Water Clarifiers Market Size (2025 – 2030)

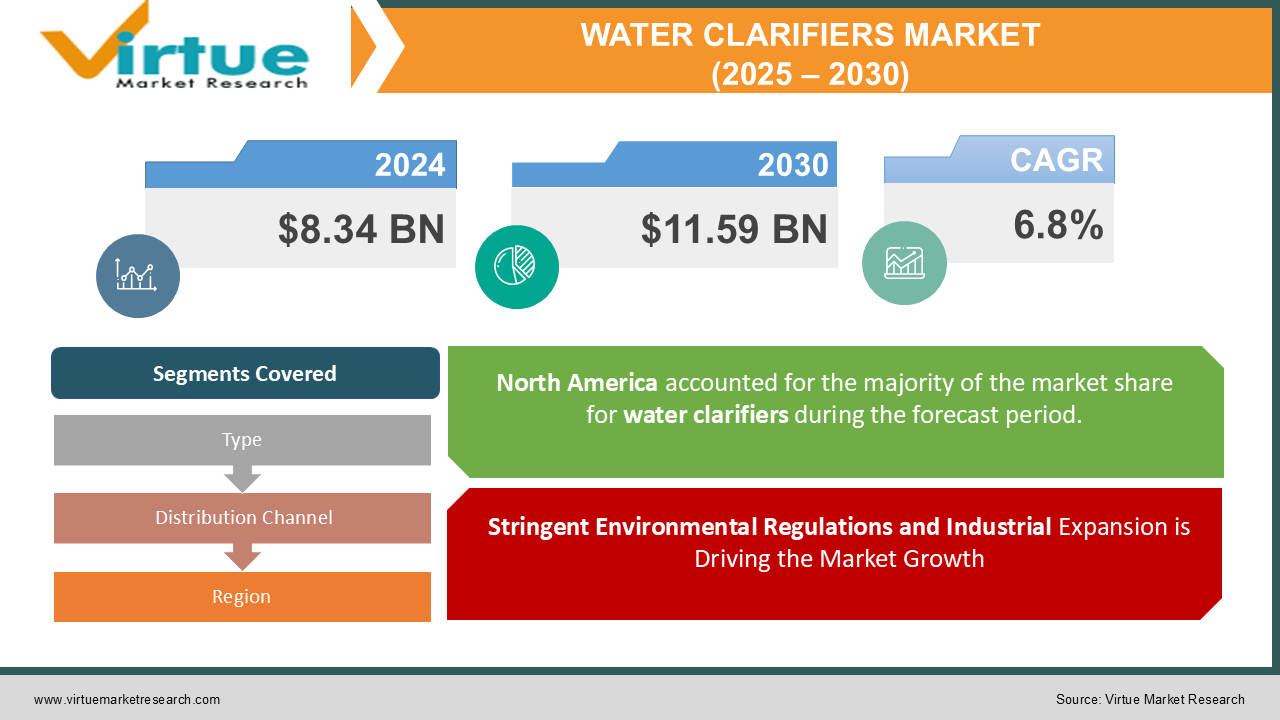

The Water Clarifiers Market was valued at USD 8.34 Billion in 2024 and is projected to reach a market size of USD 11.59 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.8%.

At the heart of the water treatment industry, the water clarifiers market in 2024 stands as a robust and dynamic segment that reflects an ongoing transformation in how water is purified and prepared for reuse. In today’s environmentally conscious era, water clarifiers have evolved from simple sedimentation aids into sophisticated chemical formulations that facilitate rapid flocculation and efficient removal of suspended particles. Industries ranging from manufacturing and mining to municipal water treatment and specialty sectors such as paper and pulp have increasingly turned to these innovative solutions to achieve optimal water clarity and operational efficiency. As environmental regulations tighten and water conservation becomes paramount, manufacturers have invested heavily in research and development, resulting in products that not only enhance performance but also comply with rigorous safety and quality standards. These innovations are reshaping the industry by offering longer shelf lives, improved chemical stability, and formulations that minimize adverse ecological impacts. The market’s evolution is further driven by the integration of digital technologies into water treatment processes.

Key Market Insights:

-

Production volumes reached over 3.2 million metric tons of water clarifier products during the year.

-

More than 12,000 industrial facilities globally incorporated advanced water clarifiers into their treatment processes in 2024.

-

Customer satisfaction ratings averaged above 4 out of 5, reflecting high confidence in product performance.

-

More than 5,000 patents related to water clarifier technologies were active, highlighting ongoing innovation.

Market Drivers:

Stringent Environmental Regulations and Industrial Expansion is Driving the Market Growth

In 2024, one of the most compelling market drivers for water clarifiers is the tightening of environmental regulations combined with rapid industrial expansion. Governments across the globe have implemented more rigorous discharge standards and water quality mandates that compel industries to adopt sophisticated water treatment solutions. In this environment, water clarifiers have emerged as a critical tool for reducing suspended solids and contaminants, ensuring that industrial effluents meet strict regulatory criteria. This regulatory pressure has driven both established and emerging companies to invest heavily in research and development, aiming to create formulations that not only meet compliance requirements but also enhance overall operational efficiency. As industrial production scales up and manufacturing activities expand, the need to manage higher volumes of wastewater becomes imperative. Water clarifiers facilitate this by promoting faster sedimentation and flocculation, which translates into reduced processing times and lower operational costs.

Technological Advancements and Efficiency Improvements is Fuelling the Market Growth

In addition to regulatory imperatives, rapid technological advancements are serving as a major catalyst for the water clarifiers market in 2024. The incorporation of state-of-the-art digital tools—such as real-time monitoring systems, automated dosing mechanisms, and smart sensors—has revolutionized water treatment processes. These technologies allow operators to precisely control the chemical dosing of water clarifiers, ensuring that optimal amounts are applied to achieve superior flocculation and sedimentation. The evolution of material science has also played a crucial role, leading to the creation of innovative formulations that boast enhanced stability and performance across a broad spectrum of water compositions. Manufacturers are leveraging cutting-edge research to produce products that are more efficient, environmentally friendly, and adaptable to modern industrial needs.

Market Restraints and Challenges:

Despite the promising growth trajectory of the water clarifiers market in 2024, several restraints and challenges present hurdles that could impede its progress. One significant challenge is the fluctuating cost of raw materials essential for manufacturing water clarifiers. The reliance on specialized chemicals and polymers often exposes companies to price volatility, which can drive up production costs and ultimately affect market pricing. Furthermore, the competitive nature of the water treatment industry necessitates continuous and costly investments in research and development to stay ahead of technological trends. This financial strain can be particularly challenging for smaller players attempting to innovate in a market dominated by large, established companies. Moreover, resistance to change among established water treatment facilities poses a significant barrier to the widespread adoption of innovative water clarifier products. Many organizations have relied on traditional treatment methods for years and may be hesitant to switch to new technologies without clear evidence of cost–benefit advantages. This cautious approach, combined with regulatory complexities and the need for extensive product testing and certification, can slow the pace of market expansion. Together, these challenges underscore the need for strategic planning, robust supply chain management, and continuous technological innovation to overcome the barriers and sustain long-term growth in the water clarifiers market.

Market Opportunities:

Despite the challenges faced, the water clarifiers market in 2024 is rife with opportunities that can drive long-term growth and innovation. One significant opportunity lies in the expansion and modernization of water treatment infrastructure across a variety of industrial sectors. As companies and municipalities modernize their facilities, there is a growing need for advanced water treatment solutions that deliver both efficiency and sustainability. Industries such as food processing, mining, and manufacturing are actively seeking technologies that can reduce treatment costs while simultaneously improving water quality. By developing formulations tailored to the unique water quality challenges of these sectors, manufacturers can capture new market segments and secure long-term contracts. Another promising opportunity is the potential for cross-industry applications. The versatile nature of water clarifiers means that their benefits can be extended beyond conventional industrial uses to emerging fields such as aquaculture and renewable energy. By diversifying their product portfolios, companies can reduce dependency on traditional markets and mitigate risks associated with market fluctuations. Moreover, strategic partnerships between technology providers and water treatment companies are fostering the co-development of next-generation solutions that combine chemical expertise with advanced digital tools, paving the way for breakthrough innovations in water treatment technology.

WATER CLARIFIERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Solvay, SNF Floerger, BASF SE, Ashland Inc., Dow Inc., Evonik Industries, Lubrizol Corporation, Clariant, Arkema |

Water Clarifiers Market Segmentation: by Type

-

Organic-based Water Clarifiers

-

Inorganic-based Water Clarifiers

-

Polymer-based Water Clarifiers

-

Composite Water Clarifiers

Within this segmentation, the fastest-growing type is polymer-based water clarifiers. These formulations are rapidly gaining traction due to their innovative composition, which offers superior performance and enhanced compatibility with modern automated dosing systems. Their ability to efficiently handle diverse water compositions makes them especially attractive to industries seeking to optimize treatment processes. In contrast, the most dominant type remains organic-based water clarifiers. With a long-established track record for reliability and consistent performance, organic-based solutions continue to be the preferred choice for many traditional water treatment facilities.

Water Clarifiers Market Segmentation: by Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retail Platforms

-

Industrial Supply Stores

Among these, online retail platforms are emerging as the fastest-growing distribution channel. The digital transformation in the industrial sector has allowed end users to access detailed product information and place orders more conveniently, spurring significant growth in this channel. However, direct sales remain the most dominant channel, primarily because they facilitate personalized customer engagement and foster long-term relationships—elements that are highly valued in the water treatment industry.

Water Clarifiers Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

In 2024, the global water clarifiers market is segmented into several key regions that contribute uniquely to the overall market performance. North America accounts for roughly 30% of the market, driven by advanced industrial infrastructure and a strong emphasis on technological integration in water treatment processes. Europe represents approximately 25% of the market share, where stringent environmental regulations and a focus on sustainability have spurred the adoption of high-performance water clarifiers. The Asia-Pacific region leads with an estimated 35% share, reflecting rapid industrial expansion, high manufacturing activity, and significant investments in modern water treatment infrastructure. Latin America contributes around 7% to the market, benefiting from ongoing improvements in water quality management and increased public–private partnerships, while the Middle East and Africa, although representing only about 3% of the market, are gradually emerging as important regions due to increasing infrastructure investments and regulatory reforms.

COVID-19 Impact Analysis on the Market:

The COVID-19 pandemic significantly reshaped the dynamics of the water clarifiers market, imparting both challenges and long-term benefits that continue to influence the industry in 2024. During the height of the pandemic, supply chain disruptions, workforce shortages, and logistical constraints created temporary setbacks in the production and distribution of water clarifier products. However, as companies adapted to these challenges, the crisis underscored the critical importance of resilient water treatment systems capable of maintaining operational continuity during unprecedented disruptions. Manufacturers responded by reconfiguring their supply chains, diversifying sourcing strategies, and accelerating the integration of digital tools to facilitate remote monitoring and automated dosing. These strategic adaptations have not only restored stability but have also enhanced operational efficiencies, ultimately driving product innovation

Latest Trends and Developments:

In 2024, the water clarifiers market is witnessing several exciting trends and developments that are reshaping the landscape of water treatment technologies. One of the most significant trends is the integration of digitalization and automation in water treatment processes. Companies are increasingly incorporating smart sensors, real–time monitoring systems, and automated dosing mechanisms into their operations, which not only optimize the performance of water clarifiers but also enhance overall process efficiency. This digital revolution is enabling operators to achieve greater precision in chemical application, reducing waste, and ensuring consistent water quality. Alongside these technological innovations, there is a strong emphasis on sustainability, with manufacturers developing eco–friendly water clarifier formulations that utilize biodegradable and renewable raw materials. These green formulations are gaining traction as industries strive to minimize their environmental footprint and comply with stringent environmental regulations.

Key Players in the Market:

-

Solvay

-

SNF Floerger

-

BASF SE

-

Ashland Inc.

-

Dow Inc.

-

Evonik Industries

-

Lubrizol Corporation

-

Clariant

-

Arkema

Chapter 1. WATER CLARIFIERS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. WATER CLARIFIERS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. WATER CLARIFIERS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. WATER CLARIFIERS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. WATER CLARIFIERS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. WATER CLARIFIERS MARKET – By Product

6.1 Introduction/Key Findings

6.2 Aluminum Sulfate

6.3 Polyaluminum Chloride

6.4 Ferrous Sulfate

6.5 Organic Coagulants

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. WATER CLARIFIERS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Municipal Water Treatment

7.3 Industrial Water Treatment

7.4 Agricultural Irrigation

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. WATER CLARIFIERS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. WATER CLARIFIERS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF

9.2 Kemira

9.3 Veolia Environnement

9.4 SUEZ

9.5 Feralco Group

9.6 SNF Group

9.7 ChemTreat

9.8 Kurita Water Industries

9.9 AkzoNobel

9.10 Solenis

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Water Clarifiers Market was valued at USD 2.4 billion in 2024 and is projected to reach USD 3.2 billion by 2030, growing at a CAGR of 5.6%.

The market is driven by increasing global water scarcity, technological advancements in water treatment, and stricter government regulations for water quality and wastewater treatment.

The market is segmented by product (aluminum sulfate, polyaluminum chloride, ferrous sulfate, organic coagulants) and application (municipal water treatment, industrial water treatment, agricultural irrigation).

Asia-Pacific is the dominant region due to rapid industrialization, population growth, and the increasing need for water treatment solutions in countries like China and India.

Leading players include BASF, Kemira, Veolia Environnement, SUEZ, and Feralco Group.