Video Intercom Devices Market Size (2024 – 2030)

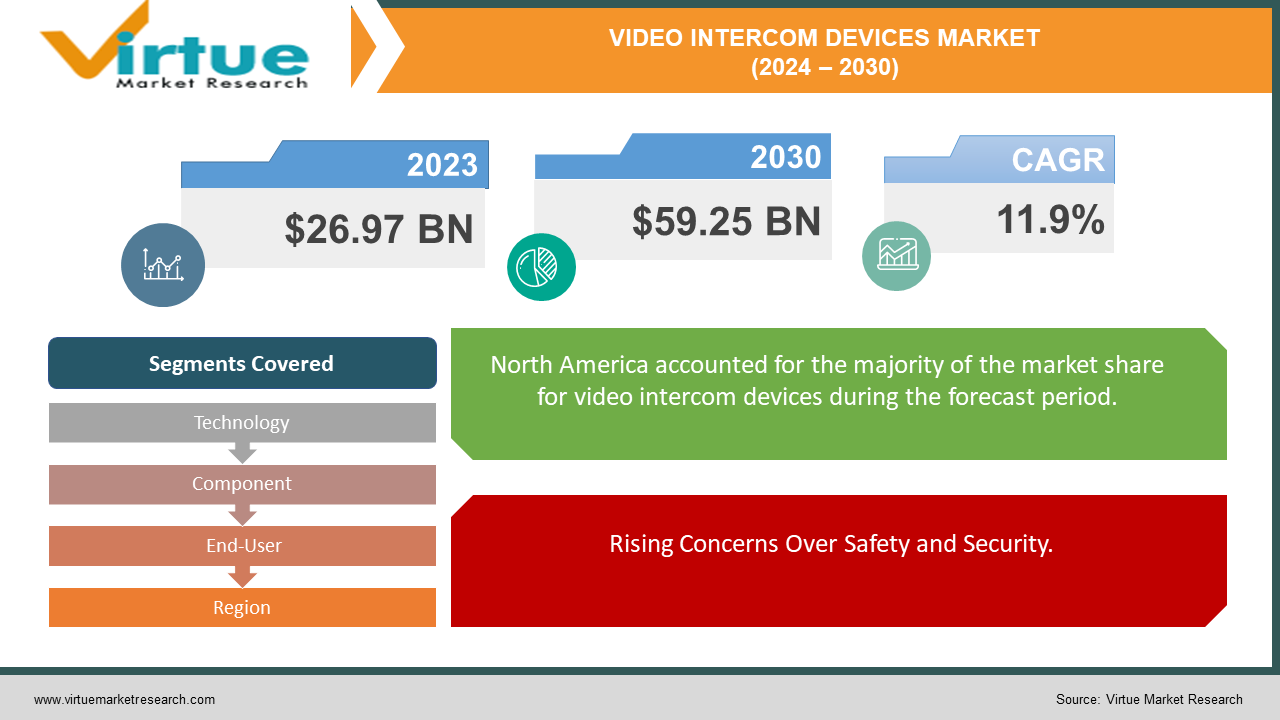

The market for video intercom devices was estimated to be worth USD 26.97 billion in 2023 and is expected to increase to USD 59.25 billion by 2030, with a projected compound annual growth rate (CAGR) of 11.9% from 2024 to 2030.

The video intercom devices market has been witnessing significant growth driven by a confluence of factors such as increasing concerns over security, technological advancements, and the proliferation of smart home solutions. Video intercom devices offer enhanced security features, convenience, and remote monitoring capabilities, making them increasingly popular in both residential and commercial settings. With the rise of smart buildings and the Internet of Things (IoT), integration with other home automation and access control systems further amplifies the appeal of video intercom devices. Moreover, the COVID-19 pandemic has accelerated the adoption of contactless solutions, leading to greater demand for video intercom systems that enable secure communication without physical interaction. As a result, the market is expected to continue its growth trajectory, driven by innovations in technology, expanding applications, and the growing emphasis on safety and security across various sectors.

Key Insights:

Residential applications dominate the video intercom devices market, accounting for approximately 60% of the overall market share, driven by increased demand for home security solutions.

Technological advancements in video intercom systems, such as integration with AI and facial recognition technology, are fueling market growth, with sales of advanced systems expected to grow by 15% year-over-year.

The Asia Pacific region is experiencing rapid adoption of video intercom devices, with China leading the market due to urbanization trends, accounting for over 35% of the global market share.

Global Video Intercom Devices Market Drivers:

Rising Concerns Over Safety and Security.

With the increasing concerns over safety and security in both residential and commercial spaces, there is a growing demand for advanced video intercom devices. These devices offer real-time visual and audio communication, allowing users to verify the identity of visitors before granting them access. The need for enhanced security measures in an increasingly uncertain world is a significant driver propelling the growth of the global video intercom devices market.

Integration of Smart Home Technologies.

The integration of video intercom devices with smart home technologies is another key driver fueling market growth. Consumers are increasingly adopting smart home systems that offer convenience, energy efficiency, and security. Video intercom devices play a crucial role in this ecosystem by providing homeowners with remote access control and monitoring capabilities, thereby enhancing the overall security and convenience of smart homes.

Advancements in Communication Technologies.

Technological advancements, such as the integration of IP-based communication and the development of high-definition video and audio capabilities, are driving innovation in the video intercom devices market. These advancements not only improve the clarity and reliability of communication but also enable additional features such as mobile connectivity and cloud-based storage. As a result, consumers are increasingly inclined towards investing in modern video intercom solutions, further driving market growth.

Global Video Intercom Devices Market Restraints and Challenges:

High Initial Cost and Installation Complexity.

One of the primary challenges facing the global video intercom devices market is the high initial cost associated with these systems. Video intercom devices often require specialized equipment and professional installation, which can be costly for both residential and commercial users. Additionally, the complexity of installation, especially in retrofitting existing buildings with video intercom systems, poses a barrier to adoption for many potential customers.

Compatibility Issues and Fragmented Standards.

Another significant challenge is the compatibility issues and fragmented standards prevalent in the video intercom devices market. With numerous manufacturers offering a wide range of products with varying specifications and protocols, ensuring interoperability between different systems can be difficult. This lack of standardization complicates the integration of video intercom devices with other security and smart home systems, limiting their effectiveness and usability.

Data Privacy and Security Concerns.

Data privacy and security concerns represent a critical restraint for the widespread adoption of video intercom devices. As these systems collect and transmit sensitive audio and video data, there is a risk of unauthorized access, hacking, or misuse of personal information. Consumers and businesses are increasingly cautious about the potential privacy implications of deploying video intercom devices, especially considering the growing regulatory scrutiny and public awareness surrounding data protection laws. Addressing these concerns and implementing robust security measures will be essential for overcoming this challenge and fostering trust among users.

Global Video Intercom Devices Market Opportunities:

Expansion of Smart Cities and Urban Infrastructure.

The rapid urbanization and the emergence of smart cities present significant opportunities for the video intercom devices market. As cities invest in upgrading their infrastructure to improve safety, efficiency, and quality of life, there is a growing demand for advanced security and communication systems. Video intercom devices can play a crucial role in smart city initiatives by enhancing public safety, facilitating secure access control in residential and commercial buildings, and enabling remote monitoring of public spaces.

Integration with Artificial Intelligence and IoT.

The integration of video intercom devices with artificial intelligence (AI) and the Internet of Things (IoT) technologies opens up new avenues for innovation and market growth. AI-powered features such as facial recognition, voice recognition, and behavior analysis enhance the functionality and security of video intercom systems, making them more intelligent and proactive in identifying and responding to potential threats. Moreover, interoperability with IoT devices allows seamless integration with other smart home and building automation systems, offering users greater convenience and control over their interconnected environments.

Market Expansion in Developing Regions.

Developing regions, particularly in Asia-Pacific, Latin America, and Africa, present untapped opportunities for the expansion of the video intercom devices market. As urbanization and infrastructure development accelerate in these regions, there is a growing need for modern security and communication solutions to address the challenges of urban living. Rising disposable incomes, increasing awareness of security concerns, and government initiatives to promote smart city development further fuel the demand for video intercom devices in these emerging markets. By catering to the unique requirements and preferences of consumers in these regions, manufacturers can capitalize on the vast growth potential offered by expanding into new geographical markets.

VIDEO INTERCOM DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.9% |

|

Segments Covered |

By Technology, Component, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Aiphone Corporation, Comelit Group S.p.A., Panasonic Corporation, Honeywell International Inc., Legrand SA, Samsung Electronics Co., Ltd., Dahua Technology Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., Axis Communications AB, VTech Holdings Limited, Fermax Electronica S.A.U., Siedle & Soehne Telefon- und Telegrafenwerke OHG |

Video Intercom Devices Market Segmentation: By Technology

-

Wired Video Intercom Devices

-

Wireless Video Intercom Devices

-

IP-based Video Intercom Devices

Among the three segments of wired, wireless, and IP-based video intercom devices, the IP-based video intercom devices segment stands out as the most effective and promising technology in the global market. IP-based video intercom devices leverage internet protocol (IP) networks to transmit audio and video data, offering several advantages over traditional wired and wireless systems. One of the key benefits of IP-based solutions is their scalability and flexibility, allowing for seamless integration with existing network infrastructure and enabling remote access and management from anywhere with an internet connection. Additionally, IP-based video intercom devices often feature advanced functionalities such as high-definition video and audio, mobile connectivity, and cloud-based storage, enhancing the overall user experience and security capabilities. With the increasing adoption of IP technology in both residential and commercial applications, driven by the proliferation of smart home and building automation systems, the demand for IP-based video intercom devices is expected to continue to grow, making it a highly effective segment in the global market.

Video Intercom Devices Market Segmentation: By Component

-

Cameras

-

Monitors

-

Keypads

-

Power Supply Units

-

Others

Among the components of video intercom systems, cameras emerge as the most pivotal and impactful segment. Cameras serve as the primary sensory input, capturing visual information crucial for security and communication purposes. Advanced camera technologies integrated into video intercom systems offer high-resolution video capture, enabling clear identification of visitors and enhancing surveillance capabilities. Moreover, features such as infrared night vision, wide-angle lenses, and pan-tilt-zoom functionality further augment the effectiveness of cameras in diverse lighting and viewing conditions. In addition to security, cameras contribute to the convenience and functionality of video intercom systems by facilitating visual verification and remote monitoring. As the demand for robust security solutions continues to rise across residential, commercial, and institutional sectors, the significance of cameras within video intercom systems is expected to grow, making them the most effective component in driving market growth and innovation.

Video Intercom Devices Market Segmentation: By End-User

-

Residential

-

Commercial

In the market segmentation by end-user, the commercial sector emerges as the most impactful and influential segment for video intercom devices. Commercial establishments, including office buildings, retail stores, hospitals, educational institutions, and industrial facilities, have complex security and communication requirements that necessitate advanced solutions like video intercom systems. These systems play a crucial role in ensuring controlled access, managing visitor traffic, and enhancing overall security measures within commercial premises. Moreover, with the increasing emphasis on customer service and operational efficiency, video intercom devices provide a convenient means for staff to communicate with visitors and authorized personnel, streamlining workflow processes. Additionally, as businesses prioritize safety and liability concerns, the integration of video intercom systems with surveillance cameras and access control systems becomes essential, further driving demand in the commercial sector. With continuous advancements in technology and evolving security needs, the commercial segment remains the primary driver of growth and innovation in the global video intercom devices market.

Video Intercom Devices Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In the global video intercom devices market, North America commands the largest market share at 35%. The region's dominance is attributed to several factors, including the widespread adoption of advanced security technologies, stringent safety regulations, and the presence of key industry players driving innovation. Europe follows closely behind with a market share of 25%, driven by increasing investments in smart city initiatives, urban infrastructure development, and growing awareness of security concerns among residential and commercial sectors. The Asia-Pacific region accounts for 20% of the market share, fueled by rapid urbanization, rising disposable incomes, and the adoption of smart home technologies across countries like China, Japan, and South Korea. South America holds an 11% market share, characterized by growing investments in infrastructure development and increasing demand for video intercom solutions in sectors such as residential complexes and commercial buildings. Lastly, the Middle East and Africa region capture a 9% market share, driven by urbanization, government initiatives promoting smart city development, and investments in the construction sector. Overall, these regional dynamics highlight the diverse market landscape and opportunities for growth across different parts of the world.

COVID-19 Impact Analysis on the Global Video Intercom Devices Market:

The COVID-19 pandemic has fundamentally altered the landscape of the global video intercom devices market, catalyzing a profound shift towards contactless solutions for access control and communication. With heightened awareness of hygiene and safety measures, there has been an unprecedented demand for video intercom systems across various sectors, including healthcare facilities, residential complexes, educational institutions, and commercial buildings. These systems offer a vital layer of security by enabling visual and auditory verification of visitors without the need for physical contact, aligning perfectly with the imperative of minimizing the risk of virus transmission. However, amidst this heightened demand, the industry has faced formidable challenges stemming from disruptions to the global supply chain. Lockdown measures, factory closures, and workforce shortages have led to delays in production and distribution, causing temporary setbacks in meeting the soaring demand for video intercom devices. Nonetheless, these challenges have prompted industry players to innovate and adapt, accelerating the development and deployment of cloud-based and mobile-enabled solutions that offer remote access and management capabilities.

Looking ahead, as economies gradually reopen and businesses navigate the complexities of the post-pandemic landscape, investments in resilient and future-proof security solutions are expected to remain a top priority. The enduring impact of the pandemic on societal behaviors and workplace norms underscores the continued relevance and importance of video intercom systems in ensuring safety, security, and operational efficiency in the evolving landscape of the new normal. Thus, while the COVID-19 pandemic has presented unprecedented challenges, it has also served as a catalyst for innovation and growth in the video intercom devices market, shaping its trajectory in the years to come.

Latest Trends/ Developments:

The video intercom devices market is experiencing a wave of innovation and evolution driven by several latest trends and developments. One significant trend is the integration of artificial intelligence (AI) and machine learning capabilities into video intercom systems. AI-powered features such as facial recognition, voice recognition, and behavior analysis enhance the functionality and security of these systems, enabling more accurate and efficient visitor identification and access control. Another notable trend is the increasing adoption of cloud-based solutions, which offer enhanced flexibility, scalability, and remote management capabilities. Cloud-based video intercom systems enable users to access and control their intercoms from anywhere with an internet connection, streamlining operations and improving overall efficiency. Moreover, there is a growing emphasis on interoperability and integration with other smart home and building automation technologies, enabling seamless connectivity and enhanced user experience. Additionally, advancements in camera technology, including higher resolutions, wider viewing angles, and improved low-light performance, are driving improvements in video quality and overall system performance. These trends collectively indicate a shift towards more intelligent, connected, and user-friendly video intercom solutions, poised to meet the evolving needs of residential, commercial, and institutional users in the digital age.

Key Players:

-

Aiphone Corporation

-

Comelit Group S.p.A.

-

Panasonic Corporation

-

Honeywell International Inc.

-

Legrand SA

-

Samsung Electronics Co., Ltd.

-

Dahua Technology Co., Ltd.

-

Hangzhou Hikvision Digital Technology Co., Ltd.

-

Axis Communications AB

-

VTech Holdings Limited

-

Fermax Electronica S.A.U.

-

Siedle & Soehne Telefon- und Telegrafenwerke OHG

Chapter 1. Video Intercom Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Video Intercom Devices Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Video Intercom Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Video Intercom Devices Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Video Intercom Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Video Intercom Devices Market – By Technology

6.1 Introduction/Key Findings

6.2 Wired Video Intercom Devices

6.3 Wireless Video Intercom Devices

6.4 IP-based Video Intercom Devices

6.5 Y-O-Y Growth trend Analysis By Technology

6.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Video Intercom Devices Market – By End-User

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Y-O-Y Growth trend Analysis By End-User

7.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Video Intercom Devices Market – By Component

8.1 Introduction/Key Findings

8.2 Cameras

8.3 Monitors

8.4 Keypads

8.5 Power Supply Units

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Component

8.8 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 9. Video Intercom Devices Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By End-User

9.1.4 By By Component

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By End-User

9.2.4 By Component

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By End-User

9.3.4 By Component

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By End-User

9.4.4 By Component

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By End-User

9.5.4 By Component

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Video Intercom Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Aiphone Corporation

10.2 Comelit Group S.p.A.

10.3 Panasonic Corporation

10.4 Honeywell International Inc.

10.5 Legrand SA

10.6 Samsung Electronics Co., Ltd.

10.7 Dahua Technology Co., Ltd.

10.8 Hangzhou Hikvision Digital Technology Co., Ltd.

10.9 Axis Communications AB

10.10 VTech Holdings Limited

10.11 Fermax Electronica S.A.U.

10.12 Siedle & Soehne Telefon- und Telegrafenwerke OHG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for video intercom devices was estimated to be worth USD 26.97 billion in 2023 and is expected to increase to USD 59.25 billion by 2030, with a projected compound annual growth rate (CAGR) of 11.9% from 2024 to 2030.

The primary drivers of the global video intercom devices market include increasing concerns over safety and security, advancements in technology, and integration with smart home systems.

The key challenges facing the global video intercom devices market include high initial costs, compatibility issues, and data privacy concerns.

In 2023, North America held the largest share of the global video intercom devices market.

Aiphone Corporation, Comelit Group S.p.A., Panasonic Corporation, Honeywell International Inc., Legrand SA, Samsung Electronics Co., Ltd., Dahua Technology Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., Axis Communications AB, VTech Holdings Limited, Fermax Electronica S.A.U., Siedle & Soehne Telefon- und Telegrafenwerke OHG are the main players.