Video on Demand Market Size (2024-2030)

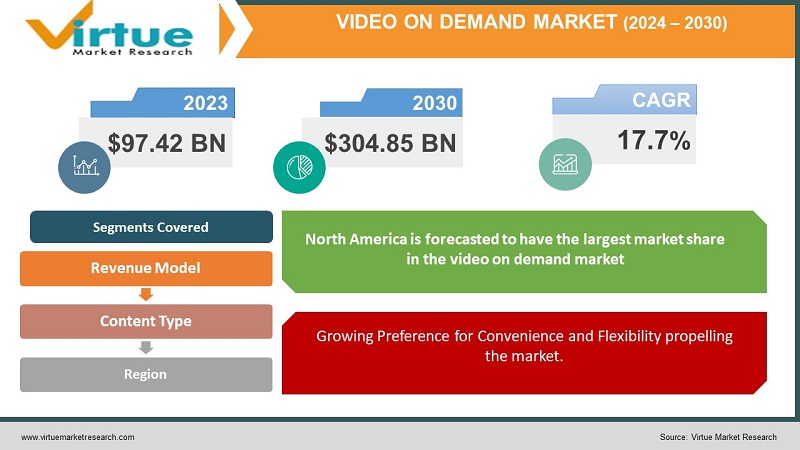

The Global Video on Demand market size is estimated at USD 97.42 billion in 2023, and is expected to reach USD 304.85 billion by 2030, growing at a CAGR of 17.7% during the forecast period (2024-2030).

The escalating global penetration of smartphones is poised to generate numerous growth opportunities for the market. The presence of cost-effective cloud platforms will contribute favorably to market expansion. Furthermore, the rising popularity of Video-on-demand services, attributed to platforms like Netflix and Amazon Prime, has been a key driver of market growth. The prevalence of these entities has significantly propelled the market forward, while the accessibility of economical cloud platforms continues to create fresh avenues for growth.

The expanding internet penetration across various nations augurs well for the overall market growth in the forthcoming years. Substantial investments in marketing and advertising for video-on-demand services have laid the groundwork for rapid market expansion. The imminent deployment of 5G networks is anticipated to serve as a pivotal moment for online services, potentially supplanting traditional movie viewing in theaters and further propelling market growth.

Key Market Insights:

The global Video on Demand (VOD) market is experiencing notable growth, fueled by the surge in digitalization, widespread high-speed internet access, and evolving consumer preferences. Critical observations indicate a strong demand for diverse content, encompassing original productions and exclusive releases. Subscription-based models take precedence, fostering customer loyalty and revenue stability for major stakeholders. The introduction of 5G technology elevates streaming capabilities, facilitating superior quality and immersive viewing experiences. The global VOD market stands out for its fierce competition, urging platforms to invest in content diversity and innovative features. As the market progresses, strategic partnerships, content curation, and technological advancements are poised to shape its trajectory, presenting compelling opportunities for growth and differentiation.

Global Video on Demand Market Drivers:

The market growth is notably propelled by the increased revenue from mobile advertisements on AVOD platforms.

The prevalence of mobile applications as a potential medium for advertisers to expand their reach is rising. The adoption of affordable mobile devices has heightened consumer preference for mobile platforms, becoming the primary medium for information consumption. Mobile advertising stands as a major revenue source for application developers. The continuous enhancement of functionality by mobile hardware and software developers has led to increased downloads of new applications, consequently boosting the revenue of AVOD platforms. The global mobile advertising market, valued at USD 360.45 billion in 2021, was anticipated to reach USD 403.70 billion by 2023, growing at a CAGR of 12.54%, according to Technavio's research, further driving the global VOD market's growth.

Growing Preference for Convenience and Flexibility propelling the market.

The convenience and flexibility offered by VOD services are some of the primary drivers of the growth in this market. VOD providers have revolutionized the way people consume media by offering viewers the ability to watch their favorite shows and movies at any time and on any device. This level of convenience is highly valued by consumers, as it allows them to watch what they want, when they want, without being tied down to traditional broadcasting schedules.

Moreover, VOD providers offer a seamless experience across multiple devices, including smartphones, tablets, smart TVs, and game consoles.

In addition, VOD providers leverage the data collected from users' viewing history to offer personalized recommendations for new content.

Global Video on Demand Market Constraints and Challenges:

A significant challenge in the market is the availability of pirated video content on online platforms.

The growth of the global VOD market is impeded by the increasing prevalence of video piracy, with torrents posing a major threat. Torrents facilitate the illegal download of VOD content, often copyrighted, bypassing the need for subscription to video streaming services. Despite the availability of various online streaming services like Netflix and Hulu, torrents remain an attractive option due to their cost-free nature and ad-free content, posing a substantial challenge to the growth of the global VOD market.

Rapid Fragmentation and Competition to Challenge Market Growth to Some Extent.

The highly saturated and competitive nature of the VOD market can be a major restraint for VOD providers. With multiple providers vying for market share, the market has become fragmented, with consumers having to navigate a range of providers to access the content they want. This fragmentation can lead to customer churn as viewers switch between different providers to find the content they want, potentially leading to lost revenue for VOD providers.

Moreover, the cost of subscription altogether for multiple VOD channels and services can be a bit daunting causing a barrier for consumers.

Opportunities in the Global Video on Demand Market:

The key opportunity in the market lies in the increasing penetration of smart TVs. The growing adoption of smart technologies worldwide is expected to boost demand for VOD, as smart TVs come with built-in capabilities to stream popular applications like Netflix and Hulu. The rising number of technological advances in consumer electronics and the inclusion of features such as cameras and gaming contribute to the increased sales of smart TVs. The launch of new smart TVs by enterprises, such as OnePlus and Samsung Electronics, is expected to drive consumers towards online streaming services, supporting the market's growth during the forecast period.

VIDEO ON DEMAND MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.7% |

|

Segments Covered |

By Revenue model, content type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Akamai Technologies Inc., Amazon.com Inc., Amdocs Ltd., Apple Inc., Cisco Systems Inc., Comcast Corp., Huawei Technologies Co. Ltd., KWIKmotion, Limelight Networks Inc., Muvi LLC, Roku Inc. |

Global Video on Demand Market Segmentation

Global Video on Demand Market Segmentation: By Revenue Model

- Subscription Video on Demand (SVoD)

- Transactional Video on Demand (TVoD)

- Advertisement-Based Video on Demand (AVoD)

The video on demand market is categorized by revenue model into transactional VoD, subscription VoD, and advertisement-based VoD. The subscription VoD segment commands the highest market share, primarily driven by the increasing adoption of OTT platforms. According to Zemoga, Inc. in April 2020, 30% of OTT time on home TVs is allocated to free streaming, 5% to transactional VoD, and 65% to subscription VoD.

Additionally, advertisement-based VoD services are experiencing steady growth due to the rising demand for advertising videos to promote products and services.

Global Video on Demand Market Segmentation By Content Type

- Sports

- Music

- TV Entertainment

- Kids

- Movies

- Others

The video on demand market, segmented by content type, includes TV entertainment, music, sports, kids, movies, and others. The TV entertainment segment is expected to dominate the market, driven by an increasing number of drama series projects, big-budget movies, and online advertising videos. The movies segment is projected to witness the highest CAGR, attributed to growing consumer demand for on-demand movies and collaborations between movie directors and streaming service providers.

Global Video on Demand Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is forecasted to have the largest market share in the video on demand market, with key players like Apple, Inc., Amazon, and Netflix focusing on advanced VoD services. The region's diversity, coupled with significant investments and the adoption of advanced technologies such as AI and cloud computing, contributes to its leadership. Asia Pacific is expected to witness the highest CAGR, driven by a substantial customer base and increasing mobile internet users in populous countries. Global market players are expanding in this region to meet the growing demand for sports, music, TV entertainment, and other content.

Impact of COVID-19 on the Global Video on Demand Market:

The global Video on Demand (VOD) market witnessed a surge in demand for smartphones, broadband connections, internet usage, and digital platforms such as video streaming and conferencing due to the COVID-19 pandemic. Temporary closures of movie theaters and shows, mandated by government restrictions and self-imposed social separation guidelines to curb viral infection, led to an increased demand for these services among both new and existing consumers. In the first quarter of 2021, there was a remarkable uptick in the adoption of digital streaming platforms like Netflix, Disney+, and Amazon Prime, attributed to evolving consumer viewing patterns on the internet. Netflix Inc. reported a 13.6% increase in new memberships in the first quarter of 2021 compared to the same period in 2020, surpassing 200 million subscribers by the end of 2020, with an additional 37 million sign-ups in that year.

Recent Trends/Developments:

In July 2022, Netflix entered into a partnership with Microsoft to introduce new ad-supported subscription plans. Microsoft became Netflix's global ad technology and delivery partner, supporting all advertising needs.

In April 2022, Hulu secured U.S. streaming rights for "Schitt’s Creek," becoming the exclusive subscription VoD destination for the popular series.

In September 2022, Amazon.com Inc. launched prime video channels in India, providing prime members with access to various on-demand video channels, including Lionsgate Play, discovery+, Eros Now, Docubay, Hoichoi, MUB, Manorama Max, and Shorts TV.

In March 2022: The Walt Disney Company declared it would introduce ad-supported video on demand (AVOD) in order to hit its objective of more than 230 million members by 2024. As of December 2021, however, the service had 130 million customers. According to the business, the service would launch by the end of 2022.

Key Players:

- Akamai Technologies Inc.

- Amazon.com Inc.

- Amdocs Ltd.

- Apple Inc.

- Cisco Systems Inc.

- Comcast Corp.

- Huawei Technologies Co. Ltd.

- KWIKmotion, Limelight Networks Inc.

- Muvi LLC

- Roku Inc.

Chapter 1. GLOBAL VIDEO ON DEMAND MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL VIDEO ON DEMAND MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL VIDEO ON DEMAND MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL VIDEO ON DEMAND MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL VIDEO ON DEMAND MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL VIDEO ON DEMAND MARKET – By Revenue Model

6.1. Introduction/Key Findings

6.2 Subscription Video on Demand (SVoD)

6.3. Transactional Video on Demand (TVoD)

6.4. Advertisement-Based Video on Demand (AVoD)

6.5. Y-O-Y Growth trend Analysis By Revenue Model

6.6. Absolute $ Opportunity Analysis By Revenue Model , 2024-2030

Chapter 7. GLOBAL VIDEO ON DEMAND MARKET – By Content Type

7.1. Introduction/Key Findings

7.2. Sports

7.3. Music

7.4. TV Entertainment

7.5. Kids

7.6. Movies

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Content Type

7.9. Absolute $ Opportunity Analysis By Content Type , 2024-2030

Chapter 8. GLOBAL VIDEO ON DEMAND MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Content Type

8.1.3. By Revenue Model

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Content Type

8.2.3. By Revenue Model

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Content Type

8.3.3. By Revenue Model

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Content Type

8.4.3. By Revenue Model

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Content Type

8.5.3. By Revenue Model

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL VIDEO ON DEMAND MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Akamai Technologies Inc.

9.2. Amazon.com Inc.

9.3. Amdocs Ltd.

9.4. Apple Inc.

9.5. Cisco Systems Inc.

9.6. Comcast Corp.

9.7. Huawei Technologies Co. Ltd.

9.8. KWIKmotion, Limelight Networks Inc.

9.9. Muvi LLC

9.10. Roku Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Video on Demand market size is estimated at USD 97.42 billion in 2023, and is expected to reach USD 304.85 billion by 2030, growing at a CAGR of 17.7% during the forecast period (2024-2030).

The worldwide Global Video on Demand Market growth is estimated to be 17.7% from 2024 to 2030

The Global Video on Demand Market is Segmentation by Revenue Model (Subscription Video on Demand (SVoD), Transactional Video on Demand (TVoD), and Advertisement Based Video on Demand (AVoD)), By Content Type (Sports, Music, TV Entertainment, Kids, Movies, and Others).

The global Video on Demand (VOD) market is set for substantial growth, propelled by an increasing desire for personalized content, original productions, and enhanced user experiences. Emerging trends encompass immersive technologies, global content partnerships, and the integration of artificial intelligence, offering lucrative opportunities for industry stakeholders.

The COVID-19 pandemic has acted as a catalyst for the expansion of the global Video on Demand market. Lockdowns and social distancing measures have elevated the demand for at-home entertainment, leading to a surge in subscriptions on streaming platforms. This underscores the market's resilience and adaptability in the face of challenging circumstances.