Washing Fluids Market Size (2024 – 2030)

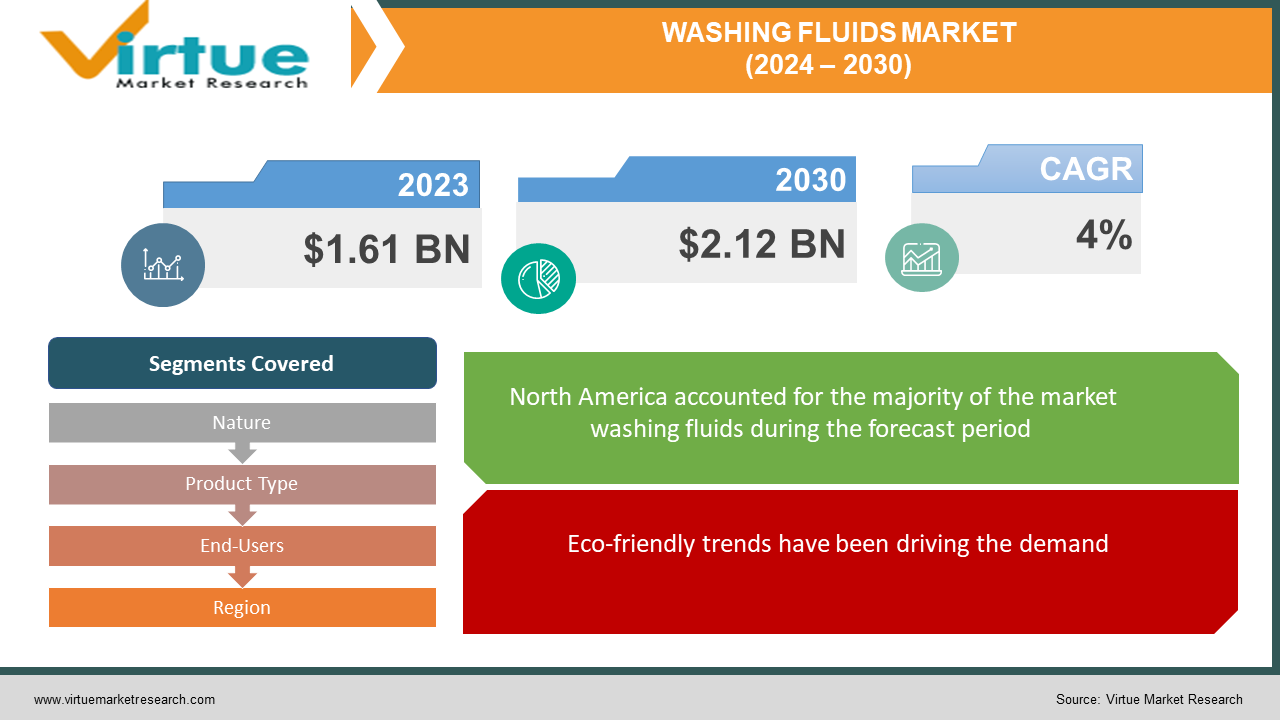

The global washing fluids market was valued at USD 1.61 billion and is projected to reach a market size of USD 2.12 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.

The market for washing fluids includes a broad spectrum of goods used in homes and businesses for cleaning. These liquids consist of dishwashing liquids, vehicle wash solutions, industrial cleaning agents, laundry detergents, and more. This market has undergone significant evolution over the years. In the past, the fluids available were mostly chemical-based. However, presently, as there is more awareness about our environment, eco-friendly formulations have come into existence. In the future, with a growing focus on sustainability and innovation, this market will see good growth.

Key Market Insights:

The market for industrial cleaners is projected to grow from its 2022 valuation of $48.37 billion to $69.24 billion by 2032.

With sales of approximately 2405.52 million dollars, Tide was the first-ranked liquid laundry detergent in the US in 2022.

India's laundry care industry is expected to produce US$5.70 billion in sales by 2024.

Global sales of household cleaners are expected to reach US$40.74 billion by 2024.

35–75% of laundry detergents include phosphate salts, which can lead to issues with water contamination. Phosphates can prevent organic materials from biodegrading, which wastewater treatment cannot remove. To tackle this, organizations have been working towards encouraging consumers to use eco-friendly products that have minimal impact on our environment. Additionally, enzymes, zeolites, and other alternatives are being used by several businesses to create alternative formulas that clean well but are less damaging to the environment.

Washing Fluids Market Drivers:

Eco-friendly trends have been driving the demand.

Over the years, there has been a lot of awareness about our environment. Changes in our way of life have contributed to a lot of problems like global warming, climate change, pollution, etc. Consumers have been looking for products that have minimal impact. Eco-friendly formulations have fewer chemicals, biodegradable substances, and other plant-based compounds. The emergence of eco-friendly companies and goods that employ renewable materials, sustainable sourcing, and environmentally friendly packaging has resulted in a shift towards consumer preference. Businesses are spending money on R&D to produce more environmentally friendly formulations that use enzymes and other environmentally friendly compounds. Investments have also seen a good rise owing to various regulatory rules and demands. Furthermore, companies have been concentrating on using recycled materials for packaging and preventing the use of plastic. As such, the market can generate more income since many people have been looking for these products.

Technological advancements are fueling the growth.

Products that contain washing fluid are increasingly integrating smart technology. This includes components that prevent waste and maximize efficiency, such as dosing sensors, smart packaging, and applications that offer dose suggestions or help with more effective detergent usage. Secondly, the application of nanotechnology and microencapsulation methods is being used to improve washing fluid performance. Better active ingredient distribution, enhanced stain removal, odor control, and fabric care are achieved by integrating these technologies. Furthermore, many R&D activities are being carried out to improve the existing formulations and commercialize them same.

Washing Fluids Market Restraints and Challenges:

Human health and environmental impact are the main issues that the market is currently facing.

Chemicals like phthalates found in dishwashing detergents have the potential to impact the human microbiota. Phthalates interfere with the body's regular hormone signaling since they are endocrine disruptors. High levels of phthalate exposure in humans have been linked to altered immunological responses to vaccinations as well as modifications in the gut microbiota. Phosphates and ammonium sulfate, which are included in dishwashing detergents, have the potential to induce severe respiratory disorders and illnesses, including asthma. Apart from this, few chemicals have been linked to an increased risk of chronic illnesses like cancer. These fluids also hurt the environment. Washing liquids contain a lot of chemicals that can create water and air pollution. Water's surface tension can be lowered by detergents, increasing the water's vulnerability to contaminants like pesticides and vehicle exhaust. Additionally, the oil may be broken up by detergents and carried deeper into the water column, where it can harm marine life and infect the water bodies’ purity. Detergents containing phosphates may cause algal blooms, which block sunlight and reduce oxygen concentrations. As the algae break down, the oxygen that is accessible to aquatic life is depleted. Furthermore, water and soil can vary in pH, and water sources can become more salinized and decrease light transmission.

Washing Fluids Market Opportunities:

Educating customers about the use of sustainable washing fluids can have a great impact on the industry. By educating the public about the small changes that they can incorporate, a greater percentage of the population might be inclined towards buying eco-friendly products. Product diversification can provide the market with many possibilities. By innovating creative formulations, a broader consumer base can be achieved. Many companies and emerging startups have been working on research and developmental activities to create new products. Besides this, companies have been concentrating on having a good virtual presence to connect with customers worldwide and increase their sales.

WASHING FLUIDS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Nature, Product Type, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Procter & Gamble (P&G), Unilever, Henkel, SC Johnson, Church & Dwight Co., Inc., Kao Corporation, Lion Corporation, Colgate-Palmolive, Reckitt ,Clorox Company |

Washing Fluids Market Segmentation: By Nature

-

Chemical-Based

-

Eco-friendly

Based on nature, the chemical-based category is the largest in this market. The main reason for this is affordability. These products are cost-effective, making a greater percentage of people choose these options. Furthermore, their accessibility is easy since they are easily available in many supermarkets, hypermarkets, and other online retail channels. Apart from this, since this type has been available for a longer duration, more customers know about it and trust the product. Hence, this segment has more customers. The eco-friendly type is the fastest-growing segment. There has been a lot of awareness about the destruction that mankind has been doing to our environment. As such, many environmentalists and other common people have been looking for ways to live a sustainable life. Hence, many consumers have been choosing eco-friendly options. Companies are working on various strategies to make these products affordable so that more consumers can purchase them and reduce their environmental impact.

Washing Fluids Market Segmentation: By Product Type

-

Laundry Detergents

-

Dishwashing Liquids

-

Surface Cleaners

-

Industrial Cleaning Agents

-

Car Wash Solutions

-

Others

Based on product type, laundry detergents are the largest category. One essential cleaning tool for getting rid of stains, filth, and smells from washable clothing is laundry detergent. These detergents are formulated to remove all the dirt. To meet specific demands and guarantee that different types of clothes are properly cared for, brands provide specialist detergents for a range of materials, colors, and washing machine types. This is an everyday essential in all households to ensure that the clothes used are bright, clean, and shining. Since it is used daily, the sales of this product are comparatively greater than the rest. Dishwashing liquid is the fastest-growing segment. They are mainly used for cleaning purposes in the kitchen. This can be for utensils, floors, and other surfaces. Keeping the kitchen clean is necessary for a healthy life. Companies have been coming up with various dishwashing liquids, including organic ones, that are a necessity in our daily lives. As such, the market share of this is significant.

Washing Fluids Market Segmentation: By End-Users

-

Household

-

Commercial

-

Industrial

The household sector is the largest end-user. This is because these products are essential in every house to have a healthy life. These liquids are required for washing, cooking, and cleaning purposes. As such, every household tends to buy these basic products, increasing revenue. The commercial sector is the fastest-growing. This segment included the food, beverage, and hospitality sectors as the most important ones. There have been many restaurants and other food outlets that have been opened over the years. With an increasing population and changing lifestyle, more people are going out regularly to experiment with their food. These washing liquids are increasingly being used to ensure safe eating. The tourism industry has undergone many changes. With an increase in travel activities, a greater number of accommodations have been strictly following all the rules to maintain the hygiene of their centers. After the pandemic, the precautions to maintain cleanliness have drastically increased in this sector.

Washing Fluids Market Segmentation: By Distribution Channels

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

Supermarkets and hypermarkets are the largest in terms of distribution channels, accounting for a share of almost 45%. Their items are accessible and easily obtained. They exist in almost every colony, which facilitates the customer's access to the goods they require. This mode makes it possible for the consumer and the business owner to communicate directly and visually check the goods to confirm their contents, expiration dates, and other crucial information. Furthermore, not many people choose this channel since they may not be aware of technology or may already have internet access. The distribution channel in this industry, which is expanding at the fastest rate, is online retail. This is primarily due to their ease. The necessary goods are brought to the residences of the customers. Additionally, people can select from a wide range of options, both domestic and foreign. Online ordering is a cost-effective choice because it occasionally offers free delivery and discounts. This helps a wider audience by making it an affordable option. Apart from this, most eco-friendly products are usually available on the Internet, encouraging more people to buy them same.

Washing Fluids Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America has the largest geographical market. This region makes up around 34% of the total. Canada and the United States are the top two nations. The primary factor contributing to this region's success is economic growth. As a result, mass production and manufacturing enable the availability of more washing liquids. More options have been created by innovations in product diversity, giving people more freedom to select what they want. Furthermore, this area has some prominent market players that are involved in this industry and have a strong global presence. Companies like P&G, Unilever, SC Johnson, and Clorox Company are the major ones. These organizations are constantly coming up with new launches, methods, and investments to benefit the market. The region with the fastest growth is Asia-Pacific. This region has a total of about 25% of the share. Leading nations include South Korea, Japan, China, and India. This is primarily due to e-commerce. More clients can obtain the necessary items because of this channel's ease. Additionally, urbanization has been another reason. The middle class now enjoys better living circumstances and can afford to buy more upscale goods. In addition, the support of several celebrities, media figures, influencers, and other environmentalists has been vital in expanding the outreach to a wider audience. As a result, a sizable portion of the population has started looking for natural and eco-friendly options.

COVID-19 Impact Analysis on the Global Washing Fluids Market:

The outbreak of the virus had a positive impact on the market. To prevent the contamination of the virus, sanitizers became essential. Institutions like hospitals, pharmaceutical companies, research labs, etc., that fell under the category of essential workers were open to carrying out their end-to-end activities. These companies and organizations kept sanitizing equipment for their staff to ensure cleanliness and prevent contamination. Additionally, people who stepped out to carry out important activities often came back and relied on sanitizers to follow safety measures. Liquid detergents had lucrative growth as well. All the products that were brought from outside were cleaned with these fluids. During the pandemic, ensuring cleanliness and sanitation were extremely crucial. Besides, governmental agencies and doctors advised frequent hand washing. E-commerce became a convenient option for consumers who stocked a lot of cleaning fluids. This increased the buying and, subsequently, the profits. According to a study published in Nature Journal, during the epidemic, it was discovered that adults used hand sanitizer more than nine times a day, while children used it up to twenty-five times daily. Post-pandemic, the market has continued to expand due to precautionary measures taken by the public.

Latest Trends/ Developments:

The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing technologies while maintaining competitive pricing. This has further resulted in increased enlargement.

The introduction of multi-purpose cleaning products has been gaining prominence. These liquids can shape themselves in a variety of cleaning applications instead of one. This is an attractive choice for the consumer as it is a more cost-effective option. Furthermore, by creating such products, the amount of chemicals introduced into the environment and exposure to other organisms can be reduced.

Key Players:

-

Procter & Gamble (P&G)

-

Unilever

-

Henkel

-

SC Johnson

-

Church & Dwight Co., Inc.

-

Kao Corporation

-

Lion Corporation

-

Colgate-Palmolive

-

Reckitt

-

Clorox Company

In December 2023, Godrej Consumers Product (GCP), a leading fast-moving consumer goods (FMCG) company, launched Godrej Fab, a liquid detergent, in the South Indian states of Tamil Nadu, Andhra Pradesh, Karnataka, and Kerala. The product is a liquid detergent that aims to revolutionize the washing experience by providing a high-quality solution for nearly half the price of competing liquid detergents on the market.

In August 2022, Osh, the brand's plant-based home care label, was introduced by The Organic World (TOW), India's biggest organic and natural retailer, together with a selection of safe and efficient cleaning products. This is the most recent achievement in the Bengaluru-based company's mission to provide clean, chemical-free options for a better lifestyle to an increasing number of Indian customers.

In December 2022, Inditex launched a detergent under its homeware and décor brand, Zara Home. The creative solution, according to the business, was created in Germany and Spain by Inditex in collaboration with I&I Solutions and BASF Home Care. Tests from many independent research institutes have demonstrated that the detergent can minimize microfiber release by up to 80%, depending on the kind of cloth and the washing circumstances.

Chapter 1. Washing Fluids Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Washing Fluids Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Washing Fluids Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Washing Fluids Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Washing Fluids Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Washing Fluids Market – By nature

6.1 Introduction/Key Findings

6.2 Chemical-Based

6.3 Eco-friendly

6.4 Y-O-Y Growth trend Analysis By nature

6.5 Absolute $ Opportunity Analysis By nature, 2024-2030

Chapter 7. Washing Fluids Market – By Product Type

7.1 Introduction/Key Findings

7.2 Laundry Detergents

7.3 Dishwashing Liquids

7.4 Surface Cleaners

7.5 Industrial Cleaning Agents

7.6 Car Wash Solutions

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Product Type

7.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Washing Fluids Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Household

8.3 Commercial

8.4 Industrial

8.5 Y-O-Y Growth trend Analysis By End-Use Industry

8.6 Absolute $ Opportunity Analysis By End-Use Industry, 2024-2030

Chapter 9. Washing Fluids Market – By Distribution Channels

9.1 Introduction/Key Findings

9.2 Supermarkets and Hypermarkets

9.3 Specialty Stores

9.4 Online Retail

9.5 Others

9.6 Y-O-Y Growth trend Analysis By Distribution Channels

9.7 Absolute $ Opportunity Analysis By Distribution Channels, 2024-2030

Chapter 10. Washing Fluids Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By nature

10.1.2.1 By Product Type

10.1.3 By End-Use Industry

10.1.4 By Technology

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By nature

10.2.3 By Product Type

10.2.4 By End-Use Industry

10.2.5 By Distribution Channels

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By nature

10.3.3 By Product Type

10.3.4 By End-Use Industry

10.3.5 By Distribution Channels

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By nature

10.4.3 By Product Type

10.4.4 By End-Use Industry

10.4.5 By Technology

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By nature

10.5.3 By Product Type

10.5.4 By End-Use Industry

10.5.5 By Distribution Channels

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Washing Fluids Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Procter & Gamble (P&G)

11.2 Unilever

11.3 Henkel

11.4 SC Johnson

11.5 Church & Dwight Co., Inc.

11.6 Kao Corporation

11.7 Lion Corporation

11.8 Colgate-Palmolive

11.9 Reckitt

11.10 Clorox Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global washing fluids market was valued at USD 1.61 billion and is projected to reach a market size of USD 2.12 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.

Eco-friendly trends and technological advancements are the main factors propelling the Global Washing Fluids Market.

Based on Product Type, the Global Washing Fluids Market is segmented into Laundry Detergents, Dishwashing Liquids, Surface Cleaners, Industrial Cleaning Agents, Car Wash Solutions, and Others.

North America is the most dominant region for the Global Washing Fluids Market.

Procter & Gamble (P&G), Unilever, and Henkel are the key players operating in the Global Washing Fluids Market.