US Gourmet Cookie Market Size (2025-2030)

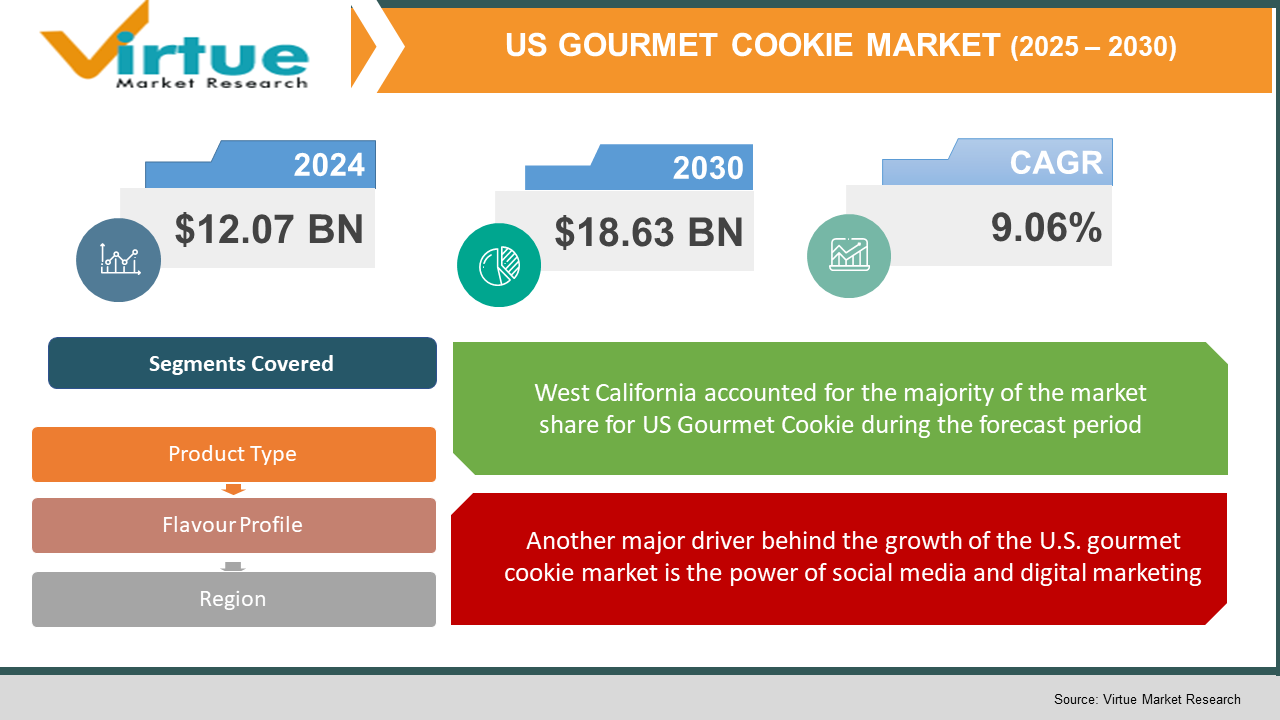

The US Gourmet Cookie Market was valued at USD 12.07 billion in 2024 and is projected to reach a market size of USD 18.63 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.06%.

The U.S. gourmet cookie market is no longer a niche industry. It has graduated to that of booming. Given the rising consumer demand for artisanal, Instagrammable, flavour-forward treats, this market merges old-school baking with modern branding and digital marketing. The millennials and Gen-Z consumer segments are especially driving growth, leaning into brands with limited flavours, pretty packaging, and social media-synced experiences. While brands such as Crumbl, Levain Bakery, and Insomnia Cookies enjoy their status as trendsetters, these companies are also positioning cookies as a highly demanded experiential item. This gourmet cookie phenomenon, with fresh ingredients and a weekly rotating menu, is more than just a sweet tooth craving; it is a cultural phenomenon that is redefining desserts in America.

Key Market Insights:

Customers, especially teens and young adults, spend an average of $4–$5 per cookie, making gourmet cookies a premium-priced yet frequently purchased indulgence.

Over 250+ unique cookie flavours have been introduced by top brands, with many companies releasing 4–6 new flavours weekly, encouraging repeat visits and driving flavour-based loyalty.

Industry data suggests that gourmet cookie consumers show a 35–40% repeat purchase rate monthly, owing to flavour innovation, gifting appeal, and brand community engagement.

US Gourmet Cookie Market Drivers:

One of the most significant drivers of the U.S. gourmet cookie market is the shift in consumer preference toward premium, experience-driven desserts.

The most notable drivers for the U.S. gourmet cookie market are changing consumer shifts to premium experience-oriented desserts. Millennials and especially Gen Z have a different attitude towards desserts and want something special, personalised, good-looking, and worth sharing on virtually every form of social media rather than just a sweet treat. Gourmet cookies fulfil this demand with their rich, diverse flavours, use of quality ingredients, and aesthetic presentation to give them something beyond a traditional cookie. Week-long flavour launches on an oversized scale, lavish portions, and artisanal toppings cause anticipation and exclusivity and keep people coming back for more. Limited-edition flavours for "cookies" mimic the fashion and tech world in launching their new products and give rise to FOMO in consumers: the fear of missing out when they've seen or read about an exciting opportunity. Experiences such as "treat culture," where people indulge with intention, are increasingly attracted by the comfort of top-end treats, creating a market for premium cookies as the most favoured way of indulging. From plain cookies, bakeries like Crumbl and Levain have transformed them into desirable lifestyle products.

Another major driver behind the growth of the U.S. gourmet cookie market is the power of social media and digital marketing.

There is a massive influence exerted by social media and digital marketing in the expansion of the gourmet cookie industry in the U.S. Crumbl and Insomnia Cookies are two brands that have built empires, creating an online following on platforms like TikTok, Instagram, and YouTube based on the visual and sensory appeal of their cookies. Each week's flavour reveals, behind-the-scenes videos of baking, customer reactions, and influencer collaborations are things that garner large engagement, so much so that they often go viral. All of this digital-friendly engagement does wonders in promoting them, but it also helps foster a strong online community that transforms customers into brand advocates. The overall customer experience is further improved with online ordering apps, real-time delivery tracking, and gamification of loyalty programs. The fusion of e-commerce with local delivery has made gourmet cookies easily accessible, allowing smaller brands to ramp up scaling at speed. From this standpoint, digital engagement has bridged the gap between cookies and the high-tech and trendy flavour content strategies for driving exponential growth.

US Gourmet Cookie Market Restraints and Challenges:

A major restraint in the U.S. gourmet cookie market is the high price point, which limits accessibility for a broader consumer base.

One of the chief limitations in the U.S. gourmet cookie arena is the very high price point, making it hard for a wider consumer base to get access to it. Gourmet cookies usually cost about $4 to $6 each, very much higher than a traditional cookie. This can be attributed to premium ingredients, artisanal baking methods, and high-end packaging. However, these features enhance the appeal of the product; on the other hand, gourmet cookies become rather unattractive to the price-sensitive consumer, especially in a very competitive snack and dessert market. With inflation and rising costs of living, however, discretionary spending on superior dessert items might plunge in poorer populations. For the brands, it is a perpetual challenge to maintain quality with increased costs of ingredients and labour. Further, keeping the customers interested with constant new flavours and advertisement means heavy investments, which may not be possible for smaller or regional players. The more the market matures, it becomes important to strike a balance between premium positioning and affordability in the long run.

US Gourmet Cookie Market Opportunities:

Potential areas for significant growth include product innovation, health-related offerings, and geographical spread within the gourmet cookie market in the United States. With strong and growing consumer interest in well-being and dietary issues, opportunities are plentiful for gluten-free, keto, vegan, or high-protein gourmet cookies- just indulgence with health. Also, major new customer bases can be opened beyond major cities by moving into unserved areas and mid-tier cities. Corporate gifting, special occasions, and e-commerce-friendly packaging are all emerging avenues for adding a source of income through subscription boxes and seasonal gift packs. Partnerships with famous influencers, celebrity bakers, or well-known franchises can further boost brand visibility and customer loyalty. Then, there are individualised, artificial intelligence-based flavour trend analysis and personalised online experiences that appeal to a tech-savvy, eco-minded community. These shifting consumer mindsets, along with digital reach and product storytelling, are paving the way for the new-age transformation for the gourmet cookie segment at the country level.

US GOURMET COOKIE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.06% |

|

Segments Covered |

By Product Type, FLAVOUR PROFILE, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA |

|

Key Companies Profiled |

Crumbl Cookies, Levain Bakery, Insomnia Cookies, Tiff’s Treats, Mrs. Fields, Milk Bar, The Dirty Cookie, Cheryl’s Cookies, Fat & Weird Cookie Co., The Cravory, Gideon’s Bakehouse, and D’VINE Cookies |

US Gourmet Cookie Market Segmentation:

US Gourmet Cookie Market Segmentation: By Product Type

- Drop Cookies

- Bar Cookies

- Rolled & Cut-Out Cookies

- Sandwich Cookies

- Stuffed Cookies

Drop cookies, such as classic chocolate chip or snickerdoodle, are popular owing to their soft, chewy texture and wide appeal. Bar cookies include cookie brownies, blondies: essentially heavy, rich formats amenable to sharing and gifting. Rolled and cut-out cookies appeal to seasonal and special occasions, as they are enjoyed by enthusiasts of custom-decorating. Now, sandwich cookies bring a premium twist to that nostalgic flavour, often filled with ganache or cream. Stuffed cookies have taken the Internet by storm in the past few years, all with molten centres that promise a solid cross between Nutella, caramel, or cheesecake and that spark curiosity and repurchases. They cater to differences in general comfort and indulgence, thus seeding a diverse pool of products and their marketing strategies.

US Gourmet Cookie Market Segmentation: By Flavour Profile

- Classic

- Innovative

- Health-Oriented

- Exotic

Classics include chocolate chip, peanut butter, oatmeal raisin, and the like; that "old-futuristic" flavour of cookies belongs, and ensures that the cookie itself provides the nostalgia and comfort of familiarity. Newly flavoured cookies, such as birthday cake, churro, or red velvet, are offered periodically to entice consumers and retain patrons. Consumers who want to care for their wellness cravings will be quite happy with health-conscious products, such as gluten-free, keto-friendly, or high-protein, that cater to indulgence without regret. Exotic flavours such as matcha, lavender, saffron, or ube give this much-needed international appeal to adventurous eaters and foodies alike. Brands focused on this segment manage to strike a balance between popularly flavoured classics with limited-edition innovations, each maximising itself in both niches: wide and seasonal. This segmentation brings rapid product life cycles, testing of trends, and much more customer loyalty.

US Gourmet Cookie Market Segmentation: Regional Analysis:

While the performance of the U.S. gourmet cookie market varies from region to region, so does consumer behaviour. With its trendsetting brands and tech-savvy consumers, West California is at the top among the Western U.S. gourmet cookie markets, focusing much on health-conscious premium desserts. There's a real emerging franchise explosion in the South, where people celebrate culture and the popular trend of community-driven food in terms of indulgence. The Northeast has highly competitive urban markets, together with artisanal bakeries, which favour traditional, gourmet-influenced flavours usually found in boutique or café-style outlets. The Midwest is quickly becoming a major area of growth due to mall expansions, college-town demand, and avenues for digital ordering. Every region varies in their flavour preferences, spending behaviour, and perception about brand loyalty, making it a powerful opportunity in the art of regional customisation for marketers and product developers alike in the gourmet cookie space.

COVID-19 Impact Analysis on the US Gourmet Cookie Market:

The impact of the COVID-19 crisis on the U.S. gourmet cookie market wavered in effect. The beginning phase resulted in widespread lockdowns and the closure of stores, affecting the supply chains and minimising foot traffic in brick-and-mortar bakeries. These transient losses in sales were, however, coupled with a move toward online ordering, home delivery, and application-enabled sales as many gourmet cookie brands rapidly transitioned to this "new normal." Increased confinement for consumers generated the craving for comfort foods, which fed the growing demand for indulgent desserts, such as cookies. Crumbl capitalised on this trend by changing menus every week and viral content on social media, getting customers to come back for more. Individually wrapped and hygienic treats were deemed safe to consume in a period full of uncertainty. Digital ordering and accompanying gifts of cookies became common after the pandemic, helping the industry bounce back rapidly and even expand into new regions and demographics.

Latest Trends/ Developments:

Dynamic trends are characterising the U.S. gourmet cookie market, merging indulgence, innovation, and digital culture. Possibly the most noticeable trend is the stuffed cookie, think molten centres of Nutella, caramel, or cheesecake continuing to go viral on social media. With Crumbl pacing the cookie market into weekly entertainment with flavour drops that attract millions of views online and long lines in store, the cookie ambience almost resembles that of a runway show. On the other side of the equation, the market for health-conscious options like gluten-free, keto-friendly, and protein-rich cookies catering to wellness aims to seize the attention of this segment. Sustainability is another burgeoning area of focus, with more bakeries adopting eco-friendly packaging and ethically sourced ingredients. Besides, the online ordering and D2C models are flourishing, where personalised subscription boxes are being offered alongside national delivery. To engage this group of adventurous eaters, exotic world flavours like matcha, Thai tea, and cardamom are being brought in. Together, these trends depict an overall image of a market led by innovation, aesthetics, and convenience for consumer attraction as well as brand growth.

Key Players:

- Crumbl Cookies

- Levain Bakery

- Insomnia Cookies

- Tiff’s Treats

- Mrs. Fields

- Milk Bar

- The Dirty Cookie

- Cheryl’s Cookies

- Fat & Weird Cookie Co.

- The Cravory

- Gideon’s Bakehouse

- D’VINE Cookies

Chapter 1. US Gourmet Cookie Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. US GOURMET COOKIE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. US GOURMET COOKIE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. US GOURMET COOKIE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. US GOURMET COOKIE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. US GOURMET COOKIE MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Drop Cookies

6.3 Bar Cookies

6.4 Rolled & Cut-Out Cookies

6.5 Sandwich Cookies

6.6 Stuffed Cookies

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. US GOURMET COOKIE MARKET – By Flavour Profile

7.1 Introduction/Key Findings

7.2 Classic

7.3 Innovative

7.4 Health-Oriented

7.5 Exotic

7.6 Y-O-Y Growth trend Analysis By Flavour Profile

7.7 Absolute $ Opportunity Analysis By Flavour Profile , 2025-2030

Chapter 8. US GOURMET COOKIE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.2. By Flavour Profile

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. US GOURMET COOKIE MARKET – Company Profiles – (Overview, Product Product Type , Portfolio, Financials, Strategies & Developments)

9.1 Crumbl Cookies

9.2 Levain Bakery

9.3 Insomnia Cookies

9.4 Tiff’s Treats

9.5 Mrs. Fields

9.6 Milk Bar

9.7 The Dirty Cookie

9.8 Cheryl’s Cookies

9.9 Fat & Weird Cookie Co.

9.10 The Cravory

9.11 Gideon’s Bakehouse

9.12 D’VINE Cookies

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The US Gourmet Cookie Market was valued at USD 12.07 billion in 2024 and is projected to reach a market size of USD 18.63 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.06%.

Rising demand for premium, artisanal desserts is driving consumer interest in gourmet cookies. Social media virality and flavour innovation are boosting brand engagement and repeat purchases.

Based on Service Provider, the US Gourmet Cookie Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

California is the most dominant region for the US Gourmet Cookie Market.

Crumbl Cookies, Levain Bakery, Insomnia Cookies, Tiff’s Treats, Mrs. Fields, Milk Bar, The Dirty Cookie, Cheryl’s Cookies, Fat & Weird Cookie Co., The Cravory, Gideon’s Bakehouse, and D’VINE Cookies are the key players in the US Gourmet Cookie Market.