Vending Machines Market Size (2024 – 2030)

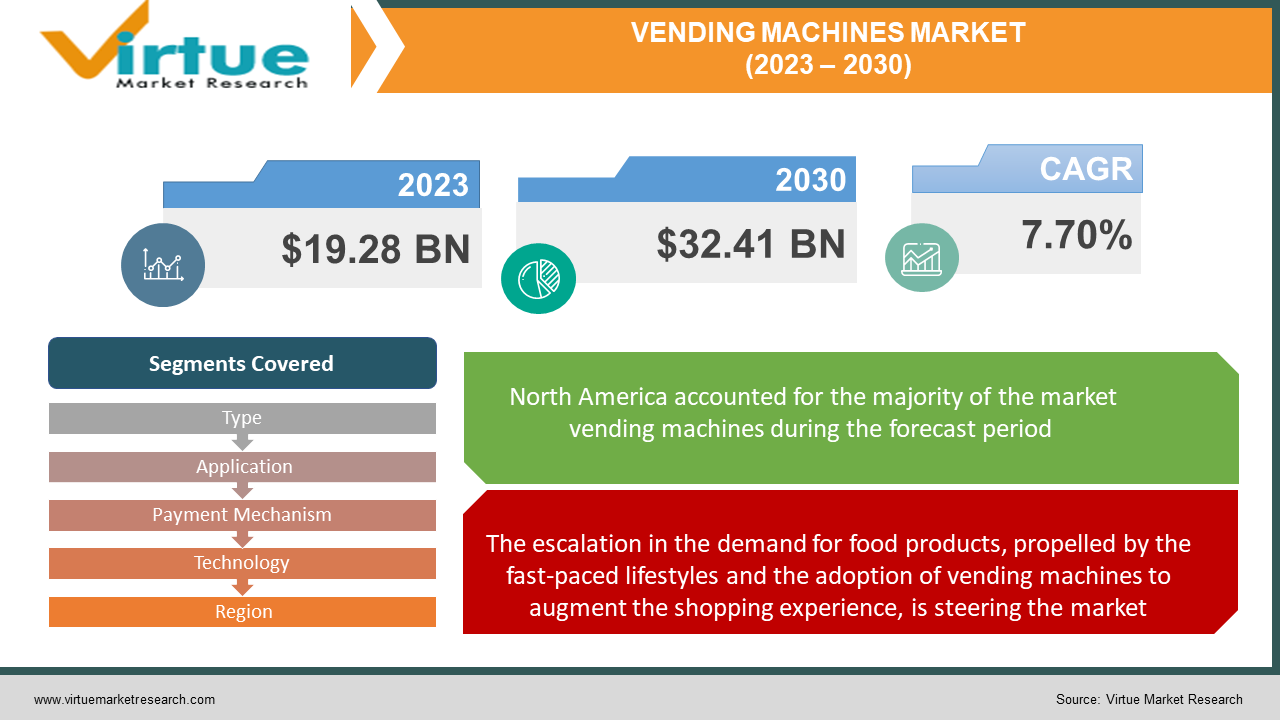

The Global Vending Machines Market reached USD 19.28 Billion in 2023 and is projected to witness lucrative growth by reaching up to USD 32.41 Billion by 2030. The market is growing at a CAGR of 7.70% during the forecast period (2024-2030).

A vending apparatus is utilized for the automated dispensing of stored items, encompassing packaged edibles, beverages, and tobacco products, in exchange for inserted coins or tokens. This automated dispensing process operates without the need for human intervention, thereby saving valuable time. Such machines are commonly found in bustling urban areas, where the rapid pace of life is prevalent. Apart from the mere dispensing function, vending machines actively engage consumers through touch-screen controls, video, audio, scent, gesture-based interaction, and cashless payment options. The versatile applications of these products extend to hotels, restaurants, corporate offices, public spaces, contributing to the expansion of the vending machine market.

The market's growth is fueled by the escalating demand for food vending machines in office and institutional settings, an upsurge in the consumption of convenience food items, and the integration of intelligent customer service technologies across various food categories. In recent years, the demand for these machines has risen substantially, amplified by the introduction of cashless payment systems that have gained widespread traction globally. Additionally, the burgeoning trend of urbanization and the concurrent increase in disposable income have further propelled the expansion of the vending machine market. However, governmental restrictions in various regions, particularly in educational institutions like schools and colleges, have curtailed the use of food and beverage vending machines, limiting their demand.

Key Market Insights:

The vending machine market is undergoing significant growth, primarily driven by the emergence of automated and versatile vending solutions. Modern consumers, seeking efficient and convenient options to align with their fast-paced lifestyles, are increasingly turning to automated beverage solutions. Recent advancements in vending machine technology have been tailored to meet these evolving demands, introducing machines that provide multiple dispensing options simultaneously, coupled with enhanced multi-functionality. These innovations streamline the shopping experience, catering to consumer needs and contributing substantially to the growth of the vending machine market. Furthermore, the surging demand for vending machines in diverse commercial settings such as hotels, airports, shopping malls, markets, and factories, spurred by the global proliferation of business centers, is a key factor propelling market growth.

Global Vending Machines Market Drivers:

The escalation in the demand for food products, propelled by the fast-paced lifestyles and the adoption of vending machines to augment the shopping experience, is steering the market.

Vending machines, renowned for their portability and prompt delivery, emerge as a highly convenient choice for consumers seeking to procure food and beverages. The contemporary surge in the need for readily accessible food, attributed to busy consumer lifestyles, urbanization, and analogous behavioral patterns, has significantly heightened the demand for vending machines. Beyond food items, vending machines facilitate the purchase of non-food products such as toiletries, stamps, newspapers, tickets, and other compact items, further contributing to their widespread adoption. Moreover, the prevalence of digital payment and cashless options in vending machines, as opposed to traditional cash transactions, has further intensified their appeal.

Manufacturers are actively engaged in the development and deployment of vending machines leveraging the Internet of Things (IoT). This integration facilitates real-time data collection, offering an end-to-end IoT solution for enhanced machine monitoring. Consequently, the ability to gather consumer experience and expectations has improved, culminating in an enhanced purchasing experience. The sector's commitment to continuous innovation and technological advancements caters to evolving consumer behavior by providing contemporary, on-the-go solutions. Features like speech recognition, interactive display systems, and the incorporation of big data have significantly enhanced the convenience and user-friendliness of vending machines, positively influencing their demand.

Global Vending Machines Market Restraints and Challenges:

The restriction on the sale of tobacco products poses a challenge to market growth.

In several countries, including India and Thailand, the sale of tobacco goods through vending machines is prohibited. Stringent regulations governing the sale of unhealthy and tobacco-related items in public spaces, educational institutions, and the majority of commercial establishments are anticipated to impede the market growth of vending machines. Smoking bans in various public locations, such as educational institutions, hospitals, government facilities, and public transportation, contribute to these challenges. While certain exemptions exist, such as designated smoking areas in airports, hotels with over 30 rooms, and restaurants with more than 30 seats, the prohibition of smoking in outdoor areas like stadiums, train stations, open auditoriums, and bus stops hinders the expansion of the global vending machine market.

Global Vending Machines Market Opportunities:

The burgeoning demand for vending machines in the retail industry creates substantial market opportunities. Modern consumers seek a convenient and personalized buying experience, prompting companies to innovate and offer solutions beyond traditional store locations. The adoption of wireless solutions, facilitated by the Internet of Things (IoT), empowers retailers to conduct transactions anywhere, enhancing customer satisfaction while simultaneously boosting revenues and reducing overall expenses. IoT integration enables vending machine operators to respond efficiently to consumer demand, thereby enhancing operational efficiency. Practical benefits, such as real-time data utilization for customer interaction, dynamic pricing for profit maximization, increased security to mitigate tampering and product loss, and monitoring environmental conditions for perishable food items, position vending machines as valuable assets for expansion in the retail business.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.70% |

|

Segments Covered |

By Type, Application, Payment Mechanism, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Jofemar S.A., Royal Vendors, Inc., Fuji Electric Co., Ltd, Crane Company, SandenVendo America, Inc., Azkoyen S.A., Bianchi Industry Spa, Seaga Manufacturing Inc., Fastcorp Vending LLC, Selecta Group B.V. |

Global Vending Machines Market Segmentation: By Type

-

Food Vending Machine

-

Beverages Vending Machine

-

Tobacco Vending Machine

-

Others Vending Machine

In 2023, the beverage vending machine category dominated the market with a 42% share. Trends within this segment are shifting towards offering healthier alternatives, like low-sugar drinks, herbal-infused waters, and specialty coffees. There's also an increasing emphasis on customization, allowing consumers to tailor their beverage choices by selecting different flavors, milk types, and sugar quantities. These trends demonstrate a shift in consumer preferences towards more health-conscious and personalized beverage options in vending machines.

The food vending machine segment is projected to grow at a notable CAGR of 7.9% during the forecast period. Current trends in this segment showcase an evolution towards providing a variety of healthier food options, meeting the increasing consumer demand for nutritious alternatives. Additionally, technological advancements like touch-free interfaces and digital payments have improved user experiences in purchasing food, aligning with the broader trend of contactless interactions in the post-pandemic era.

Global Vending Machines Market Segmentation: By Application

-

Hotels and Restaurants

-

Corporate Offices

-

Public Places

-

Others

In 2023, the hotels and restaurants segment accounted for a 40% share of the market revenue. This segment primarily involves placing vending machines within hospitality venues to offer an assortment of snacks, drinks, and convenience items to guests. Current trends include a focus on premium and tailor-made vending solutions to elevate the guest experience, with gourmet snacks, artisan drinks, and quality toiletries in luxury hotels, and restaurants incorporating vending machines for contactless payment and order collection, streamlining service and enhancing safety in a post-pandemic context.

The public places segment is expected to show the most rapid growth during the forecast period. In vending machines, public places typically refer to locations like airports, train stations, shopping centers, and transit hubs. Emerging trends in this sector include the adoption of technological enhancements for user experience, such as touch-free payment methods and interactive displays, and a rising demand for healthier vending options. Vending machine operators are increasingly focusing on eco-friendly solutions in response to environmental concerns, adapting to the evolving needs and preferences of consumers in public spaces.

Global Vending Machines Market Segmentation: By Payment Mechanism

-

Cash-Based Vending Machine

-

Cashless-Based Vending Machine

The market segmentation consists of Cash-Based and Cashless-Based Vending Machines. Cash-based machines still capture a significant market portion, catering to users who lack access to digital payment methods or prefer traditional transactions. They accept coins and banknotes, serving a diverse customer base including tourists and individuals who favor cash for small purchases. This segment remains particularly strong in areas with higher cash transaction rates or less developed digital payment infrastructures.

The cashless vending machine segment is witnessing substantial growth with the increasing prevalence of digital payment methods such as credit/debit cards, mobile wallets, and contactless payments. This segment appeals to consumers who prioritize speed, security, and convenience in transactions. With the trend towards a cashless society, these machines offer benefits like remote monitoring, transaction tracking, and potential loyalty programs. They often feature user-friendly interfaces and touchscreens, enhancing the vending experience.

Global Vending Machines Market Segmentation: By Technology

-

Automatic Machine

-

Semi-Automatic Machine

-

Smart Machine

The automatic machine segment led the market with a 55% share in 2022. Automatic vending machines, which dispense products upon receiving payment, are increasingly incorporating modern technologies like IoT integration, touchless controls, and digital payment options. These advancements are geared towards enhancing convenience for users and providing operators with efficient inventory management tools, reflecting the changing demands of contemporary consumers.

The smart machine segment is expected to grow rapidly during the forecast period. In the vending machine market, smart machines represent a technological leap, enhancing both operational efficiency and user experience. These machines incorporate features such as IoT connectivity, touchless interfaces, and data analytics. Current trends include the use of machine learning for predictive maintenance, real-time IoT monitoring, hygienic contactless payments, and personalized product suggestions. Smart vending machines are evolving to provide a streamlined, convenient, and data-driven retail experience, meeting the changing preferences of modern consumers.

Global Vending Machines Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is projected to experience growth during the forecast period. The region's market is driven by significant penetration of vending machine products and the presence of key industry players. The U.S., in particular, contributes significantly to the region's dominance in the vending machine sector, with the National Automatic Merchandising Association estimating a contribution of around USD 25 billion to the U.S. convenience service industry. Factors such as changing lifestyles and a high demand for ready-to-eat meals further stimulate the regional market.

The Asia-Pacific region is expected to register the fastest CAGR during the forecast period. The growth in the region's commercial and corporate sectors is bolstering product demand. The market is also benefiting from the introduction of innovative vending machines and the adoption of Western lifestyles. Increased disposable income is predicted to drive the market's expansion. The region's large customer base, urbanization, and a preference for vending machine food products contribute significantly to the market's growth.

COVID-19 Impact Analysis on the Global Industrial Wastewater Treatment Market:

The global vending machines market has experienced adverse effects due to the COVID-19 pandemic. The widespread concerns surrounding the pandemic have significantly and unfavorably impacted the global vending machine market. In 2020, in response to heightened demand and low supply trends, there was an escalation in prices and demand for vending machine products, reflecting the economic insecurity prevailing at the time. Temporary shortages in supply were anticipated due to disruptions in the shipping supply chain, leading to upward pressure on pricing in the short term.

Despite these challenges, key industry players have taken proactive measures to address the impact of COVID-19. Notably, vending machines equipped with COVID-19 protection products were introduced, positively influencing the market. These machines have the capability to dispense essential items such as face masks, single-use gloves, and bottles of hand sanitizer. An exemplary initiative in August 2021 involved SDSU and the University of California San Diego partnering to offer self-administered COVID-19 tests through vending machines to students, faculty, and staff. This innovative approach provides consumers with the option to avoid crowded clinics and circumvent appointment wait times.

Latest Trends/Developments:

- In a significant move in March 2023, Crane Company underwent separation from Crane Holdings, Co. Following this separation, Crane Company now operates as an independent, publicly traded entity, allowing it to focus more effectively on its business. This strategic decision positions the company to tailor its investment and capital allocation strategies to its two strategic growth platforms.

- Another notable development occurred in March 2022, with Fastcorp Vending LLC announcing a strategic partnership with ABsea Change Inc. The collaboration aims to drive the retail adoption of innovative smart vending platforms and technologies.

- On May 11, 2023, Azkoyen Group presented its most recent and innovative solutions in espresso, filter coffee, and fresh milk-based beverages to operators. Committed to providing cutting-edge solutions tailored to customer needs, Azkoyen Group introduced the patented micro-injection air technology (MIA). This technology allows the production of a diverse range of drinks with fresh milk, including cappuccinos and latte macchiatos, featuring silky and consistent foam, even with plant-based milks. Through such advancements, the company continues to promote coffee culture and develop new solutions for the Office Coffee Service (OCS) and on-the-go coffee industries.

Key Players:

-

Jofemar S.A.

-

Royal Vendors, Inc.

-

Fuji Electric Co., Ltd

-

Crane Company

-

SandenVendo America, Inc.

-

Azkoyen S.A.

-

Bianchi Industry Spa

-

Seaga Manufacturing Inc.

-

Fastcorp Vending LLC

-

Selecta Group B.V.

Chapter 1. Vending Machines Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Vending Machines Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Vending Machines Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Vending Machines Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Vending Machines Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Vending Machines Market – By Type

6.1 Introduction/Key Findings

6.2 Food Vending Machine

6.3 Beverages Vending Machine

6.4 Tobacco Vending Machine

6.5 Others Vending Machine

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Vending Machines Market – By Application

7.1 Introduction/Key Findings

7.2 Hotels and Restaurants

7.3 Corporate Offices

7.4 Public Places

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Vending Machines Market – By Payment Mechanism

8.1 Introduction/Key Findings

8.2 Cash-Based Vending Machine

8.3 Cashless-Based Vending Machine

8.4 Y-O-Y Growth trend Analysis By Payment Mechanism

8.5 Absolute $ Opportunity Analysis By Payment Mechanism, 2024-2030

Chapter 9. Vending Machines Market – By Technology

9.1 Introduction/Key Findings

9.2 Automatic Machine

9.3 Semi-Automatic Machine

9.4 Smart Machine Y-O-Y Growth trend Analysis By Technology

9.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 10. Vending Machines Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Application

10.1.3 By Payment Mechanism

10.1.4 By Technology

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Application

10.2.4 By Payment Mechanism

10.2.5 By Technology

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Application

10.3.4 By Payment Mechanism

10.3.5 By Technology

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Application

10.4.4 By Payment Mechanism

10.4.5 By Technology

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Application

10.5.4 By Payment Mechanism

10.5.5 By Technology

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Vending Machines Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Jofemar S.A.

11.2 Royal Vendors, Inc.

11.3 Fuji Electric Co., Ltd

11.4 Crane Company

11.5 SandenVendo America, Inc.

11.6 Azkoyen S.A.

11.7 Bianchi Industry Spa

11.8 Seaga Manufacturing Inc.

11.9 Fastcorp Vending LLC

11.10 Selecta Group B.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Vending Machines Market size is valued at USD 19.28 Billion in 2023.

The worldwide Global Vending Machines Market growth is estimated to be 7.70% from 2024 to 2030.

The Global Vending Machines Market is segmented by Type (Food Vending Machine, Beverages Vending Machine, Tobacco Vending Machine, Others Vending Machine), by Application (Hotels and Restaurants, Corporate Offices, Public Places, Others), by Technology (Automatic Machine, Semi-Automatic Machine, Smart Machine), by Payment Mechanism (Cash-Based Vending Machine, Cashless-Based Vending Machine).

The global vending machine market is changing as more intelligent, networked devices with contactless payment capabilities and a wide range of products are introduced. Customised vending systems, healthier food selections, and the use of artificial intelligence for data-driven insights that improve customer experience and spur market expansion present opportunities.

The global vending machine market is seeing an acceleration of trends that prioritise cleanliness and contactless purchases due to the COVID-19 epidemic. The business has changed, encouraging a more convenient and safe shopping experience for customers. This is due to the rise in demand for necessities from vending machines and the emphasis on digital payment methods.