Water Testing And Analysis Market Size (2024 – 2030)

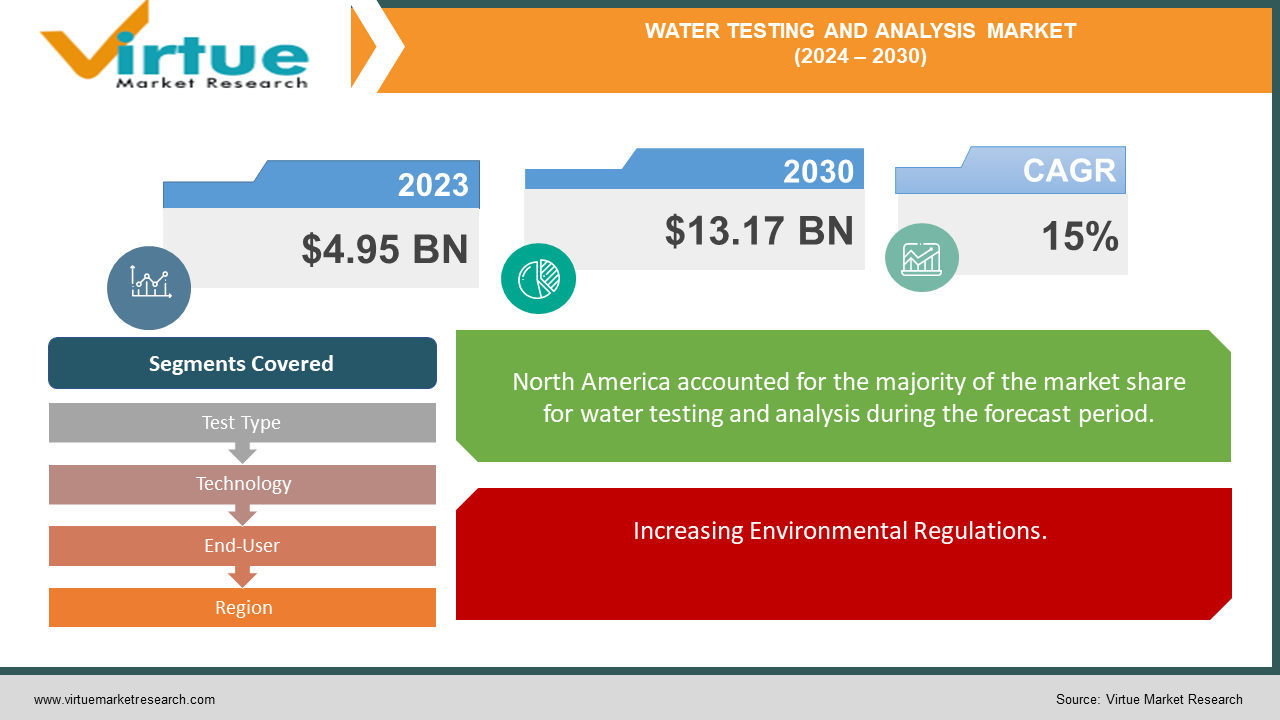

The Global Water Testing And Analysis Market was valued at USD 4.95 billion in 2023 and is projected to reach a market size of USD 13.17 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 15% between 2024 and 2030.

The Global Water Testing and Analysis Market is experiencing rapid growth due to increasing concerns about water quality and the rising demand for safe and clean water. As water contamination becomes a critical issue, driven by industrialization, urbanization, and climate change, the need for comprehensive water testing solutions is more pressing than ever. Water testing and analysis involve a variety of techniques to assess the chemical, biological, and physical properties of water, ensuring it meets safety standards for consumption, agriculture, and industrial use. This market is driven by stringent government regulations and environmental policies aimed at protecting public health and maintaining ecological balance. The adoption of advanced testing technologies, such as smart sensors and automated testing kits, has further fueled market expansion, providing more accurate and efficient methods for water quality assessment. Additionally, the growing awareness among consumers about the importance of safe drinking water is boosting the demand for regular water testing in residential and commercial settings. As industries such as pharmaceuticals, food and beverage, and agriculture increasingly rely on clean water, the demand for water testing services is expected to rise significantly. The Global Water Testing and Analysis Market is set to play a pivotal role in ensuring sustainable water management practices worldwide.

Key Market Insights:

Rising water contamination concerns are driving demand for water testing technologies globally, growing at a rate of 6.5%.

Regulatory mandates for water quality management contribute to around 35% of the market's growth.

Portable water testing kits account for approximately 20% of market share due to their ease of use.

Smart water testing solutions using IoT are growing at a CAGR of 7.8%, enhancing real-time monitoring capabilities.

Industrial wastewater testing is expanding, with an expected annual growth of 5.3% due to stricter environmental regulations.

Water Testing And Analysis Market Drivers:

Increasing Environmental Regulations.

Stricter environmental regulations are a significant driver in the global water testing and analysis market. Governments worldwide are imposing stringent guidelines to monitor and manage water quality, particularly in industrial and agricultural sectors, to prevent water pollution. The enforcement of these regulations is pushing industries to adopt advanced water testing solutions to comply with legal requirements and avoid hefty fines. In regions like Europe and North America, regulatory bodies like the Environmental Protection Agency (EPA) and the European Environment Agency (EEA) have set high standards for water quality, fostering market growth. As environmental concerns grow, companies are investing in innovative water analysis technologies to ensure they meet compliance standards.

Rising Public Health Awareness.

The increasing awareness of public health concerns related to water contamination is another critical market driver. The presence of contaminants like heavy metals, bacteria, and harmful chemicals in drinking water poses significant health risks, leading to a surge in demand for water testing solutions. Public and private sectors alike are investing in water analysis to ensure the safety of water sources, both for consumption and recreational use. This heightened awareness, combined with global initiatives for safe drinking water, is propelling the adoption of advanced testing technologies, including real-time monitoring systems, which can quickly detect pollutants and ensure water safety.

Water Testing And Analysis Market Restraints and Challenges:

The global water testing and analysis market faces several restraints and challenges that could slow its growth. One of the primary challenges is the high cost of advanced testing technologies, which limits their adoption, especially in developing regions. Many smaller municipalities and industries struggle to afford cutting-edge water testing equipment and real-time monitoring systems, resulting in limited market penetration. Additionally, a lack of technical expertise is a significant barrier in deploying and maintaining complex water testing systems. Proper training and skilled personnel are essential to handle sophisticated instruments, which can be scarce in certain regions. Inconsistent regulatory frameworks across countries also present challenges, as varying standards and testing protocols can complicate international adoption of standardized technologies. This lack of uniformity forces companies to customize their products based on regional regulations, adding to the costs and complexities. Lastly, the time-consuming nature of testing processes in some traditional methods can deter their widespread use, particularly in industries where rapid analysis is critical. Although innovations like IoT-based smart systems are emerging, their implementation remains limited due to high initial investment costs and infrastructure challenges, particularly in underdeveloped and remote areas. These factors together create barriers to the overall growth of the market.

Water Testing And Analysis Market Opportunities:

The global water testing and analysis market presents significant opportunities, primarily driven by advancements in smart technologies and real-time monitoring systems. The integration of Internet of Things (IoT) solutions into water testing devices is transforming the industry by providing continuous, real-time analysis of water quality. This technology allows for immediate detection of contaminants, enabling faster response times and reducing the risks associated with delayed testing. Another key opportunity lies in the growing demand for water testing in developing regions, where improving water infrastructure is becoming a priority due to rising concerns over public health and safety. Governments and international organizations are increasingly investing in water quality monitoring projects, opening up new markets for affordable and portable testing kits. Furthermore, the rise of sustainable water management practices in industries like agriculture, manufacturing, and energy is boosting the need for precise water testing to meet environmental compliance. As industries shift towards greener operations, advanced testing solutions are essential for monitoring water usage, recycling, and wastewater treatment. Lastly, the growing trend of privatization of water utilities in several regions is creating demand for efficient, automated water testing systems, as private companies seek to ensure quality and reduce operational costs. These opportunities position the market for significant growth in the coming years.

WATER TESTING AND ANALYSIS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

15% |

|

Segments Covered |

By Test Type, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc., Danaher Corporation, Agilent Technologies, Inc., PerkinElmer, Inc., Hach Company, Eurofins Scientific, Xylem Inc., Horiba, Ltd., IDEXX Laboratories, Inc., SUEZ Water Technologies & Solutions |

Water Testing And Analysis Market Segmentation: By Test Type

-

Physical Tests

-

Chemical Tests

-

Microbiological Tests

In 2023, based on market segmentation by Test Type, Physical Tests had the highest share of the Global Water Testing And Analysis Market. Regulatory compliance is a significant driver in the global water testing and analysis market, with many regulatory bodies, such as the Environmental Protection Agency (EPA) and the World Health Organization (WHO), setting stringent guidelines for physical parameters like pH, temperature, turbidity, and conductivity. These regulations necessitate frequent testing to ensure water quality meets required standards, thus driving demand for water testing solutions. Physical tests are crucial as they provide fundamental insights into water quality by quickly identifying issues such as pollution, contamination, or malfunctions in treatment systems. These tests are often more cost-effective compared to chemical or microbiological testing, as they are generally less expensive and can be conducted on-site using portable equipment. The wide range of applications for physical tests extends across various industries, including municipal water supply, industrial processes, environmental monitoring, and food and beverage production. However, the market share of physical tests may vary slightly depending on regional factors and the specific environmental and regulatory conditions in different areas.

Water Testing And Analysis Market Segmentation: By Technology

-

Chromatography

-

Spectrophotometry

-

Mass Spectrometry

-

Immunoassays

-

Other Techniques

In 2023, based on market segmentation by Technology, Spectrophotometry had the highest share of the Global Water Testing And Analysis Market. Spectrophotometry stands out in the global water testing and analysis market due to its versatility, affordability, and ease of use. This technique can measure a wide range of parameters, including turbidity, color, and the presence of specific contaminants, making it a valuable tool for various applications. Compared to more complex and expensive methods like chromatography, spectrophotometry is generally more cost-effective, which contributes to its widespread adoption. The ease of operation of many spectrophotometers further enhances their appeal, allowing for efficient use in diverse settings. Spectrophotometry's broad applications span several industries, including municipal water treatment, environmental monitoring, and industrial processes, where it helps in ensuring water quality and compliance with regulatory standards. Although techniques such as electrochemistry and chromatography are also critical, the combination of spectrophotometry's versatility, affordability, and user-friendly nature likely contributes to its prominence and dominance in the market. Its ability to deliver accurate and reliable results across a variety of parameters makes it a preferred choice for many water testing needs.

Water Testing And Analysis Market Segmentation: By End-User

-

Municipal Water Supply

-

Industrial Applications

-

Environmental Monitoring

-

Food and Beverage Industry

-

Pharmaceutical Industry

In 2023, based on market segmentation by End-User, Municipal Water Supply had the highest share of the Global Water Testing And Analysis Market. Regulatory compliance is a major driver in the water testing and analysis market, particularly for municipal water utilities that must adhere to stringent regulations to ensure the safety and quality of drinking water. This requirement leads to frequent testing of various parameters to meet legal standards and safeguard public health. Safe drinking water is a fundamental human right, and municipal utilities are crucial in protecting it by regularly testing to identify and address potential contamination issues. Additionally, testing is essential for infrastructure maintenance, helping to monitor the effectiveness of water treatment plants and distribution systems to ensure they operate efficiently and reliably. Environmental concerns further drive the need for testing, as municipal utilities are often involved in wastewater treatment and stormwater management. Ensuring these processes meet environmental standards is vital for sustainable water management. While industrial applications and environmental monitoring are also important, the large volume of water tested by municipal utilities and the critical nature of their responsibilities likely make them the dominant segment in the market. Their comprehensive testing needs highlight their central role in maintaining water safety and quality across communities.

Water Testing And Analysis Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, North America had the highest share of the Global Water Testing And Analysis Market. North America, particularly the United States, maintains a dominant position in the global water testing and analysis market due to several key factors. Stringent regulations governing water quality in the region have historically driven a strong demand for water testing services, ensuring compliance with rigorous standards. Additionally, North America has been a leader in the development and adoption of advanced water testing technologies, which has further reinforced its market dominance. The region's well-established infrastructure supports this leadership, encompassing a network of laboratories, equipment manufacturers, and service providers dedicated to water testing and analysis. Increased public awareness of environmental issues, including water pollution, has also contributed to heightened demand for testing services as communities seek to ensure the safety and quality of their water sources. While other regions, such as Asia-Pacific, are experiencing rapid growth and catching up, North America's established market position, combined with its robust regulatory framework and technological advancements, likely contributed to its continued leadership in 2023. The region's comprehensive approach to water quality and testing underscores its pivotal role in the global market.

COVID-19 Impact Analysis on the Global Water Testing And Analysis Market.

The COVID-19 pandemic had a mixed impact on the global water testing and analysis market. Initially, the market faced disruptions due to lockdowns, supply chain interruptions, and delays in manufacturing and distribution of testing equipment. Many industries temporarily halted operations, reducing the demand for water testing, especially in sectors like manufacturing and hospitality. However, the pandemic also highlighted the critical need for clean and safe water, particularly in healthcare facilities, residential areas, and public utilities. Increased awareness of hygiene and sanitation during the crisis led to a surge in demand for water quality monitoring and testing in key sectors, especially to ensure safe drinking water and to monitor wastewater for viral contaminants. The growing focus on public health, combined with stricter government regulations, accelerated the adoption of advanced water testing technologies, particularly for detecting pathogens. Moreover, industries that resumed operations post-lockdown implemented stringent water quality checks to meet regulatory requirements. The pandemic also spurred innovation, with an increased interest in real-time monitoring systems and remote testing technologies to minimize human intervention. Overall, while the market experienced initial challenges, the long-term demand for water testing has been reinforced by heightened public health concerns and regulatory scrutiny.

Latest trends / Developments:

The global water testing and analysis market is witnessing several emerging trends and developments that are shaping its future. One of the most notable trends is the increased adoption of smart technologies and real-time monitoring systems. Internet of Things (IoT)-enabled water testing devices are allowing continuous, automated tracking of water quality, providing instant data and improving the speed of detection for contaminants. Another significant development is the growing demand for portable and user-friendly testing kits, particularly in remote and rural areas where water infrastructure is limited. These kits are increasingly being used in regions with rising public health concerns related to water contamination. Additionally, the market is experiencing a shift toward sustainable water management practices, with industries focusing on reducing water waste and improving recycling processes. This is driving the need for precise, advanced water testing technologies to monitor water quality at every stage of usage and treatment. Blockchain technology is also emerging as a tool for ensuring transparency and accuracy in water testing data, improving trust in water quality reports. Furthermore, government initiatives and regulatory frameworks aimed at ensuring safe drinking water and proper wastewater treatment are boosting market growth, encouraging industries and municipalities to invest in state-of-the-art water testing solutions.

Key Players:

-

Thermo Fisher Scientific Inc.

-

Danaher Corporation

-

Agilent Technologies, Inc.

-

PerkinElmer, Inc.

-

Hach Company

-

Eurofins Scientific

-

Xylem Inc.

-

Horiba, Ltd.

-

IDEXX Laboratories, Inc.

-

SUEZ Water Technologies & Solutions

Chapter 1. Water Testing And Analysis Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Water Testing And Analysis Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Water Testing And Analysis Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Water Testing And Analysis Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Water Testing And Analysis Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Water Testing And Analysis Market – By Test Type

6.1 Introduction/Key Findings

6.2 Physical Tests

6.3 Chemical Tests

6.4 Microbiological Tests

6.5 Y-O-Y Growth trend Analysis By Test Type

6.6 Absolute $ Opportunity Analysis By Test Type, 2024-2030

Chapter 7. Water Testing And Analysis Market – By Technology

7.1 Introduction/Key Findings

7.2 Chromatography

7.3 Spectrophotometry

7.4 Mass Spectrometry

7.5 Immunoassays

7.6 Other Techniques

7.7 Y-O-Y Growth trend Analysis By Technology

7.8 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Water Testing And Analysis Market – By End-User

8.1 Introduction/Key Findings

8.2 Municipal Water Supply

8.3 Industrial Applications

8.4 Environmental Monitoring

8.5 Food and Beverage Industry

8.6 Pharmaceutical Industry

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Water Testing And Analysis Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Test Type

9.1.3 By Technology

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Test Type

9.2.3 By Technology

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Test Type

9.3.3 By Technology

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Test Type

9.4.3 By Technology

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Test Type

9.5.3 By Technology

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Water Testing And Analysis Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Thermo Fisher Scientific Inc.

10.2 Danaher Corporation

10.3 Agilent Technologies, Inc.

10.4 PerkinElmer, Inc.

10.5 Hach Company

10.6 Eurofins Scientific

10.7 Xylem Inc.

10.8 Horiba, Ltd.

10.9 IDEXX Laboratories, Inc.

10.10 SUEZ Water Technologies & Solutions

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Water Testing And Analysis market is expected to be valued at US$ 4.95 billion.

Through 2030, the Water Testing And Analysis market is expected to grow at a CAGR of 15%.

By 2030, the Global Water Testing And Analysis Market is expected to grow to a value of US$ 13.17 billion.

Asia- Pacific is predicted to lead the Global Water Testing And Analysis market.

The Global Water Testing And Analysis Market has segments By Application, Service Type and Region.