Waterborne Polyurethane Dispersions Market Size (2024 –2030)

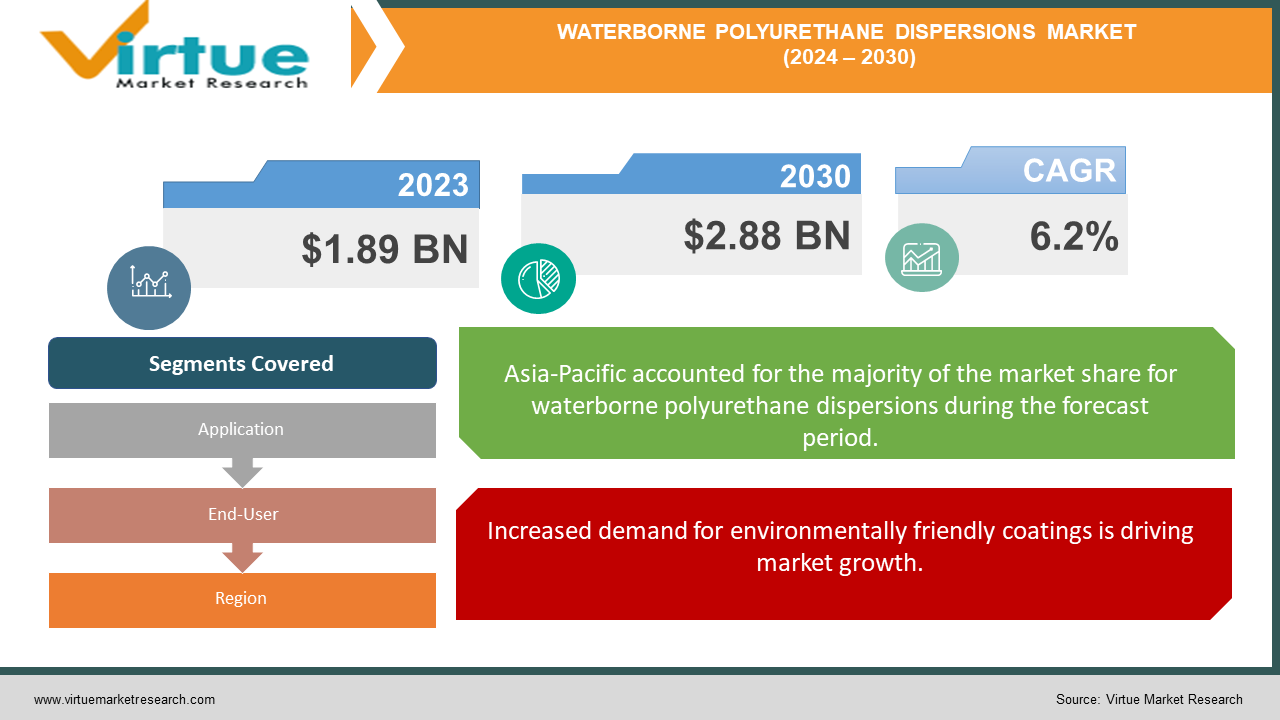

In 2023, the Global Waterborne Polyurethane Dispersions Market was valued at USD 1.89 billion and is projected to reach a market size of USD 2.88 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.

Because they are diluted with water, waterborne polyurethane dispersions (PUDs) are a readily reusable and eco-friendly kind of polymer. Water, polyurethane resins, and additional additives are present in these dispersions. The market is expanding rapidly because there is a growing need for paints, sealants, and adhesives that are low in volatile organic compounds (VOCs) and environmentally friendly. Throughout the forecast period, the market for waterborne polyurethane dispersions is anticipated to expand quickly due to the growing demand for these environmentally friendly products. The growing demand for environmentally friendly paints and sealants is expected to propel market growth, particularly in the construction sector. The Asia-Pacific region is anticipated to grow at the fastest rate, with North America and Europe predicted to lead the market. Major players in the market are concentrating on product innovation and diversifying their product offerings to meet the growing demand for environmentally friendly coatings, adhesives, and sealants.

Key Market Insights:

The coatings segment accounts for approximately 45% of the waterborne polyurethane dispersions market share, driven by the increasing demand for environmentally friendly, low-VOC coating solutions across various industries.

Aliphatic polyurethane dispersions constitute around 60% of the market demand, owing to their superior UV resistance, color stability, and durability compared to aromatic alternatives.

In terms of region, Asia-Pacific holds the largest market share of about 30% for waterborne polyurethane dispersions, attributed to the rapid industrialization, growing construction activities, and stringent environmental regulations promoting the use of water-based systems.

The adoption of bio-based waterborne polyurethane dispersions is growing at a rate of approximately 12% annually, driven by the increasing focus on sustainability and the development of renewable raw material sources for polyurethane production.

Global Waterborne Polyurethane Dispersions Market Drivers:

Increased demand for environmentally friendly coatings is driving market growth.

The growing need for environmentally friendly coatings is one of the primary factors driving the growth of the waterborne polyurethane dispersions market worldwide. Several sectors, including the building, automotive, and textile industries, have been adopting sustainable and eco-friendly coatings lately. The public's increasing awareness of these issues and the need to lessen the detrimental effects of coatings on the environment are what are driving this change. Waterborne polyurethane dispersions are gaining traction due to their reduced volatile organic compound (VOC) emissions and superior performance, including strong adhesion, resistance to abrasion, and flexibility. They are a good substitute for conventional solvent-based coatings because of these characteristics. Waterborne polyurethane dispersions are therefore being used by more industries, which is fueling the expansion of the global market.

The world economy is growing and developing at a rapid rate thanks to industrialization, which is also propelling the expansion of the global market.

The global market for waterborne polyurethane dispersions is also being driven in large part by the increasing industrialization of developing nations. The textile, building, and automotive industries, among others, have seen a rise in the need for coatings, adhesives, and sealants. These industries make extensive use of waterborne polyurethane dispersions because of their superior performance and environmental friendliness. The increasing demand for these dispersions in these sectors has led to a growth in the global market. Furthermore, top businesses are putting more of an emphasis on product innovation and research to improve waterborne polyurethane dispersions and satisfy the demands of various industries. The emphasis on innovation has helped the global market to grow even more.

Waterborne Polyurethane Dispersions Market Challenges and Restraints:

The narrow range of applications is one of the major issues facing the waterborne polyurethane dispersion industry. Waterborne polyurethane dispersions may not be appropriate for all applications, despite their excellent performance and environmental friendliness. For instance, compared to waterborne polyurethane dispersions, solvent-based coatings occasionally offer superior chemical resistance and higher tensile strength. This restriction limits the range of uses for these dispersions, which could impede the expansion of their market across a number of sectors. Major corporations are spending money on research and development (R&D) to solve this problem and produce better waterborne polyurethane dispersions that are applicable to a larger number of applications.

Waterborne Polyurethane Dispersions Market Opportunities:

The increasing need for water-based coatings in developing regions like Africa, the Middle East, and Asia-Pacific indicates a sizable global growth market for waterborne polyurethane dispersions. The demand for environmentally friendly and sustainable coatings is rising in these areas as a result of increased industrialization and urbanization. This opens up a large market for polyurethane dispersions that are waterborne.

WATERBORNE POLYURETHANE DISPERSIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dow, Bayer Material science, Axalta Coating Systems, Henkel, PPG Industries, BASF, H.B. Fuller, RPM International, 3M, Sherwin-Williams |

Global Waterborne Polyurethane Dispersions Market Segmentation: By Application

-

Coatings

-

Adhesive & Sealants

-

Leather Finishing

-

Paper & Textile

-

Others

Based on application, the waterborne polyurethane dispersion market is split into multiple segments, including coatings, leather finishing, paper & textile, adhesives & sealants, and others. Because waterborne polyurethane dispersions are frequently used in coatings for wood, metal, and plastic, coatings have the largest market share. The market for adhesives and sealants is expanding due in part to the demand from the automotive and construction industries for environmentally friendly and sustainable adhesives. The need for high-performance and environmentally friendly coatings in these industries is also expected to fuel growth in the paper & textile finishing and leather finishing sectors. At the moment, the two biggest categories are coatings and adhesives & sealants. Still, it is expected that the other segments will expand as well, given the industry's growing emphasis on eco-friendly options.

Global Waterborne Polyurethane Dispersions Market Segmentation: By End-User

-

Building & Construction

-

Automotive & Transportation

-

Electronics

-

Electronics

-

Others

The building and construction, automotive and transportation, electronics, textiles, and other end-user categories make up the global market for waterborne polyurethane dispersions. The industry with the biggest market share at the moment is building and construction, as these dispersions are widely used in a variety of applications like floor coatings, roofing, and waterproofing. The growing need for sustainable and eco-friendly adhesives and coatings is driving growth in the automotive and transportation industries. The need for high-performance adhesives and coatings that resist heat, moisture, and chemicals is anticipated to fuel ongoing expansion in the electronics industry. Furthermore, as demand for water-based paints and finishes rises, the textile industry is expected to grow significantly.

Global Waterborne Polyurethane Dispersions Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East

-

Latin America

The regions of North America, Europe, Asia-Pacific, the Middle East, and Latin America make up the majority of the world market for waterborne polyurethane dispersions. Asia-Pacific presently has the biggest market share among these regions because of the growing need for water-based adhesives and coatings in the textile, automotive, and building sectors. Urbanization, industrialization, and the region's emphasis on eco-friendly goods are the main drivers of this growth. The demand for environmentally friendly adhesives and coatings in the building, packaging, and automotive industries is driving substantial growth in Europe. Long-term growth in North America is being propelled by the construction and automotive sectors. With an emphasis on sustainability and environmental friendliness across a range of end-use industries, the Middle East and Latin America are also growing. Despite having smaller market shares at the moment, these regions are predicted to grow quickly in the years to come. Asia-Pacific currently holds the biggest market share, with North America and Europe following.

COVID-19 Impact on the Global Waterborne Polyurethane Dispersions Market:

Worldwide demand for waterborne polyurethane dispersions has surged due to the COVID-19 pandemic. Sanitation and hygiene have become more important to many industries, such as healthcare and packaging. The demand for antiviral and antibacterial adhesives and coatings has increased as a result. The demand for waterborne polyurethane dispersions has increased due to their ability to incorporate these features. But the pandemic has also caused supply chain disruptions and decreased demand in a number of sectors, including the automobile and building industries. The worldwide market has been impacted by this decrease in waterborne polyurethane dispersions' production and sales.

Latest Trend/Development:

There have been notable advancements and trends in the waterborne polyurethane dispersions (PUDs) market. Demands for low-VOC emissions and environmental sustainability are driving an increasing number of industries to adopt eco-friendly solutions. Businesses are using cutting-edge technologies to innovate and enhance PUD formulations, improving qualities like adhesion, durability, and chemical and abrasion resistance. Applications are becoming more widespread in industries such as automotive, construction, electronics, textiles, and packaging than just traditional coatings and adhesives. Due to rapid industrialization and government initiatives promoting eco-friendly products, Asia-Pacific currently holds the largest market share, with growth also seen in Europe and North America. High-performance PUDs that adhere to strict standards for weather resistance and durability are becoming more and more necessary. In addition, formulations are incorporating antimicrobial qualities more and more in response to the increased concerns about hygiene following the COVID-19 pandemic. In response to rising global demand, manufacturers are growing their production capacities and streamlining their supply chains, which reflects a changing and dynamic market environment.

Key Players:

-

Dow

-

Bayer Material science

-

Axalta Coating Systems

-

Henkel

-

PPG Industries

-

BASF

-

H.B. Fuller

-

RPM International

-

3M

-

Sherwin-Williams

Market News:

-

DAOTAN 7061/35WA, a cutting-edge waterborne polyurethane dispersion, was created by Allnex in January 2022 expressly for use in vehicle refinish and OEM automotive coatings. This product is made to work exceptionally well in a variety of applications, such as general industrial applications, automotive interior and exterior primers, and waterborne basecoats for refinishing and automobiles.

Chapter 1. Waterborne Polyurethane Dispersions Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Waterborne Polyurethane Dispersions Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Waterborne Polyurethane Dispersions Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Waterborne Polyurethane Dispersions Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Waterborne Polyurethane Dispersions Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Waterborne Polyurethane Dispersions Market – By End-User

6.1 Introduction/Key Findings

6.2 Building & Construction

6.3 Automotive & Transportation

6.4 Electronics

6.5 Electronics

6.6 Others

6.7 Y-O-Y Growth trend Analysis By End-User

6.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 7. Waterborne Polyurethane Dispersions Market – By Application

7.1 Introduction/Key Findings

7.2 Coatings

7.3 Adhesive & Sealants

7.4 Leather Finishing

7.5 Paper & Textile

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Waterborne Polyurethane Dispersions Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By End-User

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By End-User

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By End-User

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By End-User

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By End-User

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Waterborne Polyurethane Dispersions Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Dow

9.2 Bayer Material science

9.3 Axalta Coating Systems

9.4 Henkel

9.5 PPG Industries

9.6 BASF

9.7 H.B. Fuller

9.8 RPM International

9.9 3M

9.10 Sherwin-Williams

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Waterborne Polyurethane Dispersions Market was esteemed at USD 1.89 Billion in 2023 and is projected to value at USD 2.88 Billion by 2030, growing at a fast CAGR of 6.2% during the forecast period 2024-2030.

The Global Waterborne Polyurethane Dispersions Market is driven by the growing Demand for Sustainable Coatings.

The Segments under the Global Waterborne Polyurethane Dispersions Market by application are Coatings, Adhesives & Sealants, Leather Finishing, Paper & Textile, and others.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Waterborne Polyurethane Dispersions Market.

BASF, Sherwin-Williams, and PPG Industries are the three major leading players in the Global Waterborne Polyurethane Dispersions Market