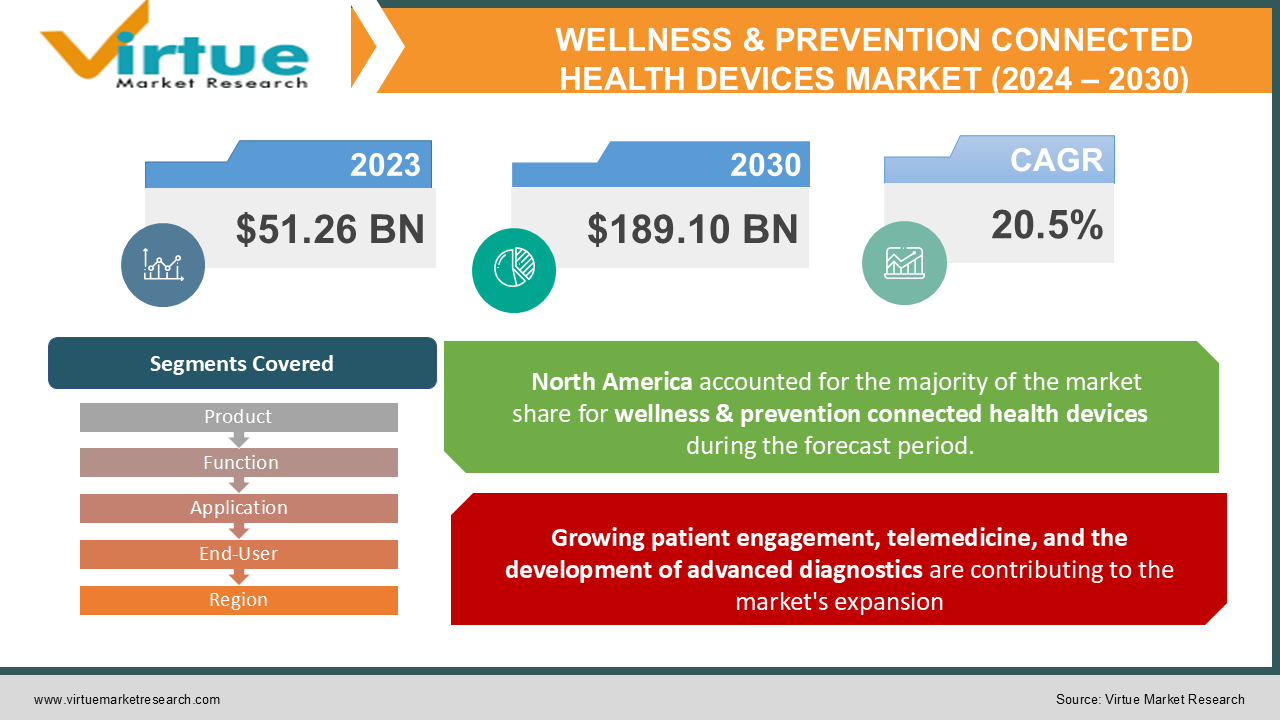

Global Wellness & Prevention Connected Health Devices Market Size (2024 - 2030)

As per our research report, the global wellness & prevention connected health devices market size is valued at USD 51.26 billion in 2023 to USD 189.10 Billion by the end of 2030. This market is anticipated to witness a CAGR of 20.5% from 2024 - 2030. Factors like high internet penetration, an increase in the prevalence of chronic diseases, the adoption of connected health and wellness technology across smartphones and wearables, the emerging blockchain technology trend, rising patient engagement, telemedicine, and the development of cutting-edge diagnostics are driving the market expansion.

Industry Overview:

Wellness and prevention connected health devices consist of a health management system that employs technology to provide medical services to patients remotely. It involves using mobile health tools, services, and e-prescriptions. Increased healthcare interoperability and research, as well as digital data management and active government support, all lead to higher usage of this technology. It enables hospitals, clinics, and other healthcare facilities to use wireless technology to deliver medical services remotely. It connects patients with caregivers via an automated system using the internet, Wi-Fi, and associated technology. Healthcare is changing and offers several advantages owing to connected healthcare. By synchronizing patient treatment and facilitating quick access to patient data through ongoing monitoring of important metrics, connected healthcare fosters patient interaction and satisfaction. To give patient-centered care recommendations, it combines data from the patient's health history and lifestyle, including biological, medical, lifestyle, genetic, and sentiment/mood data. Consumers who are concerned about their health are increasingly using wearable, connected devices, and mobile apps to track their progress and get personalized wellness advice from caregivers, and treatment reminders promptly and proactively.

The demand for connected health and wellness equipment is growing rapidly as the number of individuals with chronic illnesses rises, driving up the demand for solutions that can control disease and continuously monitor patients. Technology advancements are also bringing down the price of medical supplies and equipment and increasing accessibility to healthcare for everyone. In addition, high-speed internet and beneficial government initiatives have contributed to the market's phenomenal rise. Healthcare facilities like hospitals are moving more toward proactive and preventive care. Using connected healthcare to continuously monitor the patient's health status allows for early disease detection, and measures the body's various biochemical levels as well as blood oxygen levels and heart rate. Government spending on healthcare, particularly in developing nations, is rising as a result of the need for connected healthcare. In addition, the market is being supported by factors such as rising internet usage in both developed and emerging nations and continuously improving point-of-care models.

COVID-19 pandemic impact on Wellness & Prevention Connected Health Devices Market:

The supply chain of numerous connected devices was affected as a result of the industrial shutdown during the COVID-19 pandemic. As a result, the market for connected health and wellness devices suffered a slight loss. On the other hand, COVID-19 might lead to a long-term rise in the use of numerous connected healthcare products and services. Telemedicine services became more popular as governments all over the world implemented lockdowns during the pandemic. This is attributed to the rise in the number of patients, the pressure on healthcare providers to provide new healthcare services, and governments' attempts to advance connectivity-based apps. People are learning new techniques to monitor their health and only visit doctors in cases of crisis as hospitals focused their entire attention on treating COVID-19 patients. Sales of smart wearables, particularly smart watches, increased as a result. The pandemic encouraged healthcare professionals and people to adopt and employ a variety of technologies, including telemedicine, e-prescriptions, and others. It is projected that the widespread use of mHealth devices and the development of technologically sophisticated product designs are likely to propel the market throughout the forecast period. The industry's expansion is also anticipated to be fueled by the targeted approach to the adoption of Internet of Things (IoT) devices and wearable medical equipment, which comprise sensors and mobile communication devices. In August 2020, Validic, a developer of health data platforms and solutions, released the primary update to "Validic impact," a remote patient monitoring service. This cutting-edge Validic Impact standalone version can be utilized as a stand-alone solution without the need for EHR integration. The company also released a COVID-19 quick response solution that enables clinicians and HR managers to register thousands of people using alerts and self-reported data to track COVID-19 symptoms. Numerous connected healthcare goods and services may undergo long-term development as a result of the pandemic. Many corporations have been greatly impacted by the COVID-19 pandemic to deploy and upgrade new technology and lay the foundation for a revolutionary standard of care.

MARKET DRIVERS:

High internet penetration, the adoption of connected health and wellness technology across smartphones and wearables, and the emerging blockchain technology trend are all driving the market's expansion:

With the advancement of technology, patients are becoming more concerned about their health and fitness. The patient population is now more engaged owing to connected healthcare applications. The rise in chronic conditions and the increased usage of wearable technology, cost-effectiveness, and patient convenience have all contributed to the development of personalized healthcare solutions. Additionally, the high internet penetration combined with rising government spending on the healthcare sector to promote diverse healthcare services is influencing the expansion of the market. Blockchain technology is being embraced by the healthcare sector as a tool to handle, store, and retrieve patient records more effectively and securely. Patient care and patient demand for health monitoring have increased, providing a new set of benefits to the market.

Growing patient engagement, telemedicine, and the development of advanced diagnostics are contributing to the market's expansion:

The availability of telemedicine has increased the need for illness diagnosis and treatment by enabling the transmission of health informatics, diagnostic, and imaging data between locations. The development of new telemedicine techniques, such as video telephony, enhanced diagnostics, and telemedicine is likely to hasten the sector's expansion in the upcoming years. Patients who receive virtual visits find it simpler to ask questions, report early warning signs, and plan follow-up consultations, giving them comfort in knowing that their doctors are present and actively involved in their care.

The growing prevalence of chronic diseases is driving the market growth:

Geriatric populations and continuous point-of-care model changes are driving up demand for connected healthcare devices for real-time tracking and sharing of patient-related data. Wearable technology that can be used to track activities like heart rate, calories burned, and distance walked include trackers, glucose meters, and blood pressure monitors. The costs of routine tests are also greatly reduced because individuals can utilize these devices to examine self-medical indicators.

MARKET RESTRAINTS:

Growing threats from cyberattacks are limiting the market's expansion for wellness and prevention connected health devices:

The absence of security standards and the risk of data loss are some of the major issues that are anticipated to impede the expansion of the market. Although connected health care is groundbreaking, it creates numerous issues with sensitive health data. The connected healthcare market's growth can be hampered by cyber attack threats, data protection risks, a lack of qualified workforce to manage big volumes of data, and a lack of understanding of health apps.

The expansion of the wellness and prevention connected health devices market may be constrained by technological obstacles and high capital investment:

Technology and infrastructure limitations are impeding the market's expansion despite the enormous potential of connected healthcare goods and services. The market is severely constrained by the high expenses associated with implementing the requisite tools, systems, and equipment for the real-time assessment of healthcare data. Additionally, many developing nations are lagging in the adoption of these technologies and products due to issues with the availability of high-speed internet with high bandwidth and storage integration and transmission of data, which is limiting the market growth.

WELLNESS & PREVENTION CONNECTED HEALTH DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

20.5% |

|

Segments Covered |

By Product, Function, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GE Healthcare, Accenture Plc., Abbott, SAP SE, Omron Healthcare, Inc., Boston Scientific Corporation, Koninklijke Philips N.V., Garmin International, Inc., Apple, Inc., IBM Corporation, Fitbit LLC, Oracle Corporation, Airstrip Technology, Microsoft Corporation, Medtronic, Allscripts |

This research report on the global Wellness & Prevention Connected Health Devices Market has been segmented based on product, function, application, end-user, and region.

Wellness & Prevention Connected Health Devices Market – By Product

-

Personal Medical Devices

-

-

Glucose Monitor

-

Insulin Pump

-

BP Monitor

-

Personal Pulse Oximeter

-

Others

-

-

Wellness Products

-

Digital Pedometer

-

Others

-

Sleep Quality Monitor

-

Body Analyzer

-

Heart Rate Monitor

-

-

Software & Services

-

Others

-

Fitness & Wellness App

-

Online Subscription

-

Based on Product, the Wellness & Prevention Connected Health Devices Market is segmented into Personal Medical Devices, Wellness Products, and Software & Services. The Software & Services segment generated the highest revenue of more than 46% in 2021. This can be attributed to value-based healthcare delivery, the rising number of online subscriptions, a rise in the number of people seeking personalized medical care, and the downloading of health information as a result of greater health consciousness among people. The Wellness Products segment is anticipated to increase at the fastest rate during the forecast period. The factors driving the segment growth are consumer medical devices and personal health trackers. Better health, arguably the most conventional wellness concept, goes beyond medicine and dietary supplements. Consumers in emerging countries are willing to pay higher rates for health & wellness items owing to the increasing concern for physical fitness, which is fostering market expansion overall.

Wellness & Prevention Connected Health Devices Market – By Function

-

-

Clinical Monitoring

-

Telehealth

-

Based on Function, the Wellness & Prevention Connected Health Devices Market is segmented into Clinical Monitoring and Telehealth. The Telehealth function segment dominated the market with more than 55% of global revenue in 2021 owing to the increased use of telehealth services. A surge in healthcare spending in emerging nations and rapidly expanding healthcare infrastructure are key factors anticipated to drive this market's expansion. Additionally, the advent of wearable remote monitoring technologies and the growing significance of continuous patient monitoring for older adults are anticipated to fuel the segment's expansion.

Wellness & Prevention Connected Health Devices Market – By Application

-

-

Diagnosis & Treatment

-

Monitoring

-

Wellness and prevention

-

Others

-

Based on Function, the Wellness & Prevention Connected Health Devices Market is segmented into Diagnosis & Treatment, Monitoring, Wellness and Prevention, and Others. The Wellness and Prevention segment accounted for 42.5% of the global revenue in 2021. The segment is projected to rise as a result of the increased awareness of general health and wellbeing and the rising popularity of digital health trends.

Wellness & Prevention Connected Health Devices Market – By End User

-

-

Hospitals & Clinics

-

Home Monitoring

-

Based on End User, the Wellness & Prevention Connected Health Devices Market is segmented into Hospitals & Clinics and Home Monitoring. The Hospitals & Clinics segment dominated the market in 2021 and accounted for the largest share of more than 54.5% of the global revenue. The Hospitals and Clinics segment held more than 50% of the total market share in 2021. A connected healthcare system helps to remotely monitor patient health, including blood pressure. IoT-enhanced healthcare improves clinical outcomes, increases patient and physician satisfaction, and enables institutions to support new technologies. Another factor driving the market expansion for hospitals and clinics is the increase in the number of hospitals and clinics to improve access to healthcare. The Home Monitoring segment is anticipated to grow at the fastest rate during the forecast period. This growth can be attributed to several factors, including the growing geriatric population, the prevalence of chronic diseases, the growing demand for cost-effective healthcare delivery, and developments in-home care equipment technology.

Wellness & Prevention Connected Health Devices Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

North America accounted for the largest share of more than 41% of the global revenue in the Wellness & Prevention Connected Health Devices Market In 2021. The regional market is anticipated to continue growing while maintaining its dominant market position. This can be attributed to the existence of a highly developed healthcare infrastructure, extensive internet coverage, high consumer awareness levels, and supportive regulations created for better patient safety.

The European Wellness & Prevention Connected Health Devices Market is predicted to develop at a profitable rate owing to the high prevalence of internet usage, growing senior population, and rising demand for integrated healthcare services.

The Asia Pacific Wellness & Prevention Connected Health Devices Market is anticipated to develop at the fastest rate during the projected period. The demand for wearable medical equipment is rising and government funding for the construction of the healthcare infrastructure is also increasing, which are the key causes of this expansion. The sector is also expanding as a result of the rising use of mHealth, telehealth, and eHealth applications in developing nations like China and India. Telehealth services were used in Australia as an alternative mode of patient care delivery during the COVID-19 pandemic.

The Wellness & Prevention Connected Health Devices Market in the Middle East and Africa is projected to exhibit limited growth over the projected period due to poor internet penetration and a shortage of experienced technicians. The market for connected wellness and prevention health devices in Latin America is anticipated to grow rapidly.

Major Key Players in the Market

Some of the companies leading the global wellness & prevention connected health devices market are:

-

GE Healthcare

-

Accenture Plc.

-

Abbott

-

SAP SE

-

Omron Healthcare, Inc.

-

Boston Scientific Corporation

-

Koninklijke Philips N.V.

-

Garmin International, Inc.

-

Apple, Inc.

-

IBM Corporation

-

Fitbit LLC

-

Oracle Corporation

-

Airstrip Technology

-

Microsoft Corporation

-

Medtronic

-

Allscripts

The market is quite competitive, and the players are focusing on cutting-edge technology and user-friendly equipment. Industry leaders are engaged in strategic partnerships, mergers and acquisitions, collaboration, agreements, and regional growth to outperform their rivals.

Notable happenings in the Global Wellness & Prevention Connected Health Devices Market in the recent past:

-

Product Launch- In January 2022, Garmin unveiled a sport hybrid smartwatch with real ticking watch hands that slide to show a concealed touchscreen display. The product offers a variety of tools for improving one's health and well-being, including all-day stress tracking, sophisticated sleep monitoring with integrated GPS, Body Battery energy monitoring, and others. Additionally, it is made for customers who prefer a trendy method of tracking their fitness and health.

-

Product Launch- In January 2022, OMRON Healthcare, Inc. unveiled the first connected Blood Pressure (BP) monitors and cutting-edge mobile apps for remote patient monitoring.

-

Partnership-In February 2021, Royal Philips partnered with Dutch SAZ, a network of 28 hospitals. With the help of Philips's advanced population health management and patient monitoring throughout the healing process, the firms aim to include the observation, self-management, and monitoring of patients both inside and outside of hospitals.

-

Collaboration- In July 2021, Cognizant, a global leader in professional services, and Royal Philips, a leader in health technology, announced a new collaboration to create end-to-end digital health solutions that will help healthcare organizations and life sciences businesses improve patient care and quicken clinical trials. The strategic partnership combines the cloud-based Philips HealthSuite platform with the digital engineering know-how of Cognizant to provide and manage cutting-edge digital health solutions at scale, offering advanced connectivity and utilizing big data to produce useful insights.

-

Partnership-In December 2021, Doctor Anywhere (DA), a local omnichannel healthcare platform, and OMRON Healthcare have partnered. In this partnership, OMRON's smart health monitoring devices would be integrated with DA's telehealth platform, enabling accurate and prompt access to patient health records to manage and deliver the best care.

-

Product Launch- In March 2020, Fitbit LLC unveiled the Fitbit Charge 4, a cutting-edge health and fitness tracker with a GPS chip, Active Zone Minutes, sleep-tracking features, Spotify, and other features.

-

Partnership- In July 2020, Mount Sinai Health System, the largest academic medical institution in New York City, and OMRON Healthcare, Inc., the world leader in personal heart health and wellness technologies, have partnered to provide patients with the new VitalSightTM home blood pressure monitoring solution.

-

Product Launch- In September 2020, Roche introduced a remote patient monitoring system that enables medical practitioners to monitor diabetic patients away from the care facility.

Chapter 1. Wellness & Prevention Connected Health Devices Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Wellness & Prevention Connected Health Devices Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Wellness & Prevention Connected Health Devices Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Wellness & Prevention Connected Health Devices Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Wellness & Prevention Connected Health Devices Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Wellness & Prevention Connected Health Devices Market – By Product

6.1. Personal Medical Devices

6.1.1. Glucose Monitor

6.1.2. Insulin Pump

6.1.3. BP Monitor

6.1.4. Personal Pulse Oximeter

6.1.5. Others

6.2. Wellness Products

6.2.1. Digital Pedometer

6.2.2. Heart Rate Monitor

6.2.3. Body Analyzer

6.2.4. Sleep Quality Monitor

6.2.5. Others

6.3. Software & Services

6.3.1. Online Subscription

6.3.2. Fitness & Wellness App

6.3.3. Others

Chapter 7. Wellness & Prevention Connected Health Devices Market – By Function

7.1. Clinical Monitoring

7.2. Telehealth

Chapter 8. Wellness & Prevention Connected Health Devices Market – By Application

8.1. Diagnosis & Treatment

8.2. Monitoring

8.3 Wellness and prevention

8.4 Others

Chapter 9. Wellness & Prevention Connected Health Devices Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Wellness & Prevention Connected Health Devices Market- key players

10.1 GE Healthcare

10.2 Accenture Plc.

10.3 Abbott

10.4 SAP SE

10.5 Omron Healthcare, Inc.

10.6 Boston Scientific Corporation

10.7 Koninklijke Philips N.V.

10.8 Garmin International, Inc.

10.9 Apple, Inc.

10.10 IBM Corporation

10.11 Fitbit LLC

10.12 Oracle Corporation

10.13 Airstrip Technology

10.14 Microsoft Corporation

10.15 MedtronicAllscripts

Download Sample

Choose License Type

2500

4250

5250

6900