Virtual Classroom Market Size (2024 – 2030)

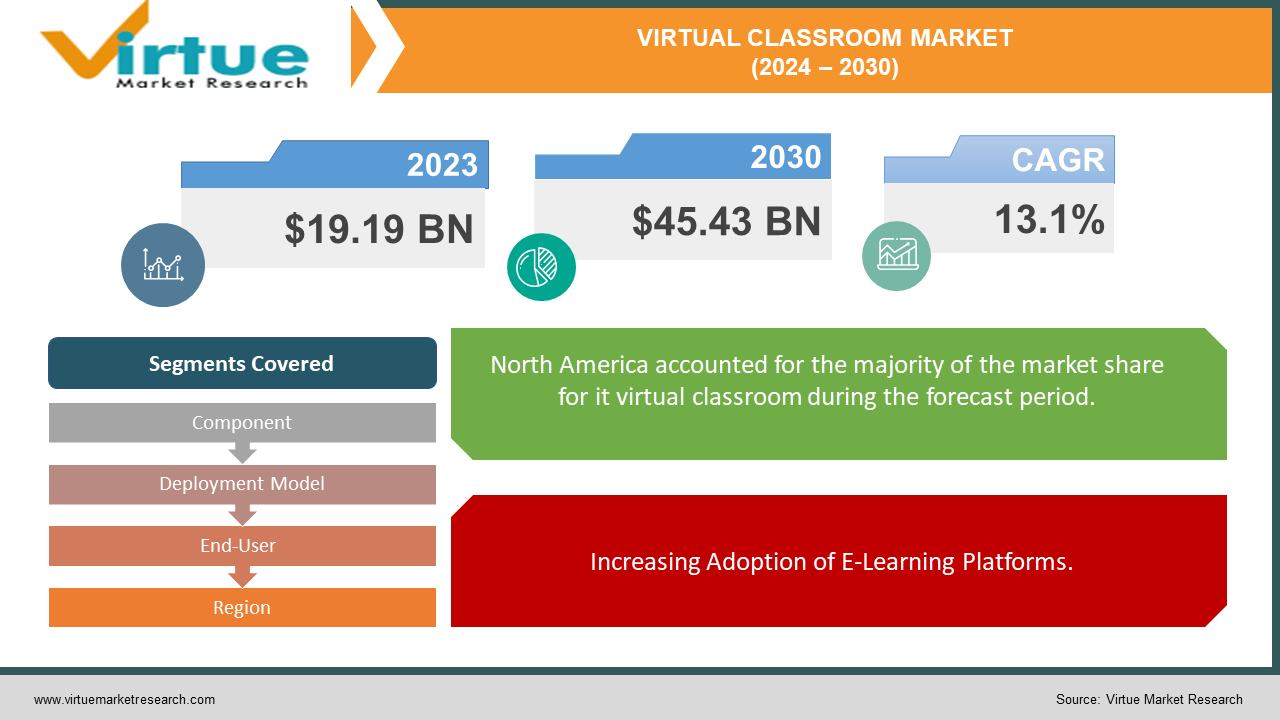

The market for virtual classrooms was estimated to be worth USD 19.19 billion in 2023 and is expected to increase to USD 45.43 billion by 2030, with a projected compound annual growth rate (CAGR) of 13.1% from 2024 to 2030.

The global virtual classroom market is experiencing robust growth, driven by the increasing demand for flexible and remote learning solutions. As of 2024, the market size is expected to reach approximately $19.19 billion, with projections indicating it will grow to $51.41 billion by 2032, reflecting a compound annual growth rate (CAGR) of 13.1%. Key drivers include the widespread adoption of cloud technologies, advancements in educational technologies, and a global shift towards hybrid and online learning environments. North America currently dominates the market, benefiting from advanced technological infrastructure and significant investments in education. However, the Asia-Pacific region is poised for the fastest growth, fueled by rapid technological advancements and increasing internet penetration. This dynamic market encompasses various components such as software solutions, hardware, and services, catering to diverse end users, including academic institutions and corporate entities.

Key Insights:

Studies show that student engagement in virtual classrooms has improved by 25% compared to traditional classroom settings, thanks to interactive tools and personalized learning experiences.

Approximately 85% of educational institutions worldwide have adopted some form of virtual classroom technology, making education more accessible to students in remote and underserved areas.

Despite the growth, about 30% of students in developing countries still lack access to reliable internet connections, limiting their ability to participate in virtual learning.

Global Virtual Classroom Market Drivers:

Increasing Adoption of E-Learning Platforms.

The surge in the adoption of e-learning platforms is a major driver for the global virtual classroom market. Educational institutions and corporate organizations are increasingly leveraging online platforms to deliver training and educational content. This shift is driven by the need for flexible learning solutions that can be accessed anytime, anywhere, which is especially critical in today's fast-paced world. The integration of multimedia, interactive tools, and personalized learning paths has made e-learning platforms more appealing, leading to their widespread acceptance and growth.

Technological Advancements in Virtual Classrooms.

Advancements in technology are propelling the virtual classroom market forward. The incorporation of artificial intelligence, virtual reality, and augmented reality has revolutionized the learning experience, making it more immersive and engaging. AI-powered tools can provide real-time feedback, adaptive learning, and customized content, enhancing the effectiveness of virtual education. These technological innovations not only improve student engagement and outcomes but also enable educators to deliver more interactive and impactful lessons.

Rising Demand for Remote Learning Solutions.

The increasing demand for remote learning solutions is another key driver of the virtual classroom market. The COVID-19 pandemic has accelerated the adoption of remote learning, highlighting its importance in ensuring continuity of education during disruptions. Even post-pandemic, the preference for remote learning remains strong due to its convenience and ability to cater to diverse learning needs. As more educational institutions and businesses recognize the benefits of remote learning, the demand for robust virtual classroom solutions continues to grow, driving market expansion.

Global Virtual Classroom Market Restraints and Challenges:

High Initial Setup Costs.

One of the significant restraints in the global virtual classroom market is the high initial setup costs. Implementing a comprehensive virtual classroom solution requires substantial investment in hardware, software, and training. Educational institutions, particularly those with limited budgets, may find it challenging to allocate the necessary funds for these technologies. Additionally, ongoing maintenance and updates can further strain financial resources. This financial barrier can slow the adoption rate and limit the growth potential of virtual classroom solutions, particularly in developing regions.

Digital Divide and Accessibility Issues.

The digital divide remains a critical challenge in the virtual classroom market. While virtual learning offers numerous benefits, a significant portion of the global population lacks access to reliable internet and necessary devices. This disparity is particularly pronounced in rural and underprivileged areas, where connectivity is often limited or nonexistent. As a result, students in these regions are at a disadvantage, unable to fully participate in virtual education. Addressing these accessibility issues requires coordinated efforts from governments, private sector partners, and non-profit organizations to improve infrastructure and provide equitable access to technology.

Security and Privacy Concerns.

Security and privacy concerns pose another challenge to the widespread adoption of virtual classroom solutions. The increasing reliance on digital platforms for education raises the risk of data breaches and cyberattacks. Sensitive information, such as student records and personal data, can be vulnerable to unauthorized access and misuse. Ensuring robust cybersecurity measures and complying with data protection regulations are essential to safeguarding this information. However, implementing and maintaining these security protocols can be complex and costly, deterring some institutions from fully embracing virtual classroom technologies.

Global Virtual Classroom Market Opportunities:

Expanding Reach.

The global virtual classroom market presents unprecedented opportunities for education providers to expand their reach beyond geographical constraints. By leveraging virtual classrooms, institutions can transcend physical boundaries, offering courses to students worldwide. This accessibility fosters inclusivity, enabling learners from diverse backgrounds to access quality education irrespective of their location.

Innovative Pedagogy.

Virtual classrooms facilitate innovative pedagogical approaches, enriching the learning experience. Through features like live interactive sessions, multimedia content, and real-time collaboration tools, educators can create dynamic and engaging lessons. This immersive learning environment not only enhances comprehension but also cultivates critical thinking, problem-solving, and digital literacy skills essential for success in the modern world.

Cost-Efficiency.

Embracing virtual classrooms offers significant cost-efficiency benefits for educational institutions and learners alike. By eliminating expenses associated with traditional brick-and-mortar setups such as infrastructure maintenance, transportation, and accommodation, institutions can allocate resources more effectively. Additionally, learners can save on travel costs and accommodation fees, making education more accessible and affordable. This democratization of education empowers individuals to pursue their academic aspirations without financial constraints.

VIRTUAL CLASSROOM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.1% |

|

Segments Covered |

By Component, Deployment Model, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zoom Video Communications, Inc., Cisco Systems, Inc., Microsoft Corporation, Adobe Inc., Blackboard Inc., Google LLC, Oracle Corporation, IBM Corporation, SAP SE, Instructure Inc., Schoology (PowerSchool), WizIQ Inc. |

Virtual Classroom Market Segmentation: By Component

-

Software

-

Hardware

-

Service

Among the components shaping the global virtual classroom market, software emerges as the most effective driver of innovation and adoption. Virtual classroom software serves as the foundation for delivering interactive and immersive learning experiences. It encompasses a wide range of functionalities, including video conferencing, content management, assessment tools, and collaborative features. This software empowers educators to create engaging lessons, facilitate real-time interactions, and track student progress effectively. With advancements in technology, virtual classroom software continues to evolve, integrating artificial intelligence, virtual reality, and gamification to enhance learning outcomes. Its versatility and scalability make it a pivotal component in transforming traditional education paradigms into dynamic digital ecosystems, catering to the diverse needs of learners worldwide.

Virtual Classroom Market Segmentation: By Deployment Model

-

Cloud-Based

-

On-Premises

Cloud-based deployment emerges as the most effective model in driving the evolution of the global virtual classroom market. Offering flexibility, scalability, and accessibility, cloud-based solutions revolutionize the way education is delivered and accessed. By leveraging cloud infrastructure, virtual classroom providers can rapidly deploy and scale their platforms without the need for extensive upfront investment in hardware or IT infrastructure. This agility enables educational institutions to adapt quickly to changing demands and scale their offerings to accommodate varying student populations. Moreover, cloud-based virtual classrooms facilitate seamless access from any location with an internet connection, promoting remote learning and collaboration. With enhanced security measures and regular updates, cloud-based deployments ensure data protection and system reliability, providing a robust foundation for modern education delivery. Overall, the cloud-based deployment model embodies the future of virtual classrooms, empowering educators and learners to connect and engage in immersive learning experiences anytime, anywhere.

Virtual Classroom Market Segmentation: By End-User

-

Academic Institutions

-

Corporate

-

Government and Public Sector

-

Non-Profits and NGOs

Academic institutions represent the most impactful segment driving the growth of the global virtual classroom market. With the increasing demand for flexible and technology-enabled learning solutions, schools, colleges, and universities are embracing virtual classrooms to enhance the quality and accessibility of education. Virtual classrooms empower academic institutions to overcome geographical barriers, reach a broader student base, and offer a diverse range of courses and programs. These institutions can leverage virtual classrooms to facilitate interactive lectures, collaborative projects, and personalized learning experiences, catering to the unique needs and learning styles of students. Furthermore, virtual classrooms enable academic institutions to optimize resources, streamline administrative processes, and reduce overhead costs associated with traditional classroom setups. As the demand for digital education continues to soar, academic institutions play a pivotal role in driving innovation and shaping the future of learning through virtual classrooms.

Virtual Classroom Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global virtual classroom market exhibits varying degrees of penetration across different regions, with North America leading at 37%, followed by Europe at 23%, and Asia-Pacific at 21%. North America's dominance is fueled by its robust technological infrastructure and a strong emphasis on educational innovation. Europe follows closely, driven by its commitment to digital transformation in education. In contrast, the Asia-Pacific region showcases rapid growth potential, propelled by expanding economies and increasing investments in education technology. South America and the Middle East and Africa regions contribute 10% and 9% respectively, indicating emerging opportunities amidst efforts to bridge digital disparities and foster inclusive learning environments globally.

COVID-19 Impact Analysis on the Global Virtual Classroom Market:

The COVID-19 pandemic has catalyzed a profound impact on the global virtual classroom market, ushering in an era of unprecedented growth and adoption. With widespread lockdowns and social distancing measures necessitating the closure of traditional educational institutions, virtual classrooms emerged as indispensable tools for continuity in learning. This sudden surge in demand for remote learning solutions propelled the virtual classroom market to new heights, as schools, colleges, and businesses swiftly transitioned to online platforms to ensure uninterrupted education and training. The pandemic underscored the importance of virtual classrooms in enabling remote collaboration, interactive learning experiences, and skill development, driving innovation and investment in the education technology sector. Furthermore, the crisis prompted governments and educational institutions worldwide to recognize the significance of digital infrastructure and remote learning capabilities, leading to sustained growth and evolution of the global virtual classroom market beyond the pandemic era.

Latest Trends/ Developments:

The latest trends and developments in the global virtual classroom market reflect a continuous evolution towards enhanced interactivity, personalized learning experiences, and technological innovation. One notable trend is the integration of artificial intelligence (AI) and machine learning algorithms to personalize instruction, adapt content delivery, and provide real-time feedback to learners. Another prominent development is the increasing adoption of immersive technologies such as virtual reality (VR) and augmented reality (AR) to create engaging and interactive learning environments. Additionally, there is a growing emphasis on collaborative learning tools and social learning platforms that facilitate peer interaction and knowledge sharing. Furthermore, the rise of hybrid learning models, combining both virtual and traditional classroom elements, is reshaping the landscape of education delivery. As the demand for flexible, accessible, and engaging learning solutions continues to rise, these trends and developments are poised to drive the future growth and innovation of the global virtual classroom market.

Key Players:

-

Zoom Video Communications, Inc.

-

Cisco Systems, Inc.

-

Microsoft Corporation

-

Adobe Inc.

-

Blackboard Inc.

-

Google LLC

-

Oracle Corporation

-

IBM Corporation

-

SAP SE

-

Instructure Inc.

-

Schoology (PowerSchool)

-

WizIQ Inc.

Chapter 1. Virtual Classroom Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Virtual Classroom Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Virtual Classroom Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Virtual Classroom Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Virtual Classroom Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Virtual Classroom Market – By Component

6.1 Introduction/Key Findings

6.2 Software

6.3 Hardware

6.4 Service

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Virtual Classroom Market – By Deployment Model

7.1 Introduction/Key Findings

7.2 Cloud-Based

7.3 On-Premises

7.4 Y-O-Y Growth trend Analysis By Deployment Model

7.5 Absolute $ Opportunity Analysis By Deployment Model, 2024-2030

Chapter 8. Virtual Classroom Market – By End-User

8.1 Introduction/Key Findings

8.2 Academic Institutions

8.3 Corporate

8.4 Government and Public Sector

8.5 Non-Profits and NGOs

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Virtual Classroom Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Deployment Model

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Deployment Model

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Deployment Model

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Deployment Model

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Deployment Model

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Virtual Classroom Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Zoom Video Communications, Inc.

10.2 Cisco Systems, Inc.

10.3 Microsoft Corporation

10.4 Adobe Inc.

10.5 Blackboard Inc.

10.6 Google LLC

10.7 Oracle Corporation

10.8 IBM Corporation

10.9 SAP SE

10.10 Instructure Inc.

10.11 Schoology (PowerSchool)

10.12 WizIQ Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for virtual classrooms was estimated to be worth USD 19.19 billion in 2023 and is expected to increase to USD 45.43 billion by 2030, with a projected compound annual growth rate (CAGR) of 13.1% from 2024 to 2030.

The primary drivers of the global virtual classroom market include the increasing demand for flexible, accessible, and technology-enabled learning solutions, coupled with advancements in internet infrastructure and digitalization initiatives worldwide.

Key challenges facing the global virtual classroom market include addressing issues of digital inequality and ensuring equitable access to technology and internet connectivity for all learners.

In 2023, North America held the largest share of the global virtual classroom market.

Zoom Video Communications.Inc., Cisco Systems, Inc., Microsoft Corporation, Adobe Inc., Blackboard Inc., Google LLC, Oracle Corporation, IBM Corporation, SAP SE, Instructure Inc., Schoology (PowerSchool), and WizIQ Inc. are the main players.