Water-Based Metal Packaging Coatings Market Size (2023 – 2030)

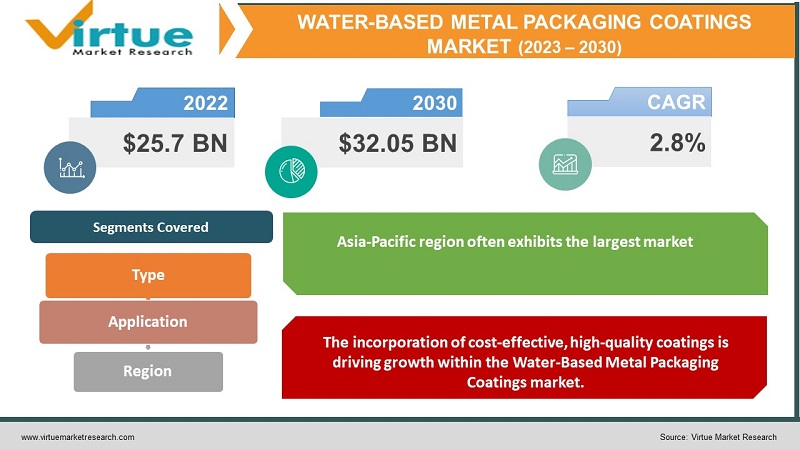

The Global Water-Based Metal Packaging Coatings Market was valued at USD 25.7 billion and is projected to reach a market size of USD 32.05 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 2.8%.

The Water-Based Metal Packaging Coatings market is experiencing continuous transformation, emerging as a significant global trend in the 21st Century. The industry's upward trajectory has captured the interest of both academic and professional communities. With its persistent growth, the need for eco-friendly coatings for metal packaging is on the rise, creating diverse career opportunities in coatings and packaging. In this dynamic landscape, industry leaders are challenged to develop fresh skill sets and gain a comprehensive understanding of the macro and micro factors influencing the demand for water-based coatings. Amidst these developments, maintaining a holistic perspective remains paramount.

Key Market Insights:

The Water-Based Metal Packaging Coatings market is characterized by several key market insights that shape its dynamics and trajectory. Firstly, the increasing emphasis on environmental concerns propels the demand for eco-friendly coating solutions within the metal packaging industry. Water-based coatings stand out as a preferred choice due to their lower environmental impact compared to solvent-based alternatives. Moreover, stringent regulatory requirements aimed at reducing volatile organic compounds (VOC) emissions are driving the adoption of water-based coatings, positioning them as a regulatory-driven market insight.

The versatility of water-based metal packaging coatings is yet another crucial insight. These coatings find applications across diverse sectors, including food and beverage, pharmaceuticals, and industrial domains. Their ability to adhere to various substrates and accommodate different metal types underscores their adaptability and market reach.

However, longer drying times and initial higher costs compared to solvent-based coatings hinder their widespread adoption. Nonetheless, continuous research and development efforts propel the market forward, fostering innovation in water-based coatings and leading to new formulations and application techniques that cater to evolving market needs.

Water-Based Metal Packaging Coatings Market Drivers:

The incorporation of cost-effective, high-quality coatings is driving growth within the Water-Based Metal Packaging Coatings market.

In a parallel manner, the Water-Based Metal Packaging Coatings market reflects a comparable trend. Just as developing nations offer high-quality medical treatments at reduced costs, the water-based coatings market provides industries with the advantage of applying advanced protective coatings to metal packaging at a relatively lower expense. These coatings' affordability does not compromise their effectiveness, as they leverage available resources to ensure product durability and quality. This economic advantage draws businesses seeking efficient packaging solutions, driving demand for water-based coatings. The cost efficiency of water-based coatings in the metal packaging realm aligns with the economic considerations observed in healthcare markets. Just as accessibility to high-quality healthcare services at affordable prices propels the medical tourism industry, developments in the water-based coatings' infrastructure and their availability at reasonable costs foster growth in the global market.

Protracted lead times are a significant concern, propelling the demand for efficient solutions in the Water-Based Metal Packaging Coatings market.

Developed countries often face protracted delays in the progression from the initial coating process to subsequent stages, potentially exacerbating issues for manufacturers. Prolonged lead times between coating application and packaging completion can hinder operational efficiency and product delivery timelines. Extended timelines in the coatings market might lead to compromised product quality and hinder supply chain performance. For instance, postponing the application of necessary protective coatings can leave metal packaging vulnerable to corrosion and damage, diminishing its overall functionality and potentially leading to subsequent complications. This interplay of time-sensitive considerations highlights the shared challenge of balancing efficiency and effectiveness across industries.

The escalating need for robust protection against corrosion and environmental factors is propelling the demand for advanced coatings within the Water-Based Metal Packaging Coatings market.

The rising prevalence of corrosion and degradation challenges, particularly in sectors relying on metal packaging, is driving the demand for advanced protective solutions in the Water-Based Metal Packaging Coating market. As industries face increasing pressures to ensure product integrity and longevity, the introduction of innovative coating technologies becomes crucial. These coatings act as a shield against the harmful effects of environmental factors, preventing corrosion and enhancing the durability of metal packaging. The growing awareness of the advantages of advanced coatings and their accessibility aligns with the heightened awareness of medical tourism, as both markets respond to evolving consumer needs and technological progress.

The surge in governmental investments towards research and development, infrastructure enhancement, and sustainability initiatives is propelling growth in the Water-Based Metal Packaging Coatings market.

The escalating commitment of governments towards fostering sustainable and advanced manufacturing practices is driving the Water-Based Metal Packaging Coatings market. Favorable regulatory frameworks, increased funding for innovation, and initiatives promoting eco-friendly coatings contribute significantly to the sector's growth. Furthermore, the proliferation of accessible information about coating formulations, their benefits, and optimal application methods plays a pivotal role in raising awareness and driving demand among industries.

Water-Based Metal Packaging Coatings Market Restraints and Challenges:

Cumbersome regulatory approval processes and challenges related to compatibility with various substrate materials pose significant constraints for the Water-Based Metal Packaging Coatings market.

The Water-Based Metal Packaging Coatings market faces comparable challenges. Some manufacturers may encounter issues stemming from the high costs charged by certain suppliers for coating materials, affecting overall operational expenses and profit margins. The Water-Based Metal Packaging coating sector faces limitations in insurance reimbursements or warranties, particularly when specific performance criteria are not met. Furthermore, coating manufacturers grapple with issues when expanding into international markets. Finally, the significance of aftercare resonates in the Water Based Metal Packaging Coating domain. While, the coatings industry must address post-application quality monitoring to ensure coatings' durability and performance over time, reflecting the shared concern of comprehensive, ongoing support.

Water-Based Metal Packaging Coatings Market Opportunities:

The Water-Based Metal Packaging Coatings market presents promising opportunities driven by the growing demand for sustainable packaging solutions. Increased environmental awareness and stringent regulations are propelling the adoption of water-based coatings that offer corrosion resistance and durability. The expansion of industries like food and beverages, pharmaceuticals, and personal care further boosts demand. Collaborations between manufacturers, research institutions, and regulatory bodies to develop innovative formulations and efficient application methods are opening avenues for advancements in this dynamic market.

WATER-BASED METAL PACKAGING COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

2.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Sherwin-Williams Company, BASF SE, AkzoNobel N.V., PPG Industries, Inc., RPM International Inc., Asian Paints Limited, Axalta Coating Systems LLC Nippon Paint Holdings Co. Ltd., Kansai Paint Co. Ltd., Tikkurila OYJ. |

Water-Based Metal Packaging Coatings Market Segmentation: By Type

-

Acrylic

-

Polyester

-

Alkyd

-

Epoxy

-

Others

In the Water-Based Coatings Market, the segments Epoxy and Acrylic Coatings typically exhibit the highest and fastest growth rates, respectively. Epoxy coatings, known for their exceptional durability and resistance properties, often witness the highest growth due to their suitability for various applications, ranging from industrial and automotive to construction. The demand for robust protection against corrosion and wear contributes to the sustained popularity of epoxy coatings. On the other hand, Acrylic coatings experience rapid growth due to their versatility, ease of application, and ability to adhere well to diverse substrates. Their ability to provide good weather resistance, glossy finishes, and UV protection further adds to their appeal across industries. While Epoxy coatings tend to have the highest growth rate, "Acrylic" coatings often experience the fastest growth, driven by their wide-ranging applications and favorable performance characteristics.

Water-Based Metal Packaging Coatings Market Segmentation: By Application

-

Architectural

-

Industrial

The Architectural segment tends to have the highest growth, while the Industrial segment often experiences the fastest growth in the context of market segmentation based on application. The Architectural segment encompasses coatings used in residential, commercial, and institutional buildings, where the demand for aesthetics, durability, and protection against weathering drives steady growth. As construction and renovation activities continue, this segment maintains a robust trajectory.

Water-Based Metal Packaging Coatings Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia-Pacific region often exhibits the largest market share of 38.5% in the Global Water-Based Metal Packaging Coatings Market and is anticipated to grow at the fastest rate as well during the forecast period. The Asia-Pacific region encompasses a diverse range of economies with rapidly expanding industrial sectors, construction activities, and consumer markets. This region's growth is fueled by factors such as urbanization, infrastructure development, increased manufacturing, and rising disposable income, driving significant demand for coatings across various applications.

COVID-19 Impact Analysis on the Global Water-Based Metal Packaging Coatings Market:

The Global Water-Based Metal Packaging Coatings Market experienced supply chain disruptions, reduced manufacturing activity, fluctuating demand for packaged goods, delayed projects, and export-import challenges due to the COVID-19 pandemic. Economic uncertainty, safety protocols, and a shift towards sustainability further influenced the market's dynamics, prompting the industry to adapt and recover amid changing consumer behaviors and market conditions.

Latest Trends/ Developments:

The Asia-Pacific region exerts significant dominance over the packaging coatings market, primarily driven by the escalating requirements from various sectors, including food and beverages, marine, architectural, packaging, and healthcare industries.

The surging interest in novel plastic technologies aimed at creating recyclable and ecologically sustainable solutions, enriched with specific attributes like lightweight durability, moisture resistance, and chemical resilience, is anticipated to play a pivotal role in fostering the growth dynamics of the packaging coatings market.

Key Players:

-

The Sherwin-Williams Company

-

BASF SE

-

AkzoNobel N.V.

-

PPG Industries

-

Inc., RPM International Inc.

-

Asian Paints Limited

-

Axalta Coating Systems LLC

-

Nippon Paint Holdings Co. Ltd.

-

Kansai Paint Co. Ltd.

-

Tikkurila OYJ.

In August 2021, The Sherwin-Williams Company announced an agreement to acquire the European industrial coatings business of Sika AG.

In February 2021, PPG announced that it had completed its acquisition of VersaFlex from DalFort Capital Partners.

Chapter 1. Water-Based Metal Packaging Coatings Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Water-Based Metal Packaging Coatings Market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Water-Based Metal Packaging Coatings Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Water-Based Metal Packaging Coatings Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Water-Based Metal Packaging Coatings Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Water-Based Metal Packaging Coatings Market – By Type

6.1. Introduction/Key Findings

6.2 Acrylic

6.3 Polyester

6.4 Alkyd

6.5 Epoxy

6.6 Other

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Water-Based Metal Packaging Coatings Market – By Application

7.1. Introduction/Key Findings

7.2 Architectural

7.3 Industrial

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 8. Water-Based Metal Packaging Coatings Market , By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1. U.K.

8.2.2. Germany

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.2.2 By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. Rest of Asia-Pacific

8.3.2 By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1. Brazil

8.4.2. Argentina

8.4.3. Colombia

8.4.4. Chile

8.4.5. Rest of South America

8.4.2 By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1. United Arab Emirates (UAE)

8.5.2. Saudi Arabia

8.5.3. Qatar

8.5.4. Israel

8.5.5. South Africa

8.5.6. Nigeria

8.5.7. Kenya

8.5.8. Egypt

8.5.9. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Water-Based Metal Packaging Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Sherwin-Williams Company

9.2 BASF SE

9.3 AkzoNobel N.V.

9.4 PPG Industries

9.5 Inc., RPM International Inc.

9.6 Asian Paints Limited

9.7 Axalta Coating Systems LLC

9.8 Nippon Paint Holdings Co. Ltd.

9.9 Kansai Paint Co. Ltd

9.10 Tikkurila OYJ

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The COVID-19 pandemic disrupted supply chains, led to reduced manufacturing activity, and caused fluctuating demand for Water-Based Metal Packaging Coatings due to economic uncertainties and safety measures.

Key drivers of growth in the Water-Based Metal Packaging coating market include increasing environmental awareness, stricter regulations, and the demand for sustainable and low-VOC coating solutions.

Regions such as Asia-Pacific, Europe, and North America exhibit some of the highest demands for Water-Based Metal Packaging Coatings due to industrial growth and sustainability initiatives.

The regulatory landscape presents challenges of compliance with stricter environmental standards and opportunities for innovation in sustainable and low-VOC formulations in the Water-Based Metal Packaging Coatings Market.

Water-based coatings offer advantages such as reduced volatile organic compounds (VOCs), lower environmental impact, and safer application processes compared to traditional solvent-based coatings in metal packaging applications.