Wave Energy Market Size (2024 – 2030)

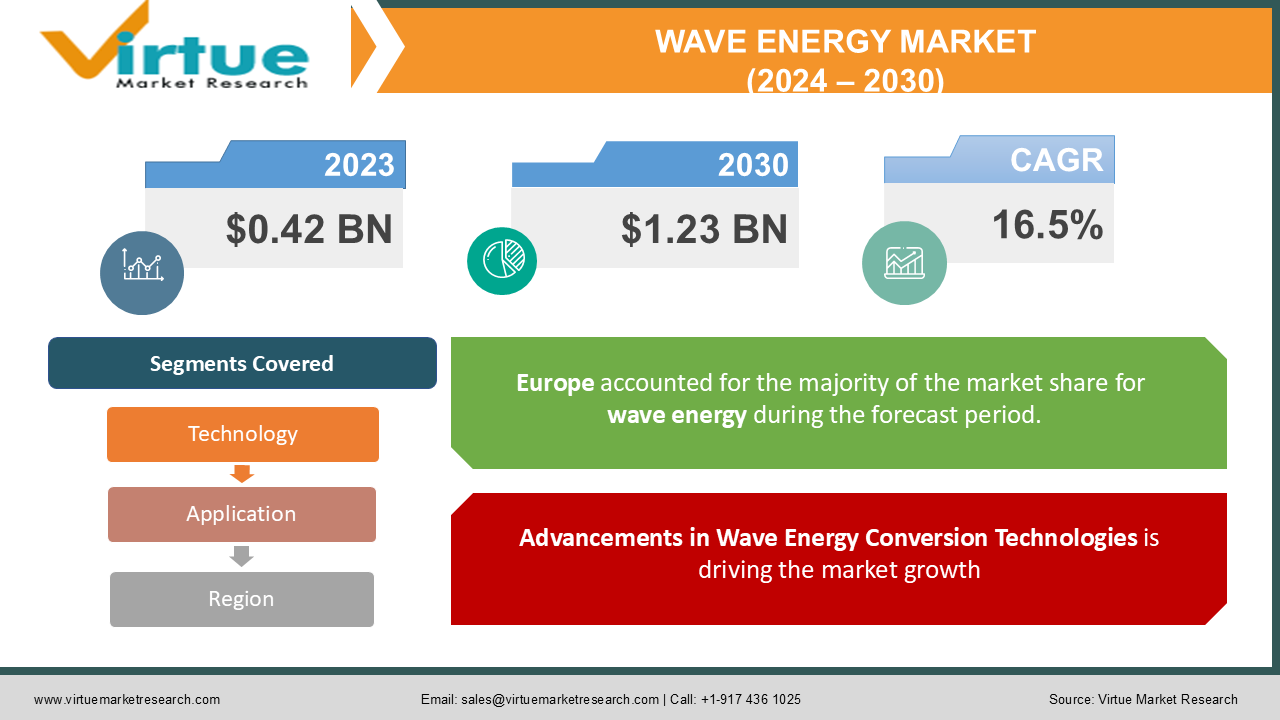

The Global Wave Energy Market was valued at USD 0.42 billion in 2023 and is expected to grow at a CAGR of 16.5% from 2024 to 2030, reaching a market size of USD 1.23 billion by 2030.

Wave energy refers to the process of capturing energy generated by ocean surface waves and converting it into electricity. As a renewable source of power, wave energy has gained attention due to its potential to provide a consistent and predictable energy output compared to other renewable sources such as solar or wind. This emerging market is driven by increasing investments in renewable energy technologies, government initiatives to reduce carbon emissions, and growing interest in exploring alternative energy sources to meet rising energy demands globally.

Key Market Insights

Europe dominates the wave energy market, accounting for more than 50% of global revenue in 2023, due to the early adoption of wave energy technologies and significant investments in marine energy projects in countries like the UK, Portugal, and Denmark.

Oscillating Water Column (OWC) technology is the most widely deployed wave energy technology, holding over 40% of the market share. OWCs have demonstrated better efficiency and durability in converting wave motion into electricity.

The Power Generation segment holds the largest share of applications in the wave energy market, contributing over 65% to the global revenue, as wave energy systems are increasingly being deployed for electricity generation in coastal regions.

The Asia-Pacific region is expected to witness the fastest growth in the wave energy market, with a CAGR of 22.5% over the forecast period, driven by increasing investments in renewable energy infrastructure in countries like China, Japan, and Australia.

Government incentives and funding for renewable energy projects are a major driver for the wave energy market. Countries are offering grants, subsidies, and tax incentives to accelerate the development of wave energy technologies.

The wave energy market faces high capital costs and challenges related to device efficiency and durability, particularly in harsh marine environments, which are restraining factors for broader market adoption.

Global Wave Energy Market Drivers

Increasing Demand for Renewable Energy and Decarbonization Targets is driving the market growth

As countries around the world commit to achieving carbon neutrality and reducing their reliance on fossil fuels, the demand for renewable energy sources is on the rise. Wave energy, as a clean and renewable power source, has gained prominence in this context. Governments and international organizations are implementing policies and initiatives to support the development of renewable energy technologies, including wave energy. For example, the European Union’s commitment to achieving a net-zero carbon economy by 2050 has led to substantial investments in marine energy, including wave energy technologies. Additionally, the Paris Agreement encourages nations to diversify their energy mix and invest in renewable sources to meet their climate goals. This push for decarbonization, along with increasing public and private sector funding for renewable energy projects, is driving the development of wave energy infrastructure, making it an integral part of the global energy transition.

Advancements in Wave Energy Conversion Technologies is driving the market growth

Technological advancements are playing a critical role in boosting the efficiency and reliability of wave energy conversion systems. Various technologies, such as oscillating water columns (OWCs), point absorbers, attenuators, and overtopping devices, are being developed and refined to enhance energy capture from ocean waves. These technologies allow for the efficient conversion of mechanical wave energy into electrical energy. Moreover, ongoing research and development (R&D) activities are focused on improving the durability of wave energy devices to withstand harsh marine environments, reducing maintenance costs, and enhancing their lifespan. Innovations in materials, such as corrosion-resistant coatings and advanced composites, have significantly improved the robustness of wave energy converters. As these technologies mature, they are expected to become more cost-competitive, further driving market adoption.

Growing Investments in Marine Renewable Energy is driving the market growth

The wave energy market is benefitting from increased investments in marine renewable energy projects. Governments, private companies, and investors are recognizing the potential of wave energy to provide a consistent and abundant source of renewable power. This has led to the establishment of wave energy test centers, pilot projects, and full-scale deployment in coastal regions across Europe, North America, and Asia-Pacific. For instance, the European Marine Energy Centre (EMEC) in Scotland has become a leading hub for testing wave and tidal energy technologies, attracting investments from energy companies and research institutions. Similarly, countries like Portugal and the United States have established national programs to support the commercialization of wave energy technologies. These investments are expected to accelerate the development and deployment of wave energy projects, helping the market grow rapidly in the coming years.

Global Wave Energy Market Challenges and Restraints

High Capital Costs and Infrastructure Challenges is restricting the market growth

One of the most significant challenges facing the global wave energy market is the high upfront capital cost associated with the deployment of wave energy systems. Building and installing wave energy converters (WECs) require significant financial investments, particularly in designing devices that can withstand the harsh marine environment, as well as the infrastructure required to transport the generated energy to the grid. In addition to device costs, wave energy projects face challenges in setting up the necessary infrastructure, such as transmission cables, offshore substations, and energy storage solutions. The cost of deploying and maintaining these systems in remote and offshore locations can be prohibitive, particularly for small and emerging market players. While government grants and subsidies have helped offset some of these costs, the overall high capital requirements remain a barrier to broader market adoption.

Environmental and Regulatory Hurdles are restricting the market growth

Wave energy projects face several regulatory and environmental challenges that can impede their development. Obtaining permits for the installation of wave energy converters in marine environments involves navigating complex regulatory frameworks that differ by country and region. These regulatory processes can be lengthy and may delay project timelines, especially when the potential environmental impact of the devices is being evaluated. Concerns related to the impact of wave energy devices on marine ecosystems, such as effects on marine wildlife, underwater noise pollution, and changes to sediment transport, have led to calls for stricter environmental assessments. In some cases, local opposition to wave energy projects, due to potential disruption to fishing activities or coastal landscapes, can further complicate regulatory approvals. Navigating these regulatory hurdles requires developers to work closely with local communities and environmental agencies to minimize ecological impacts and ensure project success.

Market Opportunities

The global wave energy market is poised for significant growth, driven by several key opportunities. First and foremost, the expansion of wave energy projects into emerging markets offers substantial potential. While Europe has been at the forefront of wave energy development, there is growing interest in countries like China, India, and Japan, where renewable energy demand is soaring due to rapid industrialization and urbanization. Governments in these regions are actively investing in marine energy as part of their broader renewable energy strategies. In addition, the integration of wave energy into off-grid and remote communities presents a valuable opportunity. Many remote coastal regions, such as islands and rural communities, rely heavily on expensive and polluting diesel generators for power. Wave energy systems can provide a reliable, clean, and cost-effective alternative for these areas. Several pilot projects are already underway, demonstrating the feasibility of using wave energy to power off-grid communities and reduce their dependence on fossil fuels. Technological advancements in hybrid renewable energy systems also present new opportunities for wave energy market growth. Combining wave energy with other renewable energy sources, such as wind or solar, can provide a more stable and consistent energy supply, addressing the intermittency challenges faced by some renewables. Hybrid systems can optimize energy production by capturing different forms of renewable energy based on weather conditions and geographical location. This hybrid approach has the potential to increase the efficiency and attractiveness of wave energy projects, especially in areas with strong wave and wind resources. Furthermore, the development of energy storage solutions tailored to wave energy systems will be critical for unlocking the full potential of wave energy. Storing excess energy generated by wave energy converters during periods of high wave activity can help balance supply and demand, making wave energy more reliable and dispatchable. As energy storage technologies continue to evolve, wave energy projects are expected to become more competitive, leading to broader market adoption.

WAVE ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

16.5% |

|

Segments Covered |

By Technology, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ocean Power Technologies, Carnegie Clean Energy, Pelamis Wave Power, CorPower Ocean, Wello Oy, Eco Wave Power, Wave Swell Energy, SINN Power, AW-Energy, Seabased Group |

Wave Energy Market Segmentation - By Technology

-

Oscillating Water Column (OWC)

-

Point Absorbers

-

Attenuators

-

Overtopping Devices

-

Others

The Oscillating Water Column (OWC) technology is the most dominant segment in the wave energy market, accounting for over 40% of the global market share. OWCs utilize the rise and fall of water levels within a chamber to compress and decompress air, which drives a turbine to generate electricity. OWCs are widely regarded for their efficiency, durability, and ability to operate in a variety of marine conditions. This technology has been extensively tested and deployed in Europe, particularly in countries like the UK and Portugal, where favorable wave conditions and government support have driven its adoption.

Wave Energy Market Segmentation - By Application

-

Power Generation

-

Desalination

-

Environmental Protection

-

Others

The Power Generation segment is the largest application for wave energy systems, accounting for over 65% of global revenue. Wave energy is being increasingly harnessed to produce electricity in coastal regions, where wave activity is consistent and reliable. The ability to generate clean, renewable energy from wave motion makes it an attractive solution for both utility-scale and off-grid power generation. In particular, coastal communities and island nations are adopting wave energy as a viable alternative to fossil fuels, given its potential to reduce carbon emissions and provide a stable power supply.

Wave Energy Market Segmentation - By Region

-

Europe

-

Asia-Pacific

-

North America

-

South America

-

Middle East and Africa

Europe is the dominant region in the global wave energy market, holding more than 50% of the global market share in 2023. European countries such as the United Kingdom, Portugal, Denmark, and Spain have been pioneers in wave energy research and development, with extensive investments in marine renewable energy projects. The region benefits from favorable wave conditions, strong government support, and well-established testing and demonstration facilities like the European Marine Energy Centre (EMEC) in Scotland. These factors have made Europe a leader in wave energy technology deployment and commercialization. Additionally, the region’s commitment to achieving net-zero emissions by 2050 has further accelerated the adoption of wave energy systems as part of broader renewable energy strategies.

COVID-19 Impact Analysis on the Global Wave Energy Market:

The COVID-19 pandemic had a mixed impact on the global wave energy market. On one hand, the disruption of global supply chains and restrictions on movement caused delays in the deployment of wave energy projects. Lockdowns and travel restrictions impacted the availability of skilled labor, as well as the transportation of materials and equipment necessary for offshore wave energy installations. Many wave energy developers faced delays in their construction timelines, leading to project postponements and increased costs.

On the other hand, the pandemic underscored the importance of resilient and sustainable energy systems, as many countries experienced disruptions in traditional energy supply chains. This has led to a renewed focus on expanding the use of renewable energy sources, including wave energy, as part of efforts to build back better and reduce reliance on fossil fuels. Additionally, government stimulus packages aimed at boosting the green economy have provided financial support to renewable energy projects, including marine energy initiatives.

The pandemic also accelerated the shift towards digitalization and remote monitoring technologies, which are now being increasingly integrated into wave energy systems. Remote sensing, data analytics, and automation have allowed for better monitoring and maintenance of wave energy devices, reducing the need for on-site personnel. This has the potential to enhance the operational efficiency and reduce the costs associated with wave energy projects in the long term.

Latest Trends/Developments:

One of the most significant trends in the global wave energy market is the increasing focus on hybrid renewable energy systems. Hybrid systems that combine wave energy with other renewable sources, such as offshore wind and solar, are gaining traction due to their ability to provide more stable and reliable energy outputs. For example, the integration of wave energy with offshore wind farms can optimize energy production by harnessing different weather conditions, making the overall energy system more resilient. These hybrid systems are being tested and deployed in regions with strong wave and wind resources, offering a promising solution for enhancing the reliability of renewable energy. Another key trend is the development of modular and scalable wave energy technologies. Companies are focusing on designing wave energy devices that can be easily scaled up or down based on the energy needs of a particular region. Modular designs allow for faster deployment and reduced costs, making wave energy more accessible to small and medium-sized projects. This trend is particularly relevant for remote coastal communities and island nations, where wave energy can be a cost-effective solution for addressing energy needs. Energy storage solutions tailored to wave energy systems are also gaining attention. As wave energy is variable and dependent on ocean conditions, the ability to store excess energy for use during periods of low wave activity is critical for ensuring a consistent power supply. Advances in battery technologies, such as lithium-ion and flow batteries, are being explored to enhance the storage capacity of wave energy systems. In addition, there is a growing emphasis on environmentally friendly wave energy devices that minimize the impact on marine ecosystems. Developers are working on designing devices that are less intrusive and have lower ecological footprints. For example, some wave energy systems are being designed to act as artificial reefs, providing habitats for marine life while generating clean energy. This dual-purpose approach aligns with increasing regulatory requirements for environmental sustainability in marine energy projects. Lastly, the expansion of international collaborations and partnerships is playing a crucial role in advancing wave energy technologies. Governments, research institutions, and private companies are joining forces to share knowledge, resources, and expertise in wave energy development. These collaborations are helping to accelerate innovation, reduce costs, and bring wave energy closer to commercialization on a global scale.

Key Players:

-

Ocean Power Technologies

-

Carnegie Clean Energy

-

Pelamis Wave Power

-

CorPower Ocean

-

Wello Oy

-

Eco Wave Power

-

Wave Swell Energy

-

SINN Power

-

AW-Energy

-

Seabased Group

Chapter 1. Wave Energy Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wave Energy Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wave Energy Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wave Energy Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wave Energy Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wave Energy Market – By Technology

6.1 Introduction/Key Findings

6.2 Oscillating Water Column (OWC)

6.3 Point Absorbers

6.4 Attenuators

6.5 Overtopping Devices

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Technology

6.8 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Wave Energy Market – By Application

7.1 Introduction/Key Findings

7.2 Power Generation

7.3 Desalination

7.4 Environmental Protection

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Wave Energy Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Technology

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Technology

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Technology

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Technology

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Technology

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wave Energy Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Ocean Power Technologies

9.2 Carnegie Clean Energy

9.3 Pelamis Wave Power

9.4 CorPower Ocean

9.5 Wello Oy

9.6 Eco Wave Power

9.7 Wave Swell Energy

9.8 SINN Power

9.9 AW-Energy

9.10 Seabased Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Wave Energy Market was valued at USD 0.42 billion in 2023 and is expected to grow to USD 1.23 billion by 2030, at a CAGR of 16.5%.

Key drivers include increasing demand for renewable energy sources, advancements in wave energy conversion technologies, and growing investments in marine renewable energy projects.

The market is segmented by Technology (Oscillating Water Column, Point Absorbers, Attenuators, Overtopping Devices) and Application (Power Generation, Desalination, Environmental Protection).

Europe is the dominant region, holding over 50% of the market share due to strong government support and significant investments in wave energy technologies.

Leading players include Ocean Power Technologies, Carnegie Clean Energy, Pelamis Wave Power, CorPower Ocean, and Wello Oy.