Wellhead Equipment Market Size (2024 – 2030)

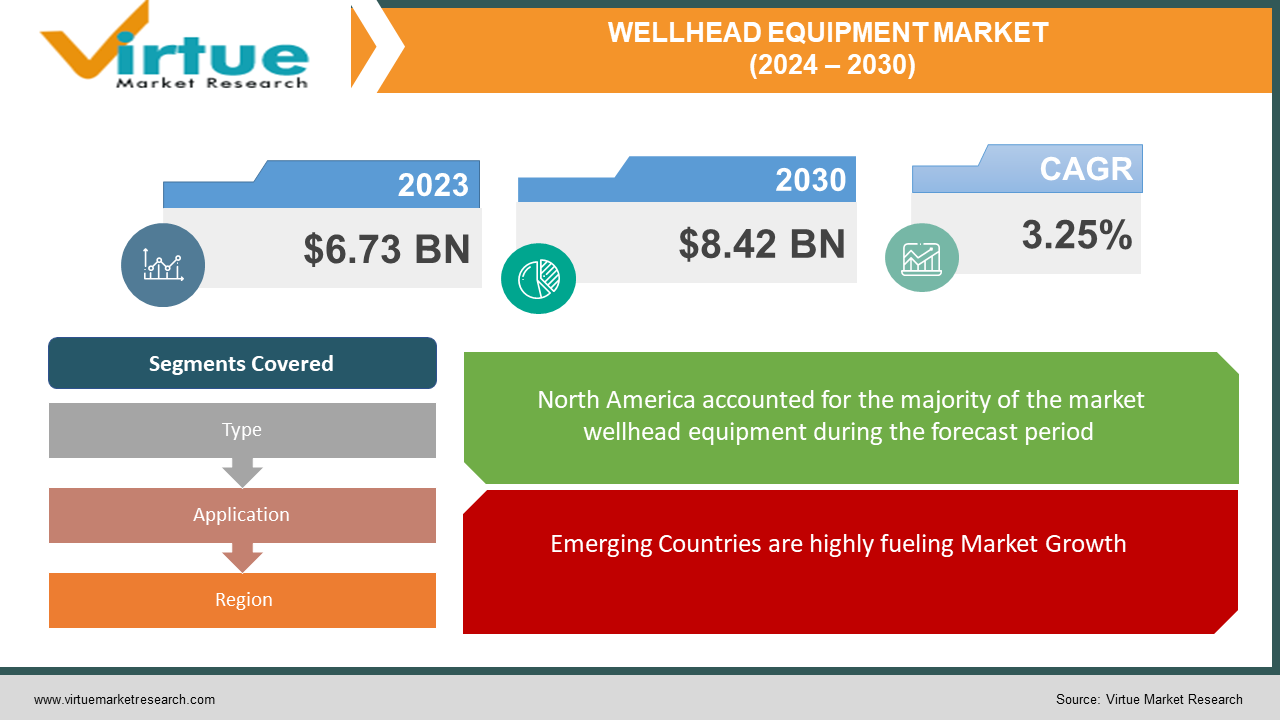

The Global Wellhead Equipment Market Size was valued at USD 6.73 billion in 2023 and is expected to reach USD 8.42 billion by 2030 and grow at a CAGR of 3.25% over the forecast period 2024-2030.

Wellhead equipment, crucial for oil and gas wells, serves as a structural and pressure interface for drilling and production tools. It ensures casing and tubing suspension, surface pressure sealing, pressure monitoring, and provides secure access to the well. Its key components include casing heads, spools, hangers, pack-offs, isolation seals, bowl protectors, test plugs, mud-line systems, tubing heads, and hangers, along with tubing head adapters. The rising global energy demand, particularly in developing nations like China and India, is boosting the market. These economies are increasingly contributing to the revenues of fuel, downstream companies, and oil firms, especially during periods of low crude oil prices. The escalating global oil and gas consumption is a major driver for the wellhead equipment market's anticipated growth in the near future.

Key Market Insights:

Wellhead equipment, a vital device installed at oil and gas well surfaces, offers a structural and pressure interface connecting drilling and production equipment with pipeline casings and tubing. Comprising casing spools, seals, plugs, suspension systems, and tubing head components, this equipment seals wells and supports casings, adaptable to various pressures, temperatures, locations, well dimensions, and drilling methods.

The oil and gas sector's steady expansion, coupled with an increase in deep and ultra-deep-water drilling, is propelling market growth. Additionally, the exploration of unconventional resources like shale oil and coal bed methane has heightened the demand for previously underutilized oilfield equipment, including wellhead systems. Manufacturers are innovating to meet the needs of more challenging and inaccessible drilling environments. For example, unmanned wellhead platforms on the seabed, serving as an economical alternative to subsea wells for shallow water ventures, are gaining traction. Government initiatives promoting sustainable oil extraction methods are further expected to spur market growth.

Global Wellhead Equipment Market Drivers:

Emerging Countries are highly fueling Market Growth

The Global Wellhead Equipment Market is expanding, primarily due to the escalating energy demands from developing countries. This surge in energy needs is prompting increased exploration and production activities, particularly in unconventional resource sectors, thereby elevating the demand for wellhead equipment. This surge is attributed to lower operational costs in its basins, rendering even marginal projects viable in a low oil price scenario. Other nations like Argentina, Colombia, India, and Indonesia are experiencing growth in this market due to governmental efforts to augment domestic production, primarily to meet rising consumption or manage well-decommissioning tasks. Such policies are anticipated to escalate onshore exploration and production, consequently boosting the need for wellhead equipment.

Rising Crude Oil Prices Bolstering Market Growth

The wellhead equipment market is also benefiting from the uptick in crude oil prices and production. The growing trend of deep and ultra-deep oil and gas drilling, along with the development of unconventional resources like shale oil and coal bed methane, is expected to be a significant driver for this market.

Furthermore, substantial investments in oil and gas projects are propelling global market expansion. The oil and gas industry, a major contributor to global revenue, is significantly influenced by prominent companies generating billions of dollars annually.

Challenges and Restraints in the Global Wellhead Equipment Market:

Escalating Raw Material Prices Impacting Market Growth

One of the primary challenges faced by wellhead equipment manufacturers is the fluctuating prices of key raw materials such as iron and alloys. These manufacturers, positioned vulnerably in the value chain, are impacted by the pricing policies of large material suppliers who often pass on increased commodity costs, resulting in higher input prices.

On the consumer side, manufacturing companies are compelled to deal with influential consumer goods corporations, which are unable to transfer price increases to the end-users. These corporations often use the threat of switching suppliers to ensure compliance, placing further pressure on manufacturers. Additionally, the varying prices and availability of raw materials in different regions are contributing to higher costs for manufacturers, potentially hindering market growth.

Global Wellhead Equipment Market Opportunities:

Integral to the wellhead system, wellhead equipment serves as a crucial accessory necessary for the assembly of the entire system. These systems play a vital role in pressure management during drilling and production operations, linking with surface pressure-control equipment and providing points for tubing and casing string suspension. Advanced technology within wellhead systems ensures reduced life cycle costs and enhanced reliability in pressure seals and suspension points.

WELLHEAD EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.25% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Weir Group PLC, UZTEL S.A., Yantai Jereh Oilfield Services Group Co., Ltd., JMP Petroleum Technologies, Inc., Delta US Corporation LLC, Jiangsu Sanyi Petroleum Equipment Co., Ltd., MSP/DRILEX, (Shanghai) Co., Ltd., Ethos Energy Group Limited, Sunnda Corporation, Integrated Equipment, Inc. |

Global Wellhead Equipment Market Segmentation: By Type

-

Casing Heads

-

Casing Spools

-

Christmas Trees

-

Tubing Adapters

-

Others

The global wellhead equipment market is segmented into casing heads, casing spools, Christmas trees, tubing adapters, and others. The casing spools segment dominates the global market and is expected to grow at a CAGR of 3.25% over the forecast period. The casing spool has a tubing head at the top of the wellhead assembly. This upper half consists of a straight bowl with a load shoulder to support the tubing string. The casing spools have lock screws to attach the tubing hanger, which is located in the head section. The lower part contains a secondary seal that is utilised to isolate the casing string.

The weld-on tubing head is directly connected to the manufacturing casing. These spools come in pressures ranging from more than 1,500 to 20,000 psi. Furthermore, technological advances in the oil and gas industry to improve drilling efficiency and reduce costs are projected to provide attractive growth possibilities for casing spool manufacturers during the projection period. The casing head, also known as the conductor pipe, is a metal flange welded to the top of the drive pipe as part of the wellhead system. The casing heads serve as a sealing point and attachment to the surface casing. Its beneficial features include a versatile design capable of supporting a maximum weight, a 45° landing shoulder that prevents test plugs from wedging under pressure, and a versatile straight bore design. Additionally, it comes with a 7-5/8" production casing and a 7-1/16" nominal bowl. Furthermore, casing heads are used in HTHP applications since they are a key component of piping systems in the oil and gas industry. Furthermore, these casing heads use an adhesive tubing adapter at the top to support the tubing string in an oil well. All of these factors are projected to drive the expansion of this segment.

Global Wellhead Equipment Market Segmentation: By Application

-

Onshore

-

Offshore

The global wellhead equipment market is divided into two segments based on application: onshore and off-shore. The on-shore segment holds the largest market share and is expected to grow at a CAGR of 3.25% during the forecast period. On-shore refers to mainland exploration and production of oil and gas, which accounts for 70% of global oil production. The equipment and buildings for drilling and exploration are built immediately on the ground; the onshore wellhead equipment market benefits from freshly discovered oil and gas resources. Furthermore, oil and gas corporations are working on exploring additional oil and gas resources to meet expanding demand. The wellhead equipment is a component of the wellhead system that is located at the exterior aperture of an oil or gas drilling well. It serves an important purpose by controlling wellhead pressure for drilling equipment. In onshore applications, wellhead equipment is also commonly utilised to ensure appropriate pressure sealing of the entire casing.

Offshore refers to the extraction of oil and natural gas from field resources beneath the ocean's surface. The use of wellhead equipment offshore has increased as undersea drilling activities for oil and gas exploration have grown. The recovery and stabilisation of crude oil prices is encouraging production and exploration activity in offshore undersea areas. The increasing reliance on pressure-pumping solution components in offshore drilling activities promotes market expansion. Furthermore, the redevelopment of mature offshore oil fields and the replacement of oil field machinery and components drive up demand for offshore wellhead equipment. Furthermore, the growth of the oil and gas industry, as well as strict laws and regulations requiring the use of effective solutions and components, are likely to drive the business of wellhead equipment for offshore oil fields in the approaching years.

Global Wellhead Equipment Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest shareholder in the global wellhead equipment market and is expected to grow at a CAGR of 3.25% over the forecast period. The increased investment in the oil and gas sector as a result of the discovery of new oil fields is predicted to boost market expansion. The primary regions in North America are likely to have a surge in demand for wellhead equipment as a result of large oil and gas production and development. Furthermore, the growth of petrochemical businesses in North America's major regions is likely to increase demand for wellhead equipment.

Furthermore, increased investment in North America's oil and gas industry presents lucrative growth potential for market participants. For example, the Canadian Association of Petroleum Producers anticipated a 41% increase in oil sands production between 2019 and 2035.

Asia-Pacific is expected to have a CAGR of 3.25% during the projection period. The need for wellhead equipment is increasing due to the high pace of oil exploration in nations such as China and Australia. Growth in these countries' oil and gas industries is likely to drive market growth. Furthermore, since field production has decreased, wellhead equipment manufacturers have increased their R&D efforts to develop cutting-edge technologies. KINETIC and WEFIC, both established in Australia, teamed in August 2017 to launch a service centre to promote high-end wellheads. Many emerging nations in the Asia-Pacific region have concentrated on establishing a comprehensive crude oil solution to gain a competitive advantage in the oil and gas sector.

COVID-19 Impact Analysis on the Global Wellhead Equipment Market:

The impact of the pandemic COVID-19 on the Wellhead Equipment supply chain, as well as the growing push to transition to cleaner, more reliable, and sustainable energy sources, is forcing corporations to coordinate their plans. Furthermore, concerns about a global economic slowdown, the impact of the war in Ukraine, and the risks of stagflation with potential market scenarios are driving the need for Wellhead Equipment industry participants to be more cautious and forward-looking. The economic and social impact of COVID is widely varied between countries/markets, and Wellhead Equipment makers and other actors are developing country-specific strategies.

Recent Trends and Developments in the Wellhead Equipment Market:

-

In January 2023, Cactus, a prominent company specializing in wellhead equipment, announced its acquisition of FlexSteel Technologies Holdings, Inc. and its related entities. This acquisition is being carried out through a merger with HighRidge Resources, Inc., FlexSteel's holding company, and Atlas Merger Sub, LLC, a newly formed subsidiary of Cactus, Inc. FlexSteel is renowned for its spoolable pipe technology, which is frequently sought after by customers during the production phase of a well's lifecycle.

-

March 2023 saw Plexus Holdings PLC securing a significant contract, valued at EUR 5 million, for its advanced POS-GRIP wellhead equipment and proprietary sealing technology. This technology is set to be implemented over a span of 12 months in a specialized project, demonstrating the company's continued innovation and growth in the sector.

Key Players:

-

The Weir Group PLC

-

UZTEL S.A.

-

Yantai Jereh Oilfield Services Group Co., Ltd.

-

JMP Petroleum Technologies, Inc.

-

Delta US Corporation LLC

-

Jiangsu Sanyi Petroleum Equipment Co., Ltd.

-

MSP/DRILEX, (Shanghai) Co., Ltd.

-

Ethos Energy Group Limited

-

Sunnda Corporation,

-

Integrated Equipment, Inc.

Chapter 1. Wellhead Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wellhead Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wellhead Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wellhead Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wellhead Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wellhead Equipment Market – By Type

6.1 Introduction/Key Findings

6.2 Casing Heads

6.3 Casing Spools

6.4 Christmas Trees

6.5 Tubing Adapters

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Wellhead Equipment Market – By Application

7.1 Introduction/Key Findings

7.2 Onshore

7.3 Offshore

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Wellhead Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wellhead Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Weir Group PLC

9.2 UZTEL S.A.

9.3 Yantai Jereh Oilfield Services Group Co., Ltd.

9.4 JMP Petroleum Technologies, Inc.

9.5 Delta US Corporation LLC

9.6 Jiangsu Sanyi Petroleum Equipment Co., Ltd.

9.7 MSP/DRILEX, (Shanghai) Co., Ltd.

9.8 Ethos Energy Group Limited

9.9 Sunnda Corporation,

9.10 Integrated Equipment, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wellhead Equipment Market size is valued at USD 6.73 billion in 2023.

The worldwide Global Wellhead Equipment Market growth is estimated to be 3.25% from 2024 to 2030.

The Global Wellhead Equipment Market is segmented By Type (Casing Heads, Casing Spools, Christmas Trees, Tubing Adapters, Others), By Application (Onshore, Offshore).

The Global Wellhead Equipment Market is expected to expand as energy demand rises and technology advances. Opportunities exist in inventions for severe environments and sustainable practices. Trends in digital integration and automation improve efficiency, while exploration in new regions opens up opportunities for market expansion.

The COVID-19 pandemic had a substantial influence on the Global Wellhead Equipment Market, disrupting supply chains and reducing demand due to declining energy usage. However, it has expedited digitalization and remote operations, increasing resilience and efficiency. Recovery is consistent with the gradual stabilisation of global energy markets.