Virtual Car Market Size (2024-2030)

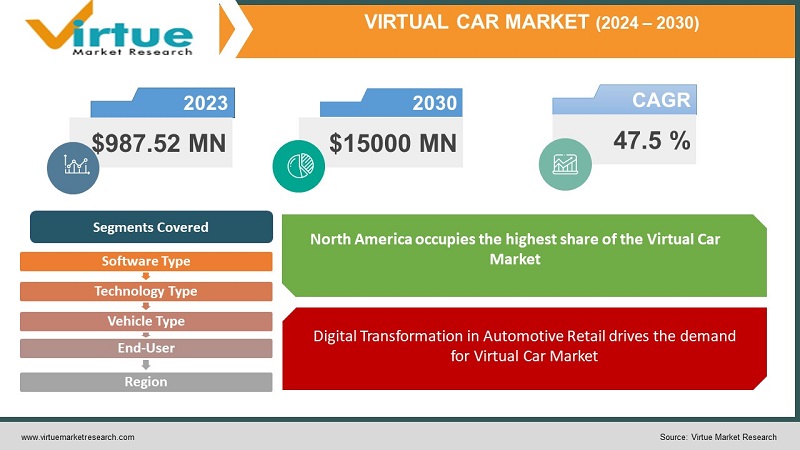

The Global Virtual Car Market was valued at USD 987.52 million and is projected to reach a market size of USD 15000 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 47.5 %.

The virtual car market plays an important role in the automotive industry that involves virtual or digital elements. Online platforms where users can browse, compare, and purchase cars without physically visiting a showroom and customers can experience cars in a virtual space. These platforms often provide virtual showrooms, 360-degree views of vehicles, and detailed specifications. The Virtual Car Market is expected to grow significantly in the coming years due to ongoing advancements in technology and the expansion of E-commerce. The major well-established key players in the Virtual Car Market are Unity Technologies, Epic Games, Autodesk, Alibaba Group, and NVIDIA

Key Market Insights:

Some companies are exploring the use of virtual reality to create immersive showrooms that allow users to explore and customize vehicles without being physically present. Augmented Reality (AR) Car applications that enable users to visualize and customize cars in real-world environments using their smartphones or AR glasses. Virtual Car Market Platforms are also dedicated to the virtual representation and trading of electric vehicles. Technological Advancements, E-commerce Expansion, Renewable Energy, Digital Transformation, Health Innovation, EV Surge, Remote Work Trends, 5G Rollout, Climate Awareness, and AI Integration are propelling the Virtual Car Market.

The restraints to the Virtual Car Market include the high implementation cost, limited physical interaction, and other data security and privacy concerns. North America occupies the highest share of the Virtual Car Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Virtual Car Market Drivers:

Digital Transformation in Automotive Retail drives the demand for Virtual Car Market

The automotive industry is undergoing a significant digital transformation due to changing consumer behavior, preferences, and expectations. Consumers increasingly prefer online interactions when purchasing vehicles. Virtual showrooms and platforms allow them to browse, customize, and even virtually test drive cars from the comfort of their homes. The integration of AR and VR technologies enhances the virtual car-buying experience. Virtual showrooms with immersive 3D models, AR-enabled car configurators, and VR-based test drives contribute to a more engaging and informative purchasing process. Consumers can virtually customize their vehicles, selecting colors, and other features through interactive online tools. This level of personalization enhances the overall customer experience. This also helps build a connection between the buyer and the product. The rise of online retail platforms dedicated to automotive sales provides a seamless and convenient way for customers to their vehicle purchases.

Rapid Advancements in Simulation Technology are propelling the Virtual Car Market

Automotive manufacturers use simulation software to create virtual prototypes. This allows them to test and refine designs before the physical manufacturing stage. This also accelerates the development process and reduces costs associated with physical prototypes. Simulation technology enables the creation of realistic virtual test drives and consumers can experience the performance, handling, and other features of a car without physically being present. This enhances the pre-purchase experience. This also contributes to informed decision-making. Virtual simulation is utilized for training purposes in the automotive industry. This allows professionals to practice and enhance their skills in a virtual environment. This also contributes to improved efficiency and safety. Manufacturers can also use simulation data to analyze and improve vehicle performance, safety features, and fuel efficiency. This results in the development of more advanced and refined automotive products.

Virtual Car Market Restraints and Challenges

The major challenge faced by the Virtual Car Market is the limited physical interaction. Virtual car experiences lack the sensory aspects of physically interacting with a vehicle, such as the feel of materials, the scent of the interior, or the actual driving experience. Many consumers still prefer traditional showrooms for a hands-on experience before making a purchase decision. Another challenge is the collection and storage of personal data during virtual car interactions. This raises concerns about data security and privacy. The other restraints to the Virtual Car Market include technological barriers, integration challenges, regulatory compliance complexity, building consumer trust, high implementation costs, and bandwidth limitations.

Virtual Car Market Opportunities:

The Virtual Car Market has various opportunities in the market. With the integration of Augmented Reality (AR) capabilities, the market is anticipated to witness significant growth in the coming years. The virtual car market offers opportunities to create immersive and engaging experiences. This fosters stronger connections between consumers and automotive brands. Virtual platforms enable automotive companies to reach a global audience. Other Opportunities in the Virtual Car Market include enhanced customer engagement, global accessibility, cost-efficient prototyping, personalized experiences, e-commerce integration, innovative marketing, training, and skill development, evolution of mobility solutions, data-driven insights, sustainable practices, collaborations, market expansion in emerging economies, enhanced product visualization, and continuous technological advancements.

VIRTUAL CAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

47.5% |

|

Segments Covered |

By Software Type, Technology type, , vehicle type, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Unity Technologies, Epic Games Autodesk, Alibaba Group, Amazon Web Services (AWS), NVIDIA, Siemens AG, Dassault Systèmes, Microsoft, Cognata |

Virtual Car Market Segmentation

Virtual Car Market Segmentation: By Software Type:

- Simulation Software

- Visualization Software

In 2023, based on market segmentation by Software Type, Simulation Software occupies the highest share of the Virtual Car Market. This is due to its crucial role in testing and development processes for virtual cars. Simulation Software allows manufacturers to simulate various scenarios. This contributes to the overall safety and efficiency of the virtual vehicles.

However, Visualization Software is also the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 12%. This is due to the increasing emphasis on user experience and customer engagement. This software enhances virtual showrooms and configurators. This provides immersive and realistic experiences for users exploring and customizing virtual cars.

Virtual Car Market Segmentation: By Technology Type:

- Virtual Reality (VR)

- Augmented Reality (AR)

In 2023, based on market segmentation by Technology Type, the Virtual Reality (VR) segment occupies the highest share of the Virtual Car Market. This is mainly due to its immersive and realistic experiences, making it a key component for virtual test drives. This creates detailed virtual showrooms.

However, Augmented Reality (AR) is the fastest-growing segment during the forecast period. This is mainly due to the growing desire to merge the virtual and physical aspects of car exploration seamlessly.AR technology overlays digital information in the real world. This makes it valuable for virtual car configurators and enhances the physical showroom experience.

Virtual Car Market Segmentation: By Vehicle Type:

- Electric Vehicles (EVs)

- Conventional Vehicles

In 2023, based on market segmentation by Vehicle Type, the Electric Vehicles (EVs) segment occupies the highest share of the Virtual Car Market. This is mainly due to the growing prominence of electric vehicles in the automotive market. This contributes to the significant demand for virtual experiences related to EVs. The virtual showrooms showcasing electric models and virtual test drives focused on electric vehicle technologies are included.

However, the Conventional Vehicles is the fastest-growing segment during the forecast period. This is mainly due to the ongoing innovations and the integration of digital technologies into traditional car buying and selling processes.

Virtual Car Market Segmentation: By End-User:

- Automotive Manufacturers

- Retail and E-commerce Platforms

In 2023, based on market segmentation by the end user, the Automotive Manufacturers segment occupies the highest share of the Virtual Car Market. This is mainly due to the crucial role of virtual solutions for automotive manufacturers in terms of design, testing, and prototyping. Simulation software and other virtual tools are extensively used by manufacturers to streamline the development and production processes. This reduces costs and improves efficiency.

However, Retail and E-commerce Platforms are the fastest-growing segment during the forecast period. This growth is driven by the increasing trend of online car sales and the desire for immersive virtual experiences. Retail and E-commerce Platforms leverage virtual showrooms and configurators to offer customers an interactive online car-buying experience.

Virtual Car Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Virtual Car Market. It has a market share of 45%. This growth is due to the high technological adoption rates and a strong automotive industry. North America is a technologically advanced region with advanced virtual solutions, including simulation software and visualization tools which are widely used by automotive manufacturers for design, testing, and prototyping. The United States is a major hub for the automotive industry.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the increasing demand for automotive technologies and a growing consumer base. Countries like China, India, Japan, and South Korea, have significant market share due to increasing adoption of virtual car experiences.

Europe remains a stable and significant market for virtual car solutions due to its established automotive industry and tech-savvy consumer base.

South America and the Middle East/Africa are often considered emerging markets for virtual car experiences. It could be influenced by factors such as economic development and technological infrastructure.

COVID-19 Impact Analysis on the Global Virtual Car Market:

The COVID-19 pandemic had a significant impact on the Virtual Car Market. There were lockdowns, various safety measures, and other travel restrictions. This led to disruptions in the global supply chain. This further affected the production and availability of physical components needed for virtual car technologies. The pandemic accelerated the adoption of online interactions and digital experiences. This potentially accelerated the adoption of virtual car platforms. The demand for contactless experiences during the pandemic created opportunities for virtual test drives, digital car customization, and other touchless interactions in the virtual car market. Thus, the pandemic accelerated certain trends in the Virtual Car Market.

Latest Trends/ Developments:

One of the developments, in the Virtual Car Market is the rise in the integration of artificial intelligence (AI) and machine learning (ML) capabilities. This enhances the overall virtual car experience. Leveraging technologies like augmented reality (AR) and virtual reality (VR) also enhances the online car-buying experience. Growing interest in digital twin technology for cars, allows real-time simulations, performance monitoring, and predictive maintenance in the virtual space. Growing emphasis on eco-friendly practices in virtual car technologies aligns with broader industry trends toward sustainability. Other ongoing trends in the virtual car market include the development of immersive showrooms, blockchain integration, a focus on electric vehicle experiences, collaborations between automotive and tech companies, subscription-based services, enhanced AR applications, remote vehicle maintenance tools, and expanded EV virtual experiences.

Key Players:

- Unity Technologies

- Epic Games

- Autodesk

- Alibaba Group

- Amazon Web Services (AWS)

- NVIDIA

- Siemens AG

- Dassault Systèmes

- Microsoft

- Cognata

Market News:

- In 2023, Hyundai Mobis partnered with Wind River to develop a digital twin-based system for Software Defined Vehicle (SDV), creating a virtual testing ground for car parts and technologies. The collaboration, establishing the "M.Dev Studio," aims to enhance development efficiency and swiftly respond to the demands of global automakers.

- In 2023, JM&A responded to consumer demand by launching Virtual F&I, providing an online alternative to in-store car-buying. The digital financing service aims to enhance the car-shopping experience, offering flexibility for customers and improving efficiency and profitability for dealers, with plans to launch an advanced platform demonstrated at the 2024 NADA convention.

Chapter 1. Global Virtual Car Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Virtual Car Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Virtual Car Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Virtual Car Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Virtual Car Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Virtual Car Market– By Software Type

6.1. Introduction/Key Findings

6.2. Simulation Software

6.3. Visualization Software

6.4. Y-O-Y Growth trend Analysis By Software Type

6.5. Absolute $ Opportunity Analysis By Software Type , 2024-2030

Chapter 7. Global Virtual Car Market– By Technology Type

7.1. Introduction/Key Findings

7.2 Virtual Reality (VR)

7.3. Augmented Reality (AR)

7.4. Y-O-Y Growth trend Analysis By Technology Type

7.5. Absolute $ Opportunity Analysis By Technology Type , 2024-2030

Chapter 8. Global Virtual Car Market– By End-User

8.1. Introduction/Key Findings

8.2. Automotive Manufacturers

8.3. Retail and E-commerce Platforms

8.4. Y-O-Y Growth trend Analysis End-User

8.5. Absolute $ Opportunity Analysis Type, 2024-2030

Chapter 9. Global Virtual Car Market– By Vehicle Type

9.1. Introduction/Key Findings

9.2. Electric Vehicles (EVs)

9.3. Conventional Vehicles

9.4. Y-O-Y Growth trend Analysis Vehicle Type

9.5. Absolute $ Opportunity Analysis Vehicle Type , 2024-2030

Chapter 10. Global Virtual Car Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Software Type

10.1.3. By Technology Type

10.1.4. By Vehicle Type

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Software Type

10.2.3. By Technology Type

10.2.4. By Vehicle Type

10.2.5. End-User

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3.2.6. Rest of Asia-Pacific

10.3.2. By Software Type

10.3.3. By Technology Type

10.3.4. By Vehicle Type

10.3.5. End-User

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Software Type

10.4.3. By Technology Type

10.4.4. By Vehicle Type

10.4.5. End-User

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Software Type

10.5.3. By Technology Type

10.5.4. By Vehicle Type

10.5.5. End-User

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Virtual Car Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Unity Technologies

11.2. Epic Games

11.3. Autodesk

11.4. Alibaba Group

11.5. Amazon Web Services (AWS)

11.6. NVIDIA

11.7. Siemens AG

11.8. Dassault Systèmes

11.9. Microsoft

11.10. Cognata

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Virtual Car Market was valued at USD 987.52 million and is projected to reach a market size of USD 15000 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 47.5 %.

Digital Transformation in Automotive Retail and Rapid Advancements in Simulation Technology are the main market drivers of the Global Virtual Car Market.

Electric Vehicles (EVs), and Conventional Vehicles are the segments under the Global Virtual Car Market by Vehicle Type.

North America is the most dominant region for the Global Virtual Car Market.

Unity Technologies, Epic Games, Autodesk, Alibaba Group, and NVIDIA are the key players in the Global Virtual Car Market.