Global Vertical High-Pressure Processing (HPP) Market Size (2023 - 2030)

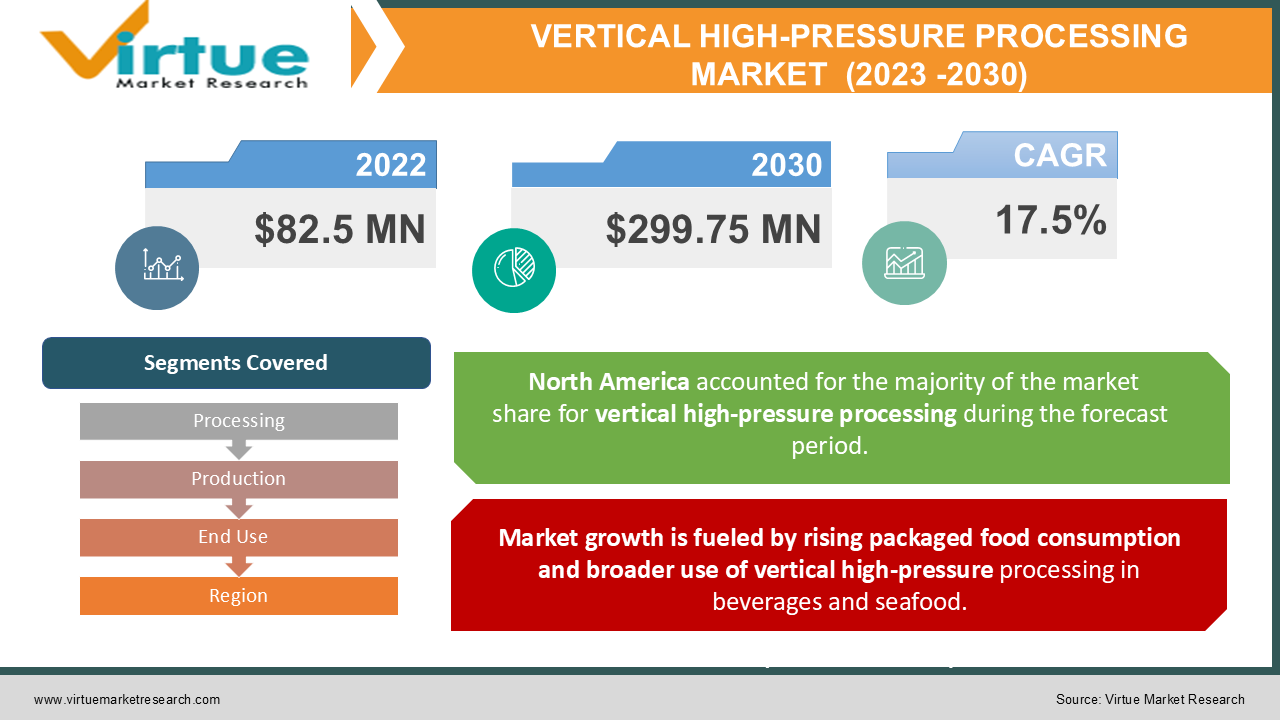

In 2022, the Global Vertical High-Pressure Processing (HPP) Market was valued at USD 82.5 million and is projected to reach a market size of USD 299.75 million by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 17.5%. The growth of the market is being driven by an increase in the consumption of packaged foods, expanding applications of vertical high-pressure processing in beverages, technological advancements in the food processing sector, and greater investment by major corporations. Shorter processing times, fewer heat damage issues, and preservation of food products' color, flavor, and freshness are just a few advantages HPP has over other processing techniques that are driving up market demand.

Industry Overview:

The vertical high-pressure technique is based on the concept of pascalization, which is the process of sterilizing food by putting it under high pressure to prevent the enzymatic breakdown of food owing to microbial contamination. High pressure is used in this procedure to inactivate specific microorganisms that might cause food spoiling and, as a result, adversely affect consumer health when consumed. By avoiding microbiological contamination, the high-pressure processing technique primarily helps to deliver biologically safe food. Food products are processed to guard against contamination from vegetative microorganisms, fungi, and food-borne viruses. Depending on the enzymes that a specific food contains, the pressure applied to different foods varies from 200 MPa to 1,000 MPa, ideally for 20 minutes. Food is often processed using one of two methods: batch processing, which involves processing a large number of items at once, or semi-continuous processing, which involves moving the product from stage to stage. The most popular food safety technique for many companies is high-pressure processing equipment, which enables retailers to offer goods that are hygienic, safe, and of the highest quality. Proteins, bioactive substances, and other enzyme products are all processed using high-pressure machinery. Using the machinery, safer, more wholesome, and tastier food can be produced. Many multinational companies are implementing new and enhanced technologies to increase HPP packaging for various materials. Additionally, governments around the world are putting forward measures to meet the demand for HPP packaging. For effective processing of food products, this has led to an increase in demand for vertical high-pressure processing equipment. The increase in demand for high-pressure applications in a variety of products, including fruit, vegetables, nuts, and baby food, is one of the main drivers influencing the market for high-pressure processing equipment. Additionally, the global market for high-pressure processing equipment is positively impacted by macroeconomic variables such as changing lifestyles and an increase in packaged food demand. Other factors are likely to moderate the market's growth rate, such as increased production of ready-to-cook meat and the busy lifestyles of consumers. The market for high-pressure processing equipment is likely to experience rapid growth due to rising disposable income and urbanization.

COVID-19 pandemic impact on the Vertical High-Pressure Processing (HPP) Market

The COVID 19 outbreak has hampered the expansion of the high-pressure processing equipment business due to lockdown measures in several countries and delays in the manufacture and production of a wide range of high-pressure processing equipment. Additionally, the COVID-19 pandemic has halted production and sales of a variety of goods in the ship loader and unloader industry, mostly because key nations around the world, such as the U.S., Italy, and the UK, were under a prolonged lockdown. The market for high-pressure processing equipment has been considerably affected by this.

MARKET DRIVERS:

Market growth is fueled by rising packaged food consumption and broader use of vertical high-pressure processing in beverages and seafood.

The increased demand for ready meals has resulted in a sharp rise in the demand for packaged foods. The demand for high-pressure processing technology has grown as a result of the rise in packaged food demand, which is fueling the market's expansion. Around the world, there has been a significant rise in the demand for natural, minimally processed, clean-label, and super-premium juices. To meet the challenges of maintaining the natural flavor and composition, ensuring food safety, and extending shelf life, several juice-producing companies are investing in HPP systems. The high-pressure processing technology is used to preserve and sterilize food products by inactivating specific microbes and enzymes. People's eating habits are changing in several developing nations, and more packaged goods are being purchased. The food business is concentrating on keeping the sensory qualities of food after processing it in high-pressure processing equipment.

The market demand is being fueled by HPP's benefits over other processing methods

HPP provides various benefits over other processing methods, such as shorter processing times, less heat damage issues, and preservation of food products' color, flavor, and freshness. In comparison to conventional heat procedures, there is no vitamin C loss and a reduction in other functional alterations. In comparison to existing technologies, HPP would increase the shelf life of pumpable goods, use less energy, and process them more efficiently. While the nutritive components, such as vitamins, antioxidants, colors, and tastes, are unaffected by the processing time, bacteria and enzymes that were inactivated at low temperatures would be eliminated. Due to microbiological contamination being avoided by HPP, fewer chemical preservatives are required.

Technological developments in the food processing industry, increased investment by the major companies, and government initiatives are driving the market's expansion

The major players in the food processing business are concentrating on creating cutting-edge technology to extend the shelf life and preserve the nutritional value of processed meals. The demand for high-pressure processing technology, also known as pascalization, is being driven by the increasing attention being paid to innovative technologies. Pascalization effectively inactivates vegetative microorganisms while preserving the food's nutritional value and protecting it from food-borne illnesses. Manufacturers of food and beverages can now match consumer requests for fresher, less-processed foods with longer shelf lives. Manufacturers of HPP systems are concentrating on the creation of creative automation solutions. Robotic arms are used to load and unload certain HPP systems. Governments from various regions regularly offer new programs to support pressure-controlled food packing techniques. The main goal of this is to limit the need for chemical preservatives to prevent microbiological infections.

MARKET RESTRAINTS:

High equipment cost is a major challenge that can impede vertical HPP market growth during the projected period

The high price of high-pressure processing equipment and the fluctuating price of raw materials restrain market expansion for vertical high-pressure processing equipment. The high cost of capital equipment and its variable operational costs has, up until now, served as a major barrier to the wider adoption of the technologies involved in ultra-high pressure processing. In comparison to commonly used techniques like heat sterilization, vertical HPP needs a significant expenditure. Additionally, it is anticipated that the superior characteristics of horizontal high-pressure processing equipment, which can operate higher volumes while providing a higher throughput than vertical HPP, may limit the adoption rate of vertical HPP.

Manufacturers face challenges with packaged food items' moisture content and in-package processing

A lack of practical understanding of the interactions between various food ingredients, problems with packing, shelf life, and high pressure can impede market growth. The resulting product's ability to maintain textural integrity must be assessed by manufacturers who use high-pressure processing. If manufacturers can appropriately balance the pressure exposure for each type of product, textural integrity can be maintained. The selection of materials and the design of the shelf life will be different for HPP-processed goods since they are prepared to have fresher qualities than standard thermally processed foods, and they typically feature high-barrier packaging alternatives. For batch processed foods, semi-rigid packaging such as trays or cups with flexible lids are an option, however, if the process is to be carried out inside the container, at least one part of the packaging needs to be able to be flexible concerning pressure. For in-package HPP processing, rigid packaging made of glass or metal is not appropriate.

VERTICAL HIGH-PRESSURE PROCESSING (HPP) MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

17.5% |

|

Segments Covered |

By Processing, Production, End Use and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

All Natural Freshness, American Pasteurization Company (APC),Astra Foods, Calavo Grower, Campofrío, Bay Grove,Cargill Meat Solutions, Fonterra Coop. Group. |

This research report on the global Vertical High-Pressure Processing (HPP) Market has been segmented based on processing, production, end-use, and region.

Vertical High-Pressure Processing (HPP) Market – By Processing

-

Continuous processing

-

Semi-continuous processing

Based on Processing, the Vertical High-Pressure Processing (HPP) Market is bifurcated into Continuous processing and semi-continuous processing. Semi-continuous process systems may include several components. Typically, there are two or more pressure vessels, a low-pressure filling pump, a high-pressure transfer pump, holding and sterilized tanks, and control valves. A freely moving divider piston is included in the pressure vessels to separate the product from the pressurizing fluid. Controlling valves are made to prevent cross-contamination between the upcoming untreated product and the treated product

In Continuous processing, fluid products are pumped through a system that intensifies their pressure to above 100 Mpa using one or more intensifiers. The fluid is then passed through a pressure release component, where it may experience shearing, cavitation, or frictional effects depending on the geometry of the component. These effects, along with those of the initial pressurization, may help to inactivate microorganisms and affect the functional characteristics of the fluid's constituent parts.

Vertical High-Pressure Processing (HPP) Market – By Production

-

Meat products

-

Seafood

-

Vegetable products

-

Beverage

Based on Production, the Vertical High-Pressure Processing (HPP) Market is bifurcated into Meat products, Seafood, Vegetable products, and Beverages. The fruits and vegetable segment leads the market due to their high perishability, which increases the demand for HPP equipment. Due to the increased adoption of the technology by leading organizations for the processing of packaged beverages, the juice & beverages category is predicted to grow at a significant CAGR during the projection period. HPP systems can be used for pumpable goods like infant food, guacamole, or fruit juices and purees that can then be packed in a hygienic way. The market's expansion is being further fueled by the small manufacturing enterprises' increasing adaptability.

Vertical High-Pressure Processing (HPP) Market – By End Use

-

Commercial

-

Industrial

Based on End Use, the Vertical High-Pressure Processing (HPP) Market is bifurcated into Commercial and Industrial. HPP has been effective in the food sector and in meeting consumer demand for fresh processed foods as an innovative food preservation technology. Due to its natural alternative to conventional food industry processing, HPP is anticipated to be widely used. In comparison to heat processing, HPP preserves greater flavor, color, and nutritional components. HPP is a beneficial method for protecting food from undesired enzymes and potentially hazardous microbes while also maintaining beneficial substances like probiotics, antioxidants, and lactoferrin.

Vertical High-Pressure Processing (HPP) Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

Geographically, North America is anticipated to dominate the Vertical High-Pressure Processing (HPP) market as food processing technologies are increasingly being adopted in this region and people are increasingly choosing packaged foods. The shift in customer preferences toward purchasing foods with longer shelf lives is driving the demand for effective pressure processing machinery. The region's increasing use of novel food processing technologies, the demand for pasteurization in the food sector to preserve and sterilize food products, and the growing popularity of processed foods among the working population are all contributing to the regional growth of the market. The High-PressurePressure Processing Market is expanding as a result of the presence of major players in the region.

Europe is anticipated to account for a significant market share due to the growing demand for processed foods from nations like the United Kingdom, France, Germany, and Italy among others.

The Asia Pacific Vertical High-Pressure Processing market is anticipated to increase with a CAGR of 13.5% during the projected period. This market is expanding as a result of rising consumer demand for ready meals, significant investments by major companies in the development of cutting-edge processing technologies, and a shift in consumer lifestyle toward more fast food habits.

The vertical high-pressure processing market in Latin America and the Middle East and Africa is predicted to grow moderately owing to the increased awareness of the advantages of vertical high-pressure processing over pasteurized foods.

Major Players in the Market

The major players operating in the Vertical High-Pressure Processing (HPP) Market are

-

All Natural Freshness

-

American Pasteurization Company (APC)

-

Astra Foods

-

Calavo Grower

-

Campofrío

-

Bay Grove

-

Cargill Meat Solutions

-

Fonterra Coop. Group.

Notable happenings in the Vertical High-Pressure Processing (HPP) Market in the recent past:

-

Expansion- In February 2021, Thyssenkrupp AG opened the largest HPP center in Germany in Quakenbrück to satisfy the ongoing demand for minimally processed, high-quality foods and to give customers access to a range of services.

-

Product Launch- In August 2021, JBT-Avure introduced the flexibulk, a brand-new bulk high-pressure pasteurization technique. The new FlexiBulk, which has a patent application pending, is truly revolutionary because it can HPP both individually packaged products and food and beverage bulk products at the same time, enables filling HPP'd products in a variety of container options (including cans and reusable bags, bottles and cartons), and is the fastest and most effective bulk HPP machine in the world with fill speeds up to 55 gallons per minute.

-

Product Launch- In September 2021, Quintus Technologies, which has been at the forefront of high-pressure technology development for more than 75 years, announced its re-entry into the food and beverage high-pressure processing (HPP) markets through the use of cutting-edge new HPP equipment and specialized service solutions.

-

Expansion- In November 2020, Hiperbaric, a leader in HPP equipment for the food sector, announced the development of its facilities for commercial machinery used for post-processing metal components.

Chapter 1. Vertical High-Pressure Processing (HPP) Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Vertical High-Pressure Processing (HPP) Market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2027) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2022 - 2027

2.3.2. Impact on Supply – Demand

Chapter 3. Vertical High-Pressure Processing (HPP) Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Vertical High-Pressure Processing (HPP) Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Vertical High-Pressure Processing (HPP) Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Vertical High-Pressure Processing (HPP) Market – By Processing

6.1. Continuous processing

6.2. Semi-continuous processing

Chapter 7. Vertical High-Pressure Processing (HPP) Market – By Production

7.1. Meat products

7.2. Seafood

7.3. Vegetable products

7.4. Beverage

Chapter 8. Vertical High-Pressure Processing (HPP) Market – By End Use

8.1. Commercial

8.2. Industrial

Chapter 9. Vertical High-Pressure Processing (HPP) Market- By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. Vertical High-Pressure Processing (HPP) Market – key players

10.1 All Natural Freshness

10.2 American Pasteurization Company (APC)

10.3 Astra Foods

10.4 Calavo Grower

10.5 Campofrío

10.6 Bay Grove

10.7 Cargill Meat Solutions

10.8 Fonterra Coop. Group.

Download Sample

Choose License Type

2500

4250

5250

6900