Virtual Care Market Size (2024-2030)

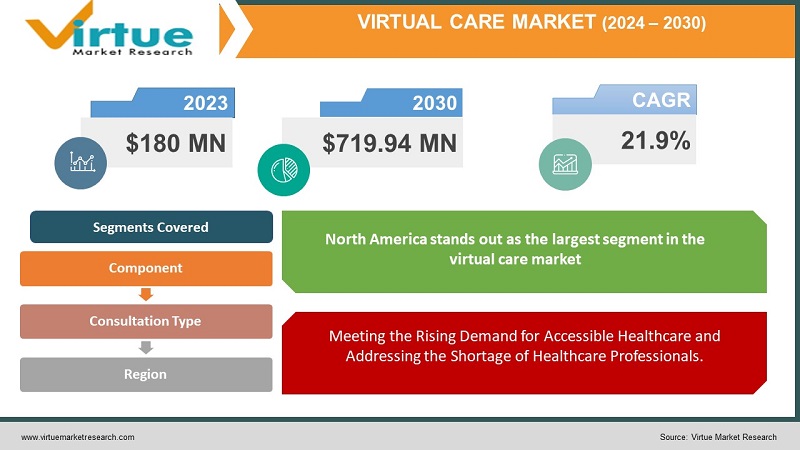

The Global Virtual Care Market was valued at USD 180 Million in 2023 and is projected to reach a market size of USD 719.94 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 21.9%.

CLICK HERE TO REQUEST FREE SAMPLE PDF

The Virtual Care Market has witnessed significant growth, propelled by the increasing adoption of telehealth solutions and the expansion of digital healthcare services. Accelerated by advancements in technology, the market encompasses a wide range of virtual care solutions, including telemedicine, remote patient monitoring, and virtual consultations. The COVID-19 pandemic has further underscored the importance of virtual care, driving widespread acceptance and implementation. With a focus on enhancing accessibility, reducing healthcare costs, and improving patient outcomes, the virtual care market is poised for continued expansion as healthcare systems globally evolve towards more integrated and digitally-driven models of care delivery.

Key Market Insights:

The virtual care market is currently undergoing a remarkable boom, reaching a staggering estimated market share of USD 180 million in 2023. This surge is propelled by various factors, notably the soaring demand for convenient and accessible healthcare. Patients, desiring flexibility and ease, are pushing virtual consultations into mainstream adoption. Technological advancements, including enhanced platforms, wearables, and data analytics tools, further contribute to this growth by boosting user experience and clinical capabilities. The effectiveness of virtual care in chronic disease management, reducing unnecessary hospital visits, and the catalyzing impact of the COVID-19 pandemic, which normalized virtual care and garnered regulatory support, collectively drive this unprecedented expansion.

The virtual care market is experiencing dynamic shifts marked by diverse developments. Telehealth platforms are diversifying their scope, extending beyond primary care into specialty areas such as mental health and surgery. The integration of artificial intelligence (AI) is gaining traction, empowering diagnosis support and enhancing service efficiency through AI-powered chatbots. Mergers and acquisitions are on the rise as industry giants consolidate to expand their reach and offer comprehensive virtual care solutions. With a projected market share growth of 21.9% by 2030, the landscape indicates a continued upward trajectory fueled by ongoing advancements and increasing adoption.

Major players are playing pivotal roles in shaping the future of virtual care. Teladoc Health, a global leader with a 6.4% market share and a valuation of USD 16.7 billion, offers a wide range of virtual care services. Amwell, a US-based telehealth giant, commands a 5.2% market share and a valuation of USD 8.2 billion, known for its user-friendly platforms and strategic partnerships. Ping An Good Doctor, a Chinese powerhouse with a 4.8% market share and a valuation of USD 45.1 billion, pioneers AI-powered virtual care solutions. Additionally, Doctor on Demand, a US player with a 2.1% market share and a valuation of USD 1.2 billion, focuses on specialized telemedicine services like psychiatry and dermatology. As the virtual care landscape evolves with new entrants and innovative offerings, the market is poised to reshape healthcare delivery, providing increased access, convenience, and cost-effectiveness for both patients and providers.

Virtual Care Market Drivers:

Meeting the Rising Demand for Accessible Healthcare and Addressing the Shortage of Healthcare Professionals.

The contemporary healthcare landscape is witnessing a profound shift as it grapples with the escalating demand for accessibility. This demand is intricately linked to the evolving expectations of patients, who now seek healthcare solutions that align with their preferences for convenience and flexibility. Modern individuals, shaped by the digital age, express a growing desire for on-demand services and virtual consultations that seamlessly integrate into their fast-paced lifestyles. Moreover, the pressing need for accessible healthcare is underscored by demographic shifts, particularly the growth of populations in geographically remote or underserved areas. In these regions, where traditional healthcare infrastructure may be limited, the emergence of accessible healthcare becomes a critical solution. Simultaneously, the global shortage of healthcare professionals intensifies the imperative for accessible healthcare, offering a means to optimize healthcare resources and reach individuals in diverse locales.

Revolutionizing Healthcare Delivery Through Innovations in Video Conferencing Software, Remote Monitoring Tools, and Advanced Data Security Measures.

The trajectory towards accessible healthcare is significantly steered by pioneering technological advancements that redefine the very fabric of healthcare delivery. Notable progress in video conferencing software and telehealth platforms has empowered individuals to connect with healthcare providers remotely, fostering a new era of virtual consultations. Concurrently, the development of wearable devices and remote monitoring tools is revolutionizing the gathering of real-time health data, enabling proactive and personalized care. This technological evolution is further fortified by advancements in data security and privacy measures, ensuring the confidentiality and integrity of patient information in the dynamic landscape of virtual care. The convergence of these technological innovations not only enhances the accessibility of healthcare services but also propels the industry towards a future marked by greater efficiency, connectivity, and patient-centricity.

Reducing Expenses Through Fewer Hospital Visits and Travel Costs, Enhancing Chronic Disease Management via Remote Monitoring, and Boosting Efficiency and Productivity for Healthcare Providers.

At the heart of the shift towards accessible healthcare lies a strategic imperative for cost-effectiveness, reshaping the economics of healthcare delivery. The reduction of healthcare costs is a direct outcome of the paradigm, with fewer hospital visits and diminished travel expenses emerging as tangible benefits for patients. Simultaneously, accessible healthcare contributes to improved chronic disease management by leveraging remote monitoring technologies, facilitating early intervention and personalized treatment plans. From the perspective of healthcare providers, the increased efficiency and productivity derived from virtual care models amplify the cost-effectiveness of healthcare delivery. As technology continues to evolve, the pursuit of accessible healthcare emerges as a transformative force that not only addresses immediate challenges but also shapes the future sustainability and efficiency of the entire healthcare industry.

Virtual Care Market Restraints and Challenges:

Unequal Access to Technology and Internet

The challenge of unequal access to technology and the internet constitutes a substantial impediment to the realization of virtual care's transformative potential. This digital divide not only acts as a technological barrier but also functions as a societal obstacle, excluding specific populations and amplifying existing healthcare disparities. To address this concern effectively, strategic initiatives must extend beyond the mere provision of technological infrastructure. A comprehensive approach involving collaborations between public and private sectors, educational programs, and community engagement efforts is essential to ensure equitable access, promote digital literacy, and cultivate a sense of inclusivity within the realm of virtual healthcare services. Overcoming the digital divide requires a commitment to societal equity, acknowledging that the journey toward inclusive virtual healthcare demands multifaceted, community-centered solutions.

Clinical and Operational Challenges in Virtual Care Implementation: Limited Physical Examinations

The integration of virtual care into healthcare systems presents a nuanced challenge concerning limited physical examinations, essential for certain medical conditions. Striking a delicate balance between the convenience of virtual care and the necessity of in-person examinations calls for innovative solutions. Augmented reality tools offer a promising avenue, providing a more immersive visualization of patients' conditions for remote assessments. Coupled with remote diagnostic technologies and comprehensive patient education, these solutions contribute to overcoming the constraints of virtual consultations, fostering a patient-centric approach that combines technological advancement and active patient participation.

Virtual Care Market Opportunities:

Strategic Opportunities in Expanding Services and Applications within the Virtual Care Market

Within the dynamic landscape of the virtual care market, significant strategic opportunities emerge as platforms consider expanding beyond primary care. The potential diversification into specialized services, such as consultations with specialists, mental health therapy, chronic disease management, and surgical guidance, presents a comprehensive and innovative approach to transforming healthcare delivery. Additionally, the integration of remote patient monitoring through wearables, sensors, and AI-powered tools provides continuous data collection capabilities, empowering proactive health management. The advent of personalized care plans, crafted based on individual health data and preferences, stands as a promising avenue for enhancing patient engagement and achieving superior health outcomes. Furthermore, the incorporation of advanced technologies like artificial intelligence (AI) and virtual reality (VR) into virtual care platforms introduces new dimensions, including real-time diagnosis support, chatbot-driven interaction, and immersive simulations for medical training and phobia treatment.

VIRTUAL CARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

21.9% |

|

Segments Covered |

By Component, consultation type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Teladoc Health, American Well, MDLIVE, Doctor on Demand, Virtuwell, CVS Health, MeMD, HealthTap, iCliniq, Sesame |

Virtual Care Market Segmentation:

Virtual Care Market Segmentation: By Component

- Solutions & Services

- Hardware

Solutions & Services emerge as the largest segment in the virtual care market's component segmentation. This category encompasses a wide range of software platforms and services that enable virtual consultations, remote patient monitoring, data analytics, and robust security measures. As the demand for comprehensive virtual care solutions grows, Solutions & Services take the lead, providing a versatile and integrated approach to healthcare delivery. The emphasis on software platforms that facilitate seamless communication between healthcare providers and patients solidifies Solutions & Services as the dominant force in this segment.

The fastest-growing segment during the forecast period in the virtual care market's component segmentation is Hardware. This category includes medical devices, wearables, sensors, and telemedicine kiosks that play a pivotal role in facilitating virtual care interactions. The integration of hardware solutions into the virtual care ecosystem enhances the capability to capture real-time patient data, enabling healthcare providers to make informed decisions remotely. As technological advancements continue to drive innovations in medical hardware, the Hardware segment is poised for accelerated growth, transforming the way virtual care is delivered and experienced.

Virtual Care Market Segmentation: By Consultation Type

- Video Consultation

- Audio Consultation

- Messaging

Video Consultation takes the lead as the largest segment in virtual care consultations. The widespread adoption of real-time video conferencing with healthcare providers has played a pivotal role in enhancing the accessibility and comprehensiveness of virtual medical appointments. This format allows for face-to-face interactions, facilitating a more personalized and visually informative healthcare experience. As patients and healthcare providers increasingly embrace the convenience and effectiveness of Video Consultation, it solidifies its position as the dominant category in this market segment.

Messaging emerges as the fastest-growing segment within the consultation type category. This growth is fueled by the increasing popularity of text-based communication with healthcare providers. The asynchronous nature of messaging services allows patients to convey non-urgent concerns, seek advice, or request medication refills conveniently. The flexibility offered by messaging platforms aligns with evolving communication preferences, contributing to its rapid adoption. As technology continues to advance and consumers seek more accessible and on-demand healthcare interactions, the Messaging segment is poised to experience robust growth throughout the forecast period, reshaping the dynamics of virtual care consultations.

Virtual Care Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America stands out as the largest segment in the virtual care market. This dominance can be attributed to the high adoption of technology, well-established healthcare infrastructure, and a growing acceptance of virtual care solutions. The region's robust technological landscape, coupled with a proactive approach to healthcare innovation, positions North America as a frontrunner in embracing virtual care platforms. The widespread availability of advanced healthcare services and a tech-savvy population contribute to the leadership of North America in the virtual care market.

Asia-Pacific emerges as the fastest-growing segment in the virtual care market during the forecast period. This growth is fueled by the region's large and diverse population, coupled with an increasing penetration of technology. Countries in Asia-Pacific are experiencing a rapid digital transformation, and the demand for virtual care solutions is surging as a result. Factors such as a rising middle class, improving healthcare infrastructure, and government initiatives to promote healthcare innovation contribute to the exceptional growth of virtual care in the Asia-Pacific region. As technology continues to integrate with healthcare services, Asia-Pacific is anticipated to witness significant advancements and become a key player in the global virtual care landscape.

COVID-19 Impact Analysis on the Global Virtual Care Market:

The adoption of virtual care has significantly improved healthcare accessibility, particularly for individuals in remote areas or with limited mobility. Geographical barriers are overcome, allowing people to easily connect with specialists and receive routine care. The convenience of virtual appointments not only saves time and travel costs for both patients and providers but also contributes to the overall efficiency of healthcare delivery. Moreover, virtual care has proven instrumental in enhancing chronic disease management through remote monitoring and regular virtual consultations, fostering improved adherence to treatment plans and better outcomes for individuals with chronic conditions.

Despite the positive strides, challenges exist within the realm of virtual care. The digital divide remains a critical issue, as unequal access to technology and the internet can exclude certain populations from availing virtual care options, perpetuating healthcare disparities. Quality of care concerns arise due to limitations in physical examinations and potential technical issues, particularly for complex medical conditions. The depersonalization of care, stemming from a lack of personal interaction and physical touch, may lead to less empathetic and personalized experiences for some patients. Additionally, data privacy and security risks associated with sharing medical information online necessitate robust security measures. There is also a concern about the potential for misdiagnosis or missed diagnoses, given the absence of comprehensive physical examinations.

Latest Trends/ Developments:

AI-powered virtual assistants, including chatbots and AI companions, have emerged as pivotal tools in the healthcare landscape. These intelligent systems provide patients with round-the-clock access to symptom checker tools, personalized health insights, and assistance in scheduling appointments. The 24/7 availability of these virtual assistants enhances patient engagement, offers timely information, and contributes to a more efficient healthcare experience.

Virtual care is entering a new era with seamless integration into wearable devices and remote monitoring technologies. By connecting with wearables, such as smartwatches and health sensors, virtual care platforms can access real-time data on vital signs like heart rate, blood pressure, and sleep patterns. This wealth of information empowers healthcare professionals to make informed decisions remotely, enabling personalized and proactive healthcare management.

The scope of virtual consultations has expanded beyond primary care, reaching into various specialty areas such as dermatology and neurology. This expansion broadens access to specialized healthcare services, particularly benefiting individuals in underserved or remote areas. Virtual specialty care not only enhances accessibility but also facilitates collaboration among healthcare professionals, fostering a more comprehensive and interconnected approach to patient care. As technology advances, the potential for virtual care to cover an even wider range of specialties continues to grow, promising greater inclusivity in healthcare services.

Key Players:

- Teladoc Health

- American Well

- MDLIVE

- Doctor on Demand

- Virtuwell

- CVS Health

- MeMD

- HealthTap

- iCliniq

- Sesame

Chapter 1. GLOBAL VIRTUAL CARE MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL VIRTUAL CARE MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL VIRTUAL CARE MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL VIRTUAL CARE MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL VIRTUAL CARE MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL VIRTUAL CARE MARKET – By Component

6.1. Introduction/Key Findings

6.2. Solutions & Services

6.3. Hardware

6.4. Y-O-Y Growth trend Analysis By Component

6.5. Absolute $ Opportunity Analysis By Component , 2024-2030

Chapter 7. GLOBAL VIRTUAL CARE MARKET – By Consultation Type

7.1. Introduction/Key Findings

7.2. Video Consultation

7.3. Audio Consultation

7.4. Messaging

7.5. Y-O-Y Growth trend Analysis By Consultation Type

7.6. Absolute $ Opportunity Analysis By Consultation Type , 2024-2030

Chapter 8. GLOBAL VIRTUAL CARE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Consultation Type

8.1.3. By Component

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Consultation Type

8.2.3. By Component

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Consultation Type

8.3.3. By Component

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Consultation Type

8.4.3. By Component

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Consultation Type

8.5.3. By Component

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL VIRTUAL CARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Teladoc Health

9.2. American Well

9.3. MDLIVE

9.4. Doctor on Demand

9.5. Virtuwell

9.6. CVS Health

9.7. MeMD

9.8. HealthTap

9.9. iCliniq

9.10. Sesame

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Virtual Care Market was valued at USD 180 Million in 2023 and is projected to reach a market size of USD 719.94 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 21.9%.

From routine consultations to AI-powered therapeutics, the global virtual care market touches a kaleidoscope of healthcare applications

COVID-19 acted as a rocket booster for the global virtual care market, propelling rapid adoption and paving the way for a future of digital healthcare