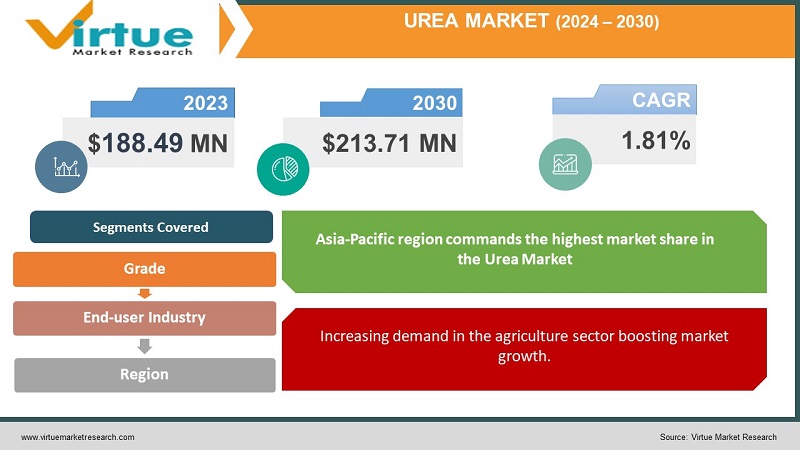

Urea Market Size (2024-2030)

The Urea Market was valued at USD 188.49 million in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 213.71 million by 2030, growing at a CAGR of 1.81%.

Urea, identified as carbonic acid diamide or carbamide, is an organic chemical compound. Predominantly recognized for its application as a nitrogen-release fertilizer, over 90% of global urea production serves this purpose. Distinguished by its high nitrogen content, reaching 46.7%, urea plays a pivotal role in promoting green leafy growth in plants, contributing to a lush appearance. Its influence extends to facilitating the photosynthesis process. Notably, the primary application of urea fertilizer lies in bloom growth, as it exclusively provides nitrogen without phosphorus or potassium.

Key Market Insights:

The synthesis of ammonium carbamate, achieved through the combination of ammonia and carbon dioxide, serves as a crucial commercial process. Subsequently, the breakdown of ammonium carbamate yields solid urea (carbamide). This product has gained popularity in the fertilizer sector due to its enriched nitrogen content. Its efficacy extends to meeting the protein requirements of ruminant animals through feed quality. Additionally, its exceptional chemical properties make urea widely applicable across various industrial sectors. As a result, a promising market outlook foresees versatile utilization in the near future.

Urea Market Drivers:

Increasing demand in the agriculture sector boosting market growth.

The burgeoning agricultural industry has significantly contributed to the increased utilization of urea in the fertilizers segment, fostering the market's growth. Urea and its compounds are extensively employed as fertilizers in various markets, with notable usage observed in North America and India. The surge in demand for N-fertilizers to promote plant growth is a key driver propelling the urea market, and this trend is particularly pronounced in developing nations across South Asia and Latin America.

Furthermore, the applications of urea extend beyond fertilizers, encompassing the production of urea-formaldehyde resins, diesel exhaust fluids, melamine, and animal feed. The demand for these diverse products is on the rise. Notably, the market is anticipated to witness sustained expansion in the forecast years, primarily attributed to the growing demand for urea from the automotive industry. This demand is driven by the automotive sector's need for diesel exhaust fluid, a crucial component used to convert nitrogen oxide emissions from exhaust systems into harmless nitrogen and water, aligning with stringent environmental standards.

Urea Market Restraints and Challenges:

Increasing awareness about organic farming hampering the market.

The escalating costs of urea, in tandem with the increased prices of petroleum and natural gas on a global scale, pose challenges for countries reliant on oil and gas imports for production. Notably, nations such as India, Brazil, Australia, Japan, and others have witnessed a surge in their import costs. Carbamide, the primary fertilizer extensively utilized in agriculture either independently or in combination with other fertilizers, has become subject to heightened input costs, contributing to elevated levels of ammonia and carbon dioxide emissions.

The repercussions of these emissions extend to the biosphere and human health, as ammonia generated during application has adverse effects, and carbon dioxide is recognized as a potent greenhouse gas. In response to these environmental concerns, governments worldwide are actively advocating for alternative agricultural techniques. These initiatives encompass various forms of sustainable practices, notably organic farming and natural farming, which operate without predefined budget constraints. The growing awareness about the environmental impact of conventional agricultural methods has prompted a global push towards more eco-friendly and sustainable approaches in the agricultural sector.

Urea Market Opportunities:

Increasing demand for the applicability of technical grade urea is fueling opportunities.

The technical-grade urea serves as a vital raw material in diverse industrial applications. It plays a pivotal role in the production of urea-formaldehyde resins, functions as stabilizers in nitrocellulose explosives, and contributes to the formulation of adhesives such as urea-melamine-formaldehyde, commonly utilized in marine plywood. Its versatility extends to the cosmetics and pharmaceutical industries, where it serves multiple purposes.

In the cosmetics sector, technical-grade urea finds application as a crucial component in various products, including but not limited to hair removal products, bath oils, conditioners, disinfectants, skin softeners, and lotions. Beyond the realm of personal care, it is integral to the production of pharmaceuticals and chemical intermediates, contributing to the formulation of a diverse range of products.

Moreover, the technical-grade urea's significance transcends into industrial applications, where it is utilized in deicers employed by airports, yeast nutrients, and tobacco flavoring additives. It serves as a protein denaturant and finds application in radiological detectors crucial for various diagnostic procedures. Additionally, it provides the essential hydrogen required for fuel cells, a key element in generating electricity from rehydrated goods. This underscores the compound's broad spectrum of applications across various industries.

Urea Market Segmentation:

Urea Market By Grade:

- Fertilizer

- Feed

- Technical

A feed-grade product, containing approximately 45% nitrogen, equivalent to 280% crude protein, plays a pivotal role in the animal feed market. The trajectory of the animal feed market is expected to witness growth, driven by the diminishing availability of grazing land and escalating costs associated with traditional animal feed. Among the various segments, the chemical synthesis category is projected to experience the fastest growth.

Technical-grade materials are frequently employed in this category to create resins, pharmaceutical and cosmetic formulations, and other specialized compounds. Within the market, the Feed & Nutrition segment stands out as the fastest-growing. Urea, serving as a source of non-protein nitrogen in animal feed and nutrition, contributes significantly to this segment. The utilization of urea in animal feed plays a crucial role in meeting the protein requirements of livestock and enhancing their overall nutrition.

The accelerated growth of the feed and nutrition segment in the urea market is attributed to the increasing demand for high-quality animal protein, particularly in emerging economies. This surge in demand underscores the importance of urea in addressing the nutritional needs of livestock, thereby fueling the growth of the feed and nutrition sector within the broader urea market.

Urea Market By End-user Industry:

- Agriculture

- Chemical

- Automotive

- Medical

- Other

Within the Urea Market, the dominant segment in the End-user Industry is Agriculture. Urea, when applied to the soil, undergoes hydrolysis, breaking down into ammonia and carbon dioxide. Subsequently, soil bacteria oxidize the ammonia to nitrate, a form readily absorbable by plants. The widespread use of urea extends to its incorporation into various multi-component solid fertilizer formulations. Due to its high solubility in water, urea is particularly suitable for use in fertilizer solutions, often combined with ammonium nitrate in formulations like 'foliar feed' fertilizers.

In the context of fertilizer application, granules are preferred due to their narrower particle size distribution, providing an advantage for mechanical application. Nitrogen fertilizers, with urea playing a significant role, serve as effective methods for enhancing crop yield and profitability, especially in non-chernozem zones and moist areas. These fertilizers act as crucial supplements for crops and are extensively utilized in the agriculture industry to optimize harvests.

Beyond the agriculture sector, there is a notable increase in urea consumption driven by advancements in the chemical, automobile, and medical industries. This diversification highlights urea's versatile applications and its growing significance across various industrial domains beyond agriculture.

Urea Market Segmentation- by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The Asia-Pacific region commands the highest market share in the Urea Market, closely followed by North America in 2023. Currently, the Asia-Pacific region heavily relies on nitrogenous fertilizers. However, challenges such as the overuse of nitrogenous fertilizers, inadequate nutrition management, diminishing soil fertility, a lack of complementary inputs, and weaknesses in marketing and distribution systems pose concerns for the agriculture sector in the region. Despite these challenges, the demand for nitrogenous fertilizers is expected to continue dominating the fertilizer market in the Asia-Pacific region in the coming years, thereby sustaining the consumption of the urea market.

Agriculture serves as the primary source of livelihood globally, with countries like India and the United States experiencing positive growth in the agriculture sector. Consequently, the demand for ammonia is anticipated to be a driving force in the market during the forecast period. Notably, China demonstrated a significant increase in urea exports, reaching 849,000 tons from July 2022 to September 2022, compared to 303,000 tons and 421,000 tons in Q1 2022 and Q2 2022, respectively. Looking ahead, the Middle East and Africa are poised to witness the highest Compound Annual Growth Rate (CAGR) during the forecast period.

COVID-19 Pandemic: Impact Analysis

The global trade in carbamide and related products faced significant disruptions due to the widespread impact of the coronavirus pandemic. However, in contrast to the industrial sector, the agricultural and animal feed industries demonstrated resilience during this period. The pandemic-induced shutdowns led to production inconsistencies, affecting potential industrial applications like chemical manufacturing, fuel additives, and resins.

The growth of the urea market faced additional challenges, including shortages of workforce and raw materials. Despite these obstacles, major consumers such as the U.S., India, China, and others gradually initiated the modernization of industrial operations in 2021, contributing to a gradual increase in the market for technological goods. However, manufacturing expenses witnessed an uptick in the last quarter of 2021 due to the sustained rise in energy prices.

Recent Trends/Developments:

- Perdaman Chemicals & Fertilizers Urea Plant in Australia (2023): In 2023, Perdaman Chemicals & Fertilizers announced plans to construct a urea plant in Australia. Upon completion, this facility is set to become the largest urea plant in Australia and one of the largest globally. The $6.0 billion urea project, located on the Burrup Peninsula in Western Australia, is supported by significant funding from Global Infrastructure Partners (GIP) and various debt providers.

- Pupuk Kaltim's Urea Factory in West Papua (June 2022): In June 2022, Pupuk Kaltim announced plans to expand its operations by constructing a urea factory in West Papua's Bintuni Bay, Indonesia. This expansion aims to increase the overall production capacity of urea.

These recent developments underscore the dynamic nature of the urea market, with significant investments and expansions taking place globally, contributing to the industry's evolution.

Key Players:

These are top 10 players in the Urea Market:-

- Chambal Fertilizers & Chemicals Ltd

- Acron

- BASF SE

- SABIC (Saudi Arabia)

- CF Industries Holdings Inc.

- China National Petroleum Corporation

- IFFCO (Indian Farmers Fertiliser Cooperative Limited)

- EuroChem Group

- Yara International

- Notore Chemical Industries PLC

Chapter 1. GLOBAL UREA MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL UREA MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL UREA MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL UREA MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL UREA MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL UREA MARKET – By Grade

6.1. Introduction/Key Findings

6.2. Fertilizer

6.3. Feed

6.4. Technical

6.5. Y-O-Y Growth trend Analysis By Grade

6.6. Absolute $ Opportunity Analysis By Grade , 2024-2030

Chapter 7. GLOBAL UREA MARKET – By End-user Industry

7.1. Introduction/Key Findings

7.2. Agriculture

7.3. Chemical

7.4. Automotive

7.5. Medical

7.6. Other

7.7. Y-O-Y Growth trend Analysis By End-user Industry

7.8. Absolute $ Opportunity Analysis By End-user Industry , 2024-2030

Chapter 8. GLOBAL UREA MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End-user Industry

8.1.3. By Grade

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By End-user Industry

8.2.3. By Grade

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By End-user Industry

8.3.3. By Grade

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By End-user Industry

8.4.3. By Grade

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By End-user Industry

8.5.3. By Grade

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL UREA MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Chambal Fertilizers & Chemicals Ltd

9.2. Acron

9.3. BASF SE

9.4. SABIC (Saudi Arabia)

9.5. CF Industries Holdings Inc.

9.6. China National Petroleum Corporation

9.7. IFFCO (Indian Farmers Fertiliser Cooperative Limited)

9.8. EuroChem Group

9.9. Yara International

9.10. Notore Chemical Industries PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The burgeoning agricultural industry has significantly contributed to the increased utilization of urea in the fertilizers segment, fostering the market's growth.

The top players operating in the Urea Market are - Chambal Fertilizers & Chemicals Ltd, Acron, BASF SE, SABIC (Saudi Arabia), CF Industries Holdings Inc., China National Petroleum Corporation, IFFCO (Indian Farmers Fertiliser Cooperative Limited), EuroChem Group, Yara International, Notore Chemical Industries PLC.

The global trade in carbamide and related products faced significant disruptions due to the widespread impact of the coronavirus pandemic

In 2023, Perdaman Chemicals & Fertilizers announced plans to construct a urea plant in Australia.

The Asia-Pacific region commands the highest market share in the Urea Market, closely followed by North America.