Vietnam Concrete Market Size (2024-2030)

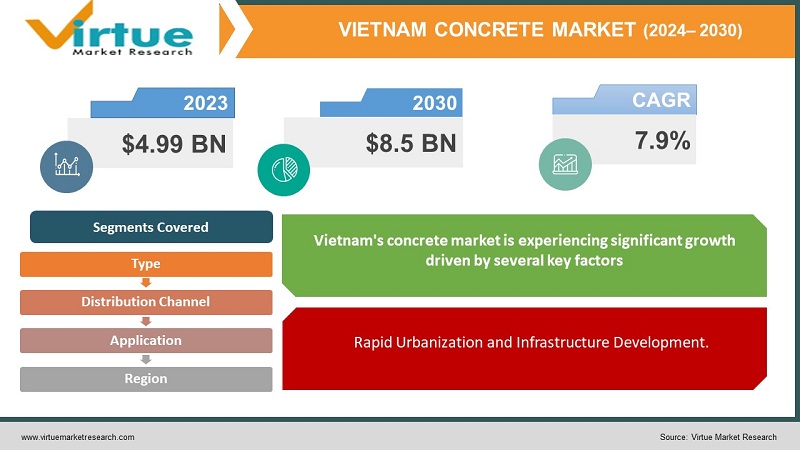

The Vietnam Concrete Market was valued at USD 4.99 billion in 2023 and is projected to reach a market size of USD 8.5 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.9%between 2024 and 2030.

The Vietnam Concrete Market is witnessing significant growth due to the rapid development of infrastructure, urbanization, and industrialization in the country. Vietnam's booming construction industry is a primary driver for concrete demand, with both residential and commercial projects contributing to the increasing need for high-quality materials. Government investments in large-scale infrastructure projects such as roads, bridges, airports, and industrial complexes further bolster the market. Additionally, Vietnam's rising population and the shift toward urban living have created a surge in the construction of housing complexes and commercial buildings, further fueling demand.

Key Market Insights:

The Vietnam construction sector contributes approximately 6% to the country's GDP, driving concrete demand.

Infrastructure projects account for over 40% of the total concrete consumption in Vietnam.

Urbanization rates in Vietnam exceed 3% annually, increasing the need for residential and commercial buildings.

Government investment in infrastructure is expected to grow by 10% per year, boosting the concrete market.

Around 70% of concrete used in Vietnam is in large-scale infrastructure and public works projects.

The eco-friendly concrete segment is growing by over 8% annually due to rising environmental concerns and stricter regulations.

Foreign direct investment (FDI) into Vietnam's construction sector has increased by over 15% in recent years, further accelerating market growth.

Vietnam Concrete Market Drivers:

Rapid Urbanization and Infrastructure Development.

Vietnam's rapid urbanization and ongoing infrastructure development are key drivers of the concrete market. With over 35% of Vietnam’s population now residing in urban areas, the demand for housing, commercial buildings, and public infrastructure has surged significantly. This urbanization trend is accompanied by an increasing number of government-backed infrastructure projects, such as roads, bridges, airports, and railways, which are heavily reliant on concrete. As a result, the construction sector in Vietnam contributes significantly to the economy, with concrete being a fundamental material for its growth. Additionally, the government's ambitious infrastructure goals, including investments in smart cities and modernization of transportation networks, are expected to accelerate the demand for concrete. Such extensive development has led to a consistent rise in concrete production, with the industry playing a crucial role in meeting the demands of Vietnam's rapidly evolving urban landscape.

Government Investments in Sustainable Construction.

Vietnam’s government has increasingly prioritized sustainability within the construction sector, driving the demand for eco-friendly and high-performance concrete. As part of its commitment to reducing greenhouse gas emissions, the government has implemented stricter regulations on construction materials, encouraging the adoption of sustainable concrete solutions. This shift is leading to a rise in the use of materials such as green concrete, which has lower carbon footprints. Furthermore, Vietnam’s plans to develop resilient infrastructure to combat climate change impacts have fostered innovations in concrete production that emphasize durability and sustainability. With government policies supporting energy-efficient buildings and sustainable urban planning, the construction sector is focusing on high-quality, environmentally friendly concrete, shaping the future of the market. This trend not only helps meet Vietnam’s environmental goals but also aligns with the global movement towards sustainable development in the construction industry.

Vietnam Concrete Market Restraints and Challenges:

The Vietnam concrete market faces several restraints and challenges that could impact its growth. One significant challenge is the fluctuating cost of raw materials, such as cement, sand, and aggregates, which directly affects the overall cost of concrete production. These price variations can be influenced by global supply chain disruptions, changes in trade policies, or local environmental regulations that limit resource extraction. Additionally, Vietnam's construction sector is experiencing labor shortages, particularly in skilled labor, which can delay projects and increase operational costs. Another major restraint is the growing environmental concern around the carbon footprint associated with concrete production. The concrete industry is one of the largest contributors to global CO2 emissions, and increasing regulatory pressure to reduce emissions poses a challenge for traditional production methods. Lastly, the sector also faces challenges related to quality control, as rapid urbanization has led to some instances of substandard concrete being used in construction, which can lead to long-term structural issues. Addressing these challenges requires investments in innovative technologies, sustainable practices, and workforce development, along with stricter regulations to ensure high-quality production standards across the industry.

Vietnam Concrete Market Opportunities:

The Vietnam concrete market presents several significant opportunities for growth, driven by the country's rapid urbanization and infrastructure development. As Vietnam continues to experience a construction boom, especially in major cities like Hanoi and Ho Chi Minh City, the demand for concrete in residential, commercial, and industrial projects is expected to rise. The government's increasing investments in infrastructure, such as roads, bridges, and public transportation systems, provide a solid foundation for the expansion of the concrete market. Additionally, Vietnam’s growing focus on sustainable development opens opportunities for eco-friendly concrete solutions, such as green concrete or concrete made from recycled materials. As environmental concerns become more prominent, there is a rising demand for low-carbon and energy-efficient construction materials. The adoption of advanced technologies, including ready-mix concrete and high-performance concrete, further enhances market potential by improving efficiency and reducing construction time. Foreign investments in Vietnam's construction sector also create opportunities for local manufacturers to form partnerships and expand their operations. With the country's ambitious infrastructure projects, coupled with the growing trend toward sustainable construction practices, the Vietnam concrete market is well-positioned to seize new opportunities and drive long-term growth in the region.

VIETNAM CONCRETE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Type, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Vietnam |

|

Key Companies Profiled |

Concrete Vietnam JSC, Holcim Vietnam, Xi măng Hà Tiên (part of SCG Cement-Building Materials), Viet Nam Concrete Corporation, Binh Duong Concrete, Lafarge Vietnam, SMC Trading Investment Joint Stock Company, Fico-YTL Cement Joint Stock Company. |

Vietnam Concrete Market Segmentation:

Vietnam Concrete Market Segmentation By Type:

- Ordinary Portland Cement (OPC) Concrete

- High-Strength Concrete

- Ready-Mix Concrete

- Self-Consolidating Concrete

- Fiber Reinforced Concrete

In 2023, based on market segmentation by Type, Ordinary Portland Cement (OPC) Concrete had the highest share of the Vietnam Concrete Market. Ordinary Portland Cement (OPC) concrete is a cornerstone of the Vietnam concrete market due to its versatility and widespread use across various construction applications. Its adaptability makes it suitable for everything from residential buildings to infrastructure projects, ensuring its dominance in the market. One of the primary advantages of OPC concrete is its cost-effectiveness, as it is generally more affordable compared to specialized types of concrete. This affordability allows it to be used in a broad range of projects, making it accessible to many construction endeavors. Additionally, Vietnam's well-established infrastructure for producing and distributing OPC concrete ensures that it is readily available throughout the country. The regulatory compliance of OPC concrete also plays a crucial role; it typically meets local standards and regulations, which guarantees its suitability for diverse construction needs. Although other types of concrete, such as high-strength and ready-mix concrete, serve specific functions, the combination of OPC concrete’s versatility, cost-effectiveness, and reliable availability underpins its leading position in the Vietnamese market. This makes OPC a preferred choice for many construction professionals and projects throughout the region.

Vietnam Concrete Market Segmentation By Application:

- Infrastructure

- Residential Construction

- Commercial Construction

- Industrial Construction

In 2023, based on market segmentation by Application, Infrastructure had the highest share of the Vietnam Concrete Market. Government initiatives, rapid urbanization, economic growth, and foreign investment are driving the expansion of the concrete market in Vietnam. The Vietnamese government has been heavily investing in infrastructure projects, including roads, bridges, and railways, all of which require substantial amounts of concrete. This commitment to infrastructure development is a major driver for the market. Additionally, the country is experiencing rapid urbanization, with growing cities and expanding populations creating a heightened demand for new infrastructure and residential buildings. Economic growth in Vietnam has spurred increased industrialization and development, necessitating robust infrastructure to support these advancements. Furthermore, Vietnam’s attractive investment climate has drawn significant foreign investment into the country, further fueling the demand for concrete through various large-scale infrastructure projects. Collectively, these factors contribute to a robust and expanding concrete market, as the country continues to develop and modernize its infrastructure to meet the needs of its growing economy and urban landscape.

Vietnam Concrete Market Segmentation By Distribution Channel:

- Ready-Mix Concrete Suppliers

- Building Material Dealers

- Online Retailers

In 2023, based on market segmentation by Distribution Channel, Ready-Mix Concrete Supply had the highest share of the Vietnam Concrete Market. Ready-mix concrete is a popular choice in the construction industry due to its significant advantages in convenience, quality control, efficiency, and suitability for large-scale projects. The primary convenience of ready-mix concrete lies in its delivery directly to construction sites, which saves contractors both time and effort compared to on-site mixing. This delivery model also ensures that the concrete is fresh and ready for use, reducing the need for manual mixing and transport. Quality control is another key benefit, as ready-mix concrete suppliers typically employ stringent quality control measures to ensure consistency in product quality, which is crucial for structural integrity and performance. Additionally, the use of ready-mix concrete can streamline construction processes, enhancing overall efficiency by minimizing the time required for mixing and preparation. This is particularly advantageous for large-scale construction projects where a consistent and timely supply of concrete is essential for maintaining project schedules and standards. While alternative distribution channels like building material dealers and online retailers exist, the convenience, reliable quality control, and efficiency offered by ready-mix concrete suppliers make them the preferred choice for many contractors and large construction projects.

By Region:

Vietnam's concrete market is experiencing significant growth driven by several key factors. Rapid urbanization has led to a surge in construction activity as new housing, infrastructure, and commercial buildings are in high demand to accommodate the expanding urban population. This rapid urbanization has directly increased concrete consumption across various projects. The Vietnamese government has also heavily invested in infrastructure development, including roads, bridges, and railways, all of which require substantial quantities of concrete for their construction. Additionally, the steady economic growth in Vietnam has spurred industrialization, leading to the development of new factories, warehouses, and other industrial facilities, all of which contribute to the rising demand for concrete. Foreign investment has further boosted the concrete market, as international investors channel funds into real estate and infrastructure projects, accelerating market growth. Finally, the rising living standards and increased disposable income of Vietnamese consumers have led to higher expectations for housing and infrastructure quality, which drives the demand for superior concrete. These combined factors are propelling the expansion of the concrete market in Vietnam, reflecting a dynamic and rapidly growing sector.

COVID-19 Impact Analysis on the Vietnam Concrete Market.

The COVID-19 pandemic significantly impacted the Vietnam concrete market, primarily through disruptions in construction activities and supply chains. During the height of the pandemic, strict lockdown measures and restrictions on movement caused delays in construction projects across the country, leading to a temporary decline in the demand for concrete. Many large-scale infrastructure projects were either halted or slowed, affecting the overall market growth. Additionally, the supply chain disruptions, including shortages of raw materials like cement and aggregates, further exacerbated the situation. The labor shortages caused by quarantine measures and health concerns also played a role in delaying projects, adding to the market’s challenges. However, as Vietnam managed to control the pandemic more effectively than many other countries, the construction sector has started to recover. Government stimulus packages aimed at reviving the economy, especially through infrastructure development, have contributed to the market’s gradual rebound. The pandemic also accelerated the adoption of digital technologies and automation in the construction industry, which could lead to increased efficiency in the concrete sector in the long term. Despite the short-term setbacks caused by COVID-19, the Vietnam concrete market is expected to bounce back as construction activities regain momentum in the post-pandemic period.

Latest trends / Developments:

The Vietnam concrete market is undergoing significant transformations driven by sustainability and technological innovation. As environmental concerns become more pressing, there is a noticeable shift towards eco-friendly concrete solutions that minimize carbon emissions and incorporate recycled materials. Government regulations and international standards are encouraging the adoption of high-performance concrete that supports green construction practices. Concurrently, technological advancements are reshaping the industry. Automation in concrete production, along with digital tools such as Building Information Modeling (BIM) and 3D printing, is enhancing efficiency, reducing material waste, and improving the precision and durability of concrete structures. These innovations enable more accurate and cost-effective construction practices. Vietnam's rapid urbanization and infrastructure development are further propelling the demand for ready-mix concrete, essential for large-scale projects like highways, bridges, and residential complexes. The rise of smart city projects and modern infrastructure investments underscores the increasing need for high-quality concrete solutions. These trends collectively highlight a dynamic market that is adapting to environmental challenges and technological advancements, positioning Vietnam’s concrete industry for sustainable growth and increased resilience in the face of evolving construction demands.

Key Players:

- Concrete Vietnam JSC

- Holcim Vietnam

- Xi măng Hà Tiên (part of SCG Cement-Building Materials)

- Viet Nam Concrete Corporation

- Binh Duong Concrete

- Lafarge Vietnam

- SMC Trading Investment Joint Stock Company

- Fico-YTL Cement Joint Stock Company

Chapter 1. Vietnam Concrete Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Vietnam Concrete Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Vietnam Concrete Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Vietnam Concrete Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Vietnam Concrete Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Vietnam Concrete Market– By Type

6.1. Introduction/Key Findings

6.2. Ordinary Portland Cement (OPC) Concrete

6.3.High-Strength Concrete

6.4. Ready-Mix Concrete

6.5. Self-Consolidating Concrete

6.6. Fiber Reinforced Concrete

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Vietnam Concrete Market– By Application

7.1. Introduction/Key Findings

7.2. Infrastructure

7.3. Residential Construction

7.4. Commercial Construction

7.5. Industrial Construction

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. Vietnam Concrete Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Ready-Mix Concrete Suppliers

8.3. Building Material Dealers

8.4. Online Retailers

8.5. Y-O-Y Growth trend Analysis Distribution Channel

8.6. Absolute $ Opportunity Analysis Distribution Channel , 2023-2030

Chapter 9. Vietnam Concrete Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Vietnam

9.1.1. By Country

9.1.1.1. Vietnam

9.1.2. By Distribution Channel

9.1.3. By Type

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Vietnam Concrete Market– Company Profiles – (Overview, Application Portfolio, Financials, Strategies & Developments)

10.1 Concrete Vietnam JSC

10.2. Holcim Vietnam

10.3. Xi măng Hà Tiên (part of SCG Cement-Building Materials)

10.4. Viet Nam Concrete Corporation

10.5. Binh Duong Concrete

10.6. Lafarge Vietnam

10.7. SMC Trading Investment Joint Stock Company

10.8. Fico-YTL Cement Joint Stock Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

By 2023, the Vietnam Concrete market is expected to be valued at US$ 4.99 billion.

Through 2030, the Vietnam Concrete market is expected to grow at a CAGR of 7.9 %.

By 2030, Vietnam Concrete Market is expected to grow to a value of US$ 8.5 billion.

Concrete Vietnam JSC, Holcim Vietnam, Xi măng Hà Tiên (part of SCG Cement-Building Materials), Viet Nam Concrete Corporation, Binh Duong Concrete, Lafarge Vietnam, SMC Trading Investment Joint Stock Company, Fico-YTL Cement Joint Stock Company.

The Vietnam Concrete Market has segments By Application, Type, Distribution Channel, and Region.