Waterfall Kitchen Sink Market Size (2025 – 2030)

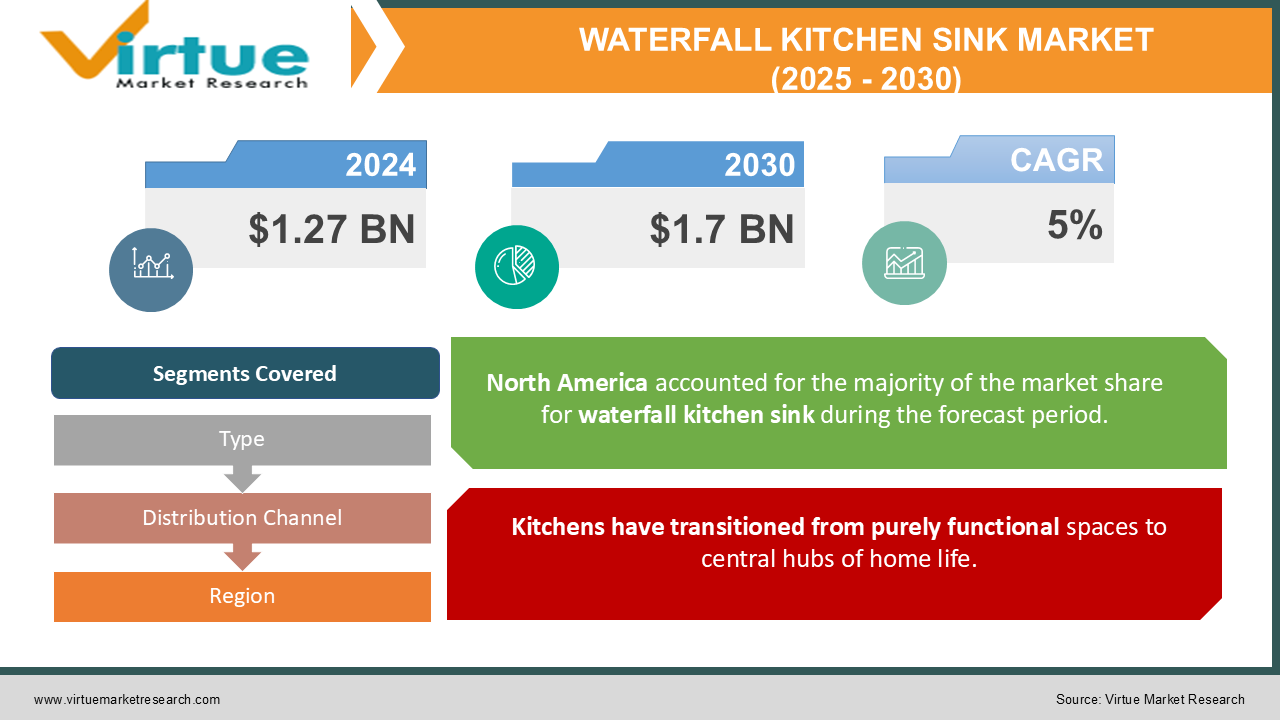

The Waterfall Kitchen Sink Market was valued at USD 1.27 billion in 2024 and is projected to reach a market size of USD 1.7 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5%.

The waterfall kitchen sink market is gaining remarkable traction as consumer preferences for functional, yet aesthetically pleasing kitchen solutions grow. This innovative category of sinks has emerged as a transformative element in modern kitchen design, merging practicality with luxury. Waterfall kitchen sinks, characterized by their cascading water effect and sleek lines, are redefining how households perceive and use kitchen sinks. Unlike traditional models, these sinks add a dynamic feature to kitchens, enhancing the overall ambiance while ensuring efficient functionality. The growth of the market can be attributed to the increasing emphasis on premium kitchen aesthetics, the rise of smart home integration, and the demand for efficient water use in daily household tasks.

Key Market Insights:

-

The global sales volume of waterfall kitchen sinks in 2023 reached approximately 7.5 million units.

-

Around 65% of consumers reported aesthetic appeal as a primary factor influencing their choice of a waterfall sink.

-

Premium materials like stainless steel accounted for 40% of total waterfall kitchen sink production in 2023.

-

The average price of a waterfall kitchen sink globally was $450 in 2023.

-

Residential installations represented 72% of the total market demand.

-

Commercial applications accounted for 28% of installations, with upscale restaurants being the largest segment.

-

The average lifespan of waterfall kitchen sinks is estimated to be 15 years, driving consumer perception of them as a long-term investment.

Market Drivers:

Kitchens have transitioned from purely functional spaces to central hubs of home life.

The demand for aesthetically appealing, multifunctional kitchens has transformed them into symbols of personal style and comfort. This shift has led consumers to prioritize fixtures that contribute to the kitchen's overall ambiance, and waterfall kitchen sinks fit seamlessly into this narrative. Their sleek, modern designs complement diverse interior styles, making them a popular choice among homeowners aiming for a sophisticated yet practical look. The rise of open-concept living has further fueled this trend, as kitchens are now often visible from living and dining areas. Waterfall sinks, with their cascading water effect and streamlined structures, create a focal point that adds visual appeal to these open spaces. The integration of ambient features such as LED lighting, available in various customizable colours, enhances this aesthetic appeal by creating a dramatic and elegant effect. Furthermore, the growing popularity of social media platforms like Pinterest and Instagram has amplified the importance of visually appealing kitchens. Consumers are increasingly influenced by online content showcasing luxurious kitchen designs, with waterfall sinks frequently featured as a key design element. These platforms serve as virtual showrooms, exposing potential buyers to the latest trends and inspiring purchases. Upscale kitchen remodelling projects have also contributed to the market's growth. According to industry insights, around 40% of kitchen renovations in 2023 included upgrades to premium fixtures like waterfall sinks. With an average household spending $25,000 to $50,000 on kitchen remodels, the inclusion of high-quality, visually appealing sinks is becoming standard practice, particularly among the upper-middle-class demographic.

Market Restraints and Challenges:

One of the most significant barriers to the widespread adoption of waterfall kitchen sinks is their relatively high price point compared to traditional sinks. The average price of a waterfall sinks ranges between $400 and $1,000, making it an investment that not all consumers are willing or able to make. The inclusion of advanced features like smart sensors, LED lighting, and eco-friendly water systems further adds to the cost, making these sinks less accessible to budget-conscious buyers. Despite growing global demand, awareness about waterfall kitchen sinks remains limited in developing regions. Consumers in these markets often prioritize affordability over aesthetics or advanced features, which has slowed the market's penetration. Additionally, the lack of widespread marketing and distribution networks in these areas restricts consumer access to these products. Waterfall kitchen sinks are often designed for modern, open-concept kitchens. This focus on contemporary aesthetics can pose challenges for homeowners with traditional or compact kitchen layouts, where installing such sinks may not be feasible or practical. While many waterfall sinks incorporate water-saving features, concerns about their overall environmental impact persist. The production of these sinks, especially those made from materials like stainless steel or granite, involves significant energy consumption and resource use. Addressing these environmental concerns will be crucial for manufacturers aiming to align with global sustainability goals.

Market Opportunities:

Despite the challenges, the waterfall kitchen sink market is ripe with opportunities for growth and innovation. These opportunities stem from emerging trends, evolving consumer preferences, and technological advancements that allow manufacturers to cater to a broader audience. As awareness about premium kitchen fixtures grows in developing regions, manufacturers have an opportunity to tap into these untapped markets. Affordable models and targeted marketing campaigns can help bridge the gap between consumer aspirations and purchasing power, driving demand in these regions. The demand for personalized home décor is on the rise, and waterfall kitchen sinks are no exception. Offering customization options, such as unique finishes, basin shapes, and integrated features, allows manufacturers to cater to individual consumer preferences. Sustainability remains a critical focus area for the industry. Developing sinks with eco-friendly materials, such as recycled composites or low-impact manufacturing processes, can appeal to environmentally conscious consumers and enhance brand reputation.

WATERFALL KITCHEN SINK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kohler Co., Franke Group, Blanco GmbH, Elkay Manufacturing, Roca Sanitario SA, Moen Incorporated, Teka Group, Dornbracht AG, Delta Faucet Company, American Standard Brands, Villeroy & Boch, Hansgrohe SE, Zuhne USA, Kraus USA, Astracast Ltd. |

Waterfall Kitchen Sink Market Segmentation: By Type

-

Stainless Steel

-

Granite

-

Composite Materials

-

Ceramic

The most dominant type is stainless steel, favoured for its durability, resistance to corrosion, and modern aesthetic. The fastest-growing type, however, is composite materials, which offer a balance of affordability, durability, and design versatility.

Waterfall Kitchen Sink Market Segmentation: By Distribution Channel

-

Online Retail

-

Offline Retail (Specialty Stores, Home Improvement Centers, etc.)

Online retail is the fastest-growing channel due to the convenience of browsing and purchasing from home, along with the availability of detailed product descriptions and reviews. Offline retail remains the most dominant, as many consumers prefer to see and feel the product before making a purchase.

Waterfall Kitchen Sink Market Segmentation - by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

North America and Europe collectively dominate the market due to higher disposable incomes, strong home remodelling trends, and early adoption of premium kitchen fixtures. Asia-Pacific, while slightly behind in share, is rapidly closing the gap due to urbanization and a rising middle-class population. North America stands as the most dominant region, driven by robust demand in the United States and Canada. The preference for luxurious and technologically advanced kitchen fixtures propels this dominance. Additionally, the popularity of kitchen remodelling projects, influenced by media exposure and social trends, sustains the high demand.

The Asia-Pacific region emerges as the fastest-growing market. This growth is attributed to rapid urbanization, increased disposable incomes, and changing consumer lifestyles in countries such as China, India, and Southeast Asia. The region's growing middle class aspires to modernize their kitchens, leading to increased demand for stylish yet functional fixtures like waterfall sinks. Additionally, government initiatives in several Asia-Pacific countries to promote urban housing projects and homeownership contribute to the market's expansion. For instance, China's "Beautiful Countryside" initiative has boosted kitchen modernization efforts in rural areas, indirectly fueling the demand for premium kitchen fixtures.

COVID-19 Impact Analysis

The COVID-19 pandemic had a multifaceted impact on the waterfall kitchen sink market, influencing both demand and supply dynamics. The prolonged periods of lockdowns and restrictions led to significant changes in consumer behaviour, industry operations, and market strategies. With people spending more time at home, there was a noticeable shift in spending patterns towards home improvement and renovation projects. Kitchens, being the heart of the home, became a primary focus for these projects. Consumers invested in upgrading their kitchens to create more functional and aesthetically pleasing spaces, which drove demand for premium fixtures, including waterfall sinks. Online sales of kitchen sinks surged during the pandemic, as consumers turned to e-commerce platforms to explore and purchase products. Companies that had established a strong digital presence before the pandemic were better positioned to capitalize on this trend. The global supply chain disruptions caused by the pandemic posed challenges for manufacturers and suppliers in the waterfall kitchen sink market. Delays in raw material procurement, production halts, and increased shipping costs affected the timely delivery of products. This was particularly evident in regions heavily reliant on imports for high-quality kitchen fixtures. However, manufacturers adapted by diversifying supply chains and increasing regional production capacities. Many companies adopted just-in-time (JIT) inventory models to manage costs and minimize waste. The pandemic accelerated digital transformation across industries, including the home improvement sector. Virtual showrooms, 3D visualization tools, and augmented reality (AR) apps allowed consumers to visualize how waterfall sinks would look in their kitchens. This innovation enhanced the customer experience and boosted sales, even during lockdowns.

Latest Trends and Developments:

The waterfall kitchen sink market is characterized by rapid innovation and evolving consumer preferences, resulting in several notable trends and developments that define the industry. One significant trend is the increasing demand for smart sinks. Equipped with advanced features such as touchless operation, voice control, and water usage monitoring, these sinks offer convenience and functionality that resonate with tech-savvy consumers. Manufacturers are integrating these smart features to appeal to younger demographics, particularly millennials and Gen Z. Sustainability continues to be a driving force in product development. The use of eco-friendly materials, such as recycled stainless steel and low-impact composite materials, has gained traction. Additionally, water-saving technologies, including aerated water streams and dual-flow systems, are being incorporated to meet the growing demand for environmentally conscious solutions. Customization has become a cornerstone of consumer expectations. Many companies now offer personalized options for waterfall sinks, allowing customers to select finishes, basin shapes, and integrated features that align with their unique tastes. This trend reflects the broader move toward individualized home design. E-commerce platforms are playing a pivotal role in reshaping the market landscape. The convenience of online shopping, coupled with advanced visualization tools, has made it easier for consumers to explore and purchase waterfall sinks. Virtual showrooms and AR tools enable customers to see how different models will fit into their kitchens, enhancing the buying experience. Another notable development is the increasing emphasis on hygiene and sanitation. Post-pandemic, consumers prioritize products that minimize the risk of contamination. Waterfall sinks with antimicrobial coatings, self-cleaning surfaces, and touchless operation have become highly sought after, addressing these concerns effectively.

Key Players in the Market

-

Kohler Co.

-

Franke Group

-

Blanco GmbH

-

Elkay Manufacturing

-

Roca Sanitario SA

-

Moen Incorporated

-

Teka Group

-

Dornbracht AG

-

Delta Faucet Company

-

American Standard Brands

-

Villeroy & Boch

-

Hansgrohe SE

-

Zuhne USA

-

Kraus USA

-

Astracast Ltd.

Chapter 1. Waterfall Kitchen Sink Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Waterfall Kitchen Sink Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Waterfall Kitchen Sink Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Waterfall Kitchen Sink Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Waterfall Kitchen Sink Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Waterfall Kitchen Sink Market – By Type

6.1 Introduction/Key Findings

6.2 Stainless Steel

6.3 Granite

6.4 Composite Materials

6.5 Ceramic

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Waterfall Kitchen Sink Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online Retail

7.3 Offline Retail (Specialty Stores, Home Improvement Centers, etc.)

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Waterfall Kitchen Sink Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Waterfall Kitchen Sink Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Kohler Co.

9.2 Franke Group

9.3 Blanco GmbH

9.4 Elkay Manufacturing

9.5 Roca Sanitario SA

9.6 Moen Incorporated

9.7 Teka Group

9.8 Dornbracht AG

9.9 Delta Faucet Company

9.10 American Standard Brands

9.11 Villeroy & Boch

9.12 Hansgrohe SE

9.13 Zuhne USA

9.14 Kraus USA

9.15 Astracast Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth of the Waterfall Kitchen Sink Market is driven by rising awareness of nasal breathing benefits, increasing prevalence of sleep-related issues like snoring and apnea, and the demand for non-invasive health solutions. Growing health consciousness, innovations in hypoallergenic and breathable tapes, and widespread adoption among fitness enthusiasts and sleep technology users further fuel market expansion.

Main concerns about the waterfall kitchen sink market include high initial costs, limited consumer awareness in developing regions, supply chain disruptions, material availability issues, competition from conventional sinks, and challenges in integrating advanced technologies with existing plumbing systems.

Kohler Co., Franke Group, Blanco GmbH, Elkay Manufacturing, Roca Sanitario SA, Moen Incorporated, Teka Group.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.