Vitamin Water Enhancer Market size (2025-2030)

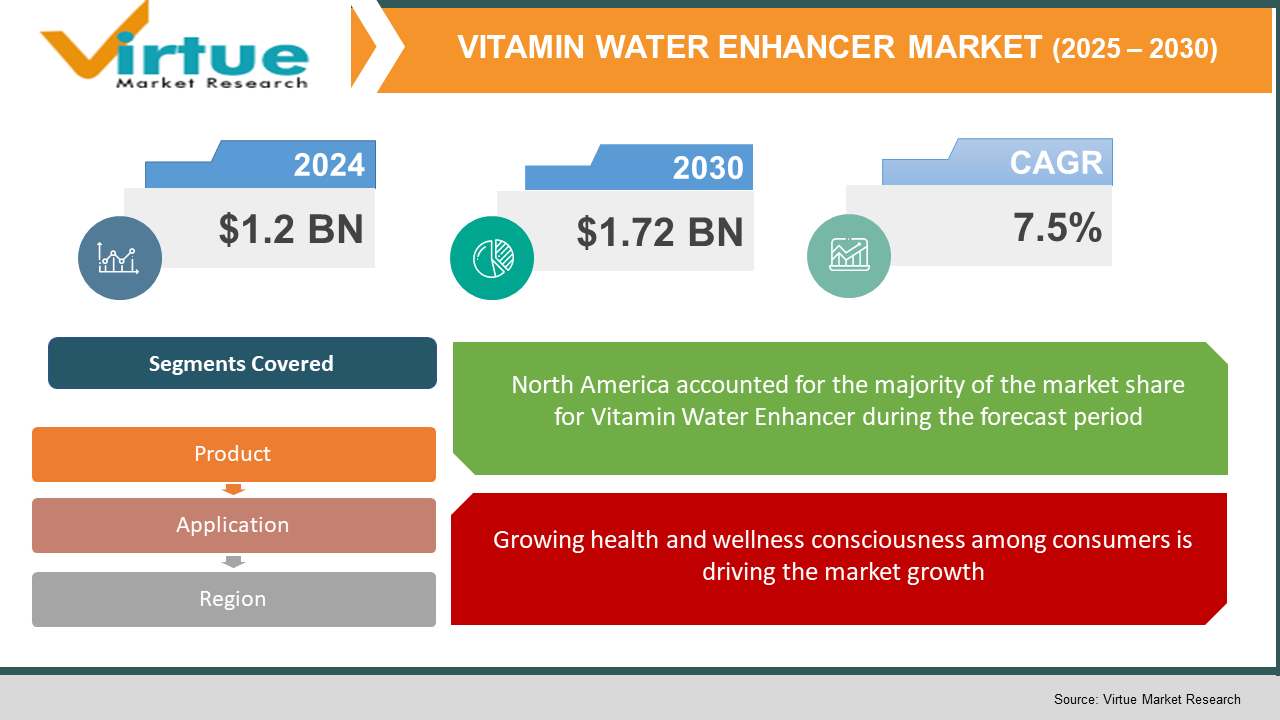

The Global Vitamin Water Enhancer Market was valued at USD 1.2 billion in 2024 and will grow at a CAGR of 7.5% from 2025 to 2030. The market is expected to reach USD 1.72 billion by 2030.

The Vitamin Water Enhancer Market revolves around concentrated liquid or powder supplements that can be added to water to enhance flavor and provide added vitamins and minerals. These products are typically portable, convenient, and often marketed as low-calorie or sugar-free alternatives to traditional soft drinks. With increasing consumer focus on health, hydration, and functional benefits, this market is poised for robust growth. Key factors include rising demand for personalized nutrition, increasing adoption of active lifestyles, and growing aversion to sugary sodas.

Key market insights:

- North America holds the dominant market share, accounting for over 40% in 2024 due to high consumer awareness, product availability, and strong retail infrastructure.

- Powder-based vitamin water enhancers are witnessing increased adoption with a projected CAGR of 8.2% from 2025 to 2030 due to longer shelf life and ease of use.

- Functional claims such as “energy-boosting”, “immune-supporting”, and “hydration-focused” have become major marketing tools, influencing over 65% of consumer purchasing decisions.

- E-commerce contributed to over 25% of total sales in 2024, with convenience and variety cited as key drivers for online purchases.

- Flavors such as berry, citrus, and tropical mixes remain consumer favorites, with citrus-based variants leading at 28% of market share.

- Major players are investing in eco-friendly packaging and clean-label formulas, which is expected to influence market dynamics in sustainability-conscious regions.

- Asia-Pacific is the fastest-growing region with a CAGR of 9.3% during the forecast period, driven by urbanization, western lifestyle adoption, and growing middle-class populations.

Global Vitamin Water Enhancer Market Drivers

Growing health and wellness consciousness among consumers is driving the market growth

One of the primary drivers for the vitamin water enhancer market is the increasing consumer awareness and emphasis on health and wellness. As modern lifestyles become more sedentary and fast-paced, consumers are actively seeking products that support hydration, immunity, energy, and overall well-being without excessive sugar or calorie content. This shift in preference has significantly contributed to the demand for functional beverages like vitamin-enhanced water. These products cater to the need for convenient yet nutritious solutions that integrate seamlessly into daily routines. The pandemic further reinforced this trend by increasing awareness of personal health, leading to a surge in demand for immunity-boosting beverages. Moreover, a growing preference for preventive healthcare measures among millennial and Gen Z consumers has also been instrumental in market growth. With water being a fundamental component of daily hydration, vitamin water enhancers offer an easy way to upgrade a routine activity with added nutritional benefits. The trend is further supported by rising health campaigns and endorsements by fitness influencers and nutritionists, making consumers more likely to adopt these functional products as part of their wellness journey.

Shift towards convenient and portable nutrition solutions is driving the market growth

Consumers are increasingly leaning toward products that provide not only health benefits but also ease of use and portability. Vitamin water enhancers, available in compact and easy-to-use forms such as squeezable liquid drops and dissolvable powders, cater to this demand effectively. These products can be carried anywhere and used to transform regular water into a nutrient-rich beverage within seconds. The portability factor has proven especially attractive to on-the-go professionals, fitness enthusiasts, and students who seek quick nutritional supplementation without the need for refrigeration or complicated preparation. Additionally, the wide range of packaging options such as single-serve sticks, multipacks, and eco-friendly pouches has further contributed to the popularity of these enhancers. This convenience also extends to the customization aspect, as consumers can control the intensity of flavor and the amount of nutrients added to their water. This aligns well with the broader personalization trend in the food and beverage industry, where consumers seek tailored products that meet their individual needs and preferences. The growing urban population and busy lifestyles across both developed and developing regions further reinforce the demand for such easy-to-use and portable nutritional formats.

Rising demand for clean-label and natural ingredients is driving the market growth

Another major driver propelling the vitamin water enhancer market is the growing consumer inclination towards clean-label and naturally sourced ingredients. Today’s consumers are not only focused on health benefits but also the integrity and source of the ingredients they consume. As a result, there is a heightened demand for vitamin water enhancers that are free from artificial colors, preservatives, sweeteners, and synthetic vitamins. This shift is evident in the increasing popularity of products formulated with plant-based vitamins, natural flavorings, organic fruit extracts, and non-GMO components. Many brands have responded by launching enhancers that boast “no added sugar,” “organic-certified,” and “gluten-free” claims. This trend is especially pronounced among health-conscious segments such as millennials and young professionals who carefully examine product labels before purchase. Furthermore, regulatory pressures and global movements advocating for transparency and sustainability in food and beverage products have added momentum to this clean-label trend. As a result, manufacturers are innovating with novel natural ingredients like stevia, monk fruit, and adaptogenic herbs to appeal to evolving consumer preferences. In the long term, this focus on clean-label formulations is expected to strengthen consumer trust and brand loyalty, offering manufacturers a competitive edge in a crowded market.

Global Vitamin Water Enhancer Market Challenges and Restraints

Regulatory complexity and labeling standardization is restricting the market growth

One significant challenge for the vitamin water enhancer market lies in navigating the regulatory landscape, particularly regarding health claims and labeling requirements. As these products are often positioned as functional beverages, they must comply with stringent regulations pertaining to nutritional content, safety, and health benefits. Regulatory bodies such as the FDA in the U.S., EFSA in Europe, and other international organizations impose strict guidelines that manufacturers must follow. However, there is a lack of uniformity in these regulations across regions, leading to inconsistencies in product claims, ingredient approvals, and labeling practices. For example, while some jurisdictions may allow the use of certain functional claims like “immune support” or “energy boost,” others may categorize them as misleading or require extensive scientific validation. This inconsistency complicates product formulation, marketing, and distribution strategies for global brands. Additionally, evolving regulatory updates require constant monitoring and adaptation, increasing operational costs and timelines. Start-ups and small players may find it particularly difficult to scale in such a regulated environment due to limited resources. Moreover, non-compliance or mislabeling can lead to product recalls, legal penalties, and damage to brand reputation. Thus, manufacturers must invest in regulatory expertise and proactive compliance strategies to successfully navigate this fragmented regulatory framework.

Market saturation and competitive pricing pressure is restricting the market growth

The vitamin water enhancer market is experiencing an influx of new entrants and product innovations, leading to increasing competition and market saturation, particularly in developed regions. This heightened competition has led to aggressive pricing strategies, discounting, and promotional activities, making it difficult for both established players and newcomers to maintain profitability. As more brands enter the market with similar claims around health benefits, flavor options, and convenience, differentiation becomes challenging. Consumers are often drawn to lower-priced alternatives, particularly in price-sensitive markets, reducing brand loyalty and margin stability. This pricing pressure is further compounded by the increasing cost of high-quality ingredients, sustainable packaging, and regulatory compliance. Private-label brands offered by large retail chains are also gaining traction, intensifying competitive dynamics by offering comparable products at lower prices. While innovation and branding can offer temporary advantages, sustaining growth in a highly competitive market demands consistent investment in R&D, marketing, and customer engagement. Smaller companies may struggle to keep up, leading to consolidation or exit from the market. As a result, despite the overall positive outlook for the industry, market saturation and pricing pressures remain a key restraint that players must strategically navigate.

Market opportunities

The Vitamin Water Enhancer Market is poised for significant expansion as it taps into the broader trends of health, convenience, and personalization. One of the most compelling opportunities lies in product innovation aligned with evolving consumer preferences. There is strong demand for multifunctional enhancers that go beyond basic vitamin supplementation to include adaptogens, probiotics, electrolytes, and nootropics. These enhanced functionalities appeal to consumers looking for targeted benefits like mental clarity, digestive health, and sustained energy. In addition, flavor innovation remains a key opportunity, especially for brands that can offer globally inspired flavors or seasonal limited editions that entice trial and repeat purchases. Moreover, eco-conscious packaging innovations such as biodegradable pouches and recyclable squeeze bottles are gaining momentum and can serve as a major differentiator. Another area with immense potential is digital and personalized marketing. With the rise of health apps and wearable devices, companies can explore offering customized enhancer formulations based on individual hydration or nutrition goals. Direct-to-consumer (DTC) models and subscription-based services are also growing, offering brands the chance to build closer relationships with customers and gather valuable usage data. Geographic expansion, particularly in emerging economies such as India, Indonesia, and Brazil, represents another lucrative opportunity. In these markets, rising disposable incomes, urbanization, and increasing health awareness create fertile ground for market penetration. Collaborations with fitness chains, wellness influencers, and nutrition experts can further solidify market presence. Overall, brands that prioritize innovation, sustainability, and customer-centric approaches are well-positioned to capture the next wave of growth in this dynamic market.

VITAMIN WATER ENHANCER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé, PepsiCo, Kraft Heinz, Gatorade, and Vitamin Well. |

Vitamin Water Enhancer Market segmentation

Vitamin Water Enhancer Market By Product:

• Liquid Enhancers

• Powder Enhancers

• Tablet/Dissolvable Enhancers

Liquid enhancers are the most dominant product segment in the vitamin water enhancer market. These products account for the highest share owing to their ease of use, precise dosing, and wide flavor availability. Their portability and compatibility with various packaging formats, including squeezable bottles, make them especially attractive for on-the-go consumers. Moreover, liquid enhancers often include a combination of vitamins, electrolytes, and natural flavors, enhancing their appeal among health-conscious individuals. The ability to customize flavor intensity also gives them an edge. Their established presence in retail outlets and e-commerce platforms ensures broad accessibility, contributing to their market leadership.

Vitamin Water Enhancer Market By Application:

• General Hydration

• Sports and Fitness

• Immunity Boosting

• Energy and Focus

• Others

General hydration remains the most dominant application segment for vitamin water enhancers. This segment encompasses consumers who use enhancers simply to improve the taste and nutritional value of daily water intake. These users are not necessarily targeting specific health functions but are drawn to the convenience and added value enhancers provide. With increasing awareness about the importance of hydration and the harmful effects of sugary sodas, more people are shifting toward healthier, flavored hydration solutions. The simplicity of use and widespread appeal across all age groups give general hydration a broad consumer base, thereby driving its market dominance.

Vitamin Water Enhancer Market Regional segmentation

North America

Asia-Pacific

Europe

South America

Middle East and Africa

North America stands out as the most dominant region in the global vitamin water enhancer market. This leadership is primarily driven by strong consumer awareness regarding health and wellness, high disposable income, and a mature functional beverage market. The United States, in particular, has a well-developed retail and e-commerce infrastructure that supports broad product availability and brand visibility. Consumer preferences in the region favor low-calorie, functional beverages, making vitamin water enhancers an attractive option. Additionally, North American consumers are early adopters of clean-label and natural ingredient trends, encouraging innovation and premium product development. The presence of major market players and high penetration of health-focused marketing campaigns further boost regional growth. A strong fitness culture, especially among millennials and Gen Z, contributes to regular use of hydration supplements. Furthermore, convenience plays a significant role, as busy lifestyles in urban areas drive demand for portable and easy-to-use nutrition solutions. Retail giants and supermarkets have also embraced private-label versions, enhancing accessibility. All these factors together consolidate North America’s leadership position in the market.

COVID-19 Impact Analysis on the Vitamin Water Enhancer Market

The COVID-19 pandemic had a dual impact on the vitamin water enhancer market. On one hand, it heightened consumer interest in immunity and wellness products, which significantly increased the demand for vitamin-fortified beverages. With health becoming a top priority, consumers began actively seeking ways to improve their nutritional intake, and vitamin water enhancers provided a convenient and effective solution. The rise of home-based lifestyles led to an uptick in e-commerce sales, as people avoided in-store shopping. This shift helped smaller and digitally native brands gain visibility through online platforms and direct-to-consumer channels. On the other hand, the market faced supply chain disruptions during the early phases of the pandemic, affecting product availability and distribution. Manufacturing delays and packaging shortages led to temporary stock-outs and fluctuations in product pricing. Additionally, new product launches were postponed due to uncertain demand forecasts and logistical constraints. However, as economies reopened and supply chains normalized, the market rebounded quickly, buoyed by sustained consumer interest in preventive healthcare. Brands responded by reformulating products to include immunity-supporting ingredients like vitamin C and zinc and highlighting these benefits in marketing campaigns. The pandemic also led to a broader acceptance of personalized nutrition and functional beverages, creating long-term growth potential for the vitamin water enhancer market. Overall, while the market experienced short-term disruptions, COVID-19 ultimately acted as a catalyst for growth by aligning the category with essential health and wellness needs.

Latest trends/Developments

The vitamin water enhancer market is witnessing several key trends and innovations that are shaping its future trajectory. One of the most notable developments is the incorporation of multifunctional ingredients. Beyond basic vitamins, brands are now introducing enhancers with added electrolytes, probiotics, adaptogens, and cognitive support elements like nootropics. This aligns with the broader consumer interest in holistic wellness. Another trend gaining momentum is clean-label formulation. Consumers are increasingly looking for products free from artificial sweeteners, colors, and preservatives. This has pushed brands to innovate with natural flavoring agents, organic fruit extracts, and plant-based sweeteners such as stevia and monk fruit. Packaging innovation is another area seeing advancement, with eco-friendly options like recyclable bottles, biodegradable pouches, and reusable dispensers gaining favor among environmentally conscious consumers. On the digital front, the rise of e-commerce and personalized marketing is playing a pivotal role. Brands are leveraging AI and data analytics to offer customized product recommendations based on individual lifestyle and fitness goals. Limited edition and seasonal flavors are also being launched more frequently to maintain consumer interest and create buzz. Furthermore, collaborations with fitness influencers, wellness apps, and sports nutrition brands are helping enhance product credibility and outreach. Lastly, regional and cultural flavor integration is being explored to appeal to diverse markets globally. These trends collectively highlight the market’s dynamic evolution and the growing focus on health, sustainability, and consumer engagement.

Key Players:

- Nestlé

- PepsiCo

- Kraft Heinz

- Gatorade

- Vitamin Well

- 4C Foods Corp.

- Stur Drinks

- Skinnygirl

- Splenda

- True Citrus

Chapter 1. VITAMIN WATER ENHANCER MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. VITAMIN WATER ENHANCER MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. VITAMIN WATER ENHANCER MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. VITAMIN WATER ENHANCER MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. VITAMIN WATER ENHANCER MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. VITAMIN WATER ENHANCER MARKET – By Product

6.1 Introduction/Key Findings

6.2 Liquid Enhancers

6.3 Powder Enhancers

6.4 Tablet/Dissolvable Enhancers

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. VITAMIN WATER ENHANCER MARKET – By Application

7.1 Introduction/Key Findings

7.2 General Hydration

7.3 Sports and Fitness

7.4 Immunity Boosting

7.5 Energy and Focus

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. VITAMIN WATER ENHANCER MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. VITAMIN WATER ENHANCER MARKET – Company Profiles – (Overview, Product , Portfolio, Financials, Strategies & Developments)

9.1 Nestlé

9.2 PepsiCo

9.3 Kraft Heinz

9.4 Gatorade

9.5 Vitamin Well

9.6 4C Foods Corp.

9.7 Stur Drinks

9.8 Skinnygirl

9.9 Splenda

9.10 True Citrus

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Vitamin Water Enhancer Market was valued at USD 1.2 billion in 2024 and will grow at a CAGR of 7.5% from 2025 to 2030. The market is expected to reach USD 1.72 billion by 2030.

Key drivers include rising health consciousness, demand for convenient nutrition, and interest in clean-label ingredients

The market is segmented by product (liquid, powder, tablet) and by application (general hydration, sports, immunity, energy, others).

North America is the most dominant region due to strong consumer awareness and robust retail presence.

Leading players include Nestlé, PepsiCo, Kraft Heinz, Gatorade, and Vitamin Well.