Water Purification Market size (2025-2030)

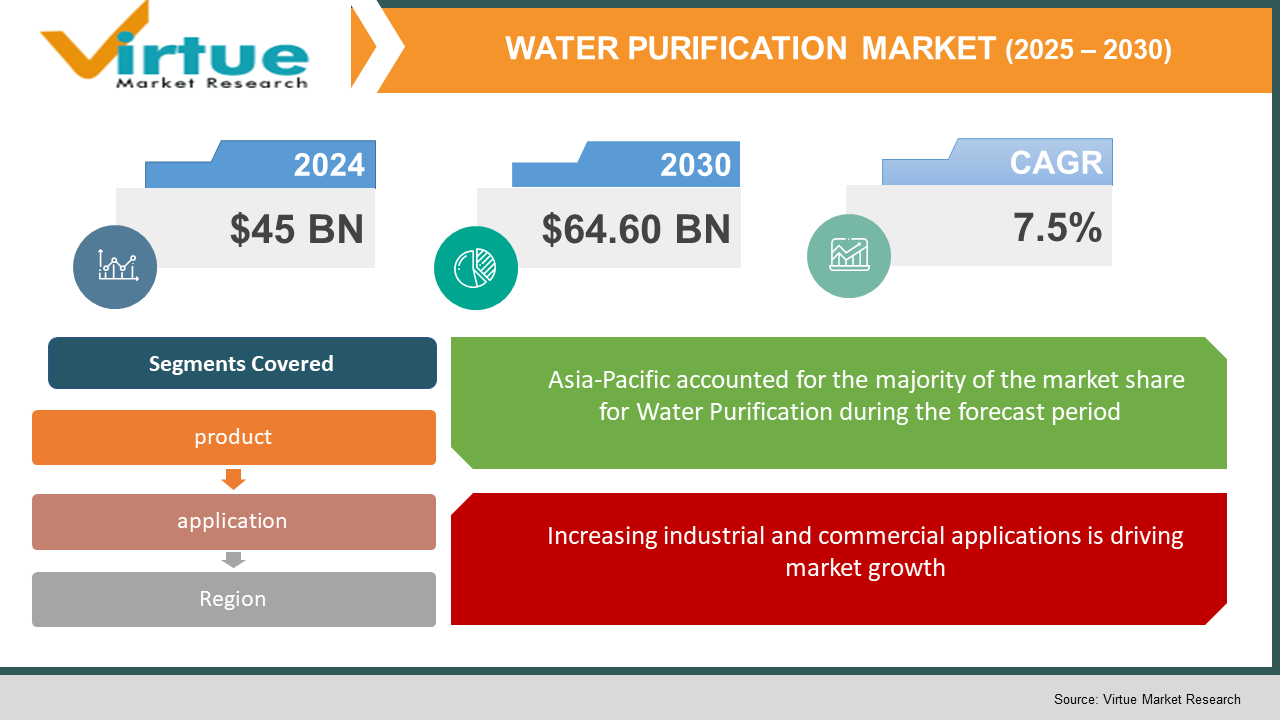

The Global Water Purification Market was valued at USD 45 billion in 2024 and will grow at a CAGR of 7.5% from 2025 to 2030. The market is expected to reach USD 64.60 billion by 2030.

The Water Purification Market focuses on technologies and solutions designed to remove contaminants, chemicals, and harmful microorganisms from water sources, making it safe for consumption and industrial use. With increasing concerns about waterborne diseases, pollution, and scarcity of clean drinking water, the demand for efficient purification systems is rising. The market is driven by stringent government regulations, rapid urbanization, and growing public awareness regarding water quality. Additionally, technological advancements such as advanced filtration systems, ultraviolet purification, and reverse osmosis contribute to the industry's expansion.

Key market insights

- Asia-Pacific held the largest market share in 2024, accounting for nearly 35% of the global revenue, followed by Europe, which is projected to grow at the fastest rate due to rapid urbanization and industrialization.

- The household water purifier segment dominated the market in 2024, contributing over 40% of the revenue due to growing consumer demand for affordable and effective purification solutions.

- The desalination segment is witnessing rapid expansion, particularly in water-scarce regions such as the Middle East, where demand for fresh drinking water is driving the adoption of seawater purification solutions.

Global Water Purification Market Drivers

Rising water pollution and health concerns is driving market growth:

Water contamination has become a global issue, with industrial waste, agricultural runoff, and domestic sewage contributing to the degradation of water quality. The increasing prevalence of waterborne diseases, including cholera, typhoid, and dysentery, has heightened consumer awareness regarding the importance of purified water. Governments and regulatory bodies worldwide have imposed stringent guidelines on water quality standards, mandating the use of effective purification technologies. The growing adoption of home-based water purifiers and municipal water treatment facilities reflects a heightened concern for health and hygiene. Furthermore, the demand for bottled water has surged, particularly in regions where tap water is deemed unsafe for consumption. The rise in disposable income and urbanization has further fueled the market's growth, with consumers willing to invest in high-quality water filtration systems. Advanced purification methods such as ultraviolet treatment, activated carbon filtration, and reverse osmosis are widely adopted, ensuring the elimination of contaminants and enhancing water taste. The increasing integration of smart water purifiers equipped with real-time monitoring and maintenance features is further driving the market.

Increasing industrial and commercial applications is driving market growth:

Industries, including pharmaceuticals, food and beverage, and power generation, require high-quality purified water for production processes. The growing awareness of sustainable industrial practices and compliance with environmental regulations has led to the widespread adoption of water purification systems. In the pharmaceutical industry, ultra-purified water is essential for drug formulation, ensuring product safety and efficacy. The food and beverage sector relies on purified water for manufacturing, cleaning, and processing, preventing contamination and maintaining quality standards. The power generation industry uses purified water in cooling systems to prevent scale formation and corrosion, improving efficiency and longevity. Additionally, commercial establishments such as hotels, restaurants, and hospitals have significantly increased their investment in water purification solutions to provide clean drinking water to customers and patients. The demand for large-scale purification plants has risen in response to growing urban populations and the need for sustainable water management solutions. The development of modular and decentralized purification systems has further contributed to market expansion, offering cost-effective and energy-efficient solutions for industrial and commercial applications.

Technological advancements in water purification systems is driving market growth: Innovations in water purification technologies have significantly enhanced the efficiency and affordability of filtration systems, making them accessible to a broader consumer base. The development of advanced membranes, nanotechnology, and AI-powered purification systems has revolutionized the market, offering solutions with improved contaminant removal capabilities and lower energy consumption. Reverse osmosis technology has seen substantial improvements, with newer models offering higher recovery rates and reduced waste production. Additionally, UV purification systems have become more sophisticated, ensuring effective microbial disinfection without the use of chemicals. The integration of IoT in smart water purifiers allows users to monitor water quality and filter status in real-time, enhancing convenience and efficiency. Furthermore, emerging technologies such as electrochemical oxidation and graphene-based filters are gaining traction, providing sustainable and eco-friendly purification options. The increasing affordability of these technologies, coupled with government incentives for clean water initiatives, is expected to drive the adoption of advanced purification solutions across residential, commercial, and industrial sectors.

Global Water Purification Market Challenges and Restraints

High initial investment and maintenance costs is restricting market growth: Despite the increasing demand for water purification systems, the high cost of installation and maintenance remains a major challenge. Advanced filtration systems such as reverse osmosis and ultrafiltration require significant upfront investment, making them less accessible to low-income households and small businesses. Additionally, regular maintenance, filter replacements, and energy consumption contribute to the ongoing operational costs, further discouraging widespread adoption. Industrial and municipal water treatment plants face similar financial challenges, as large-scale purification infrastructure requires substantial funding. Developing nations with limited financial resources often struggle to implement effective water purification solutions, leading to continued reliance on untreated water sources. The high capital expenditure associated with desalination plants is another concern, particularly in water-scarce regions where such solutions are necessary. The need for skilled personnel to operate and maintain purification systems further adds to the cost burden. Addressing these cost-related challenges through technological innovations and government subsidies will be crucial in expanding market penetration.

Limited access to clean water in rural areas is retracting market growth: While urban areas have witnessed significant advancements in water purification infrastructure, rural regions continue to face challenges in accessing clean drinking water. Many remote communities lack the necessary resources and infrastructure to implement water treatment solutions, relying instead on traditional methods that may not effectively remove contaminants. The lack of awareness about waterborne diseases and the benefits of purification systems further exacerbates the issue. Governments and non-governmental organizations have launched various initiatives to provide affordable and portable water purification solutions to underserved populations, but widespread implementation remains a challenge. The development of low-cost, easy-to-use filtration systems, such as solar-powered purifiers and portable water filters, is gaining momentum as a potential solution to this problem. However, logistical barriers, including transportation and distribution challenges, continue to hinder market expansion in rural areas.

Market opportunities

The growing emphasis on sustainable water management presents significant opportunities for the water purification market. Governments and organizations are increasingly investing in smart water treatment solutions, promoting the use of renewable energy in purification processes, and encouraging wastewater recycling. The adoption of decentralized purification systems in both urban and rural settings is gaining popularity, offering localized and cost-effective solutions. Additionally, the increasing demand for premium water purification products, including alkaline and hydrogen water purifiers, reflects a shift in consumer preferences towards health-oriented solutions. The expansion of water purification services in emerging economies, supported by infrastructure development and policy incentives, is expected to further drive market growth.

WATER PURIFICATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

A. O. Smith, Pentair, Veolia, Culligan International, and 3M, Evoqua Water Technologies, Kent RO Systems, Tata Swach, LG Electronics, Panasonic |

Water Purification Market segmentation

Water Purification Market segmentation By product:

- Reverse osmosis systems

- Ultrafiltration systems

- Ultraviolet purification systems

- Activated carbon filters

- Sediment filters

- Distillation systems

- Ion exchange systems

The reverse osmosis segment dominated the market in 2024, accounting for the highest revenue share due to its effectiveness in removing contaminants, improving water taste, and widespread adoption across residential and industrial sectors. The segment's growth is further fueled by technological advancements in energy-efficient RO membranes.

Water Purification Market segmentation By application:

- Residential

- Commercial

- Industrial

- Municipal

The residential segment held the largest market share in 2024, driven by increasing consumer awareness regarding water quality, rising health concerns, and the affordability of home water purifiers. The demand for compact and smart purifiers with real-time monitoring features has further accelerated growth in this segment.

Water Purification Market segmentation Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific emerged as the dominant region in the water purification market due to rapid industrialization, urbanization, and increasing government initiatives to provide clean drinking water. Countries like China and India have witnessed a surge in demand for water purifiers, driven by pollution concerns and population growth.

COVID-19 Impact Analysis on the Water Purification Market

The COVID-19 pandemic significantly impacted the global water purification market, creating both challenges and opportunities. With heightened awareness of hygiene and water safety, there was a surge in demand for home-based water purifiers, bottled water, and advanced filtration systems. Consumers became more cautious about waterborne diseases, leading to increased adoption of purification technologies in households. This shift was particularly evident in urban areas, where concerns about water contamination and the need for reliable drinking water solutions intensified. However, the pandemic also disrupted global supply chains, causing delays in manufacturing, distribution, and installation of water purification systems. Lockdowns, restrictions on trade, and shortages of raw materials such as activated carbon, membranes, and UV disinfection components created significant bottlenecks in production. Many companies faced operational challenges, struggling to meet rising consumer demand while dealing with logistical hurdles. The commercial and industrial sectors, including hospitality and office buildings, experienced a decline in demand due to lockdowns and reduced occupancy rates. Despite these initial setbacks, the long-term impact of the pandemic was largely positive for the water purification market. Governments and organizations around the world recognized the importance of clean water access, leading to increased investments in sanitation infrastructure, water treatment plants, and smart filtration technologies. Additionally, businesses and institutions implemented stricter water quality protocols, integrating purification systems into their facilities to ensure safer drinking water for employees and customers. The market also witnessed a rise in innovations such as touchless water dispensers and IoT-enabled purifiers, catering to the demand for hygiene-focused solutions. Overall, COVID-19 reinforced the critical role of water purification, driving long-term growth and innovation in the industry while encouraging governments, businesses, and consumers to prioritize clean and safe water.

Latest trends/developments

The water purification market is witnessing rapid technological advancements, with smart purification technologies, AI-powered monitoring systems, and sustainable solutions gaining traction. The integration of artificial intelligence (AI) in water filtration has led to the development of smart purifiers that can monitor water quality in real-time, detect contaminants, and adjust purification settings accordingly. These systems use data analytics and machine learning to provide users with insights about their water consumption and filter maintenance, enhancing efficiency and convenience. Another major trend is the increasing focus on sustainable purification solutions, driven by rising environmental concerns and the need for energy-efficient systems. Solar-powered desalination is emerging as a viable alternative to traditional purification methods, particularly in regions facing water scarcity. These systems harness solar energy to convert seawater into fresh drinking water, reducing dependency on fossil fuels and lowering operational costs. Governments and private enterprises are investing in large-scale solar desalination plants to address global water shortages, making this technology a key player in the future of water purification. Consumer preferences are also shifting towards health-focused water purification solutions, with the rising popularity of alkaline and hydrogen water purifiers. These purifiers claim to offer additional health benefits, such as improved hydration, enhanced detoxification, and antioxidant properties. As consumers become more health-conscious, the demand for water purifiers that go beyond basic filtration and provide functional benefits is increasing. Companies are responding by introducing advanced mineralization and ionization technologies to cater to this growing segment. Overall, the latest trends in water purification highlight a strong push towards automation, sustainability, and wellness-driven innovations, shaping the industry’s future and meeting evolving consumer demands.

Key players

- A. O. Smith Corporation

- Pentair

- Veolia

- Culligan International

- 3M

- Evoqua Water Technologies

- Kent RO Systems

- Tata Swach

- LG Electronics

- Panasonic

Chapter 1. WATER PURIFICATION MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. WATER PURIFICATION MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. WATER PURIFICATION MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. WATER PURIFICATION MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. WATER PURIFICATION MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. WATER PURIFICATION MARKET – By Product

6.1 Introduction/Key Findings

6.2 Reverse osmosis systems

6.3 Ultrafiltration systems

6.4 Ultraviolet purification systems

6.5 Activated carbon filters

6.6 Sediment filters

6.7 Distillation systems

6.8 Ion exchange systems Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. WATER PURIFICATION MARKET – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Municipal

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. WATER PURIFICATION MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. WATER PURIFICATION MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 A. O. Smith Corporation

9.2 Pentair

9.3 Veolia

9.4 Culligan International

9.5 3M

9.6 Evoqua Water Technologies

9.7 Kent RO Systems

9.8 Tata Swach

9.9 LG Electronics

9.10 Panasonic

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Water Purification Market was valued at USD 45 billion in 2024 and is expected to reach USD 64.60 billion by 2030, growing at a CAGR of 7.5%.

Key drivers include rising water pollution, growing health concerns, increasing industrial applications, and advancements in purification technologies.

The market is segmented by product into reverse osmosis, UV purification, ultrafiltration, and others, and by application into residential, commercial, industrial, and municipal.

Asia-Pacific is the dominant region, driven by industrialization, urbanization, and increasing government initiatives for clean water access.

Major players include A. O. Smith, Pentair, Veolia, Culligan International, and 3M.