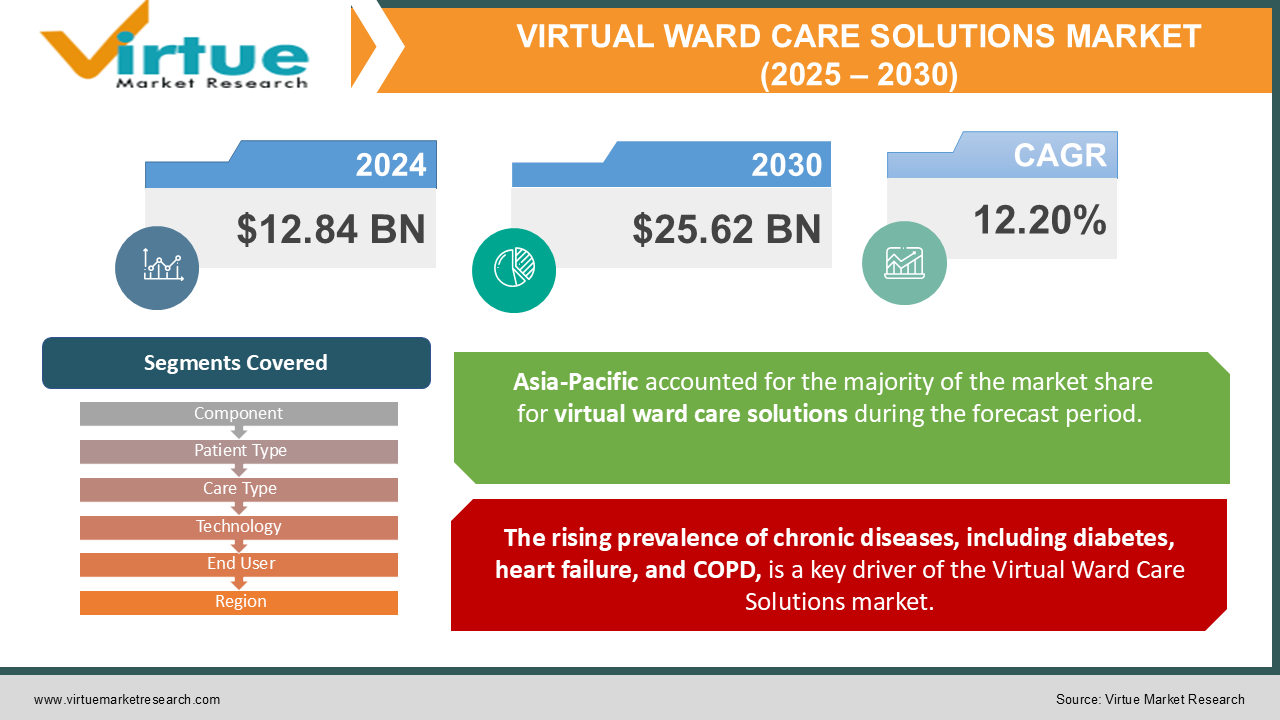

Virtual Ward Care Solutions Market Size (2025 – 2030)

The Virtual Ward Care Solutions Market was valued at USD 12.84 Billion in 2024 and is projected to reach a market size of USD 25.62 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 12.20%.

The Virtual Ward Care Solutions market represents a transformative shift in the global healthcare ecosystem, driven by the increasing need for decentralized, technology-driven, and patient-centered care. Virtual ward care bridges the gap between traditional in-hospital treatment and home-based care, enabling healthcare providers to deliver comprehensive medical services remotely. This model leverages advanced technologies, such as remote patient monitoring (RPM), telehealth platforms, artificial intelligence (AI), and wearable devices, to replicate the capabilities of a physical ward in a virtual environment. The concept revolves around closely monitoring patients who would typically require hospitalization, including those recovering from surgeries, managing chronic illnesses, or facing acute health challenges, within the comfort of their homes.

Key Market Insights:

-

Over 28 million patients globally utilized virtual ward care solutions in 2023. Virtual ward care solutions saved healthcare systems an estimated $32 billion in hospitalization costs in 2023.

-

Approximately 67% of chronic disease patients using virtual wards reported improved health outcomes in 2023.

-

Telehealth consultations within virtual wards increased by 48% compared to 2022. Nearly 70% of healthcare providers in developed economies adopted at least one virtual ward care solution by the end of 2023.

-

Post-surgical recovery patients constituted 18% of the virtual ward care population in 2023. Over 85% of healthcare facilities utilizing virtual wards reported enhanced patient satisfaction rates in 2023.

-

Data analytics platforms in virtual wards processed over 1.2 petabytes of patient health data in 2023. The deployment of AI in virtual ward solutions rose by 35% in 2023.

Market Drivers:

The rising prevalence of chronic diseases, including diabetes, heart failure, and COPD, is a key driver of the Virtual Ward Care Solutions market.

Globally, healthcare systems are under immense pressure to manage chronic conditions more effectively, given their long-term nature and significant economic burden. Virtual ward care offers an innovative solution by enabling remote monitoring and real-time management of patients from their homes. Chronic disease patients often require frequent health check-ups, constant medication adjustments, and immediate intervention when complications arise. Virtual ward systems integrate remote patient monitoring tools, wearable devices, and data analytics to ensure continuous care, reduce hospital admissions, and improve overall patient outcomes. In addition, virtual ward care empowers patients with chronic illnesses by giving them greater control over their health. Patients can track their vitals using wearable health devices, consult with healthcare providers through telehealth platforms, and receive timely reminders for medication adherence and lifestyle modifications. These features not only improve health outcomes but also enhance the overall patient experience, contributing to the growing adoption of virtual ward solutions. Healthcare providers are equally motivated to adopt virtual wards due to their ability to optimize resource utilization. Managing chronic disease patients remotely reduces the burden on hospital infrastructure and medical staff, enabling providers to focus on critical in-patient care. This shift toward decentralized healthcare delivery is particularly significant in the wake of the COVID-19 pandemic, which underscored the importance of resilient, scalable, and tech-driven healthcare systems. With chronic diseases accounting for over 70% of healthcare costs in many countries, virtual ward care solutions are positioned as a cost-effective and sustainable alternative to traditional care models.

The rapid evolution of healthcare technology has been instrumental in driving the growth of the Virtual Ward Care Solutions market.

Innovations in wearable devices, telehealth platforms, AI-driven analytics, and cloud-based solutions have significantly enhanced the efficiency, scalability, and accessibility of virtual ward care. These technologies enable real-time monitoring of patients’ health metrics, such as blood pressure, heart rate, oxygen saturation, and glucose levels, allowing healthcare providers to detect anomalies early and take proactive measures. Artificial intelligence and predictive analytics are particularly transformative, enabling healthcare providers to anticipate complications, identify at-risk patients, and personalize treatment plans. For instance, AI algorithms can analyse vast amounts of patient data to detect patterns and trends that might indicate a potential health crisis, such as an impending cardiac event or respiratory distress. This capability not only improves patient outcomes but also reduces healthcare costs by preventing emergencies and hospitalizations. Cloud-based platforms and mobile applications further enhance the convenience and accessibility of virtual ward care. These solutions enable seamless data sharing between patients, caregivers, and healthcare professionals, ensuring timely interventions and better care coordination. Moreover, the integration of virtual ward platforms with electronic health records (EHR) and electronic medical records (EMR) systems allows for comprehensive and holistic patient management. In addition, the proliferation of wearable health technologies and IoT-enabled devices has made virtual ward care more affordable and user-friendly. These devices are designed to be lightweight, non-invasive, and easy to use, encouraging greater adoption among patients and caregivers. As technology continues to advance, the capabilities of virtual ward care solutions are expected to expand further, driving their adoption across diverse patient populations and healthcare settings.

Market Restraints and Challenges:

Despite its many advantages, the Virtual Ward Care Solutions market faces several challenges that could hinder its growth. One of the primary barriers is the high initial cost of implementing virtual ward systems. Healthcare providers, particularly those in resource-constrained settings, may find it difficult to invest in the necessary infrastructure, such as remote monitoring devices, telehealth platforms, and data analytics tools. While the long-term cost savings are significant, the upfront expenses can be prohibitive for smaller healthcare organizations and rural facilities. Another major concern is data security and privacy. Virtual ward care relies heavily on the collection, storage, and transmission of sensitive patient health data, making it vulnerable to cyberattacks and data breaches. Ensuring the confidentiality and integrity of patient information is critical to building trust among users and complying with regulatory requirements. However, the complexity of securing interconnected systems and devices can pose significant challenges for healthcare providers and technology vendors. Interoperability issues also remain a significant hurdle. Virtual ward systems often involve multiple technologies and stakeholders, including wearable device manufacturers, software developers, healthcare providers, and insurers. Ensuring seamless integration and compatibility between these components is essential for the smooth functioning of virtual wards. However, the lack of standardized protocols and frameworks can lead to fragmentation, inefficiencies, and increased costs.

Market Opportunities:

The Virtual Ward Care Solutions market is ripe with opportunities, driven by the increasing demand for innovative, patient-centered healthcare models. One of the most significant opportunities lies in expanding access to care in underserved regions. Virtual ward care has the potential to bridge healthcare disparities by providing remote monitoring and teleconsultation services to patients in rural and remote areas. This can help address the shortage of healthcare professionals and infrastructure in these regions, improving health outcomes and reducing the burden on urban healthcare facilities. Another promising opportunity is the growing emphasis on preventive care and wellness. Virtual ward solutions enable healthcare providers to identify health risks early, monitor patients’ progress, and deliver timely interventions, reducing the incidence of severe complications and hospitalizations. This approach aligns with the global shift toward value-based care models that prioritize patient outcomes over service volumes. By leveraging AI and predictive analytics, virtual ward care can further enhance the effectiveness of preventive care programs, creating significant opportunities for healthcare providers and technology vendors. The increasing adoption of wearable health technologies and IoT devices also presents a lucrative opportunity for the market. These devices are becoming more affordable and sophisticated, enabling real-time data collection and personalized care. As wearable technology continues to evolve, virtual ward care solutions are expected to become even more accessible and efficient, driving their adoption across diverse patient populations.

VIRTUAL WARD CARE SOLUTIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

12.20% |

|

Segments Covered |

By Component, Patient Type, Care Type, Technology, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Philips Healthcare, Medtronic, GE Healthcare, ResMed, Teladoc Health, Cerner Corporation, Allscripts Healthcare Solutions, Siemens Healthineers, Masimo Corporation, Abbott Laboratories, Honeywell Life Sciences |

Virtual Ward Care Solutions Market Segmentation: By Component

-

Hardware

-

Remote Patient Monitoring Devices

-

Wearable Health Devices

-

Telehealth Equipment

-

Smart Medical Devices

-

-

Software

-

Virtual Ward Platforms

-

Telehealth and Teleconsultation Software

-

Remote Patient Monitoring Software

-

Integration with EHR/EMR Systems

-

Data Management & Analytics Platforms

-

-

Services

-

Deployment and Integration Services

-

Remote Patient Management Services

-

Teleconsultation Services

-

Training and Education

-

Technical Support and Maintenance

-

The most dominant segment within hardware is Remote Patient Monitoring Devices, owing to their widespread use for chronic disease management and post-surgical care. The fastest-growing segment is Wearable Health Devices, driven by increasing adoption among tech-savvy patients who seek to actively monitor their health.

Virtual Ward Care Solutions Market Segmentation: By Patient Type

-

Chronic Disease Patients

-

Heart Failure

-

Diabetes

-

COPD and Respiratory Conditions

-

-

Acute Care Patients

-

Post-Surgical Patients

-

Acute Respiratory Infections

-

-

Elderly and Frail Patients

-

COVID-19 and Infectious Disease Patients

-

Others

The most dominant group is Chronic Disease Patients, owing to the growing prevalence of long-term conditions that require continuous care. The fastest-growing segment is COVID-19 and Infectious Disease Patients, reflecting the need for remote care models during pandemics.

Virtual Ward Care Solutions Market Segmentation: By Care Type

-

Hospital-at-Home Care

-

Transitional Care

-

Preventive Care

-

Rehabilitation and Recovery Care

-

Palliative Care

Hospital-at-Home Care is the dominant type, providing an alternative to inpatient care for conditions like heart failure and COPD. The fastest-growing segment is Preventive Care, driven by the increasing emphasis on wellness and early intervention.

Virtual Ward Care Solutions Market Segmentation: By Technology

-

Telehealth and Teleconsultation Technology

-

Remote Patient Monitoring (RPM)

-

Wearable and IoT Health Technology

-

Artificial Intelligence (AI) and Predictive Analytics

-

Cloud-Based Solutions

-

Mobile Applications

Remote Patient Monitoring is the most dominant technology, facilitating the core functionality of virtual wards. The fastest-growing segment is Artificial Intelligence and Predictive Analytics, reflecting its transformative potential in personalized and predictive care.

Virtual Ward Care Solutions Market Segmentation: By End User

-

Hospitals and Healthcare Providers

-

Home Care Agencies

-

Health Insurance Providers (Payers)

-

Government and Public Health Bodies

-

Patients and Families

Hospitals and Healthcare Providers remain the dominant segment, reflecting their leadership in care delivery. Patients and Families represent the fastest-growing segment, highlighting the increasing demand for patient-centered care solutions.

Virtual Ward Care Solutions Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

The most dominant region is North America, owing to its advanced healthcare systems, strong technological adoption, and significant investments in telehealth infrastructure. The fastest-growing region is Asia-Pacific, driven by increasing healthcare digitization, rising demand for remote care, and growing awareness about virtual ward solutions.

North America benefits from established players, high chronic disease prevalence, and supportive government policies promoting telehealth. Conversely, Asia-Pacific's rapid growth is fueled by expanding healthcare access, increasing smartphone penetration, and the growing burden of chronic diseases.

COVID-19 Impact Analysis:

The COVID-19 pandemic acted as a catalyst for the Virtual Ward Care Solutions market, accelerating the adoption of remote healthcare technologies. With hospitals overwhelmed and in-person consultations restricted, virtual ward systems emerged as a lifeline for patients requiring continuous care. Healthcare providers rapidly deployed telehealth platforms, remote monitoring devices, and wearable technologies to manage patients with chronic conditions, COVID-19, and other acute illnesses from the safety of their homes. The pandemic also highlighted the need for resilient and scalable healthcare systems, prompting governments and organizations to invest in virtual care infrastructure. These investments have not only mitigated the immediate impact of the pandemic but also paved the way for long-term adoption of virtual ward care solutions.

Latest Trends and Developments:

AI-powered platforms are enhancing the predictive capabilities of virtual wards, enabling healthcare providers to identify risks early and personalize care. The proliferation of smart devices has expanded the scope of virtual care, enabling real-time monitoring of a wide range of health metrics. Cloud solutions are improving data accessibility, enabling seamless collaboration between patients, providers, and payers. Virtual ward systems are increasingly addressing mental health needs, integrating telepsychiatry and remote counselling services. Governments worldwide are introducing regulations and reimbursement policies to promote telehealth adoption, driving market growth.

Key Players in the Market:

-

Philips Healthcare

-

Medtronic

-

GE Healthcare

-

ResMed

-

Teladoc Health

-

Cerner Corporation

-

Allscripts Healthcare Solutions

-

Siemens Healthineers

-

Masimo Corporation

-

Abbott Laboratories

-

Honeywell Life Sciences

Chapter 1. VIRTUAL WARD CARE SOLUTIONS MARKET– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Virtual Ward Care Solutions Market– Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. VIRTUAL WARD CARE SOLUTIONS MARKET– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. VIRTUAL WARD CARE SOLUTIONS MARKETEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. VIRTUAL WARD CARE SOLUTIONS MARKET– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. VIRTUAL WARD CARE SOLUTIONS MARKET– BY COMPONENT

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Remote Patient Monitoring Devices

6.4 Wearable Health Devices

6.5 Telehealth Equipment

6.6 Smart Medical Devices

6.7 Software

6.8 Virtual Ward Platforms

6.9 Telehealth and Teleconsultation Software

6.10 Remote Patient Monitoring Software

6.11 Integration with EHR/EMR Systems

6.12 Data Management & Analytics Platforms

6.13 Services

6.14 Deployment and Integration Services

6.15 Remote Patient Management Services

6.16 Teleconsultation Services

6.17 Training and Education

6.18 Technical Support and Maintenance

6.19 Y-O-Y Growth trend Analysis BY COMPONENT

6.20 Absolute $ Opportunity Analysis BY COMPONENT, 2025-2030

Chapter 7. VIRTUAL WARD CARE SOLUTIONS MARKET– BY PATIENT TYPE

7.1 Introduction/Key Findings

7.2 Chronic Disease Patients

7.3 Heart Failure

7.4 Diabetes

7.5 COPD and Respiratory Conditions

7.6 Acute Care Patients

7.7 Post-Surgical Patients

7.8 Acute Respiratory Infections

7.9 Elderly and Frail Patients

7.10 COVID-19 and Infectious Disease Patients

7.11 Others

7.12 Y-O-Y Growth trend Analysis BY PATIENT TYPE

7.13 Absolute $ Opportunity Analysis BY PATIENT TYPE, 2025-2030

Chapter 8. VIRTUAL WARD CARE SOLUTIONS MARKET– BY CARE TYPE

8.1 Introduction/Key Findings

8.2 Hospital-at-Home Care

8.3 Transitional Care

8.4 Preventive Care

8.5 Rehabilitation and Recovery Care

8.6 Palliative Care

8.7 Y-O-Y Growth trend Analysis BY CARE TYPE

8.8 Absolute $ Opportunity Analysis BY CARE TYPE, 2025-2030

Chapter 9. VIRTUAL WARD CARE SOLUTIONS MARKET– BY TECHNOLOGY

9.1 Introduction/Key Findings

9.2 Telehealth and Teleconsultation Technology

9.3 Remote Patient Monitoring (RPM)

9.4 Wearable and IoT Health Technology

9.5 Artificial Intelligence (AI) and Predictive Analytics

9.6 Cloud-Based Solutions

9.7 Mobile Applications

9.8 Y-O-Y Growth trend Analysis BY TECHNOLOGY

9.9 Absolute $ Opportunity Analysis BY TECHNOLOGY, 2025-2030

Chapter 10. VIRTUAL WARD CARE SOLUTIONS MARKET– By End User

10.1 Introduction/Key Findings

10.2 Hospitals and Healthcare Providers

10.3 Home Care Agencies

10.4 Health Insurance Providers (Payers)

10.5 Government and Public Health Bodies

10.6 Patients and Families

10.7 Y-O-Y Growth trend Analysis By End User

10.8 Absolute $ Opportunity Analysis By End User, 2025-2030

Chapter 11. Virtual Ward Care Solutions Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 BY COMPONENT

11.1.2.1 BY PATIENT TYPE

11.1.3 BY CARE TYPE

11.1.4 By By End User

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 BY COMPONENT

11.2.3 BY PATIENT TYPE

11.2.4 BY CARE TYPE

11.2.5 BY TECHNOLOGY

11.2.6 By By End User

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 BY COMPONENT

11.3.3 BY PATIENT TYPE

11.3.4 BY CARE TYPE

11.3.5 BY TECHNOLOGY

11.3.6 By By End User

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 BY COMPONENT

11.4.3 BY PATIENT TYPE

11.4.4 BY CARE TYPE

11.4.5 BY TECHNOLOGY

11.4.6 By By End User

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 BY COMPONENT

11.5.3 BY PATIENT TYPE

11.5.4 BY CARE TYPE

11.5.5 BY TECHNOLOGY

11.5.6 By By End User

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. VIRTUAL WARD CARE SOLUTIONS MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Philips Healthcare

12.2 Medtronic

12.3 GE Healthcare

12.4 ResMed

12.5 Teladoc Health

12.6 Cerner Corporation

12.7 Allscripts Healthcare Solutions

12.8 Siemens Healthineers

12.9 Masimo Corporation

12.10 Abbott Laboratories

12.11 Honeywell Life Sciences

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the Virtual Ward Care Solutions market include technological advancements, increasing chronic disease prevalence, government support for telehealth, cost-effective healthcare solutions, and growing patient demand for remote care.

Main concerns about the Virtual Ward Care Solutions Market include data privacy and security issues, regulatory challenges, technological integration difficulties, high initial costs, limited patient engagement, and healthcare provider adoption barriers.

Prominent companies include Philips Healthcare, Medtronic, GE Healthcare, ResMed, Teladoc Health, Cerner Corporation, Allscripts Healthcare Solutions, Siemens Healthineers, Masimo Corporation, Abbott Laboratories, Honeywell Life Sciences, Biotelemetry Inc., Epic Systems, Athenahealth, and iRhythm Technologies.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.