Virtual Data Room Market Size (2024 – 2030)

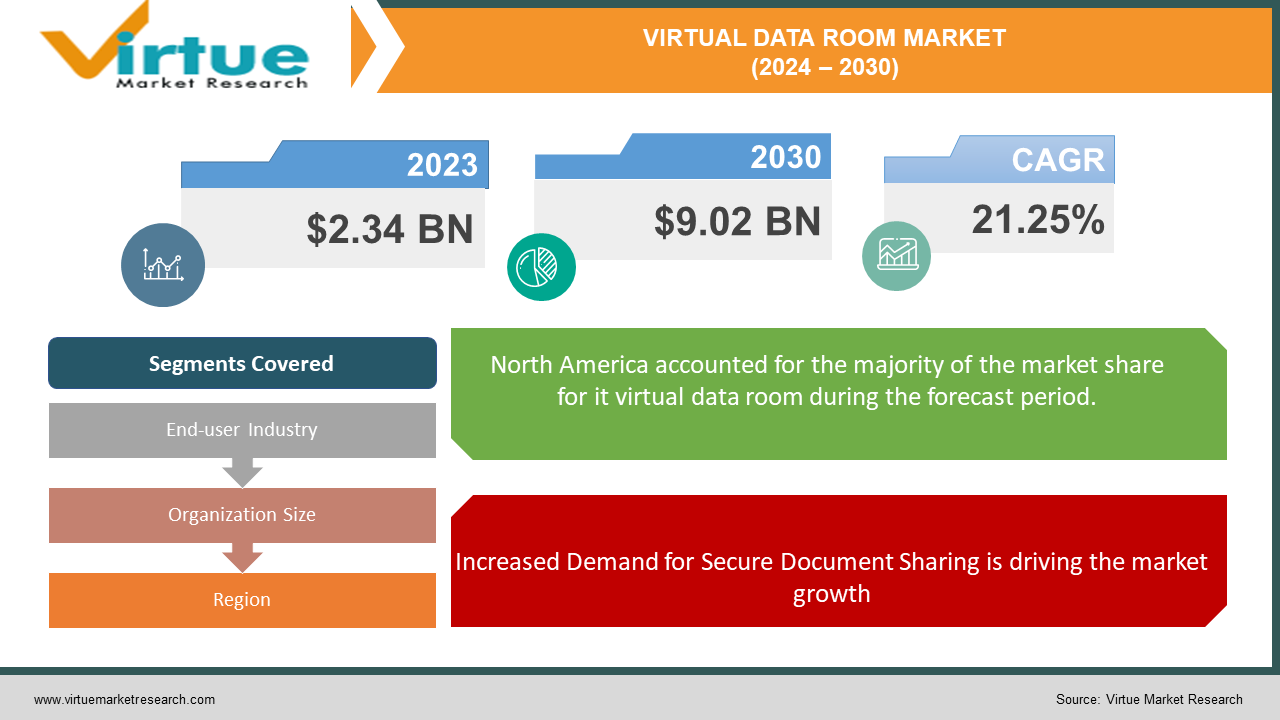

The Global Virtual Data Room Market was valued at USD 2.34 billion in 2023 and will grow at a CAGR of 21.25% from 2024 to 2030. The market is expected to reach USD 9.02 billion by 2030.

The virtual data room market is experiencing significant growth, driven by factors like increased digitalization, remote work, and the need for secure document sharing. This market provides secure online platforms for businesses to store and share sensitive information during transactions like mergers and acquisitions, due diligence, and fundraising.

Key Market Insights:

Increasing demand for secure data storage and transaction solutions across diverse sectors like banking, finance, healthcare, and IT.

Growing adoption of cloud storage technology, offering cost-effectiveness and remote accessibility.

Secure online platforms for storing, sharing, and managing confidential documents and information.

Rising volumes of business data due to M&A activities and complex business operations.

North America currently holds the dominant position, driven by factors like a strong presence of established technology players, and high adoption of cloud computing.

Global Virtual Data Room Market Drivers:

Increased Demand for Secure Document Sharing is driving the market growth

As the need to share confidential documents and information grows, corporations and legal entities are increasingly seeking secure solutions. Virtual data rooms have emerged as the preferred choice due to their robust security features. These platforms offer advanced encryption to safeguard sensitive data, granular access controls to restrict unauthorized access, and comprehensive audit trails to track all activity within the data room. This level of security provides peace of mind for organizations handling sensitive information, making virtual data rooms the go-to solution for secure document sharing and collaboration.

Digital Transformation and Remote Work is driving the market growth

The digital revolution and the surge in remote work have dramatically impacted the virtual data room market. Traditional physical data rooms, designed for in-person access, are becoming increasingly cumbersome and impractical in today's dynamic business environment. With geographically dispersed teams and a growing emphasis on digital collaboration, virtual data rooms offer a convenient and accessible alternative. These cloud-based platforms provide a centralized repository for secure document sharing and collaboration, enabling seamless access and communication regardless of location. This eliminates the need for physical travel and facilitates efficient teamwork, making virtual data rooms a crucial tool for businesses embracing digital transformation and remote work models.

M&A Activity and Due Diligence are driving the market growth

The surge in M&A activity has significantly boosted the demand for virtual data rooms (VDRs). These secure online platforms provide a centralized and efficient space for conducting due diligence, a crucial stage in any merger or acquisition. VDRs streamline the process by offering organized storage of all relevant documents, facilitating easy access for authorized users, and enabling seamless document sharing and analysis. This eliminates the need for physical data rooms and cumbersome document exchange methods like email, significantly accelerating the due diligence process. Additionally, VDRs offer robust security features like access controls, encryption, and audit trails, ensuring the confidentiality and integrity of sensitive information throughout the transaction. As M&A activity continues to rise, VDRs are poised to play an increasingly critical role in facilitating smooth and secure transactions.

Global Virtual Data Room Market challenges and restraints:

Data Integration Challenges are restricting the market growth

One of the key challenges in utilizing virtual data rooms (VDRs) lies in seamlessly integrating data from diverse sources and platforms. This process can be time-consuming and complex due to incompatibility issues and data formatting problems, hindering smooth data flow and accessibility. To overcome these hurdles, organizations need to invest in robust data integration solutions and expertise, ensuring efficient data transfer and seamless user experience within the VDR.

Privacy and Compliance Concerns are restricting the market growth

With the growing importance of data privacy, stringent regulations like GDPR and CCPA have raised concerns about data security and compliance within virtual data rooms (VDRs). VDR providers have a crucial responsibility to ensure adherence to these regulations. This involves implementing robust security measures, such as encryption and multi-factor authentication, to safeguard sensitive data. Additionally, they must offer features that enable users to effectively manage data access and permissions. Granular control over who can view, download, and share documents within the VDR is essential for maintaining compliance and mitigating the risk of data breaches. By prioritizing data security and offering user-friendly tools for managing access, VDR providers can help organizations navigate the complexities of data privacy regulations.

Market Opportunities:

The virtual data room (VDR) market is brimming with exciting opportunities for both businesses and service providers. As the need for secure data sharing and collaboration continues to grow, several factors are creating a fertile ground for innovation and expansion. The increasing adoption of cloud computing is paving the way for more flexible and scalable VDR solutions. This allows businesses to access secure data storage and collaboration tools without significant upfront investments in infrastructure. Additionally, the rise of automation and artificial intelligence (AI) is transforming the VDR landscape, enabling providers to offer more efficient and cost-effective solutions. For instance, AI-powered tools can automate document redaction and access control, freeing up human resources for more strategic tasks. Furthermore, the growing focus on cybersecurity is creating new opportunities for specialized VDR services. As businesses grapple with increasingly sophisticated cyber threats, they are increasingly seeking VDR solutions that offer robust security features like multi-factor authentication and intrusion detection systems. This presents a significant opportunity for providers to develop and offer advanced security services tailored to specific industry needs. Beyond security, the evolving regulatory landscape around data privacy is driving the need for compliant and secure VDR practices. This creates opportunities for providers who can demonstrate their commitment to data security and compliance with regulations like GDPR and CCPA. By offering comprehensive data protection solutions and transparent data governance practices, providers can attract businesses seeking secure and compliant VDR partnerships. The VDR market is witnessing a surge in demand from non-traditional sectors like healthcare and life sciences. These industries are increasingly adopting VDRs for secure sharing of clinical trial data, patient information, and other sensitive documents. This presents a significant growth opportunity for providers who can cater to the specific needs of these specialized sectors. The VDR market is brimming with potential for growth and innovation. By embracing new technologies, focusing on specialized services, and prioritizing data security, both businesses and service providers can capitalize on the numerous opportunities this dynamic market presents.

VIRTUAL DATA ROOM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

21.25% |

|

Segments Covered |

By End-user Industry, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Intralinks, SecureDocs, Data site Box, iDeals, Firmex, Brainloop, Citrix ShareFile, BlackLine, Merrill Corporation |

Virtual Data Room Market Segmentation - by End-user Industry

-

BFSI (Banking, Financial Services, and Insurance)

-

IT and Telecommunication

-

Healthcare

-

Government and Legal Services

The BFSI (Banking, Financial Services, and Insurance) sector reigns supreme as the most dominant end-user industry for VDRs. This sector's inherent need for secure data sharing during M&A transactions, fundraising, and regulatory compliance drives its extensive adoption of VDR solutions.

Virtual Data Room Market Segmentation - By Organization Size

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

Small and Medium-sized Enterprises (SMEs) are rapidly becoming the most dominant segment. This is fueled by the increasing affordability and ease of use of VDR solutions, making them accessible to businesses of all sizes. SMEs are recognizing the benefits of VDRs for secure data sharing, collaboration, and compliance, leading to their widespread adoption.

Virtual Data Room Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently holds the dominant position, driven by factors like a strong presence of established technology players, high adoption of cloud computing, and a mature M&A landscape. Asia-Pacific is witnessing rapid growth due to a burgeoning startup ecosystem, increasing government regulations, and growing awareness of data security. Europe follows closely, with a strong legal and financial sector and a focus on data privacy regulations like GDPR. South America the Middle East and Africa are also showing promising growth potential, fueled by rising digitalization and increasing M&A activity in these regions.

COVID-19 Impact Analysis on the Global Virtual Data Room Market

The COVID-19 pandemic has had a significant and lasting impact on the global virtual data room market. The initial disruption caused by lockdowns and economic uncertainty led to a temporary slowdown in M&A activity, impacting the market's growth. However, the pandemic also accelerated the adoption of remote work and digital transformation, creating a long-term boost for virtual data rooms. With geographically dispersed teams and a heightened focus on digital collaboration, virtual data rooms emerged as a critical tool for secure and efficient document sharing and due diligence processes. Furthermore, the pandemic has highlighted the importance of data security and compliance. Virtual data rooms, with their robust security features and audit trails, provide a secure platform for sensitive document exchange, attracting organizations across various industries. Overall, the COVID-19 pandemic has been a catalyst for the virtual data room market, accelerating its growth and solidifying its position as a vital tool for secure and efficient document sharing and collaboration in the digital age.

Latest trends/Developments

The virtual data room (VDR) market is experiencing exciting growth and innovation. Artificial intelligence (AI) is playing a crucial role, with features like automated document redaction, intelligent search, and analytics providing enhanced efficiency and security. Cybersecurity remains a top concern, prompting VDR providers to invest in advanced security measures like multi-factor authentication and intrusion detection systems. Integration with other business tools like CRM and project management platforms is streamlining workflows and improving collaboration. Additionally, the rise of blockchain technology has the potential to further enhance data security and transparency within VDRs. As the market evolves, VDRs are becoming increasingly user-friendly with intuitive interfaces and mobile accessibility, catering to the needs of a diverse user base. These trends are shaping the future of VDRs, making them more secure, efficient, and integrated into the wider business ecosystem.

Key Players:

-

Intralinks

-

SecureDocs

-

Data site

-

Box

-

iDeals

-

Firmex

-

Brainloop

-

Citrix ShareFile

-

BlackLine

-

Merrill Corporation

Chapter 1. Virtual Data Room Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Virtual Data Room Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Virtual Data Room Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Virtual Data Room Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Virtual Data Room Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Virtual Data Room Market – By Organization Size

6.1 Introduction/Key Findings

6.2 Large Enterprises

6.3 Small and Medium-sized Enterprises (SMEs)

6.4 Y-O-Y Growth trend Analysis By Organization Size

6.5 Absolute $ Opportunity Analysis By Organization Size, 2024-2030

Chapter 7. Virtual Data Room Market – By End-use Industry

7.1 Introduction/Key Findings

7.2 BFSI (Banking, Financial Services, and Insurance)

7.3 IT and Telecommunication

7.4 Healthcare

7.5 Government and Legal Services

7.6 Y-O-Y Growth trend Analysis By End-use Industry

7.7 Absolute $ Opportunity Analysis By End-use Industry, 2024-2030

Chapter 8. Virtual Data Room Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Organization Size

8.1.3 By End-use Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Organization Size

8.2.3 By End-use Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Organization Size

8.3.3 By End-use Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Organization Size

8.4.3 By End-use Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Organization Size

8.5.3 By End-use Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Virtual Data Room Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Intralinks

9.2 SecureDocs

9.3 Data site

9.4 Box

9.5 iDeals

9.6 Firmex

9.7 Brainloop

9.8 Citrix ShareFile

9.9 BlackLine

9.10 Merrill Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Virtual Data Room Market was valued at USD 2.34 billion in 2023 and will grow at a CAGR of 21.25% from 2024 to 2030. The market is expected to reach USD 9.02 billion by 2030.

Increased Demand for Secure Document Sharing, Digital Transformation and Remote Work, M&A Activity, and Due Diligence are the reasons which is driving the market.

Based on end-user it is divided into four segments – BFSI (Banking, Financial Services, and Insurance), IT and Telecommunication, Healthcare, Government and Legal Services

North America is the most dominant region for the Virtual Data Room Market.

Firmex, Brainloop, Citrix ShareFile, BlackLine, Merrill Corporation