Water Buffalo Dairy Market Size (2024 – 2030)

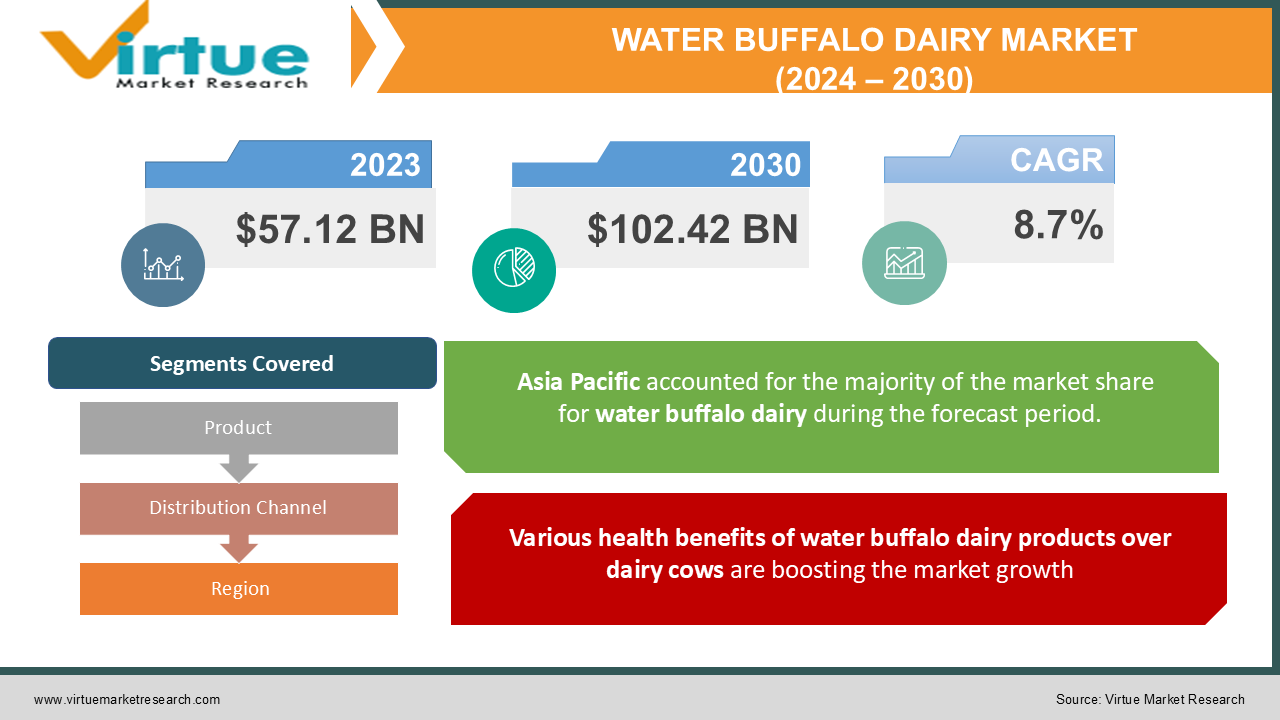

The Global Water Buffalo Dairy Market is valued at USD 57.12 billion in 2023 and is projected to reach a market size of USD 102.42 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.7%.

INDUSTRY OVERVIEW

With a population of roughly 180 million, water buffalo are found all over the world. The water buffalo is regarded as an effective converter of subpar forages into superior goods. In South-Western Serbia, where these animals are maintained using extensive husbandry and sustainable practices, buffaloes play a crucial part in the history and economy of the local rural inhabitants. The water buffalo is a placid animal. The method of milking is identical to that used with dairy cows. Similar to cow milk, buffalo milk can be utilized in the production of a wide range of dairy products. It has long been prized for its favorable elemental composition, which affects its nutritional qualities and suitability for the creation of both traditional and commercial dairy products. It is notably helpful for the manufacturing of dairy products with high-fat content, including butter and kajmak, as it contains less water and more fat than cow milk. In contrast to other ruminant species, water buffalo milk has unique physicochemical characteristics, such as a higher amount of fatty acids and proteins. Swamp-type and river-type water buffalo milk have different physical and chemical characteristics. Compared to cow milk, water buffalo milk has higher levels of total solids, crude protein, fat, calcium, and phosphorus, as well as a slightly higher lactose concentration. Water buffalo milk is perfect for processing into dairy products with added value, such as cheese, due to its high total solids content. Changes in the gross composition of water buffalo milk as well as variations in CLA levels may be influenced by seasons and genetics. Dairy products made from water buffalo milk include soft cheeses, hard cheeses, fermented milk, whey, and others.

Low profitability is one of the biggest issues the buffalo breeding industry is experiencing. On the other hand, an increase in demand for dairy products made from buffalo has been seen in many nations, which is expanding the market. As a result, most farms are using incremental intensification of raising practices.

COVID-19 IMPACT ON THE WATER BUFFALO DAIRY MARKET

The market was impacted negatively by disruptions in supply and demand brought on by the COVID-19 pandemic. In 2020, the COVID-19 pandemic swept around the world, causing supply chain problems as a result of panic buying. Lockdowns were implemented in numerous nations, which had an impact on the whole food and beverage business. Due to the impact on the food and beverage industry, demand scenarios for these products vary by country. Demand decreased in some countries where lockdowns were quite stringent, but it did not significantly harm the dairy business in other nations where partial markets remained open. The prices of cheese and butter were somewhat impacted because there was less demand for high-value goods. In the future months, the recovery of the hospitality, catering, and dairy industries as well as cutting-edge dairy processing skills may support this sector despite the coronavirus.

MARKET DRIVERS:

Various health benefits of water buffalo dairy products over dairy cows are boosting the market growth

Water buffalo milk is healthier in many respects than typical cow's milk despite having more butterfat. Compared to cow's milk, water buffalo milk has 11% more protein, 9% more calcium, and 37% more iron. The cholesterol content of water buffalo milk is also lower. Less fat is present in milk as it is produced in greater quantities by water buffalo. Six to ten percent of water buffalo are overweight. (Dairy cows are closer to 4%)

Demand for Value-Added Dairy Products is Growing which is driving the Market’s Growth

With breakthroughs and innovations bringing novel dairy products to the retail platform, the dairy business is thriving all over the world. Consumer demand for value-added goods like cheese, butter, creams, and yogurt has increased as a result of consumers' constantly changing lifestyles and rising disposable budgets. Yogurt, kefir, and other fermented foods will become more and more popular as people's understanding of gut health grows. Leading dairy processors have been compelled to create novel products, such as cheese powder and dairy creamers, to meet consumer demand as a result of the food service industry's explosive growth.

MARKET RESTRAINTS:

Growing Adoption of Plant-Based Dairy Alternatives Will Limit Market Expansion

Consumer demand for plant-based foods has increased as consumer awareness of animal cruelty has grown. Plant-based dairy substitutes are quickly gaining traction in mainstream retail. The demand for these dairy substitutes, such as soy milk and almond milk-based products, is driven by the growing belief that plant-based foods are safer and healthier. The demand for dairy substitutes is rising along with the rise of lactose intolerance. It is anticipated that the quickly growing dairy alternatives market will be hampered by new product innovations such as non-dairy ice creams, cheese analogs, and whipped creams.

The market expansion is being hampered by the large capital expenditures required by dairy product makers to construct processing equipment.

The installation of processing machinery is expensive for dairy product makers. As a costly addition that reduces the operating margins of dairy product processors, this processing equipment has significant installation costs and calls for regular maintenance. Therefore, it is anticipated that excessive capital investment will also impede market expansion.

WATER BUFFALO DAIRY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.7% |

|

Segments Covered |

By Product, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arla Foods amba, Fonterra Co-operative Group, GCMMF, The Kraft Heinz Company, Nestle S.A., Danone S.A., Royal FrieslandCampina, Dairy Farmers of America, Inc., DMK Group, Meiji Holdings Co., Ltd. |

This research report on the Water Buffalo Dairy Market has been segmented and sub-segmented based on Product, By Distribution Channel, and By Region.

WATER BUFFALO DAIRY MARKET – BY PRODUCT

- Milk

- Cheese

- Butter

- Dessert

- Yogurt

- Others

Based on the product the Water Buffalo Dairy Market is segmented into Milk, Cheese, Butter, Dessert, Yogurt, and Others. Among these, due to its extensive use in a variety of products, milk is experiencing promising growth. A wide range of customers from industrialized and developing nations have been benefiting nutritionally over the past few years from the rising intake of milk through functional beverages. The dairy industries have strong growth prospects as a result of the milk industry's rapid rise in both production and consumption. For customers of all ages, milk is regarded as being incredibly nourishing and advantageous. It contains a variety of minerals, which helps to significantly increase the availability of magnesium, riboflavin, selenium, calcium, pantothenic acid (vitamin B5), and vitamin B12. Numerous industry participants are introducing unique functional milk products in light of these advantages. This tendency is anticipated to continue during the projected period, which will be advantageous for the expansion of the dairy food market.

WATER BUFFALO DAIRY MARKET - BY DISTRIBUTION CHANNEL

- Supermarket/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

Based on the product the Water Buffalo Dairy Market is segmented into Supermarket/Hypermarkets, Convenience Stores, Specialty Stores, and Online Retail. With a revenue share of almost 60% in 2021, the supermarkets/hypermarkets segment had the biggest revenue contribution. The key drivers of the segment growth are an increase in the number of supermarkets and hypermarkets and the accessibility of a wide variety of products in such establishments. To prevent any deterioration, dairy products are stored in supermarkets on shelves with controlled temperatures. Daily necessities can be conveniently purchased by customers at lower prices in these shops, which is predicted to greatly fuel the segment's expansion in the upcoming years. Due to the ease these distribution channels provide, the online category is anticipated to grow at the quickest CAGR during the projection period. Just Milk, Sainsbury's, Ocado, Mr. Case, and Walmart are some of the widely used online distribution platforms for dairy products. Some businesses also offer online delivery of their goods using mobile applications. For instance, GCMMF (Amul), an Indian company, provides milk and other dairy goods through their mobile app. Internet usage is increasing, and global connectivity is getting better, which will help the segment thrive.

WATER BUFFALO DAIRY MARKET - BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Water Buffalo Dairy Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East, and Africa. The largest portion of the global dairy market is in the Asia Pacific. The largest population concentration in the area and shifting consumer habits are primarily to blame for this. The region has a large number of millennials because it is where the majority of the population resides. Compared to older age groups, millennials spend more and have more disposable income. Digital technology has given millennials more influence, and they are both more varied and demanding. The number of new product launches in the Asia Pacific has increased as a result of the region's growing number of market participants. Throughout the forecast period, it is anticipated that this market will continue to dominate the global market due to the region's growing population and high rate of product launches.

The per capita consumption of dairy products in North America is predicted to undergo a significant change. This is due to a shift in consumer eating preferences, such as a desire for plant-based foods. The advantages of dairy products generated from animals, which are largely absent from goods derived from plants, are being made known to customers by manufacturers. Whey powder and newborn formula consumption are anticipated to increase at a considerable CAGR in the coming years. This may help the market expand and increase its share of the worldwide market during the anticipated timeframe. Due to the presence of major dairy product manufacturing nations like the U.K. and Germany in the region, the European region is predicted to develop at a considerable CAGR. The increased demand for various goods, including cheese, milk powders, ice creams, and flavored yogurts, has been facilitated by rising consumer income levels and an expansion of the region's spending power. Strategic promotional initiatives are being used by the top dairy firms to boost sales of milk products like yogurt and flavored milk. The emergence of new minor companies is another factor contributing to the market expansion in the area.

WATER BUFFALO DAIRY MARKET - BY COMPANIES

Some of the major players operating in the Water Buffalo Dairy Market include:

- Arla Foods amba

- Fonterra Co-operative Group

- GCMMF

- The Kraft Heinz Company

- Nestle S.A.

- Danone S.A.

- Royal FrieslandCampina

- Dairy Farmers of America, Inc.

- DMK Group

- Meiji Holdings Co., Ltd.

NOTABLE HAPPENING IN THE ENHANCED WATER MARKET

- EXPANSION- Amul stated that it will begin producing buffalo mozzarella in March 2021 and plans to invest Rs 200 crore in this business. Indian exports of mozzarella cheese may soon overtake those of Italy as the world's primary source of exports.

- ACQUISITION- In 2021, Danone acquired Follow your heart.

- PRODUCT LAUNCH- The Fonterra Dairy Firm introduced milk powder as a new product in 2021. According to the company, the product's characteristic is that it is full of probiotics derived from fruits and vegetables as well as lactoferrin, a crucial protein that will strengthen immunity.

Chapter 1. Water Buffalo Dairy Market– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Water Buffalo Dairy Market– Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Water Buffalo Dairy Market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Water Buffalo Dairy MarketEntry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Water Buffalo Dairy Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Water Buffalo Dairy Market– - BY PRODUCT

6.1. Milk

6.2. Cheese

6.3. Butter

6.4. Dessert

6.5. Yogurt

6.6. Others

Chapter 7. Water Buffalo Dairy Market– BY DISTRIBUTION CHANNEL

7.1. Supermarket/Hypermarkets

7.2. Convenience Stores

7.3. Specialty Stores

7.4. Online Retail

Chapter 8. Water Buffalo Dairy Market - By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Water Buffalo Dairy Market– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Arla Foods amba

9.2. Fonterra Co-operative Group

9.3. GCMMF

9.4. The Kraft Heinz Company

9.5. Nestle S.A.

9.6. Danone S.A.

9.7. Royal FrieslandCampina

9.8. Dairy Farmers of America, Inc.

9.9. DMK Group

9.10. Meiji Holdings Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900