest rates in history because of the presence of several providers on e-commerce platforms. The market for wet vacuum cleaners is growing because consumers are more inclined to purchase wet vacuums if they have easy availability and can take advantage of various deals and discounts on electrical appliances. To increase the market share of wet vacuum cleaners and provide them with lightweight, compact designs, manufacturers are also investing in R&D centers. To boost demand for wet vacuum cleaners, manufacturers are also focusing on producing vacuums with aftermarket-accessible HEPA filters. In addition, the wet vacuums are outfitted with modern features like Bluetooth and remote-control access, which simplify operations and boost wet vacuum sales.

WET VACUUM CLEANER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Samsung, LG Electronics, Panasonic Corporation, Electrolux, Haier Inc., Koninklijke Philips N.V., Miele & Cie. KG, Dyson, BISSELL, BLACK+DECKER Inc. |

Global Wet Vacuum Cleaner Market Segmentation: By Type

-

Cordless

-

Wired

The wired segment has the largest market share. The constant power source provided by these cleaners removes the need for battery replacement or recharging. They are well-liked in both home and business settings since they can withstand prolonged cleaning sessions and heavy-duty use. The corded category is the fastest grower. This has been linked to the corded wet vacuum's enhanced performance because of its longer uptime after joining the computer unit and stronger suction power. As a result, corded vacuum cleaners might collect more dust. The corded water vacuum also has a significantly greater storage capacity to gather spilled liquids and particles.

Global Wet Vacuum Cleaner Market Segmentation: By Distribution Channel

-

Online

-

Supermarkets

-

Specialized Stores

The supermarket channel accounted for the largest portion of the worldwide wet vacuum cleaner market in 2023 and was the primary market. They offer their clients excellent service, thorough product descriptions, and knowledgeable guidance. These retailers also encourage private-label and foreign sales at their establishments. The online segment is the fastest-growing. These channels have coupons and discounts that draw more clients and boost revenue. Besides, these channels have a lot of options from which consumers can choose. Products are delivered to the doorstep of the customer. This convenience is a major factor driving the expansion. With digitalization becoming the new norm, this segment is anticipated to account for notable revenue.

Global Wet Vacuum Cleaner Market Segmentation: By Application

-

Household

-

Commercial

The commercial segment has the largest market. Over fifty percent of the market was accounted for by the commercial segment in 2023, and it is anticipated that this segment will continue to dominate during the projection period. This is mostly due to the commercial sector's growing concern for the advancement and upkeep of environmental cleanliness and hygiene, as these factors have a positive impact on staff health. Furthermore, a tidy office boosts productivity. This makes it more and more necessary for the commercial sector to employ cleaning tools like wet vacuums to maintain hygienic and clean facilities. The household segment is the fastest-growing. Household wet vacuums are mostly used for cleaning duties in domestic environments. These cleaners are adaptable and appropriate for a range of cleaning jobs around the house, including moist messes, spills, and stains on carpets, and other surfaces. They are essential for keeping the living areas hygienic and tidy.

Global Wet Vacuum Cleaner Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the wet vacuum cleaner market because of the region's growing demand from the automotive (garage services) and building sectors. The USA has one of the biggest wet vacuum cleaner markets in the world. Between 2024 and 2030, wet hoover sales in the USA are predicted to follow the typical boom and bust trend. Besides, most of the major players are located in this region. They have a global presence, contributing to greater revenue. Prominent ones include Stanley Black & Decker, Inc., Nilfisk Group, Tennant Company, and Kärcher. Due to increased consumer awareness in the region, Western Europe is anticipated to experience significant growth in the coming years. When robotic vacuums are introduced, backed by R&D initiatives and modern technologies, the need for wet vacuum cleaners is expected to rise. Europe has become one of the world's top hubs for technological advancement since the lockdown was removed. Due to their elevated level of viability and flexibility, which makes cleaning space corners easier, wet vacuum sales have increased. However, because of growing disposable income and health consciousness, Asia-Pacific is expected to develop at the fastest rate over the forecast period. Raising living standards is predicted to accelerate revenue growth, especially in China, Japan, and India.

COVID-19 Impact Analysis on the Global Wet Vacuum Cleaner Market:

The COVID-19 pandemic hindered the expansion of the wet vacuum cleaner sector in the area. Lockdowns, restricted mobility, and social isolation were all part of the new normal. This caused serious disruptions to the supply chain, transportation logistics, and other sectors. For many others, this meant losing their jobs. Most companies and sectors of the economy were shut down to prevent the virus from spreading. A considerable decline in sales was caused by a significant fall in demand. Moreover, consumers refrained from investing in automobiles owing to financial setbacks. Rather, their attention was drawn to the essentials. The industry suffered as a result. Most of the collaborations and launches were canceled or rescheduled. The majority of the funds were used to create vaccines and purchase necessities for healthcare, such as oxygen tanks, ventilators, and hospital beds. After the pandemic, the market has begun to rebound Due to the commercial sector's decision to resume operations, there is now a greater need for wet vacuum cleaners in the area. As a result, growth in the market is anticipated throughout the forecast period.

Latest Trends/ Developments:

Growing concerns about hygiene and health, together with an increasingly global workforce, are driving the expansion of the wet hoover cleaner market globally. Due to this, there is an increasing need in the retail sector for quick and effective IOT infusion cleaning devices, such as wet vacuums. As a result, the global wet vacuum cleaner market is expanding. Furthermore, the commercial sector—which includes the hotel, restaurant, and café (HoReCa) industries as well as others—also makes extensive use of wet vacuums. Thus, the market for wet hoover cleaners is expanding as a result of this. Producers have historically allocated resources towards research and development of novel items to create lightweight and compact designs. It enhances transportation in all forms and vehicles as a result. Companies are also concentrating on creating HEPA filters that may be easily acquired in the aftermarket. The manufacturers of wet vacuum cleaners are also creating goods that may be turned on quickly or automatically using a Bluetooth remote control or battery.

Businesses in this sector are driven to grow their market share through a variety of tactics, such as investments, joint ventures, and acquisitions. Businesses are investing a significant amount of money in developing strategies to maintain competitive pricing. This has led to more growth.

Key players:

-

Samsung

-

LG Electronics

-

Panasonic Corporation

-

Electrolux

-

Haier Inc.

-

Koninklijke Philips N.V.

-

Miele & Cie. KG

-

Dyson

-

BISSELL

-

BLACK+DECKER Inc.

Chapter 1. Wet Vacuum Cleaner Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wet Vacuum Cleaner Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wet Vacuum Cleaner Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wet Vacuum Cleaner Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wet Vacuum Cleaner Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wet Vacuum Cleaner Market – By Application

6.1 Introduction/Key Findings

6.2 Household

6.3 Commercial

6.4 Y-O-Y Growth trend Analysis By Application

6.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Wet Vacuum Cleaner Market – By Type

7.1 Introduction/Key Findings

7.2 Cordless

7.3 Wired

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Wet Vacuum Cleaner Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online

8.3 Supermarkets

8.4 Specialized Stores

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Wet Vacuum Cleaner Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Type

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Type

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Type

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Type

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Type

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Wet Vacuum Cleaner Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Samsung

10.2 LG Electronics

10.3 Panasonic Corporation

10.4 Electrolux

10.5 Haier Inc.

10.6 Koninklijke Philips N.V.

10.7 Miele & Cie. KG

10.8 Dyson

10.9 BISSELL

10.10 BLACK+DECKER Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Throughout the projected period, a compound annual growth rate (CAGR) of 5% is expected for the wet vacuum cleaner market.

By 2030, it is projected that the wet vacuum cleaner market share will amount to USD 2.51 billion.

North America is the largest-growing region in the wet vacuum cleaner market.

The main elements propelling market expansion are the advantages and the surge in demand.

Market segmentation for wet vacuum cleaners is based on regional distribution channels, applications, and types.