Ursolic Acid Market Size (2024 – 2030)

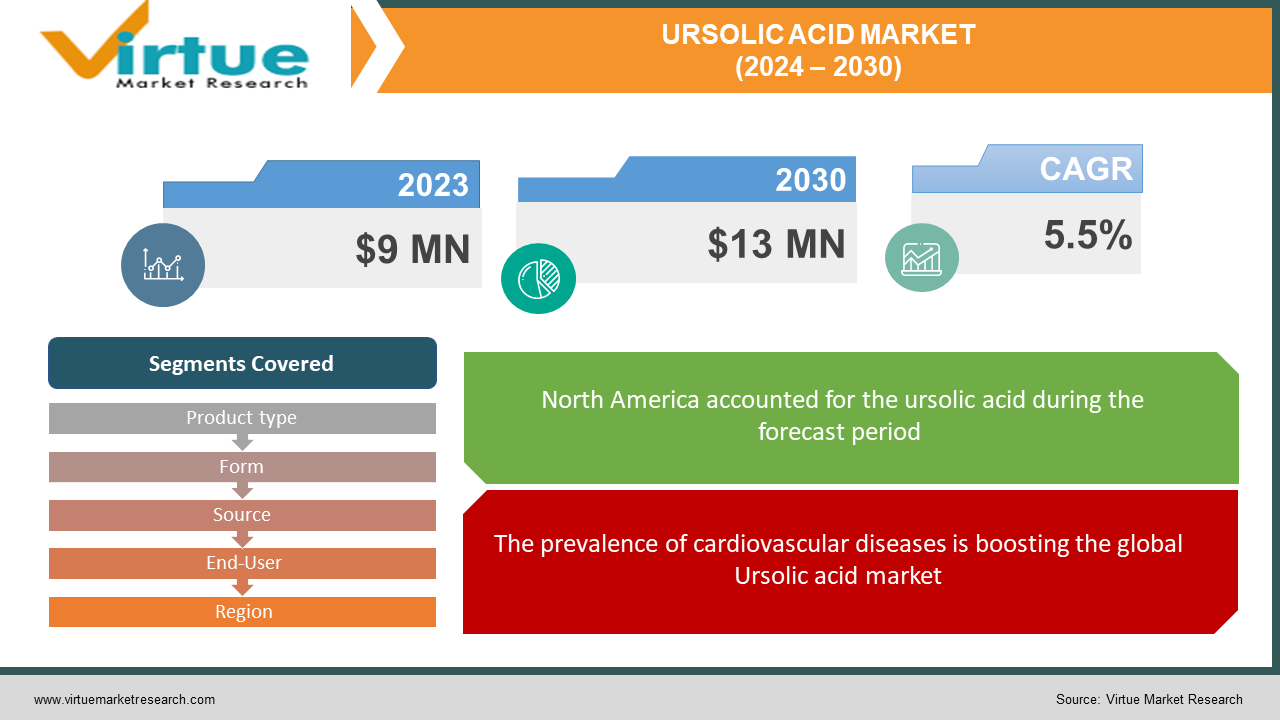

The global Ursolic Acid Market size was exhibited at USD 9 million in 2023 and is projected to hit around USD 13 million by 2030, growing at a CAGR of 5.5% during the forecast period from 2024 to 2030.

Ursolic Acid, a triterpene acid found in various plant sources such as prunes, hawthorn, thyme, oregano, lavender, cranberries, and apples, among others, is characterized by its numerous health-promoting properties. These encompass antioxidant, anti-fungal, anti-bacterial, and anti-inflammatory attributes. Extensive research has been conducted to extract and utilize Ursolic Acid in diverse food products and pharmaceutical applications.

In 2015, Ursolic Acid gained recognition for its role in mitigating muscle atrophy. A subsequent study involving mice subjected to a high-fat diet revealed that supplementation with Ursolic Acid resulted in enhanced muscle strength and mass, improved glucose tolerance, diminished white adipose tissue, and increased deposition of brown adipose tissue. This implies that Ursolic Acid could serve as a valuable nutritional component to counteract age-related alterations in metabolic function and body composition. Beyond its impact on muscle health, Ursolic Acid exhibits anti-depressant properties and promotes the formation of ceramics in human skin. These findings underscore its multifaceted potential for addressing various health concerns.

Key Market Insights:

The global Ursolic Acid market is witnessing significant growth, driven by its diverse applications and the recognition of its health-promoting properties. With a presence in various plant sources, such as prunes, hawthorn, and apples, Ursolic Acid's demand is propelled by its antioxidant, anti-fungal, anti-bacterial, and anti-inflammatory characteristics. Ongoing research and studies highlight its potential in food products and pharmaceuticals. Additionally, its effectiveness in countering muscle atrophy and addressing age-related metabolic changes further contributes to the expanding market. These key insights emphasize the promising trajectory of the global Ursolic Acid market.

Global Ursolic Acid Market Drivers:

The prevalence of cardiovascular diseases is boosting the global Ursolic acid market.

The anticipated rise in cardiovascular diseases is poised to propel the expansion of the Ursolic Acid market in the forthcoming years. Ursolic acid exhibits the capability to reduce heart rate, suppress the expression of reproducing cell nuclear antigen in injured artery cells, and diminish lipid peroxide levels through the scavenging of free radicals. A notable example is reflected in an October 2022 publication by the Centers for Disease Control and Prevention, a US-based public health agency, revealing heart disease as the foremost cause of death in the United States across gender and ethnic groups. In 2021, approximately 695,000 individuals succumbed to heart disease, representing approximately 1 in 5 deaths. This underscores the market growth propelled by the escalating prevalence of cardiovascular diseases.

The demand for Ursolic acid in the ever-growing cosmetics industry is also driving the market growth.

The ursolic acid market is anticipated to experience growth in the coming years due to the rapid increase in its utilization across various cosmetic products. This surge is attributed to the heightened demand for herbal products and the growing trend in the cosmetic industry. Ursolic acid is incorporated into cosmetic formulations for its roles as an anti-aging, anti-inflammatory, anti-wrinkle agent, and antioxidant. Notably, South Korea's cosmetic exports exceeded 10 trillion won ($8 billion) in 2021, marking a 21.3% growth from the previous year, with skincare cosmetics leading as the most significant import category, accounting for 34.17 percent, or $560 million. The escalating incorporation of ursolic acid in the cosmetic sector underscores its market growth.

Global Ursolic Acid Market Restraints and Challenges:

The side effects associated with Ursolic acid may impede market growth.

The excessive consumption of ursolic acid has been associated with adverse effects, including DNA damage and a decline in reproductive capacity, particularly affecting sperm mortality. These side effects act as deterrents to the demand for ursolic acid. Instances of DNA damage and compromised sperm viability serve as cautionary factors, prompting concerns among consumers and healthcare professionals. The acknowledgment of these potential negative consequences underscores the importance of cautious and regulated usage of ursolic acid to mitigate the risk of side effects and maintain the balance between its health benefits and potential drawbacks to ensure overall well-being.

Limited awareness and availability of alternatives may hinder the Ursolic acid market growth.

In under-developed countries, the limited awareness regarding the applications and advantages of ursolic acid, coupled with the presence of alternative products in the market, results in a shift in consumer preference, thereby impeding the sales of ursolic acid. The lack of education on the uses and benefits of this compound hinders its widespread adoption, as consumers opt for alternatives with more established recognition. Overcoming these challenges requires targeted efforts to enhance awareness and emphasize the unique benefits of ursolic acid, fostering a better understanding among consumers in under-developed regions and stimulating its market growth.

Global Ursolic Acid Market Opportunities:

The global Ursolic Acid market is witnessing substantial opportunities, driven by its versatile applications across industries. Increased awareness of its health benefits, especially in skincare and pharmaceuticals, is fueling demand. The cosmetic sector is capitalizing on its anti-aging and anti-inflammatory properties, while pharmaceutical applications are exploring its potential in various health issues. The upsurge in cardiovascular diseases is creating openings for Ursolic Acid in heart health solutions. Seizing these prospects involves strategic collaborations, research, and development efforts to further explore its diverse applications, fostering a conducive environment for the expansion of the global Ursolic Acid market.

URSOLIC ACID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product type, Form, Source, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sabinsa Corporation, Sami-Sabinsa Group Limited, Changsha Staherb Natural Ingredients Co. Ltd., Shaanxi Jintai Biological Engineering Co. Ltd., Hunan NutraMax Inc., TCI Chemicals (India) Pvt. Ltd, Parchem fine & specialty chemicals, Xi'an Greena Biotech Co., Ltd, ANGLE BIO PHARMA, VIDYA EUROPE SAS, BASF SE, Cayman Chemical, Wilshire Technologies, ALB Technology Limited, Biosearch Life |

Global Ursolic Acid Market Segmentation: By Product Type

-

25% Ursolic Acid

-

50% Ursolic Acid

-

90% Ursolic Acid

-

98% Ursolic Acid

-

Others

Within the forecast period, 98% Ursolic Acid is anticipated to command a substantial segment in the Global Ursolic Acid Market. Recognized as a pentacyclic triterpene acid, it serves as a vital component in medicinal formulations, food products, and cosmetics. Derived from sources like the loquat leaf, as well as fruits and herbs such as apple and rosemary, its versatile applications contribute to its dominance. The prevalence of 98% Ursolic Acid underscores its significance across diverse industries, affirming its projected significant share in the global market. This highlights its crucial role as a key player, driven by its varied uses and widespread presence in natural sources.

Global Ursolic Acid Market Segmentation: By Form

-

Liquid

-

Powdered

-

Capsules

During the forecast period, the Global Ursolic Acid Market is anticipated to witness a notable share held by the powdered form segment. The prevalence of ursolic acid powder in the health supplement market is attributed to its remarkable capacity to prevent illnesses associated with the degeneration of brain cells. Moreover, research suggests its potential contributions to weight loss and muscle growth, further enhancing its demand. The projected prominence of the powdered form segment underscores the significant role it plays in addressing health concerns, positioning it as a key player in the global market during the forecast period.

Global Ursolic Acid Market Segmentation: By Source

-

Rosemary

-

Apple Peel

-

Elderflowers

-

Oregano

-

Peppermint Leaves

-

Holy Basil (Tulsi)

-

Periwinkle

-

Bilberry

-

Devil’s Claw

-

Hawthorn

During the forecast period, the rosemary segment is expected to hold a substantial market share. Rosemary leaves serve as a prevalent source of various bioactive chemicals with demonstrated benefits for human health. Among the triterpenes found in rosemary leaves, Ursolic Acid stands out. Clinical research indicates that the anticancer and anti-inflammatory properties attributed to Rosemary are closely linked to its Ursolic acid content, along with other chemical constituents. The prominence of the rosemary segment underscores its significant role in the market, driven by the recognized health-enhancing properties of Ursolic Acid and other bioactive compounds found in rosemary leaves.

Global Ursolic Acid Market Segmentation: By End-User

-

Food and Beverage

-

Pharmaceuticals

-

Nutraceuticals

-

Cosmetics

During the forecast period, the Nutraceuticals segment is anticipated to experience significant growth, capturing a substantial market share. These non-specific biological medications play a crucial role in enhancing overall health, symptom management, and the prevention of malignant diseases. Recently, attention has shifted towards novel nutraceuticals, exploring their potential to support muscle mass, protein metabolism, and exercise adaptations, despite the limited current research in this domain. Ursolic acid (UA), a naturally occurring phytochemical found in apple peel, has garnered interest, particularly after UA-supplemented rats demonstrated a 7% increase in muscular weight, suggesting potential for muscle hypertrophy induction. Ongoing research aims to elucidate the effects of UA on human subjects.

Global Ursolic Acid Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America holds the major marker share of Ursolic acid. This is because of the escalating prevalence of health issues like obesity and cardiovascular diseases in the region. The growing emphasis on maintaining good health contributes to the increased adoption of Ursolic acid. Furthermore, the preference for biological plant-derived products among consumers further fuels the expansion of the Ursolic acid market in North America. The Asia Pacific region is expected to undergo substantial growth throughout the forecast period. Increasing demand for Ursolic acid and heightened awareness regarding its benefits in Asian countries propel its market growth. In these nations, where hepatocellular carcinoma is the most prevalent primary liver cancer, there has been significant attention on natural food ingredients like fruits, vegetables, and spices for their potential disease-preventive properties, particularly against cancer. Ursolic acid, a naturally occurring triterpenoid found in various sources, exhibits anticancer and antioxidant properties, making it a valuable chemopreventive agent in addressing diseases induced by free radicals, such as cancer.

COVID-19 Impact Analysis on the Global Ursolic Acid Market:

The global Ursolic Acid market witnessed a notable impact from the COVID-19 pandemic, initially experiencing a downturn due to reduced demand. However, a silver lining emerged as a 2021 study highlighted Ursolic Acid's potential in mitigating inflammatory and oxidative stress caused by COVID-19, fostering renewed interest. The pandemic paradoxically heightened awareness of Ursolic Acid-related supplements and products among health-conscious consumers. Despite challenges, this increased awareness and the recognition of potential health benefits have set the stage for the Ursolic Acid market's recovery, with evolving consumer preferences and a growing emphasis on natural health solutions post-pandemic.

Recent Trends and Developments in the Global Ursolic Acid Market:

Prominent companies in the Ursolic Acid market are adopting a strategic partnership approach to enhance their offerings. This strategy involves leveraging each other's strengths and resources for mutual benefits and success. In December 2022, CJ FNT, a biotechnology firm based in South Korea, entered a strategic collaboration with Emmyon, aiming to apply Ursolic Acid technology to the global nutrition market. Under this partnership, CJ FNT will focus on developing nutritional raw materials that address muscle loss, offering a comprehensive solution that includes manufacturing insights and raw material application technologies for functional food manufacturers. Emmyon, a biotechnology startup based in the United States, specializes in skeletal muscle biology, metabolism, and small molecule discovery.

In December 2022, CJ CheilJedang Corporation, a South Korea-based food company, collaborated with Emmyon Inc. to create ingredients for health supplements targeting muscle loss prevention. This partnership entails a license agreement, granting CJ CheilJedang permission to utilize Emmyon's diverse patents related to ursolic acid, a compound present in apple peels, as well as herbs like rosemary and thyme. Emmyon Inc., headquartered in the United States, specializes in biotechnology, with a focus on discovering and developing small molecules that enhance muscle mass, strength, and metabolism

Key Players:

-

Sabinsa Corporation

-

Sami-Sabinsa Group Limited

-

Changsha Staherb Natural Ingredients Co. Ltd.

-

Shaanxi Jintai Biological Engineering Co. Ltd.

-

Hunan NutraMax Inc.

-

TCI Chemicals (India) Pvt. Ltd.

-

Parchem fine & specialty chemicals

-

Xi'an Greena Biotech Co., Ltd.

-

ANGLE BIO PHARMA

-

VIDYA EUROPE SAS

-

BASF SE

-

Cayman Chemical

-

Wilshire Technologies

-

ALB Technology Limited

-

Biosearch Life

Chapter 1. Ursolic Acid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ursolic Acid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ursolic Acid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ursolic Acid Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ursolic Acid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ursolic Acid Market – By Product Type

6.1 Introduction/Key Findings

6.2 25% Ursolic Acid

6.3 50% Ursolic Acid

6.4 90% Ursolic Acid

6.5 98% Ursolic Acid

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Ursolic Acid Market – By Form

7.1 Introduction/Key Findings

7.2 Liquid

7.3 Powdered

7.4 Capsules

7.5 Y-O-Y Growth trend Analysis By Form

7.6 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Ursolic Acid Market – By Source

8.1 Introduction/Key Findings

8.2 Rosemary

8.3 Apple Peel

8.4 Elderflowers

8.5 Oregano

8.6 Peppermint Leaves

8.7 Holy Basil (Tulsi)

8.8 Periwinkle

8.9 Bilberry

8.10 Devil’s Claw

8.11 Hawthorn

8.12 Y-O-Y Growth trend Analysis End-Use Industry

8.13 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Ursolic Acid Market – By End-User

9.1 Introduction/Key Findings

9.2 Food and Beverage

9.3 Pharmaceuticals

9.4 Nutraceuticals

9.5 Cosmetics

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Ursolic Acid Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Form

10.1.3 By Source

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Form

10.2.4 By Source

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Form

10.3.4 By Source

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Form

10.4.4 By Source

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Form

10.5.4 By Source

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Ursolic Acid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Sabinsa Corporation

11.2 Sami-Sabinsa Group Limited

11.3 Changsha Staherb Natural Ingredients Co. Ltd.

11.4 Shaanxi Jintai Biological Engineering Co. Ltd.

11.5 Hunan NutraMax Inc.

11.6 TCI Chemicals (India) Pvt. Ltd.

11.7 Parchem fine & specialty chemicals

11.8 Xi'an Greena Biotech Co., Ltd.

11.9 ANGLE BIO PHARMA

11.10 VIDYA EUROPE SAS

11.11 BASF SE

11.12 Cayman Chemical

11.13 Wilshire Technologies

11.14 ALB Technology Limited

11.15 Biosearch Life

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Ursolic Acid Market size is valued at USD 9 million in 2023.

The worldwide Global Ursolic Acid Market growth is estimated to be 5.5% from 2024 to 2030.

The Global Ursolic Acid Market is segmented By Product Type (25% Ursolic Acid, 50% Ursolic Acid, 90% Ursolic Acid, 98% Ursolic Acid, and Others); By From (Liquid, Powdered, Capsules); By Source (Rosemary, Apple Peel, Elderflowers, Oregano, Peppermint Leaves, Holy Basil (Tulsi), Periwinkle, Bilberry, Devil’s Claw, and Hawthorn); By End-User (Food and Beverage, Pharmaceuticals, Nutraceuticals, and Cosmetics).

Future trends and opportunities for the Global Ursolic Acid Market include expanding applications in health supplements, skin care, and pharmaceuticals. Additionally, ongoing research and increased consumer awareness may drive growth, presenting promising avenues for market development.

The global Ursolic acid market initially declined during the COVID-19 pandemic. However, a 2021 study revealing its potential against Covid-19-induced stress sparked renewed interest. The pandemic increased awareness, setting the stage for market recovery and evolving consumer preferences.