Vessel Energy Storage System Market Size (2024 – 2030)

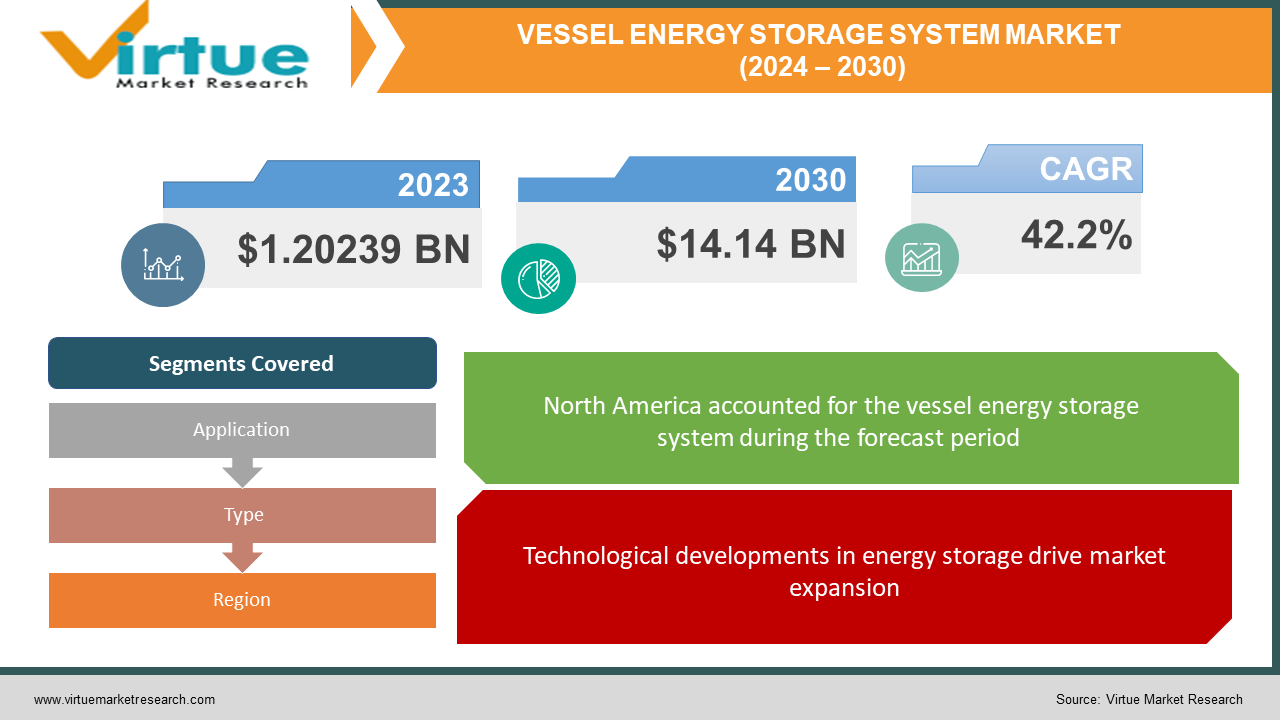

The market for vessel energy storage systems at the global level is expanding quickly; it was estimated to be worth 1.20239 USD billion in 2023 and is expected to increase to USD 14.14 billion by 2030, with a projected compound annual growth rate (CAGR) of 42.2% from 2024 to 2030.

The marine industry's increasing focus on sustainable and efficient power sources is reflected in the market growth of vessel energy storage systems. This growth in this market is the result of several factors, including increased environmental regulations, the demand for cleaner and greener technology in maritime transportation, and advancements in energy storage technologies. The industry is expanding due in part to the increasing usage of fuel cells, hybrid solutions, and battery energy storage systems in a range of vessel types, including offshore support vessels and commercial ships. The market's landscape, which is characterized by the dynamic interaction of significant players and innovative solutions, further demonstrates the conscious effort undertaken to fulfill the shifting energy demands of the global maritime sector. Future developments in maritime propulsion and auxiliary power systems are anticipated to be greatly influenced by the market for vessel energy storage systems, especially if the industry continues to prioritize sustainability.

Key Market Insights:

The expansion of the market can be attributed to the industry's growing preference for sustainable energy solutions, which is being driven by both increased environmental consciousness and regulatory restrictions. Notably, battery energy storage systems, hybrid technologies, and fuel cells are emerging as significant players that may satisfy the diverse needs of commercial boats, offshore support fleets, and naval applications. A global trend towards cleaner and more efficient operations, seen in the various markets of North America, Europe, Asia-Pacific, and other regions, can be credited with the growth of maritime operations. Prominent industry players are promoting innovation and emphasizing the significance of research and development in shaping the sector's future.

Global Vessel Energy Storage System Market Drivers:

Technological developments in energy storage drive market expansion.

Because energy storage technology is developing so quickly, the market for vessel energy storage systems is growing quickly. The marine industry is experiencing a shift in the power landscape due to modern technologies. These include advanced battery systems, fuel cells, and hybrid configurations. These innovations not only increase the efficiency of propulsion systems but also significantly reduce emissions, aligning with the industry's rising focus on sustainability.

Green initiatives' regulatory embrace is speeding up market adoption.

The swift implementation of eco-friendly legislation by global authorities is one of the primary drivers of the ship energy storage system market's robust growth. Stricter pollution regulations and environmental rules are putting pressure on maritime operators to invest in greener, more sustainable power options. As ship owners try to comply with ever-changing laws, the market for energy storage devices is witnessing a fundamental shift. Systems that ensure both operational efficiency and environmental compliance are becoming more and more necessary as a result.

Growing consciousness of environmental effects is accelerating the growth rate.

Sales of vessel energy storage systems are increasing as more individuals become conscious of the environmental impact of conventional maritime propulsion systems. The environmental consequences of using traditional fuel sources over the long term are becoming known to an increasing number of stakeholders in the maritime industry. As a result of growing environmental consciousness, industry players are making investments in energy storage technology, positioning themselves as crucial collaborators in the sector's overarching goal of achieving more sustainable and ecologically friendly marine operations.

Global Vessel Energy Storage System Market Restraints and Challenges:

High prices prevent widespread adoption.

One of the main obstacles facing the global vessel energy storage system business is cost. Certain segments of the maritime industry have challenges when implementing novel energy storage technologies due to the initial expenses associated with high-capacity batteries and intricate hybrid systems. If shipowners are reluctant to deploy energy storage devices because they are concerned about the return on investment, then these technologies may not be extensively implemented.

Challenges of technological complexity and integration are often faced by the market.

The complexity of integrating energy storage devices into the vessel structures that are already in use is one of the main challenges. For maritime operators, integrating cutting-edge technologies seamlessly without disrupting regular operations is a challenge. Because of the requirements for specific technical skills, compatibility issues, and retrofitting difficulties, several industry players are hesitant to employ these systems. To effectively integrate energy storage technologies across a range of vessel types, several integration issues need to be fixed.

Limited system infrastructure for energy storage is a barrier.

The lack of proper infrastructure is impeding the growth of the market for energy storage systems. Probably, the infrastructure required for charging or refilling to support widespread adoption is absent from ports and other maritime facilities. Concerns over the availability of alternative fuels for certain systems and the dearth of charging stations hinder the deployment of vessel energy storage technologies. Addressing these infrastructure limitations is essential to ensuring the seamless integration and operation of energy storage systems across the world's maritime environments.

Global Vessel Energy Storage System Market Opportunities:

Energy storage systems in vessels are poised to benefit from the decarbonization trend.

The marine industry's growing focus on decarbonization indicates that a revolutionary period in the worldwide market for vessel energy storage systems is about to begin. Stakeholders have an unrivaled opportunity to embrace cutting-edge solutions and technology that not only meet legal requirements but also significantly advance the sustainability goals of the industry. Vessel owners and operators can capitalize on these opportunities as the maritime landscape evolves by investing in state-of-the-art energy storage technologies that redefine the future of clean and efficient maritime propulsion.

Technological development opens the door to innovative energy storage.

Advancements in technology and ongoing research are enabling innovation in the dynamic field of vessel energy storage systems. Due to developments in energy density, battery efficiency, and the discovery of novel materials, market participants are leading the way in a technological revolution that might change the marine industry. Businesses that invest in R&D can become trailblazers and usher in a new era of energy storage innovation by offering state-of-the-art solutions that cater to the evolving needs of the marine industry.

Global funding programs and government incentives are providing many possibilities.

Because of government incentives and funding, vessel energy storage systems are becoming more and more common. As the world's attention turns to environmental sustainability, several countries are offering financial incentives to incentivize the marine industry to implement environmentally friendly technologies. Boat owners can benefit from this opportunity to invest in green solutions by utilizing government funding to lower upfront costs and encourage quicker adoption of energy storage systems. When private investment and governmental policy work together, there's a strong likelihood that we will be moving toward a more resilient and sustainable maritime future.

VESSEL ENERGY STORAGE SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

42.2% |

|

Segments Covered |

By Application, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Corvus Energy, ABB, Siemens, Saft, Lelanche, Plan B Energy Storage, Rolls Royce , MG Energy Systems, PATHION, Hyundai Electric, Kokam, Maxwell Technologies |

Vessel Energy Storage System Market Segmentation: By Application

-

Commercial Vessels

-

Transport

-

Military

-

Others

The commercial segment is both the largest and fastest-growing application. The majority of boats in the world's fleet are commercial ships, which include bulk carriers, container ships, tankers, and offshore support vessels. These boats are used for a variety of marine transportation tasks, including logistics, cargo shipping, and offshore operations. Energy storage solutions and other cleaner and more sustainable propulsion technologies are becoming more and more popular in the marine sector as a result of increased focus on lowering greenhouse gas emissions and increasing fuel economy.

Vessel Energy Storage System Market Segmentation: By Type

-

Lithium-ion

-

Hybrid Energy Storage System

Hybrid energy storage systems hold the largest market share in 2023. Innovative energy storage systems, known as hybrid energy storage systems (HESS), integrate many energy storage technologies to meet particular needs and provide synergistic effects. By offering redundancy and backup capabilities, HESS improves system resilience and dependability. Other storage components can smoothly compensate in the event of a breakdown or degradation in one component, guaranteeing continuous operation and minimizing downtime. Lithium-ion is the fastest-growing. Because of their great energy density, reasonable cost, and established dependability, lithium-ion batteries are extensively used in many different sectors. They are often employed in maritime applications, such as energy storage systems on vessels, because of their capacity to deliver dependable and efficient power for auxiliary functions, propulsion, and emergency backup.

Vessel Energy Storage System Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The market for vessel energy storage systems is fragmented across key regions, with varying market shares that reflect the dynamic nature of the marine industry. North America leads the world with a 33% market share due to stringent environmental regulations and a concerted effort to incorporate sustainable technologies into the well-established shipping industry. Following closely behind is Europe, which commands a 28% market share and is renowned for its steadfast dedication to increasing renewable energy initiatives in maritime operations and reducing carbon emissions. The Asia-Pacific is the fastest-growing market. This region highlights its leadership in international shipping and increased emphasis on integrating state-of-the-art energy storage technology for both commercial and military vessels, with a share of 22%.

COVID-19 Impact Analysis on the Global Vessel Energy Storage System Market:

The COVID-19 pandemic had a devastating effect on the global vessel energy storage system industry, just like it did on many other industries. Early in the pandemic, production delays, problems in the supply chain, and a stop to maritime activities negatively impacted the market for a while. However, the market held up well as governments all over the world introduced stimulus packages and the maritime industry adapted to the new normal. The epidemic accelerated the adoption of energy-efficient and emission-reducing technologies, such as vessel energy storage systems, and brought sustainability to the forefront of public discourse. Reliable power sources became more important as ships tried to optimize operations with fewer crew members and less human intervention. Notwithstanding its challenges, the pandemic encouraged innovation and steered the market for vessel energy storage systems in the direction of a more advanced and sustainable technical future. Following the COVID-19 pandemic, market expansion is expected to be driven by the industry's recovery and the shift towards environmentally responsible maritime operations.

Latest Trends/ Developments:

The market for vessel energy storage systems is now being influenced by several notable trends and advancements that are steering it toward a more sustainable and technologically advanced future. The increasing use of artificial intelligence (AI) and machine learning in energy storage technologies is a significant advancement since it increases system efficiency and allows for predictive maintenance. Another significant development is the increasing acceptance of modular and scalable energy storage systems, which provide flexibility and adaptability to various vessel sizes and operational requirements. Lithium-ion batteries continue to lead the industry because of ongoing advancements that increase energy density and reduce costs. In addition, there is more attention being paid to the development of hybrid energy storage systems, which combine batteries with other technologies like fuel cells or flywheels for maximum performance. Research into ammonia and green hydrogen as potential energy sources is being encouraged by the marine industry's increased emphasis on fulfilling zero-emission standards. This is opening up new possibilities for innovation in vessel energy storage. When taken as a whole, these patterns show how environmental requirements and technological advancements are combining to change the possibilities for energy storage in maritime applications.

Key Players:

-

Corvus Energy

-

ABB

-

Siemens

-

Saft

-

Lelanche

-

Plan B Energy Storage

-

Rolls Royce

-

MG Energy Systems

-

PATHION

-

Hyundai Electric

-

Kokam

-

Maxwell Technologies

Chapter 1. Vessel Energy Storage System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Vessel Energy Storage System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Vessel Energy Storage System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Vessel Energy Storage System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Vessel Energy Storage System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Vessel Energy Storage System Market – By Application

6.1 Introduction/Key Findings

6.2 Commercial Vessels

6.3 Transport

6.4 Military

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Vessel Energy Storage System Market – By Type

7.1 Introduction/Key Findings

7.2 Lithium-ion

7.3 Hybrid Energy Storage System

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Vessel Energy Storage System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Vessel Energy Storage System Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Corvus Energy

9.2 ABB

9.3 Siemens

9.4 Saft

9.5 Lelanche

9.6 Plan B Energy Storage

9.7 Rolls Royce

9.8 MG Energy Systems

9.9 PATHION

9.10 Hyundai Electric

9.11 Kokam

9.12 Maxwell Technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The vessel energy storage system market at the global level is forecast to grow at a projected compound annual growth rate (CAGR) of 42.2% from 2024 to 2030, from an estimated 1.20239 USD billion in 2023 to USD 14.14 billion by 2030.

The growing emphasis on sustainability in the maritime sector, strict environmental laws, and developments in energy storage technologies are the main factors propelling the global vessel energy storage system market.

Adopting modern energy storage technologies in maritime operations comes with significant upfront costs and integration challenges, which are the main obstacles facing the global vessel energy storage system market.

In 2023, North America held the largest share of the global vessel energy storage system market.

Corvus Energy, ABB, Siemens, Safe, Lelanche, Plan B Energy Storage, Rolls Royce, MG Energy Systems, PATHION, Hyundai Electric, Kokam, and Maxwell Technologies are some of the prominent businesses.