Virtual Power Plant Market Size (2024 – 2030)

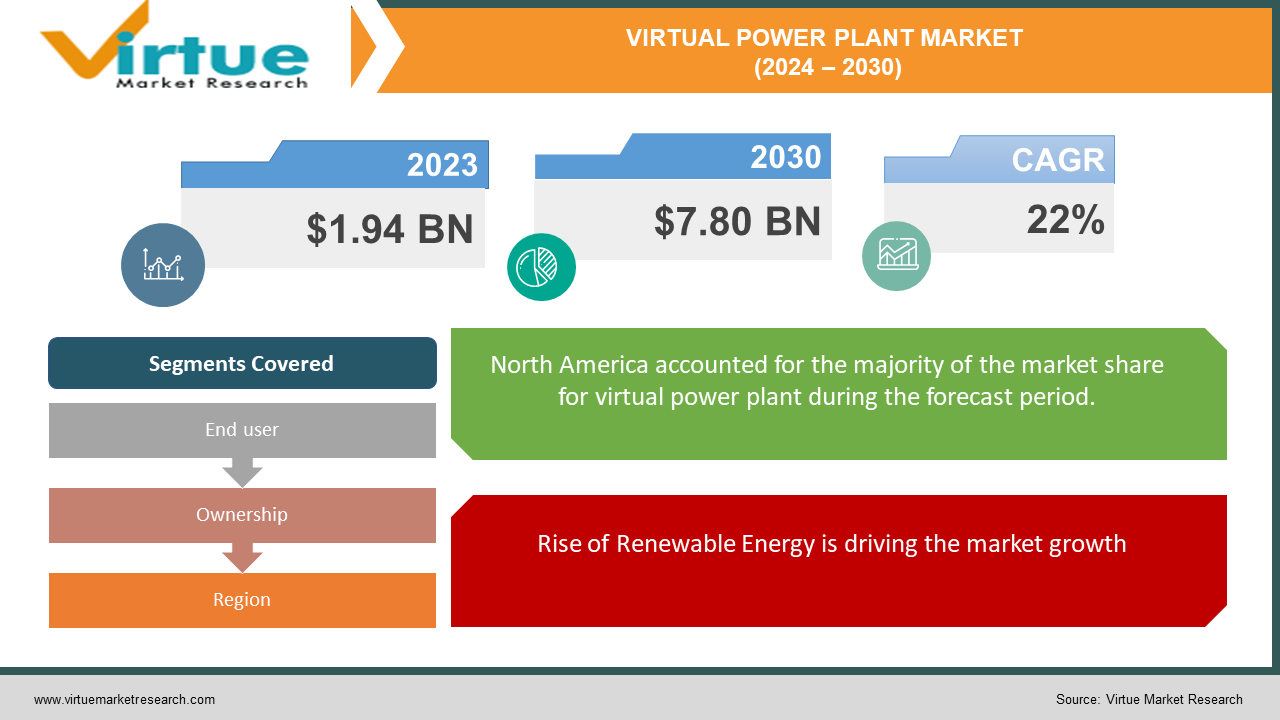

The Global Virtual Power Plant Market was valued at USD 1.94 billion in 2023 and will grow at a CAGR of 22% from 2024 to 2030. The market is expected to reach USD 7.80 billion by 2030.

The Virtual Power Plant (VPP) market connects multiple sources of energy, like rooftop solar panels and battery storage, into a network that acts like a single power plant. This allows for cleaner energy integration, grid stability management, and participation in energy markets. Though facing challenges like cybersecurity threats and upfront costs, the VPP market is driven by falling solar and storage costs, rising EV integration potential, and growing focus on sustainability, making it a key player in the future of a more adaptable and eco-friendly power grid.

Key Market Insights:

- Rising adoption of renewable energy sources like solar and wind, which VPPs can seamlessly integrate.

- Integration of electric vehicles with VPPs for grid balancing and potential revenue generation.

- Demand response is the dominant technology segment, allowing VPPs to adjust energy consumption based on grid needs.

- Increasing focus on sustainability and carbon emission reduction, with VPPs enabling efficient use of distributed energy resource.

- North America with 34.7% market share currently holds the dominant position in the Virtual Power Plant (VPP) market, due to supportive government policies and established grid infrastructure.

- The Asia-Pacific region with market share 19.8% is expected to witness the fastest growth in the coming years.

Global Virtual Power Plant Market Drivers:

Rise of Renewable Energy is driving the market growth

The surge in renewable energy, particularly solar and wind, is a double-edged sword. While it promotes sustainability, their fluctuating output due to weather can wreak havoc on grid stability. Here's where Virtual Power Plants (VPPs) come in as game changers. By aggregating these renewables alongside battery storage and even traditional power plants, VPPs act like a conductor in an orchestra. They can strategically adjust the output from each source based on real-time needs. Solar panels might be generating excess power during a sunny day, so a VPP can use that to charge batteries. When the sun sets or wind dies down, the stored energy from the batteries can kick in, seamlessly bridging the gap and ensuring a constant, reliable flow of electricity for the grid. This masterful coordination by VPPs tames the variability of renewables, guaranteeing grid stability and paving the way for a future powered by clean energy.

Growing Demand for Sustainability is driving the market growth

As the world prioritizes environmental responsibility and weaning off fossil fuels, Virtual Power Plants (VPPs) are emerging as a critical tool for a cleaner energy future. By cleverly combining renewable sources like solar and wind with battery storage and even existing power plants, VPPs act as an eco-conscious orchestrator. They strategically tap into these resources, maximizing the use of clean energy during peak generation times. Let's say solar panels are producing abundantly on a sunny day. A VPP can use this surplus to charge batteries, essentially storing sunshine for later. When the sun dips or wind weakens, the VPP seamlessly switches on the stored energy, minimizing reliance on traditional, carbon-emitting power plants. This intelligent management by VPPs optimizes the utilization of renewable energy, significantly reducing dependence on fossil fuels and consequently, greenhouse gas emissions. It's a win-win for both the planet and our energy security.

Integration with Smart Grids is driving the market growth

The rise of smart grids, with their digital brains constantly optimizing electricity flow, is another key driver for VPPs. These smart grids are like a sophisticated nervous system for power delivery, and VPPs plug right in. Imagine a neighborhood with a mix of solar panels, battery banks, and homes. Traditionally, managing this distributed energy would be a nightmare. But VPPs, acting as a central coordinator, communicate seamlessly with the smart grid. They receive real-time data on electricity demand and generation from each source. If there's a surge in demand during peak hours, the VPP can tap into stored solar energy from batteries or even draw from a nearby power plant. Conversely, if solar panels are overflowing with energy on a sunny day, the VPP can signal the smart grid to reduce power from traditional sources. This two-way communication between VPPs and smart grids allows for real-time monitoring and control, ensuring a perfectly balanced and efficient flow of electricity throughout the entire network.

Global Virtual Power Plant Market challenges and restraints:

High Investment Costs are a big challenge

A major hurdle for wider VPP adoption is the high upfront investment required. Integrating a multitude of distributed energy resources, like solar panels, wind turbines, and battery storage, necessitates robust monitoring and control systems. These sophisticated platforms ensure real-time communication and coordinated operation of these diverse elements. Furthermore, optimizing VPP performance for maximum efficiency and profitability relies on advanced predictive analytics software. This software analyzes vast amounts of data on energy production, consumption patterns, and grid conditions. By forecasting energy demands and market fluctuations, it allows VPP operators to strategically adjust power output and participate in electricity markets most effectively. Unfortunately, both the monitoring and control systems, as well as the predictive analytics software, come with a hefty price tag, which can be a significant barrier for potential VPP developers and participants.

Cybersecurity Threats are a big challenge

The interconnected nature of VPPs, relying heavily on operational technology (OT) and communication infrastructure, creates a critical vulnerability – cyberattacks. Unethical actors can exploit weaknesses in these systems to wreak havoc. Denial-of-service attacks could flood VPP networks with fake traffic, crippling its ability to manage energy resources. Data breaches could expose sensitive information on energy production, consumption patterns, and even financial transactions. Perhaps the most concerning threat is manipulation of energy output. Hackers could disrupt power grids by causing VPPs to overproduce or underproduce electricity, potentially leading to blackouts or equipment damage. These vulnerabilities highlight the need for robust cybersecurity measures, including encryption, access control, and continuous monitoring to safeguard VPP operations and ensure a reliable flow of energy.

Market Opportunities:

The Virtual Power Plant (VPP) market presents exciting opportunities at the intersection of sustainability, technology, and economic viability. The declining costs of solar panels and energy storage systems are making VPPs a more attractive option for both grid operators and energy consumers. With the increasing integration of electric vehicles (EVs), VPPs could tap into a vast network of distributed batteries, providing additional grid balancing capabilities and potential revenue streams for EV owners. Furthermore, advancements in artificial intelligence can enhance VPPs' ability to predict energy demands and optimize performance. This can lead to more efficient use of renewable energy sources and reduced reliance on traditional fossil fuel power plants. Additionally, the rise of pro-environmental policies and growing consumer interest in sustainability are creating a favorable market landscape for VPPs. As VPPs demonstrate their ability to provide clean, reliable, and cost-effective energy, their role in the future of the power grid is expected to grow significantly.

VIRTUAL POWER PLANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22% |

|

Segments Covered |

By End user, Ownership, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Siemens AG , Schneider Electric SE , General Electric , Shell plc , Tesla Inc. , ABB Ltd. , AutoGrid Systems Inc. , Sunverge Energy Inc. , AGL Energy Ltd. , Next Kraftwerke , Enel X North America Inc. , Hitachi Energy Ltd. |

Virtual Power Plant Market Segmentation - by End user

-

Residential

-

Commercial

-

Industrial

Currently, the commercial sector holds the dominant user position within the VPP market segmentation by end-user. This is due to a few key factors. Commercial buildings often have significant and relatively predictable energy consumption patterns, making them ideal candidates for VPP optimization. Additionally, these buildings typically have the infrastructure and resources to implement smart controls for lighting, HVAC systems, and other high-energy equipment. Furthermore, commercial entities often face higher electricity costs compared to residential users, creating a strong financial incentive to participate in VPPs and benefit from demand response programs or energy cost reductions. While residential and industrial sectors are growing in VPP participation, the commercial sector's established infrastructure and cost-driven motivation solidify its current dominance.

Virtual Power Plant Market Segmentation - By Ownership

-

Utility-Owned

-

Third-Party Owned

-

Customer-Owned

utility-owned VPPs hold the dominant position in the ownership segmentation. This dominance stems from a few key advantages. Firstly, utilities already have a well-established infrastructure for managing the grid, which makes integrating a VPP system much smoother. Secondly, direct ownership allows for tight control over the resources within the VPP, ensuring optimal grid stability and service delivery. Finally, utilities have the existing customer base and regulatory framework to implement VPP programs efficiently. However, third-party owned VPPs are expected to see significant growth in the future. These independent companies offer flexibility and expertise in VPP aggregation and management, potentially leading to more efficient resource utilization. While customer-owned VPPs promote community involvement and potentially lower costs, their overall market share remains relatively small.

Virtual Power Plant Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

While North America currently holds the dominant position in the Virtual Power Plant (VPP) market, thanks to supportive government policies and established grid infrastructure, the Asia-Pacific region is expected to witness the fastest growth in the coming years. This surge is driven by a combination of factors: rapidly growing economies and rising energy demands, ambitious renewable energy targets set by governments, and increasing investments in smart grid technologies. Countries like China, Japan, and South Korea are at the forefront of this VPP boom, actively developing the infrastructure and deploying VPP solutions to integrate renewables, improve grid stability, and ensure a more sustainable energy future.

COVID-19 Impact Analysis on the Global Virtual Power Plant Market

The COVID-19 pandemic delivered a temporary shock to the Virtual Power Plant (VPP) market. Global lockdowns and economic slowdown caused a significant drop in energy demand in 2020, leading to a decline of around 17% compared to pre-pandemic growth [Fortune Business Insights]. Disruptions in supply chains hampered the installation of new VPP systems, while reduced investment in grid projects further dampened market growth. However, the impact has been short-lived. As economies recover and energy consumption rebounds, the VPP market is expected to regain momentum. The pandemic has also highlighted the importance of grid resilience and the potential of VPPs to integrate and manage fluctuating renewable energy sources. This could lead to increased government support for VPP development in the post-pandemic era. Additionally, the rise in remote working and distributed energy generation models post-pandemic could create new opportunities for VPPs to optimize energy use and provide cost-effective solutions for businesses and communities. While the initial COVID-19 impact was negative, it has also underscored the long-term potential of VPPs in building a more sustainable and adaptable energy future.

Latest trends/Developments

The Virtual Power Plant (VPP) market is experiencing a surge in innovation, driven by the increasing demand for clean energy and grid stability. A key trend is the integration of behind-the-meter resources, such as rooftop solar panels and battery storage systems in homes and businesses, into VPPs. This allows for a more decentralized and flexible energy grid. Additionally, advancements in artificial intelligence (AI) and machine learning (ML) are enabling VPPs to optimize energy production and consumption in real-time. AI can predict energy demand fluctuations and optimize dispatch based on weather patterns, grid conditions, and energy prices. This results in more efficient use of renewable energy sources and reduced reliance on traditional power plants. Furthermore, the rise of electric vehicles (EVs) presents a new opportunity for VPPs. VPP aggregators are exploring ways to integrate EVs with VPPs, utilizing their battery storage capacity for grid balancing and potentially providing additional revenue streams for EV owners through vehicle-to-grid (V2G) technology. Looking ahead, advancements in blockchain technology hold promise for secure and transparent peer-to-peer energy trading within VPPs. This could empower consumers to become active participants in the energy market, selling excess solar power or purchasing electricity at competitive rates. As these trends continue to evolve, VPPs are poised to play a transformative role in the future of the power grid, enabling a more sustainable, resilient, and consumer-centric energy landscape.

Key Players:

-

Siemens AG

-

Schneider Electric SE

-

General Electric

-

Shell plc

-

Tesla Inc.

-

ABB Ltd.

-

AutoGrid Systems Inc.

-

Sunverge Energy Inc.

-

AGL Energy Ltd.

-

Next Kraftwerke

-

Enel X North America Inc.

-

Hitachi Energy Ltd.

Chapter 1. Virtual Power Plant Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Virtual Power Plant Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Virtual Power Plant Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Virtual Power Plant Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Virtual Power Plant Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Virtual Power Plant Market – By end user

6.1 Introduction/Key Findings

6.2 Residential

6.3 Commercial

6.4 Industrial

6.5 Y-O-Y Growth trend Analysis By end user

6.6 Absolute $ Opportunity Analysis By end user, 2024-2030

Chapter 7. Virtual Power Plant Market – By Ownership

7.1 Introduction/Key Findings

7.2 Utility-Owned

7.3 Third-Party Owned

7.4 Customer-Owned

7.5 Y-O-Y Growth trend Analysis By Ownership

7.6 Absolute $ Opportunity Analysis By Ownership, 2024-2030

Chapter 8. Virtual Power Plant Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By end user

8.1.3 By Ownership

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By end user

8.2.3 By Ownership

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By end user

8.3.3 By Ownership

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By end user

8.4.3 By Ownership

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By end user

8.5.3 By Ownership

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Virtual Power Plant Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Siemens AG

9.2 Schneider Electric SE

9.3 General Electric

9.4 Shell plc

9.5 Tesla Inc.

9.6 ABB Ltd.

9.7 AutoGrid Systems Inc.

9.8 Sunverge Energy Inc.

9.9 AGL Energy Ltd.

9.10 Next Kraftwerke

9.11 Enel X North America Inc.

9.12 Hitachi Energy Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Virtual Power Plant Market was valued at USD 1.94 billion in 2023 and will grow at a CAGR of 22% from 2024 to 2030. The market is expected to reach USD 7.80 billion by 2030.

Integration with Smart Grids, Rise of Renewable Energy these are the reasons which is driving the market.

Based on end user it is divided into three segments – Residential, Commercial, Industrial.

North America is the most dominant region for the Virtual Power Plant Market.

Siemens AG, Schneider Electric SE, General Electric, Shell plc, Tesla Inc