Water Soluble Packaging Market Size (2024-2030)

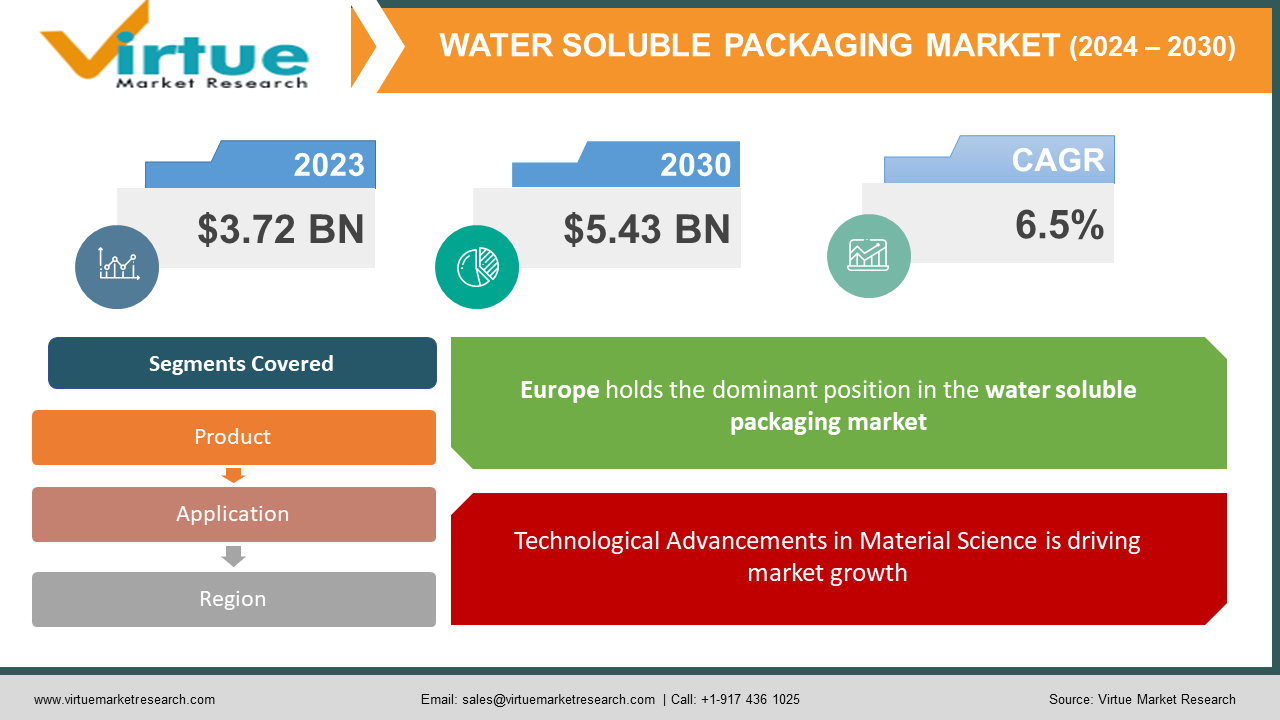

The Global Water Soluble Packaging Market was valued at USD 3.72 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is anticipated to reach USD 5.43 billion by 2030.

Water soluble packaging, primarily used in the packaging of chemicals, detergents, and healthcare products, is designed to dissolve when exposed to water, offering an environmentally friendly alternative to traditional packaging. Driven by increasing awareness of plastic pollution and demand for sustainable packaging solutions, the water soluble packaging market is positioned for significant growth. Factors such as rising environmental regulations and consumer preference for eco-friendly packaging contribute to this growth trajectory, as water soluble packaging is largely biodegradable and reduces the overall plastic waste footprint.

Key Market Insights:

- The water soluble packaging market saw a rapid increase in demand as a result of growing environmental awareness, with approximately 30% of consumers indicating a preference for sustainable packaging solutions in 2023.

- North America and Europe account for over 60% of the market share due to stringent environmental policies and high levels of consumer awareness about sustainability.

- Demand for water soluble packaging in the pharmaceutical sector is projected to grow at a CAGR of 8% due to innovations in packaging that ensure accurate dosing and minimize contamination risks.

Global Water Soluble Packaging Market Drivers:

Environmental Regulations and Consumer Awareness is driving market growth:

The growing awareness regarding the adverse impacts of plastic waste on the environment has prompted governments worldwide to implement strict regulations that promote sustainable packaging solutions. The European Union, for instance, has enforced measures to reduce plastic consumption by banning single-use plastics and offering incentives for eco-friendly alternatives. Consequently, water soluble packaging has gained traction as an alternative that reduces waste and promotes biodegradability. Consumers are increasingly aware of the need for sustainability, resulting in a shift in preference toward eco-friendly packaging options. This trend is particularly strong among millennials and Generation Z, who actively seek brands that adopt sustainable practices. The combination of regulatory support and consumer demand has catalyzed innovation within the water soluble packaging market, pushing manufacturers to develop packaging solutions that dissolve efficiently and minimize environmental impact.

Technological Advancements in Material Science is driving market growth:

Advances in material science, particularly with polyvinyl alcohol (PVA), have significantly influenced the water soluble packaging market. PVA is an ideal material for water soluble applications due to its high solubility in water and biodegradability, which leaves minimal residue after use. Technological innovations have further optimized the formulation of PVA, allowing it to dissolve at varying temperatures and accommodating diverse applications such as detergent pods, agricultural chemicals, and healthcare products. Improved production processes have also made it possible to scale manufacturing while reducing costs, making water soluble packaging more accessible to businesses across different industries. As the market for sustainable packaging expands, manufacturers continue to invest in R&D to explore other soluble polymers and composites that could offer enhanced performance, ultimately expanding the scope of applications for water soluble packaging.

Increasing Applications in Consumer Goods and Healthcare Sectors is driving market growth:

The consumer goods and healthcare sectors represent substantial growth opportunities for the water soluble packaging market. Within the consumer goods sector, laundry and dishwasher pods have become widely popular, providing a convenient and eco-friendly solution for consumers. As these sectors emphasize convenience and sustainability, water soluble packaging aligns well with their values, leading to high adoption rates. In the healthcare sector, water soluble packaging has proven useful in securely packaging individual doses of medications, reducing contamination risks, and simplifying the disposal process. Additionally, the trend toward unit-dose packaging within the pharmaceutical industry has seen substantial growth as it improves the accuracy of dosing and reduces wastage. As more industries recognize the advantages of water soluble packaging, its adoption in consumer goods and healthcare is expected to drive steady growth in the market.

Global Water Soluble Packaging Market Challenges and Restraints:

High Production Costs and Limited Material Options is restricting market growth:

Despite the advantages of water soluble packaging, high production costs remain a primary restraint. PVA, the most widely used material, is more expensive than traditional plastic packaging materials, which discourages some manufacturers from adopting it. Production processes require specialized machinery and technology, adding to the initial investment needed for manufacturers to enter this market. Although economies of scale may eventually lower costs, smaller manufacturers face financial constraints in implementing water soluble packaging solutions. Furthermore, there are limited material options in this market. PVA is highly suitable for various applications, but it has limitations, such as sensitivity to moisture, which can restrict its use in certain product categories. Finding alternative water soluble materials that match the performance and biodegradability of PVA, while remaining cost-effective, remains a challenge that the industry must address to broaden the application scope of water soluble packaging.

Concerns Over Packaging Durability and Moisture Sensitivity is restricting market growth:

Water soluble packaging, by nature, is designed to dissolve upon contact with water. This characteristic, while beneficial in specific applications, poses challenges in terms of durability and stability, especially in humid or wet environments. Concerns over moisture sensitivity and potential degradation before the intended use are common, particularly in regions with high humidity. The risk of unintended solubility can result in product contamination and increased wastage, undermining consumer trust in water soluble packaging. To address these concerns, manufacturers need to develop solutions that offer controlled solubility, where the packaging remains stable until contact with a specific temperature or amount of water. However, such advancements increase production complexity and, consequently, costs, making it challenging for manufacturers to balance durability, functionality, and affordability in their offerings.

Market Opportunities:

As consumer preference shifts towards eco-friendly solutions, water soluble packaging stands out as a unique product offering, fulfilling the demand for biodegradable and sustainable options across various sectors. This growing interest offers significant opportunities for expansion in untapped regions and new applications, especially as governments worldwide impose more stringent environmental regulations. Expansion into regions like Asia-Pacific presents a promising avenue due to increasing awareness of environmental issues and a shift in industrial policies favoring sustainability. Furthermore, innovations in material science can drive new applications for water soluble packaging, such as agricultural and industrial applications, where controlled dissolution of packaging material can enhance safety and reduce waste. Strategic partnerships with environmental organizations and retailers can further boost the credibility and reach of companies in the water soluble packaging market. As businesses increasingly align their practices with environmental sustainability, those offering water soluble packaging solutions are well-positioned to capture a broader market share by appealing to the environmental conscience of modern consumers.

WATER SOLUBLE PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kuraray Co., Ltd., Mitsubishi Chemical Corporation, Sekisui Chemical Co., Ltd., MonoSol, LLC, and Cortec Corporation |

Water Soluble Packaging Market Segmentation:

Water Soluble Packaging Market Segmentation By Product:

- Polyvinyl Alcohol (PVA) Packaging

- Polyglycolic Acid Packaging

- Others

The most dominant segment by product is Polyvinyl Alcohol (PVA) Packaging. PVA’s high water solubility and biodegradability make it the preferred choice, comprising nearly 70% of the market share. Its applications range widely, from household cleaning products to healthcare items, highlighting its versatility and market preference.

Water Soluble Packaging Market Segmentation By Application:

- Detergent Packaging

- Agrochemical Packaging

- Food Packaging

- Pharmaceutical Packaging

- Others

The most dominant application segment is Detergent Packaging. Accounting for approximately 40% of market demand, detergent packaging, particularly for laundry and dishwashing pods, remains the largest application due to its convenience and eco-friendliness for household use.

Water Soluble Packaging Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Europe holds the dominant position in the water soluble packaging market, attributed to strict environmental regulations, a strong focus on sustainability, and high consumer awareness. The European Union’s legislative measures against plastic waste, along with incentives for biodegradable packaging solutions, have spurred the adoption of water soluble packaging across industries. European consumers are notably more conscious of sustainable choices, which further strengthens the demand for water soluble packaging. Additionally, European manufacturers have readily invested in eco-friendly technologies, making the region a leader in both innovation and adoption of sustainable packaging alternatives. This commitment to reducing plastic waste and encouraging green packaging is likely to ensure Europe’s continued dominance in the water soluble packaging market.

COVID-19 Impact Analysis on the Water Soluble Packaging Market:

The COVID-19 pandemic accelerated the demand for sustainable and single-use packaging solutions, benefiting the water soluble packaging market. With heightened awareness of hygiene and safety, consumers showed a preference for single-use products to minimize contamination, leading to an increase in demand for water soluble packaging in sectors such as household cleaning, healthcare, and pharmaceuticals. The surge in online shopping during lockdowns also pushed for eco-friendly packaging as companies aimed to reduce their environmental impact amidst growing scrutiny of excessive plastic use in e-commerce. However, supply chain disruptions posed challenges, impacting the availability and cost of raw materials like PVA. Despite these hurdles, the long-term outlook remains positive as the pandemic reinforced the importance of sustainable practices, and governments globally are more committed than ever to reducing plastic waste. The lessons from COVID-19 have created a more favorable environment for water soluble packaging as an essential component of eco-conscious and hygienic product delivery.

Latest Trends/Developments:

The water soluble packaging market has seen significant developments, with companies investing in materials that enhance durability without compromising solubility. Innovations are underway to create multi-layered soluble films that offer controlled dissolution, making them suitable for diverse applications such as agricultural chemicals and medical packaging. Additionally, the trend of “green branding” has led companies to adopt water soluble packaging to align with consumer expectations for eco-friendly solutions. This trend is evident in sectors like personal care and healthcare, where brands seek to communicate sustainability through packaging choices. Collaborations between packaging manufacturers and environmental advocacy groups have also increased, aimed at promoting sustainable packaging standards. Furthermore, developments in smart packaging, where soluble materials are embedded with indicators for contamination or freshness, offer exciting new functionalities that could revolutionize the market. Such innovations are set to expand the appeal of water soluble packaging, driving its application across an even broader range of industries.

Key Players:

- Kuraray Co., Ltd.

- Mitsubishi Chemical Corporation

- Sekisui Chemical Co., Ltd.

- MonoSol, LLC

- Cortec Corporation

- Aquapak Polymers Ltd.

- Lactips

- Amtrex Nature Care Pvt Ltd.

- Cortec Corporation

- Soltec Development Group

Chapter 1. GLOBAL WATER SOLUBLE PACKAGING MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WATER SOLUBLE PACKAGING MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL WATER SOLUBLE PACKAGING MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL WATER SOLUBLE PACKAGING MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL WATER SOLUBLE PACKAGING MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WATER SOLUBLE PACKAGING MARKET– BY Product

6.1. Introduction/Key Findings

6.2. Polyvinyl Alcohol (PVA) Packaging

6.3. Polyglycolic Acid Packaging

6.4. Others

6.5. Y-O-Y Growth trend Analysis By Product

6.6. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 7. GLOBAL WATER SOLUBLE PACKAGING MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Detergent Packaging

7.3. Agrochemical Packaging

7.4. Food Packaging

7.5. Pharmaceutical Packaging

7.6. Others

7.7. Y-O-Y Growth trend Analysis By APPLICATION

7.8. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL WATER SOLUBLE PACKAGING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Application

8.2.3. By Product

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Application

8.3.3. By Product

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Application

8.4.3. By Product

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Application

8.5.3. By Product

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL WATER SOLUBLE PACKAGING MARKET – Company Profiles – (Overview, Product Product s Portfolio, Financials, Strategies & Development

9.1. Kuraray Co., Ltd.

9.2. Mitsubishi Chemical Corporation

9.3. Sekisui Chemical Co., Ltd.

9.4. MonoSol, LLC

9.5. Cortec Corporation

9.6. Aquapak Polymers Ltd.

9.7. Lactips

9.8. Amtrex Nature Care Pvt Ltd.

9.9. Cortec Corporation

9.10. Soltec Development Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Water Soluble Packaging Market was valued at USD 3.72 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is anticipated to reach USD 5.43 billion by 2030

Key drivers include environmental regulations, consumer awareness, and technological advancements in material science that support sustainable, biodegradable packaging.

Major segments include types such as Polyvinyl Alcohol (PVA) Packaging and applications like detergent packaging, agrochemical packaging, food packaging, and pharmaceutical packaging.

Europe leads the market due to strict environmental policies, high consumer awareness, and strong industry commitment to sustainable packaging solutions.

Prominent players include Kuraray Co., Ltd., Mitsubishi Chemical Corporation, Sekisui Chemical Co., Ltd., MonoSol, LLC, and Cortec Corporation.