Vodka Seltzer Market Size (2023 – 2030)

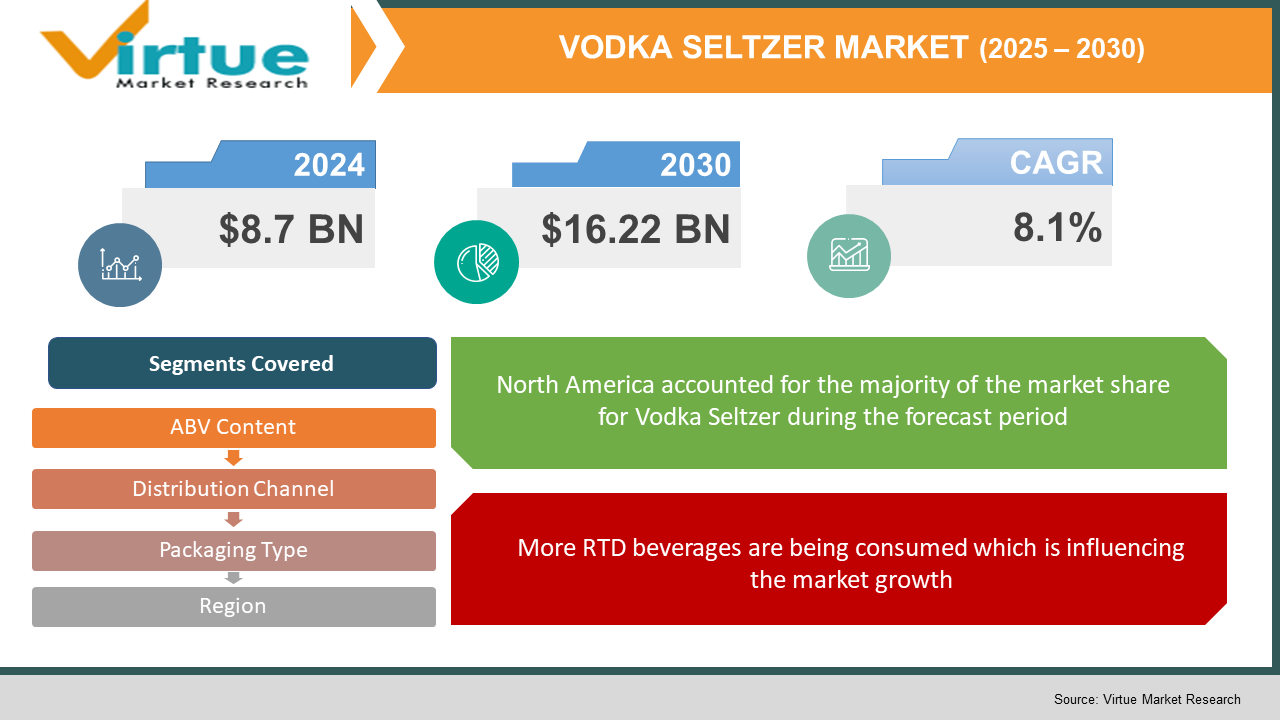

The Global Vodka Seltzer Market was valued at USD 8.7 billion in 2022 and is projected to reach a market size of USD 16.22 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 8.1%. The demand for the product is being driven by the younger generation's growing preference for low-alcohol beverages. Additionally, people are attempting to cut back on their alcohol intake or are becoming "sober-curious," which has increased the market for non-alcoholic drinks.

INDUSTRY OVERVIEW

Vodka seltzer is a carbonated or sparkling beverage with over 5% alcohol by volume that is comparable to beer. It is created using soda water, flavorings, and either malted rice or cane sugar that has been brewed. These days, vodka seltzer comes in a variety of flavors, including strawberry, passionfruit, pomegranate, tangerine, lemon, watermelon, lime, and strawberry. Due to its lack of gluten and low calorie, carbohydrate, and sugar content, it is regarded as a healthy substitute for traditional alcoholic beverages. As a result, it is becoming more and more well-liked among health-conscious shoppers and those with allergies, celiac disease, inflammatory illnesses, and auto-immune disorders.

The increasing consumer preferences toward drinks with low alcohol by volume (ABV) content are the main factors driving the worldwide vodka seltzer industry. Worldwide demand for ready-to-drink sparkling drinks like hard seltzer is strong due to the rising popularity of flavored alcoholic beverages and healthier substitutes. In addition, several firms are offering cutting-edge product versions to diversify their current product lines. For instance, the California-based Sudwerk Brewing Co. introduced the Life Is Hard Seltzer in May 2020 in the flavors of black cherry, grapefruit, and passionfruit. It is fermented with sugar and yeast, after which natural fruit concentrates are added for taste. The top alcoholic beverage producers are also creating 100% natural hard seltzer free of artificial sweeteners, flavors, or preservatives. Additionally, manufacturers are introducing innovative package designs that are transportable and recyclable in response to growing environmental concerns which are allied to the sustainable goals of the younger generation thus propelling the market growth.

COVID-19 IMPACT ON THE VODKA SELTZER MARKET

During the COVID-19 epidemic, several industries, especially the food and beverage sector, had unforeseen difficulties. Global supply chains were hampered by a variety of government restrictions, including lockdowns, manufacturing halts, travel bans, and border restrictions. Additionally, this contributed to labour and raw material deficit. However, during lockdowns, there was a noticeable increase in the demand for alcoholic beverages. People liked to drink beverages at home since they had to stay indoors. Additionally, as a result of fewer trips to bars, RTD drinks like hard seltzer saw a huge increase in demand. The vodka seltzer market is anticipated to experience considerable growth throughout the projected period as immunization rates rise globally and manufacturing facilities recover from their losses.

MARKET DRIVERS:

It is anticipated that rising disposable income would increase product demand

Asia is quickly overtaking rich countries of the world like Europe, where the average annual income is over $60,000. Instead, Asia is becoming the new global hub for wealth. Despite the COVID-19 limitations slowing economic development, India and China had positive growth in 2021 because of soaring exports. The massive manufacturing of pharmaceutical medications and vaccines is one of the primary causes of this fascinating rise in these two countries. Despite the lockout, exports reached $3.36 trillion and had a $676.4 billion trade surplus. These figures suggest that the general level of discretionary money among individuals will increase, which is projected to fuel the Vodka seltzer industry.

More RTD beverages are being consumed which is influencing the market growth

Since they may be consumed anywhere and at any time, ready-to-drink (RTD) beverages are becoming more and more popular. People are favoring items in RTD packaging more and more because of their hurried lifestyles and packed schedules. RTD drinks are perfect for consumption when travelling. Furthermore, RTD drinks typically come in recyclable cans, which satisfy customer concerns about sustainability. This includes Vodka Seltzers. Cans are also convenient to handle and appealing to a wide range of customers since they are sleek, small, and printed in brilliant colours. These elements have helped RTD drinks become much more well-liked regionally, which has helped the market for vodka seltzers expand.

MARKET RESTRAINTS:

It is anticipated that constricting manufacturing operations would restrain market expansion

Lockdowns have been around for more than two years. The rate of mutations suggests that this pandemic has been developing for some time. Governments all around the world have been obliged to implement lockdowns as a deterrent strategy to stop the virus spread due to the possibility of new variations. As a result, a lot of businesses are compelled to stop producing since both the demand and supply chains have significantly weakened. Yelp.com had 140,104 businesses listed as temporarily closed at the start of the epidemic, but by August, that number had dropped to 65,769. According to Yelp.com's Local Economic Impact Report, more than 97,966 companies have closed permanently as a result of the epidemic. Therefore, these elements seriously hindered market expansion.

VODKA SELTZER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

8.1% |

|

Segments Covered |

By ABV Content, By Distribution Channel, Packaging Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

HARD SELTZER BEVERAGE COMPANY, LLC, WHITE CLAW SELTZER WORKS, BAREFOOT CELLARS, FUTURE PROOF BRANDS LLC, BON & VIV, FICKS & CO, NUDE BEVERAGES, KONA BREWING CO., LIFT BRIDGE BREWING CO., BUD LIGHT SELTZER |

This research report on the Vodka Seltzer Market has been segmented and sub-segmented based on ABV Content, By Distribution Channel, Packaging Type and By Region.

VODKA SELTZER MARKET – BY ABV CONTENT

-

1.0% to 4.9%

-

5.0% to 6.9%

-

Others

Based on the ABV content, the Vodka Seltzer market is segmented into 1.0% to 4.9%, 5.0% to 6.9%, and others. With a market share of more than 51.5 % in 2021, the 5.0 % to 6.9 % ABV content segment is anticipated to continue to dominate over the forecast period. This market is expanding as a result of the increasing trend of moderation, which is particularly prevalent in the United States. The number of companies offering low-alcohol beverages has increased among several alcohol industry participants. However, it is anticipated that throughout the projection period of 23.9 % from 2023 - 2030, the category with ABV content ranging from 1.0 % to 4.9 % would see the highest CAGR.

VODKA SELTZER MARKET - BY DISTRIBUTION CHANNEL

-

Off-trade

-

On-trade

Based on the distribution channel, the Vodka Seltzer market is segmented into Off-trade and On-trade. Off-trade accounted for the greatest portion of distribution channels and a revenue share of almost 70.0 % in 2021. All retail establishments, including hypermarkets, supermarkets, convenience stores, micro markets, and wine and spirit stores, are included in this sector. People favor these shops because they frequently have great deals and discounts. To reach the greatest number of consumers, the majority of businesses launch their products through supermarket chains like Walmart, Target, and others.

From 2023 - 2030, it is predicted that the on-trade distribution channel segment would increase at the quickest pace, exceeding 23.5%. Outlets like pubs, clubs, motels, and lounges are examples of on-trade distribution channels. Lockdowns and closures have occurred all across the world as a result of the worldwide COVID-19 outbreak. Sales through these channels have decreased as a result of this. Product sales through on-trade channels are anticipated to rise, nevertheless, as social conventions are eased and people place more emphasis on gatherings, parties, and socializing.

VODKA SELTZER MARKET – BY PACKAGING TYPE

-

Plastic bottles

-

Glass bottles

-

Aluminium cans

Based on the packaging type, the Vodka Seltzer market is segmented into Plastic bottles, Glass bottles and Aluminium cans. In 2021, the category for aluminium cans had the biggest share. Their sustainability is what has caused the expansion. Aluminium cans, in contrast to PET bottles, are naturally recyclable and can be used to create new beverage containers. These cans are lightweight because they are made with a very thin coating of metal. In addition to being environmentally friendly, aluminium cans function as a superior barrier or cordon to protect the beverage from bacterial contamination and maintain its integrity for a longer amount of time. Additionally, the visual attractiveness of can packaging attracts customers' attention. Similar to this, the aluminium cans market is anticipated to see the fastest growth, with a CAGR of 9.4% from 2023 - 2030. This increase might be attributed to the fact that it is more affordable than other packaging methods. Companies can save shipping and material expenses because of their lightweight construction and small size. On the other hand, they provide quality printing options and durability.

VODKA SELTZER MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Vodka Seltzer Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The highest revenue share in 2021—more than 45 %—came from North America. High demand has been seen in the area, particularly from young customers. Leading manufacturers are using creative methods to promote their goods. For instance, in June 2019, the well-known Mark Anthony Brands company White Claw from Vancouver saw a large increase in sales because of its active social media presence, which included YouTube videos and internet memes. The widespread appeal of these beverages has also helped both male and female customers embrace them, which will likely lead to an increase in the consumption of vodka seltzer in the years to come. The expansion of this market may be attributed to factors like the general increase in health consciousness. America is one of the countries with the highest rates of cancer worldwide, and heavy drinking plays a significant part in this. Because seltzers contain so little alcohol, people, especially millennials, are turning to them. Additionally, nations like the U.S. and Canada have an excellent network of distribution channels. On the other hand, residents' strong purchasing power has contributed significantly to the growth of the relevant marketing in this market.

However, throughout the projected period of 2022–2030, Asia–Pacific is anticipated to have the fastest growth rate. This expansion is due to increased western influence in Asian countries. This significant shift in consumer purchasing behaviour is mostly attributable to the developing economies of China and India. Global centers for worldwide brands have formed in nations like China, Australia, and Japan. Additionally, vodka seltzers with less than 5% alcohol by volume are in extremely high demand throughout Asia. As a result, increasing demand and choices for ease of doing business thanks to lower labour motivate many corporations throughout the world to establish production facilities in Asia.

VODKA SELTZER MARKET - BY COMPANIES

Some of the major players operating in the Vodka Seltzer Market include:

-

HARD SELTZER BEVERAGE COMPANY, LLC

-

WHITE CLAW SELTZER WORKS

-

BAREFOOT CELLARS

-

FUTURE PROOF BRANDS LLC

-

BON & VIV

-

FICKS & CO

-

NUDE BEVERAGES

-

KONA BREWING CO.

-

LIFT BRIDGE BREWING CO.

-

BUD LIGHT SELTZER

NOTABLE HAPPENING IN THE VODKA SELTZER MARKET

-

PRODUCT LAUNCH- In April 2022, The Boston Beer Co launched a new vodka-based RTD to its Truly hard seltzer brand.

-

PRODUCT LAUNCH- To appeal to Australia's expanding vegan community, United Breweries and Carlton introduced Actual Vodka Seltzer in May 2020. It has a 4.2 % ABV and comes in two flavors: Pure and Lime.

Chapter 1. Vodka Seltzer Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Vodka Seltzer Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Vodka Seltzer Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Vodka Seltzer Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Vodka Seltzer Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Vodka Seltzer Market – By ABV Content

6.1. 1.0% to 4.9%

6.2. 5.0% to 6.9%

6.3. Others

Chapter 7. Vodka Seltzer Market – By Distribution Channel

7.1. Off-trade

7.2. On-trade

Chapter 8. Vodka Seltzer Market – By Packing Type

8.1. Plastic bottles

8.2. Glass bottles

8.3. Aluminium cans

Chapter 9. Vodka Seltzer Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Vodka Seltzer Market – key players

10.1 HARD SELTZER BEVERAGE COMPANY, LLC

10.2 WHITE CLAW SELTZER WORKS

10.3 BAREFOOT CELLARS

10.4 FUTURE PROOF BRANDS LLC

10.5 BON & VIV

10.6 FICKS & CO

10.7 NUDE BEVERAGES

10.8 KONA BREWING CO.

10.9 LIFT BRIDGE BREWING CO.

10.10 BUD LIGHT SELTZER

Download Sample

Choose License Type

2500

4250

5250

6900