Vascular Embolotherapy Market Size (2023-2030)

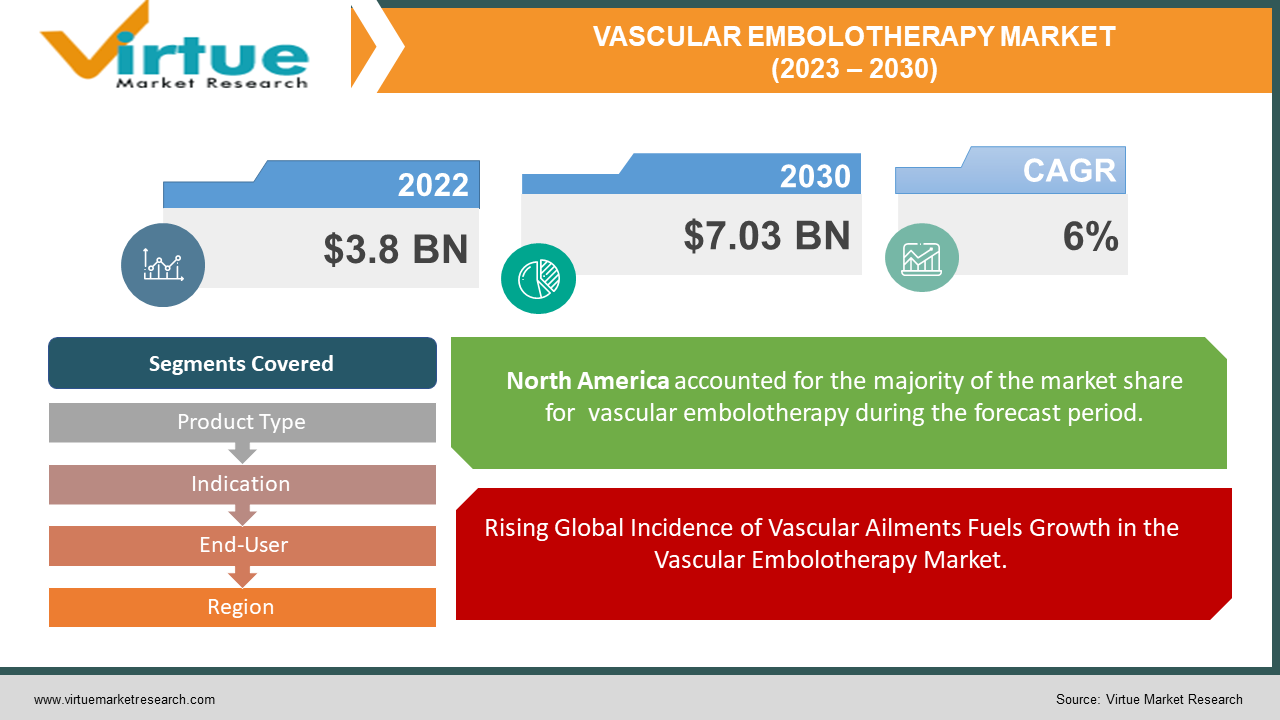

The Global Vascular Embolotherapy Market was estimated to be worth USD 3.8 Billion in 2022 and is projected to reach a value of USD 7.03 Billion by 2030, growing at a CAGR of 6% during the outlook period 2023-2030.

In contrast, to open surgery, embolization is a less invasive treatment that plugs one or more blood arteries or unusual vascular pathways. Blood vessel blockage is made possible via embolization techniques, preventing invasive surgery. Embolization is a procedure that can stop arterial bleeding as well as restrict blood arteries for various purposes, such as treating malignancies, rerouting blood flow, or reducing vascular abnormalities, among others. In interventional radiology, embolization is a common and effective technique. Vascular embolization providers employ the power of mechanical occlusion to stop the flow of blood via a blood artery or vascular area. Vascular embolization agents provide several advantages, including a high success rate, seldom use of generic anesthetics, faster recovery times, a low risk of infection, and no scarring. Market participants are expected to see a huge increase thanks to rising demand for less invasive procedures. For instance, according to the American College of Cardiology, in the United States, around 1.2 million angioplasties were performed in a single year in 2020. Additionally, a sizable patient group is projected to be drawn in by hospitals' high levels of accessibility and cost compared to specialty clinics. The primary driving forces behind the development of the global vascular embolotherapy market are the rising prevalence of vascular illnesses, technical advancements in embolization products and procedures, increasing research and development efforts, and a growing desire for less invasive methods. The rise in minimally invasive procedures combined with rising rates of peripheral vascular diseases, liver cancer, strokes, and uterine fibroids, as well as rising public-private organization research funding, grants, and investment, will drive the market's expansion over the coming years.

Global Vascular Embolotherapy Market Drivers:

Rising Global Incidence of Vascular Ailments Fuels Growth in the Vascular Embolotherapy Market:

Global vascular disease incidence is expected to rise throughout the course of the projected period, driving the growth of the global vascular embolotherapy market. Any situation that affects the blood vessel community is a vascular disease. They can be severe and are common. For instance, according to the World Health Organization (WHO), cardiovascular diseases (CVDs) claim an estimated 17.9 million lives annually, making them the leading cause of mortality worldwide. This accounts for 35% of fatalities worldwide.

Embolization Products and Strategies: Driving Growth in the Vascular Embolotherapy Market:

Over the projected period, it is predicted that improvements in embolization products and tactics will fuel even greater growth in the global vascular embolotherapy market. For instance, Terumo Medical Corporation announced the debut of its AZUR Vascular Plugin in July 2021. It is the first and only plug-like device with a micro-catheter to occlude arteries with a diameter of up to 8 mm. The new component of Terumo's reliable embolization portfolio is suggested for usage to reduce or stop the rate of blood drift in peripheral vascular arteries.

Global Vascular Embolotherapy Market Challenges:

Vascular embolotherapy is characterized by elaborate processes and apparatus, which can make training and application difficult for medical personnel. Despite improvements, there is still little knowledge about vascular embolotherapy's advantages and accessibility among medical professionals and patients. This may limit the market's ability to expand. Products used in vascular embolotherapy must pass strict regulatory clearances and safety evaluations, which might delay product introductions and raise total development costs. There is a shortage of skilled surgeons (including radiologists and neurosurgeons) in the healthcare industry. By 2025, the US is expected to have a shortage of 41,000 general surgeons, according to the Association of American Medical Colleges (US) (Source: Association of American Medical Colleges US, 2017). By 2025, there will be a shortage of more than 2,300 medical oncologists in the US (Source: Journal of Global Oncology). Similarly to this, there is a severe lack of oncologists, radiotherapists, and surgical oncologists in India. There is just one oncologist for every 2,000 cancer patients in the nation, which has 1.8 million cancer patients. The adoption of embolotherapy techniques is anticipated to be impacted by the global scarcity of oncologists and radiologists. Various locations have various vascular embolotherapy reimbursement regulations and coverage, which causes confusion and financial hardship for patients and healthcare professionals alike.

COVID-19 Impact on Global Vascular Embolotherapy Market:

The pandemic caused a huge disruption in the world's healthcare systems, postponing or cancelling a large number of non-emergency operations and surgeries. As a result, the demand for vascular embolotherapy operations temporarily decreased. The epidemic made it clear how crucial it is to cut down on hospital stays and infection risks. As a result, the importance of minimally invasive techniques, such as vascular embolotherapy, as alternatives to more invasive operations has grown. The market may eventually be driven by this movement in preferences. Before the outbreak in Wuhan (China) in December 2019, COVID-19 was mostly unknown but quickly turned into a global epidemic. The COVID-19 epidemic has increased the strain on the world's healthcare systems. Companies increased their R&D efforts to develop vaccinations and medications to combat the virus. The COVID-19 epidemic had an effect on the market for vascular embolotherapy since hospitals' and doctors' access to care for people with non-COVID symptoms had been severely curtailed owing to social exclusion policies implemented worldwide. The pandemic caused a huge disruption in the world's healthcare systems, postponing or cancelling a large number of non-emergency operations and surgeries. As a result, the demand for vascular embolotherapy operations temporarily decreased. Increased Focus on Minimally Invasive Therapies: The pandemic brought to light the value of lowering hospital stays and infection risk. As a result, the importance of minimally invasive techniques, such as vascular embolotherapy, as alternatives to more invasive operations has grown. The market may eventually be driven by this movement in preferences.

Global Vascular Embolotherapy Market Recent Developments:

-

In March 2022, Expanding the vascular embolotherapy indications has been the subject of continuing research and development. The use of embolization procedures in the treatment of liver cancer, uterine fibroids, and benign prostatic hyperplasia (BPH) are some of the novel applications that businesses have looked into. These innovations seek to offer less intrusive alternatives to conventional treatment modalities.

-

In October 2023, The first radiofrequency balloon ablation catheter, the HELIOSTARTM Balloon Ablation Catheter, has been launched in Europe, according to Biosense Webster, Inc., a division of Johnson & Johnson MedTech.

-

In September 2021, The ICEfx Cryoablation System, a minimally invasive tool used to treat tumors and other vascular problems, was introduced by BTG International. By freezing tissue with liquid nitrogen, the gadget stops blood flow and kills aberrant cells.

VASCULAR EMBOLOTHERAPY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Product Type, Indication, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Terumo Corporation, Medtronic plc, BTG International Ltd. (Part of Boston Scientific Corporation), Stryker Corporation, Cook Medical Inc., Merit Medical Systems Inc., Johnson & Johnson (Cerenovus), Penumbra Inc., Boston Scientific Corporation, Cardinal Health Inc. |

Global Vascular Embolotherapy Market Segmentation: By Product Type

-

Microspheres

-

Embolic coils

-

Embolic Plug Systems

-

Detachable Ballons

-

Liquid Embolic Agents

-

Others

Small, spherical particles called microspheres are employed in embolization operations to stop or limit blood flow to certain locations. They are frequently constructed from biocompatible substances like gelatin or acrylic. Small metallic coils or wires called embolic coils are inserted into blood arteries to encourage clotting and stop blood flow. They are often employed in the management of vascular abnormalities and aneurysms. Devices called embolic plug systems are made to physically block off blood vessels or shunts. To stop the blood flow, these systems may use plug-like devices that are inserted through catheters. Inflatable devices called detachable balloons can be put into blood arteries and used to either temporarily or permanently obstruct blood flow. They are frequently employed in the management of aneurysms and arteriovenous malformations. Injectable compounds called liquid embolic agents are used to obstruct blood arteries. These substances have the potential to harden or polymerize after injection, thereby obstructing blood flow.

Global Vascular Embolotherapy Market Segmentation: By Indication

-

Peripheral Vascular Disease

-

Neurovascular Disease

-

Oncology

-

Uterine Fibroids

-

Varicocele

-

Others

The treatment of diseases that affect the peripheral arteries, includes arteriovenous malformations (AVMs), deep vein thrombosis (DVT), and peripheral arterial disease (PAD). Techniques for vascular embolotherapy are applied to occlude or stop blood flow in the damaged arteries. the treatment of diseases that damage the brain's and central nervous system's blood vessels. Arteriovenous malformations (AVMs), intracranial aneurysms, and other neurovascular diseases are all treated with vascular embolotherapy. In the field of interventional oncology, vascular embolotherapy is essential. The blood supply to tumors is blocked by embolic agents, denying them nutrition and causing tumor necrosis or shrinking. This method is frequently used to treat solid tumors including liver cancer (hepatic embolization), renal cancer, and others. A minimally invasive alternative to surgical excision of fibroids is vascular embolization, sometimes referred to as uterine fibroid embolization (UFE) or uterine artery embolization (UAE). It includes restricting blood supply to the fibroids, which causes them to contract and relieves symptoms.

Global Vascular Embolotherapy Market Segmentation: By End-User

-

Hospitals

-

Clinics

-

Ambulatory surgical centers

-

Others

Patients in hospitals are the most common recipients of vascular embolotherapy treatments. They have the facilities, trained medical personnel, and equipment to carry out even the most intricate embolization treatments. Hospitals represent a sizable portion of the market because of the variety of embolization treatments they offer and the volume of patients they serve. The vascular embolotherapy industry also includes clinics, both general and specialist, as well as outpatient facilities. Outpatient treatment is provided by these clinics, which may have a specialized specialization like interventional radiology or vascular surgery. Patients who need embolization procedures that do not need hospitalization will appreciate their accessibility and ease of use. Same-day surgical techniques, such as vascular embolotherapy, are available at ASCs, or ambulatory surgery centers. The high quality of care provided at a low cost is what has made ASCs so popular. For those in need of less involved embolization treatments, these clinics are a great option for hospitals.

Global Vascular Embolotherapy Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

North America, Europe, Asia-Pacific, South America, and the Middle East & Africa are the five main geographical categories that make up the embolotherapy market. The important factors driving the market expansion in this area are the growing presence of key market players in the region to seize the rising possibilities presented by these nations, as well as the improving healthcare infrastructure in the region and the huge patient population for target illnesses. The United States-based company Boston Scientific Corporation has a sizable part of the embolotherapy industry. To expand its customer base and product line, the corporation puts most of its efforts towards growth methods including acquisitions and expansions. The purchase of BTG has also contributed to the company's rising revenues and expanding market share. This is a key reason why Boston Scientific will be able to increase its selection of BTG products used in chemoembolization, radioembolization, and ablation treatments. Boston Scientific is persistent in its pursuit of governmental and insurance company approvals. The company's long-term growth plan includes expanding into and investing in fast-growing areas, such as the worldwide healthcare industry.

Global Vascular Embolotherapy Market Key Players:

-

Terumo Corporation

-

Medtronic plc

-

BTG International Ltd. (Part of Boston Scientific Corporation)

-

Stryker Corporation

-

Cook Medical Inc.

-

Merit Medical Systems Inc.

-

Johnson & Johnson (Cerenovus)

-

Penumbra Inc.

-

Boston Scientific Corporation

-

Cardinal Health Inc.

Chapter 1. VASCULAR EMBOLOTHERAPY MARKET - Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. VASCULAR EMBOLOTHERAPY MARKET - Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. VASCULAR EMBOLOTHERAPY MARKET - Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. VASCULAR EMBOLOTHERAPY MARKET - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. VASCULAR EMBOLOTHERAPY MARKET - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. VASCULAR EMBOLOTHERAPY MARKET - By Product Type

6.1 Microspheres

6.2 Embolic coils

6.3 Embolic Plug Systems

6.4 Detachable Ballons

6.5 Liquid Embolic Agents

6.6 Others

Chapter 7. VASCULAR EMBOLOTHERAPY MARKET - By Indication

7.1 Peripheral Vascular Disease

7.2 Neurovascular Disease

7.3 Oncology

7.4 Uterine Fibroids

7.5 Varicocele

7.6 Others

Chapter 8. VASCULAR EMBOLOTHERAPY MARKET - By End-User

8.1 Hospitals

8.2 Clinics

8.3 Ambulatory surgical centers

8.4 Others

Chapter 9. VASCULAR EMBOLOTHERAPY MARKET – By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Latin America

9.5 The Middle East

9.6 Africa

Chapter 10. VASCULAR EMBOLOTHERAPY MARKET – Key players

10.1 Terumo Corporation

10.2 Medtronic plc

10.3 BTG International Ltd. (Part of Boston Scientific Corporation)

10.4 Stryker Corporation

10.5 Cook Medical Inc.

10.6 Merit Medical Systems Inc.

10.7 Johnson & Johnson (Cerenovus)

10.8 Penumbra Inc.

10.9 Boston Scientific Corporation

10.10 Cardinal Health Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Vascular Embolotherapy Market was estimated to be worth USD 3.8 Billion in 2022 and is projected to reach a value of USD 7.03 Billion by 2030, growing at a CAGR of 6% during the outlook period 2023-2030.

The Global Vascular Embolotherapy Market is majorly driven by Increasing Prevalence of Vascular Diseases, Increasing Prevalence of Vascular Diseases, Increasing Prevalence of Vascular Diseases, Increasing Geriatric Population

The Segments under the Global Vascular Embolotherapy Market by Indication are Retail, Food and Beverage, and Pharmaceuticals.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Vascular Embolotherapy Market.

Terumo Corporation, Medtronic plc, and BTG International Ltd. are the three major leading players in the Global Vascular Embolotherapy Market.