USA Cards And Payments Market Size (2024-2030)

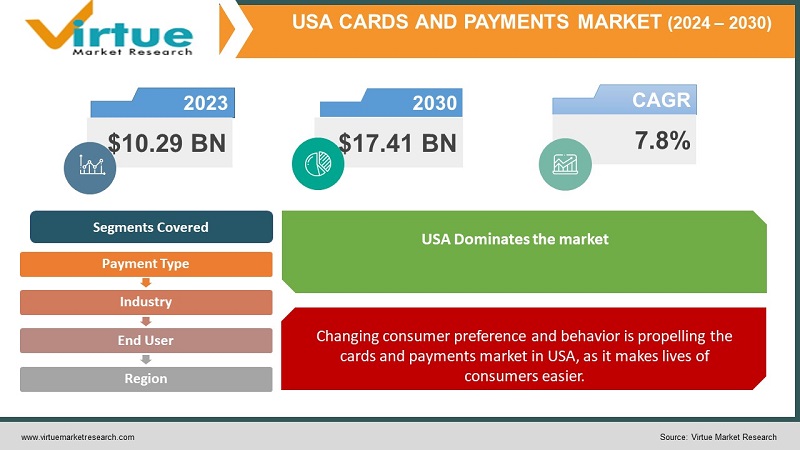

The USA Cards And Payments Market was valued at USD 10.29 Billion in 2023 and is projected to reach a market size of USD 17.41 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.8%.

The USA cards and payments market represents a dynamic and highly advanced landscape driven by widespread adoption of digital payment methods, including credit and debit cards, mobile wallets, and digital transfers. With a tech-savvy population and a robust financial infrastructure, the market continues to witness a shift from traditional cash transactions to electronic payments. Major players in the industry, including banks, fintech firms, and payment processors, constantly innovate to offer secure, convenient, and seamless payment experiences. The market's evolution includes increasing use of contactless payments, e-commerce growth, and the integration of emerging technologies like AI and blockchain, shaping the future of payments in the United States.

Key Market Insights:

The connectivity of financial institutions, households, and businesses in the United States relies significantly on interbank payment services like the ACH network and wire transfer systems. These services play a vital role in transferring funds securely from one bank account to another, forming the backbone of the financial system and contributing to overall economic stability.

The US e-commerce landscape stands out for its remarkable adoption rate, with approximately 78% of Americans embracing online shopping.

Amazon accounts for nearly half of all online sales in the country, while other prominent domestic retail brands are making substantial investments in digital offerings.

USA Cards and Payments Market Drivers:

Changing consumer preference and behavior is propelling the cards and payments market in USA, as it makes lives of consumers easier.

Consumer behavior and preferences play a pivotal role in shaping the payments market. The demand for convenience, security, and seamless transactions has driven the adoption of cards and digital payment methods. Consumers increasingly prefer the ease of using credit and debit cards, mobile wallets, and other digital payment solutions for in-store and online purchases. Moreover, the COVID-19 pandemic accelerated the shift towards contactless payments as consumers prioritize hygienic and touch-free payment options, further propelling the growth of digital transactions in the cards and payments market.

USA Cards And Payments Market Restraints and Challenges:

Security and Fraud Concerns is the biggest challenge hindering the growth of USA Cards and payments market.

As digital transactions increase, so do security threats and fraud risks. Cybersecurity remains a significant challenge for the market, with the potential for data breaches, identity theft, and unauthorized access to payment information. Maintaining robust security measures to protect sensitive data and financial transactions is a constant challenge, requiring continuous investment in advanced security technologies and protocols to stay ahead of evolving threats.

Regulatory and Compliance Complexity might pose challenges for businesses in cards and payments market.

The cards and payments industry is heavily regulated to ensure consumer protection, fair practices, and financial stability. Compliance with multiple regulations, including those related to data protection (such as GDPR and CCPA), payment processing standards (like PCI DSS), and evolving federal and state-level regulations, poses a challenge for industry players. Adapting to changing compliance requirements while maintaining operational efficiency and delivering seamless customer experiences can be complex and resource-intensive, particularly for smaller fintech firms or startups entering the market.

USA Cards And Payments Market Opportunities:

The USA cards and payments market presents promising opportunities fueled by the ongoing shift towards digital transactions, offering avenues for innovation, partnerships, and enhanced customer experiences. Advancements in technology, including contactless payments, mobile wallets, and the integration of AI-driven solutions, create openings for industry players to develop tailored, convenient, and secure payment solutions. Moreover, the growing trend of e-commerce, coupled with the evolving preferences of consumers for seamless and instant payment experiences, opens doors for businesses to capitalize on creating integrated and user-friendly payment ecosystems, thereby unlocking substantial growth potential within the market.

USA CARDS AND PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024- 2030 |

|

CAGR |

7.8% |

|

Segments Covered |

By Payment Type , Industry, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA |

|

Key Companies Profiled |

Visa Inc., Mastercard Incorporated, American Express Company, PayPal Holdings, Inc., Discover Financial Services, Square, Inc., JPMorgan Chase & Co., Apple Inc. (Apple Pay), Google LLC (Google Pay), Bank of America Corporation |

USA Cards And Payments Market Segmentation:

USA Cards And Payments Market Segmentation: By Payment Type:

- Credit Cards

- Debit Cards

- Prepaid Cards

- Contactless Payments

- Mobile Payments

- Online Payments

In the USA cards and payments market, the largest segment by payment type is the Credit Cards category having market share of 56%. Credit cards offer users the flexibility to make purchases while deferring payments, enabling consumers to manage cash flow efficiently. Credit cards often come with various rewards programs, cashback offers, and benefits like travel insurance or purchase protection, attracting consumers seeking added incentives. Moreover, the ease of access to credit, coupled with extensive acceptance at various merchants, contributes to the widespread usage and dominance of credit cards, making it the largest segment in the market. The fastest-growing segment by payment type is Contactless Payments. This surge can be attributed to changing consumer preferences, particularly post-pandemic, favoring quicker, more hygienic, and convenient transaction experiences. Contactless payments, facilitated by NFC technology embedded in cards and mobile wallets, eliminate physical contact during transactions, aligning with safety concerns. The accelerated adoption of contactless payments also stems from increased merchant acceptance, coupled with marketing efforts and incentives from financial institutions, encouraging both consumers and businesses to embrace this secure and efficient payment method.

USA Cards And Payments Market Segmentation: By Industry:

- Retail

- E-Commerce

- Hospitality & Travel

- Others

In the USA cards and payments market, the largest segment by industry is the E-Commerce sector holding significant share of 51%. This segment's prominence stems from the significant shift in consumer behavior towards online shopping and digital transactions. The rise of e-commerce platforms like Amazon, eBay, and various online retail outlets has propelled a surge in digital payments, as consumers increasingly prefer the convenience and accessibility of shopping from their homes or mobile devices. The COVID-19 pandemic further accelerated this trend, with lockdowns and social distancing measures prompting a dramatic increase in online shopping. The fastest-growing segment within the USA cards and payments market is also E-commerce. This accelerated growth is primarily attributed to the significant shift in consumer behavior towards online shopping, especially catalyzed by the COVID-19 pandemic. The increasing preference for convenience, coupled with the rise of digital marketplaces and the ease of making purchases online, has fueled the surge in e-commerce transactions. Consumers' inclination to use credit cards, debit cards, and digital wallets for online payments, along with the expansion of secure payment gateways and mobile payment options, has further boosted the e-commerce segment.

USA Cards And Payments Market Segmentation: By End User:

- Consumer Payments

- Business Payments

The largest segment in the USA cards and payments market by end user is Consumer Payments. This segment dominates primarily due to the sheer volume and frequency of transactions made by individual consumers for daily purchases, retail shopping, online shopping, and various personal expenses. Consumer payments encompass a wide spectrum of transactions, including those at retail stores, restaurants, online platforms, and other everyday services. The high frequency of these transactions, combined with the growing adoption of digital payment methods among consumers, contributes significantly to the substantial size and prominence of the Consumer Payments segment within the market. Consumer payments are also considered the fastest growing segment in the USA cards and payments market. This growth is driven by the increasing adoption of digital payment methods among consumers, particularly in response to evolving preferences for convenience, speed, and contactless transactions. Factors such as the proliferation of e-commerce, the widespread use of mobile devices, and the emergence of innovative payment solutions like mobile wallets and contactless cards have significantly fueled this trend. Moreover, consumer payments cater to a larger user base, including individuals across diverse demographics, thereby contributing to the rapid expansion of this segment within the market.

COVID-19 Impact Analysis on the USA Cards And Payments Market:

The COVID-19 pandemic significantly accelerated the adoption of digital payments in the USA cards and payments market as consumers sought contactless and remote transaction options to minimize physical interaction. The shift from cash to electronic payments surged during the pandemic, fostering a greater reliance on mobile wallets, online payments, and contactless card transactions. Moreover, the closure of physical retail spaces and the rise of e-commerce further boosted digital payment volumes. However, the economic downturn impacted consumer spending patterns, leading to cautious spending and altering payment preferences. While digital payment adoption soared, the economic uncertainty posed challenges like increased delinquencies and shifts in consumer behaviors, necessitating adaptability and agility among market participants to navigate the evolving landscape.

Latest Trends/ Developments:

One prevalent trend in the USA cards and payments market is the rapid growth of contactless payments. This trend gained substantial traction, especially during the COVID-19 pandemic, as consumers prioritized safer and more hygienic payment methods. Contactless payments, facilitated by near-field communication (NFC) technology embedded in cards and mobile wallets, offer a seamless and quick transaction experience without the need for physical contact, aligning with the changing consumer preferences for convenience and safety.

A notable development in the market is the increasing integration of artificial intelligence and machine learning in payment processing systems. These technologies are being utilized to enhance fraud detection, personalize user experiences, and streamline payment processes. AI-powered solutions help in analyzing vast amounts of transactional data in real-time, enabling faster and more accurate fraud detection and prevention measures while also enabling businesses to offer personalized services based on individual spending patterns and preferences. This development is reshaping the efficiency and security of payment systems, contributing to a more tailored and secure transaction environment for consumers and businesses alike.

Key Players:

- Visa Inc.

- Mastercard Incorporated

- American Express Company

- PayPal Holdings, Inc.

- Discover Financial Services

- Square, Inc.

- JPMorgan Chase & Co.

- Apple Inc. (Apple Pay)

- Google LLC (Google Pay)

- Bank of America Corporation

Chapter 1. USA Cards And Payments Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. USA Cards And Payments Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. USA Cards And Payments Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. USA Cards And Payments Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. USA Cards And Payments Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global USA Cards And Payments Market– By Payment Type

6.1. Introduction/Key Findings

6.2. Credit Cards

6.3. Debit Cards

6.4. Prepaid Cards

6.5. Contactless Payments

6.6. Mobile Payments

6.7. Online Payments

6.8. Y-O-Y Growth trend Analysis By Payment Type

6.9. Absolute $ Opportunity Analysis By Payment Type , 2024-2030

Chapter 7. USA Cards And Payments Market– By Industry

7.1. Introduction/Key Findings

7.2. Retail

7.3. E-Commerce

7.4. Hospitality & Travel

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Industry

7.7. Absolute $ Opportunity Analysis By Industry , 2024-2030

Chapter 8. USA Cards And Payments Market– By End User

8.1. Introduction/Key Findings

8.2. Consumer Payments

8.3. Business Payments

8.4. Y-O-Y Growth trend Analysis End User

8.5. Absolute $ Opportunity Analysis End User , 2024-2030

Chapter 9. USA Cards And Payments Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. USA

9.1.1. By Country

9.1.1.1. Newyork

9.1.1.2. Los angeles

9.1.1.3. Chicago

9.1.2. By Payment Type

9.1.3. By Industry

9.1.4. By End-use Industry

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global USA Cards And Payments Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Visa Inc.

10.2. Mastercard Incorporated

10.3. American Express Company

10.4. PayPal Holdings, Inc.

10.5. Discover Financial Services

10.6. Square, Inc.

10.7. JPMorgan Chase & Co.

10.8. Apple Inc. (Apple Pay)

10.9. Google LLC (Google Pay)

10.10. Bank of America Corporation

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The USA Cards And Payments Market was valued at USD 10.29 Billion in 2023 and is projected to reach a market size of USD 17.41 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.8%.

Digital Transformation and Technological Innovations and Consumer Preferences and Changing Habits are drivers of USA Cards and Payments market

Based on end user, the USA Cards And Payments Market is segmented into Consumer payments and Business payments

Visa Inc., Mastercard Incorporate, American Express Company, PayPal Holdings, Inc.are few of the key players operating in the USA Cards And Payments Market.

Credit Cards, Debit Cards, Prepaid Cards, Contactless Payments, Mobile Payments, and Online Payments are the segments by payment type