Waterborne PU Coatings for Textiles Market Size (2023 – 2030)

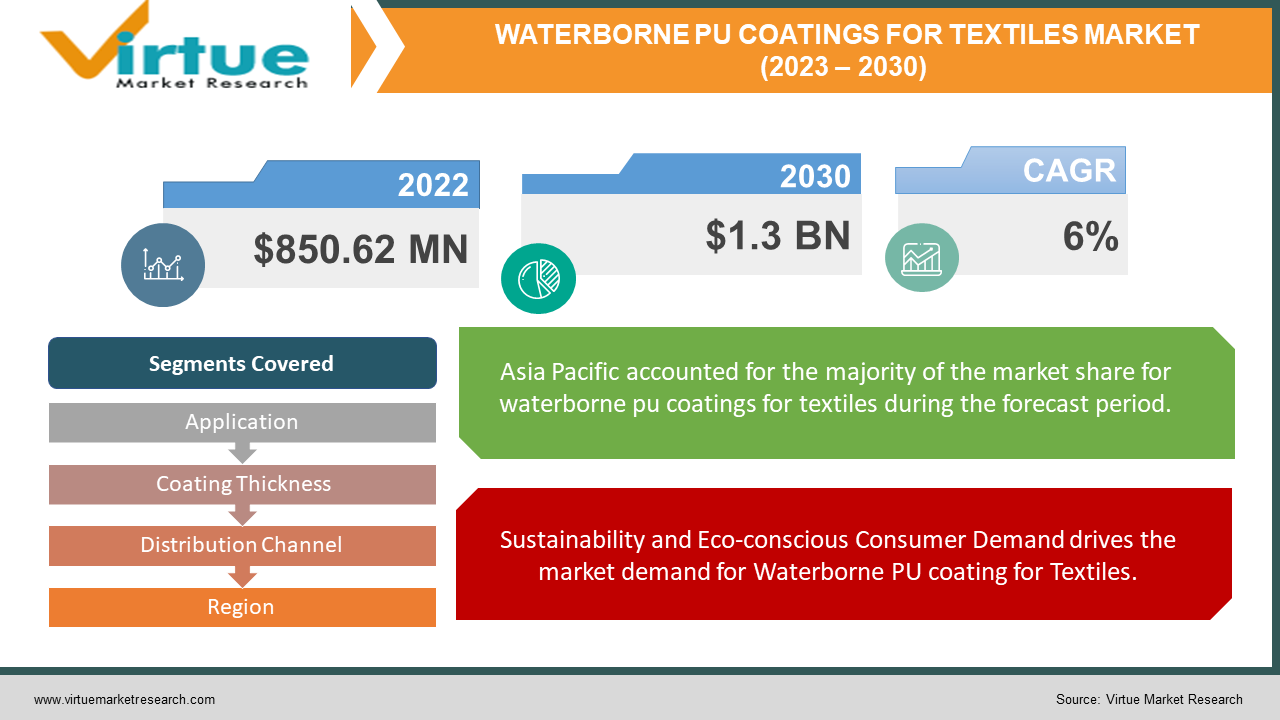

The Global Waterborne PU Coatings for Textiles Market was valued at USD 850.62 Million and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6%.

Waterborne Polyurethane (PU) coating is a protective coating material that is primarily composed of water and polyurethane resins. Waterborne Polyurethane (PU) Coatings are commonly used in various industries, including textiles, paints, automotive, and construction. Waterborne PU coatings have lower levels of volatile organic compounds (VOCs), have milder odors, are less flammable, and are environment-friendly. In the textile industry, they are applied to fabrics to enhance properties such as water repellency, stain resistance, and durability. These coatings are used on textiles, which encompass a wide range of materials including fabrics, yarns, fibers, and other textile-based products. In the past, there was a significant shift towards sustainable and eco-friendly coatings. At present, the demand for waterborne PU coatings in textiles is on the rise. Consumers are seeking products that offer protection against water and stains. In the future, research and development efforts are expected to result in the advancement of waterborne PU coatings for textiles. Key players in this market are BASF SE, The Dow Chemical Company, Covestro AG, Huntsman Corporation, and Corporation.

Key Market Insights:

Waterborne PU coatings have lower levels of volatile organic compounds (VOCs) and a 70% lower carbon footprint in production. These coatings are used on textiles, which encompass a wide range of materials including fabrics, yarns, fibers, and other textile-based products. They are applied to fabrics to enhance properties such as water repellency, stain resistance, and reduction of textile waste. In a study, it was found that it helps in an 80% reduction in textile waste. The study also shows that there is a 50% longer textile lifespan with Waterborne PU Coatings.

Waterborne PU Coatings for Textiles Market Drivers:

Sustainability and Eco-conscious Consumer Demand drives the market demand for Waterborne PU coating for Textiles.

Waterborne PU coatings have lower levels of volatile organic compounds (VOCs) and are environment-friendly. The increase in demand for sustainable products among consumers drives the waterborne PU coatings for the textiles market. Manufacturers are shifting to sustainable solutions with no harsh chemical emissions. This reduces the impact on air quality. The waterborne PU coatings for textiles have milder odors and are less flammable compared to other solvent-based alternatives, which enhances safety during application. Using waterborne PU coatings there is a 70% lower carbon footprint in the production

Technological Advancements have boosted the market for Waterborne PU Coatings for Textiles

Recent technological innovations have transformed the waterborne PU coatings for the textiles market. Technological integration in textiles, such as smart fabrics and wearable technologies, creates a demand for coatings that can protect and enhance these specialized materials. Advancements in Formulation Technology led to the creation of advanced waterborne PU coatings with enhanced performance characteristics, such as improved adhesion, durability, and water resistance. Continuous development and research can lead to more self-cleaning properties. With the advent of technologies, the market is anticipated to witness significant growth in the coming years. Continuous innovation and research in waterborne PU coatings can create more advanced waterborne PU coatings with advanced performance including self-cleaning properties. Manufacturers can invest in this innovation and technologies which further produce more profit in the market

Waterborne PU Coatings for Textiles Market Restraints and Challenge

The major challenge faced by the waterborne PU coatings for textiles market is the high technical complexity and expertise requirements as formulating and applying waterborne PU coatings can be technically difficult. Manufacturers may require specialized knowledge and expertise to ensure proper application and achieve desired performance. There is also limited performance in certain applications. While waterborne PU coatings offer a wide range of benefits, they may not be suitable for all applications and in some cases, solvent-based coatings may still provide superior performance characteristics, limiting the application of waterborne formulations. Waterborne coatings may require longer curing times compared to solvent-based alternatives and this can impact production schedules and lead to potential difficulties in manufacturing processes. Also, waterborne PU coatings for the textiles market are very competitive, and there is continuous pressure to achieve more features as consumer demands are increasing.

Waterborne PU Coatings for Textiles Market Opportunities:

The waterborne PU coatings for textiles market has various opportunities in the market. With the advent of technologies, the market is anticipated to witness significant growth in the coming years. Continuous innovation and research in waterborne PU coatings can create more advanced waterborne PU coatings with advanced performance including self-cleaning properties. Manufacturers can invest in this innovation and technologies which further produce more profit in the market. Offering waterborne PU coatings for textiles to specific applications can address niche markets and specialized customer needs. In essence, these developments can help the growth of waterborne PU coatings for the textiles market.

WATERBORNE PU COATINGS FOR TEXTILES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Application, Coating Thickness, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, The Dow Chemical Company, Covestro AG, Huntsman Corporation, DIC Corporation, Wacker Chemie AG, Clariant AG, Archroma, Hexion Inc., Evonik Industries AG |

Waterborne PU Coatings for Textiles Market Segmentation: By Application

-

Apparel

-

Home Textiles

-

Industrial and Technical Textiles

In 2022, based on market segmentation by application, Apparel occupies the highest share of the market. It involves applying waterborne PU coatings on clothing items and waterborne PU coatings provide properties such as water repellency, and durability. They are used in raincoats, sportswear, jackets, and even footwear. Industrial and Technical Textiles are the fastest-growing segment and are growing at a fast CAGR of 20% during the forecast period. This segment involves textiles used in specialized applications and waterborne PU coatings for industrial and technical textiles are designed to meet specific performance requirements. They are used in products like awnings, tents, automotive fabrics, and medical textiles.

Waterborne PU Coatings for Textiles Market Segmentation: By Coating Thickness

-

Thin Film Coatings

-

Thick Film Coatings

In 2022, based on market segmentation by Coating Thickness, Thin film coatings occupied the highest share of the market at around 47%. In this, a layer of waterborne PU coating is applied thinly on the surface of the textile and these coatings provide a minimal layer which gives flexibility to the material. Thin film coatings are lightweight in nature and preserve the natural feel and flexibility of the textile. They are used in applications where maintaining the original texture and drape of the fabric is essential. For example, in apparel like lightweight rain jackets or breathable sportswear

Thick Film Coatings is the fastest-growing segment during the forecast period and is growing at a CAGR of more than 20%. It is driven by the increasing demand for specialized coatings in industries where robust protection and durability are crucial, such as industrial textiles and technical textiles.

Waterborne PU Coatings for Textiles Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors and Wholesalers

-

Online Retailers

In 2022, the distributors and wholesalers occupy the highest market share about 30% of the market. These play a crucial role in distributing waterborne PU coatings to retailers, manufacturers, and other businesses in the textile industry.

The fastest-growing application segment in terms of revenue is expected to be the Online retailers. Online retailers sell waterborne PU coatings through e-commerce platforms. Online Retail (E-commerce) is the fastest-growing sector because it can provide a wide selection and competitive prices in the market.

Waterborne PU Coatings for Textiles Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, Asia Pacific occupies the highest share of about 45% of the market. This is due to the presence of robust textile manufacturing industries in countries like China, India, Japan, and Southeast Asian nations. The Asia-Pacific region's textile industry is a major driver for the demand for waterborne PU coatings, supported by factors like economic growth, population size, and an increasing focus on sustainability.

Asia-Pacific is the fastest-growing segment during the forecast period due to rapid urbanization and industrialization.

COVID-19 Impact Analysis on the Global Waterborne PU Coatings for Textiles Market:

The pandemic had a significant impact on the waterborne PU coatings for the textiles market. Due to global supply chain disruptions, all the industries were closed, which affected the production and distribution of waterborne PU coatings and resulted in delays in manufacturing and delivery times in textiles industries. The pandemic prompted changes in consumer behavior, including awareness of sustainability, and led to an increased demand for eco-friendly waterborne coatings for textiles, which impacted the market. Manufacturers are shifting to sustainable solutions with no harsh chemical emissions. This reduces the impact on air quality.

Latest Trends/ Developments:

Technological integration in textiles, such as smart fabrics and wearable technologies, creates a demand for coatings that can protect and enhance these specialized materials. Advancements in Formulation Technology led to the creation of advanced waterborne PU coatings with enhanced performance characteristics, such as improved adhesion, durability, and water resistance. Advancements in formulations are creating waterborne PU coatings with even lower environmental impact and include innovations in raw materials sourcing, recycling, and reducing overall carbon footprint. The integration of digital technologies and automation in the manufacturing process is leading to more precise and efficient application of coatings and can result in higher quality products and reduced waste. Nanotechnology is used to enhance the performance of waterborne PU coatings and can improve properties like water repellency, UV resistance, and abrasion resistance.

Key Players:

-

BASF SE

-

The Dow Chemical Company

-

Covestro AG

-

Huntsman Corporation

-

DIC Corporation

-

Wacker Chemie AG

-

Clariant AG

-

Archroma

-

Hexion Inc.

-

Evonik Industries AG

Chapter 1.Waterborne PU Coatings for Textiles Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2.Waterborne PU Coatings for Textiles Market– Executive Summary

2.1 Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3.Waterborne PU Coatings for Textiles Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4.Waterborne PU Coatings for Textiles MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5.Waterborne PU Coatings for Textiles Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6.Waterborne PU Coatings for Textiles Market– By Application

6.1 Introduction/Key Findings

6.2 Apparel

6.3 Home Textiles

6.4 Industrial and Technical Textiles

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 7.Waterborne PU Coatings for Textiles Market– By Coating Thickness

7.1 Introduction/Key Findings

7.2 Thin Film Coatings

7.3 Thick Film Coatings

7.4 Y-O-Y Growth trend Analysis By Coating Thickness

7.5 Absolute $ Opportunity Analysis By Coating Thickness, 2023-2030

Chapter 8.Waterborne PU Coatings for Textiles Market– By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors and Wholesalers

8.4 Online Retailers

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2023-2030

Chapter 9.Waterborne PU Coatings for Textiles Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Coating Thickness

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Coating Thickness

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Coating Thickness

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Coating Thickness

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Coating Thickness

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10.Waterborne PU Coatings for Textiles Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF SE

10.2 The Dow Chemical Company

10.3 Covestro AG

10.4 Huntsman Corporation

10.5 DIC Corporation

10.6 Wacker Chemie AG

10.7 Clariant AG

10.8 Archroma

10.9 Hexion Inc.

10.10 Evonik Industries AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Waterborne PU Coatings for Textiles Market was valued at USD 850.62 Million and is projected to reach a market size of USD 1.3 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6%.

Sustainability, Eco-conscious Consumer Demand, and Technological advancements are the market drivers of the Global Waterborne PU Coatings for Textiles Market.

Thin Film Coatings and Thick Film Coatings are the segments under the Global Waterborne PU Coatings for Textiles Market by coating thickness.

Asia Pacific is the most dominant region for the Global Waterborne PU Coatings for Textiles Market.

BASF SE, Dow Chemical Company, and Covestro Ag are the key players in the Global Waterborne PU Coatings for Textiles Market.