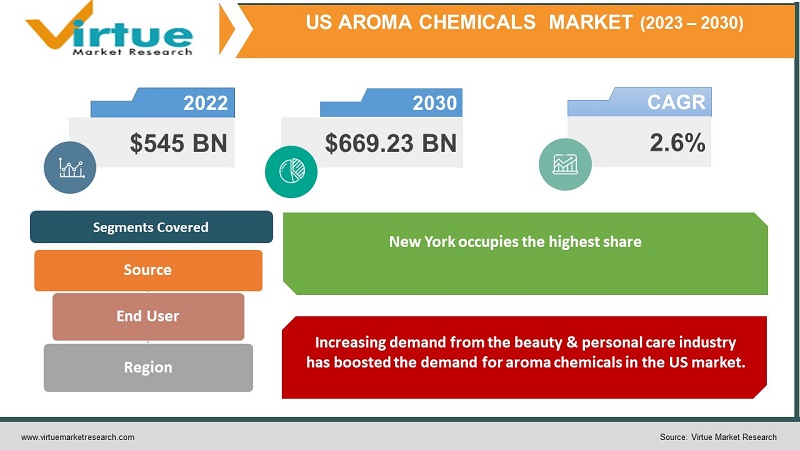

US Aroma Chemicals Market Size (2023-2030)

The US Aroma Chemicals Market was valued at USD 545 Billion and is projected to reach a market size of USD 669.23 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 2.6%.

Chemicals is one of the most developed industries in the US market and aroma chemicals hold a significant position in the market. Synthetic aroma chemicals have been in use for a very long time in the US, especially for luxury fragrances. Moreover, these chemicals are produced from petrochemical-based compounds and processed using intensive chemical processing such as heating, cooling, filtration, distillation, and others. Furthermore, these chemicals are extensively used in the food & beverage industry for adding flavouring to various dishes and beverages. In present times, aroma chemicals have witnessed a drastic transformation due to the growing trends in sustainability. Moreover, consumer demand for natural and environment-friendly products has led to the development of naturally sourced aroma chemicals that are prepared using plant-based essential oils, extracts, leaves, and others. Moreover, rising demand for skin-friendly products has boosted the market for eco-friendly skincare products among consumers. Furthermore, the future holds positive for the aroma chemicals market in the US, as new sourcing methods are developed for collecting natural and plant-based materials for producing aroma chemicals. Additionally, advancements in biotechnology for producing aroma chemicals with natural extracts have further boosted the market for aroma chemicals in the US.

Key Market Insights:

As per the International Trade Administration, US Department of Commerce, the chemical industry in the US is one of the largest manufacturing industries that occupies a sizable share in the domestic as well as global market.

A survey poll conducted by INSIDER revealed that 34% of adults in the US believe in the health benefits of essential oils.

As per Skinstore US, the male skincare segment is growing by 400%.

Furthermore, hand cream is the highest-searched skincare product in the US, accounting for 141% growth. This is attributed to increasing trends in skincare post-pandemic, as consumers increased their demand for antibacterial skin products.

The food and beverage industry in Chicago is the largest in the US generating US$ 9.4 billion annually.

US Aroma Chemicals Market Drivers:

Increasing demand from the beauty & personal care industry has boosted the demand for aroma chemicals in the US market.

Aroma chemicals are widely used in the preparation of fragrances due to their pleasant scent, long-lasting properties, and versatility with various other ingredients such as fruity and exotic ingredients. Moreover, these chemicals enhance the scent of fragrances and offer long-lasting scent to consumers. Furthermore, they are also increasingly used in face care products in the country, due to increased demand from the entertainment industry, such as lip balms, lipsticks, face brightening creams, anti-ageing creams, moisturizers, and others. For instance, as per a survey from Advanced Dermatology in 2022, Americans spend US$ 722 on their appearance, which includes skincare. Furthermore, increased consumer preferences for natural flavoured and scented body washes and shower gels, have raised the demand for naturally sourced aroma chemicals, such as rose, lavender, sandalwood, vanilla, eucalyptus, and other natural ingredients. In addition, rising demand for hair styling products in salons & spas has further shaped the market landscape for aroma chemicals in the US market.

Rising demand for flavouring and aromatic agents in the food & beverage sector drives the demand for aroma chemicals in the US market.

Due to their long-lasting effect, long shelf life, and durability, aroma chemicals are widely used in the food & beverage sector. Moreover, they are used to add flavour and scent to various cuisines in the US, for instance, aroma chemicals can replicate flavours of strawberries, orange, lime, muskmelon, and others that can be used in cakes, muffins, pastries, cookies, and chocolates. Moreover, the popular alcohol culture of the country boosts the usage of aroma chemicals in alcoholic beverages such as wine, beer, cocktails, and others. In addition, the rising demand for exotic cocktails has increased the usage of aroma chemicals in the US.

US Aroma Chemicals Market Restraints and Challenges:

Quality control is one of the prime challenges in the US aroma chemicals market. Maintaining the quality of aroma chemicals, especially natural ones is a difficult task for manufacturers and producers, as these chemicals can deteriorate faster and affect the quality of products produced from natural aroma chemicals.

Furthermore, environmental and sustainability concerns can reduce the market demand for aroma chemicals, as these chemicals, especially synthetic chemicals increase material waste and release harmful emissions during the manufacturing and processing process, which can reduce its demand in the US market.

US Aroma Chemicals Market Opportunities:

The US Aroma Chemicals Market is anticipated to deliver lucrative opportunities for businesses, which include acquisitions, partnerships, collaborations, product launches, and agreements during the forecasted period. Furthermore, increasing demand for natural and organic beauty & personal care products such as personalized perfumes made from natural ingredients and continuous research & development for producing aroma chemicals sustainably, is predicted to develop the market for the US aroma chemicals and enhance its future growth opportunities.

US AROMA CHEMICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

2.6% |

|

Segments Covered |

By Source, End user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

New York, Los Angeles, Chicago, San Francisco, Rest of the USA |

|

Key Companies Profiled |

Bell Flavours & Fragrances, DSM-Firmenich, International Flavours & fragrances Inc, Lawter Inc, Aurochemicals, Prinova Aromas |

US Aroma Chemicals Market Segmentation

US Aroma Chemicals Market Segmentation: By Source

- Natural

- Synthetic

In 2022, based on market segmentation by source, the synthetic segment occupies the highest share of about 33% in the country. Synthetic aroma chemicals are the most common type of aroma chemicals used in various industries due to increased efficiency and faster applicability. Moreover, these chemicals are produced in the laboratory or industries by using chemical processes. Furthermore, due to their increased applicability in fragrance, they are widely used in making perfumes and body mists.

The natural segment is the fastest-growing segment during the forecast period. Natural aroma chemicals are made of natural and plant-based ingredients such as essential oils, botanical extracts, or animal-sourced extracts. These are increasingly used due to their environment friendliness and wide applicability in aroma therapy and the food industry.

US Aroma Chemicals Market Segmentation: By End-User

- Food & Beverage

- Beauty & Personal Care

- Pharmaceuticals

- Industrial

- Hospitality

- Others

In 2022, based on market segmentation by end-user, beauty & personal care occupies the highest share of about 30% in the country. Aroma chemicals possess a pleasant scent, which makes them suitable for fragrance-based products. These products include perfumes, mists, skincare products such as lotions and creams, shampoos, hair styling products, and others. Moreover, these chemicals provide greater stability, long shelf life, and durability, which increases the consumer demand for fragrance products in the country. Additionally, naturally sourced aroma chemicals-based products such as lavender, rose, tea-tree, vanilla, and others are witnessing an increase in demand, as consumers have become aware of skin-care health and environmental impacts of harsh chemical products.

Food and beverage is the fastest-growing segment during the forecast period. Aroma chemicals are widely used as a flavouring agent in various US cuisines and beverages. These include the use of aroma chemicals in soft drinks, and alcoholic & non-alcoholic beverages such as wine, spirits, malt, cocktails, and others. Further, the rising demand for natural-scent cocktails has raised the demand for aroma chemicals in the country. Furthermore, confectionary products such as cakes, chocolates, and muffins find increased applications of aroma chemicals, especially natural aroma chemicals.

US Aroma Chemicals Market Segmentation: Country Analysis:

- New York

- Los Angeles

- Chicago

- San Francisco

- Rest of the USA

In 2022, based on market segmentation by country, New York occupies the highest share of about 28% in the market. The growth is attributed to fast booming fashion industry that increasingly demands premium beauty care products such as perfumes, lotions, face creams, and others. Furthermore, the increased disposable income of consumers has boosted the market for luxury fragrances in the region.

Chicago is the fastest-growing region country during the forecast period. Due to the country’s well-established and prosperous food culture, especially fast food and beverages, there is an increased demand for aroma chemicals in the market. For instance, as per the US Bureau of Labor Statistics, an average US household spends 65.3% of their food budget at home and 34.7% on food away from home. Moreover, these chemicals are increasingly used in producing pizzas, cakes, muffins, doughnuts, chocolates, and others for adding unique flavour and enhancing the taste of these food products.

COVID-19 Impact Analysis on the US Aroma Chemicals Market:

The pandemic had a significant impact on the aroma chemicals market in the US. Due to geographical movement restrictions, the transfer of chemicals and allied products witnessed a slowdown, which affected the distribution process and reduced the demand for aroma chemicals in the country. Furthermore, the closure of the food & and beverage industry, beauty, & personal care industry, and other major industries led to the decline usage of aroma chemicals in the market. However, the healthcare sector significantly contributed to the demand for aroma chemicals for preparing medications such as tablets, capsules, syrups, and others for treating patients during the pandemic. These chemicals helped in masking the bad odour and bitter taste of drugs which made it easier for patients to consume or swallow them, especially geriatric patients with taste sensitivities.

Latest Developments:

The market for aroma chemicals in the US is witnessing an upward trend on account of an increase in sustainability and environmental awareness among consumers. Further, this has induced manufacturer of chemicals to incorporate clean labels in their products, especially for food products that contain aroma chemicals. Furthermore, the increasing market presence of plant-based ingredients has influenced consumers’ demand for personalized fragrances that use natural aroma chemicals. These include the use of botanical extracts and essential oils for producing natural aroma compounds. Furthermore, stringent regulations by US regulatory bodies such as the FDA (Food & Drug Administration) and EPA (Environmental Protection Agency) have induced manufacturers of aroma chemicals to incorporate sustainable and emission-free production of chemicals that comply with safety standards set by the government. These include adhering to the clean and green labelling requirements in food products and reducing the usage of harsh chemicals in the pharmaceuticals and beauty industry.

Key Players:

- Bell Flavours & Fragrances

- DSM-Firmenich

- International Flavours & fragrances Inc

- Lawter Inc

- Aurochemicals

- Prinova Aromas

Chapter 1. US Aroma Chemicals Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. US Aroma Chemicals Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. US Aroma Chemicals Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. US Aroma Chemicals Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. US Aroma Chemicals Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. US Aroma Chemicals Market– By Source

6.1. Introduction/Key Findings

6.2. Natural

6.3. Synthetic

6.4. Y-O-Y Growth trend Analysis By Source

6.5. Absolute $ Opportunity Analysis By Source, 2023-2030

Chapter 7. US Aroma Chemicals Market– By End User

7.1. Introduction/Key Findings

7.2. Food & Beverage

7.3. Beauty & Personal Care

7.4. Pharmaceuticals

7.5. Industrial

7.6. Hospitality

7.7. Others

7.8. Y-O-Y Growth trend Analysis By End User

7.9. Absolute $ Opportunity Analysis By End User, 2023-2030

Chapter 8. US Aroma Chemicals Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. U.S

8.1.1. By Country

8.1.1.1. New York

8.1.1.2. Los Angeles

8.1.1.3. Chicago

8.1.1.4. San Francisco

8.1.1.5. Rest of the USA

8.1.2. By Source

8.1.3. By End User

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. US Aroma Chemicals Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Bell Flavours & Fragrances

9.2. DSM-Firmenich

9.3. International Flavours & fragrances Inc

9.4. Lawter Inc

9.5. Aurochemicals

9.6. Prinova Aromas

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The US Aroma Chemicals Market was valued at USD 545 Billion and is projected to reach a market size of USD 669.23 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 2.6%.

Increasing demand from the beauty & personal care industry and Rising demand for flavouring and aromatic agents in the food & beverage sector are the market drivers of the US Aroma Chemicals Market.

Natural and Synthetic are the segments under the US Aroma Chemicals Market by source

New York is the most dominant region for the US Aroma Chemicals Market

Chicago is the fastest-growing region in the US Aroma Chemicals Market.