Upstream Production Automation Market Size (2023 - 2030)

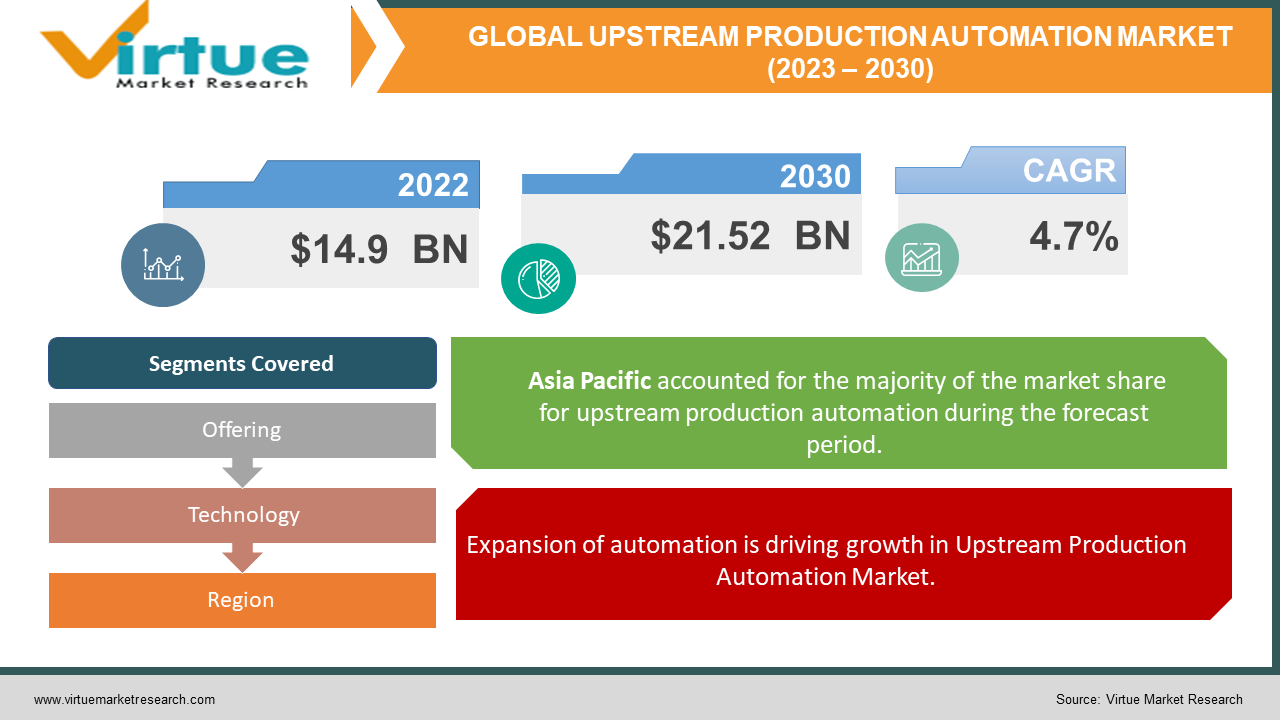

In 2022, the Global Upstream Production Automation Market was valued at $14.9 billion, and is projected to reach a market size of $21.52 billion by 2030. Over the forecast period of 2023-2030, market is projected to grow at a CAGR of 4.7%.

Industry Overview:

The Upstream Production Automation Market is anticipated to grow at a very steady CAGR throughout the forecasted years, 2023 - 2030. The transition to digitization in the Upstream Production Automation industry has started as more sensors are collecting data from rigs all around the world. Adopting digital technology is enabling engineering teams to collaborate more effectively and efficiently with Upstream Production Automation firms to handle data and project needs, which is enhancing internal communication and simplifies plans and the overall workflow processes. In the Upstream Production Automation sector, automation can increase productivity and reduce costs. Following the Deepwater Horizon oil leak, it is believed that automation might considerably enhance the work of measuring oil pressure and flow. Without an on-site crew, the pressure, flow, and level of oil can be remotely reported from the field using smart sensors that are linked to centralised monitoring software. The rig crews can keep an eye on things and change settings as necessary with the aid of this information. The Upstream Production Automation industry may be able to apply automation technology at reduced prices in order to increase production and get rid of any potential bottlenecks in the business model. The Upstream Production Automation industry is benefiting from the deployment of Internet of Things (IoT) solutions, from downhole sensors to surface control valves broadcasting real-time data into boardrooms for analysis. This not only enhances operations but also makes the entire oilfield a safer place to work.

COVID-19 Impact:

The COVID-19 pandemic has had a variety of immediate effects, despite the fact that it continues to affect the development of numerous industries. Many industries will remain untouched and show promising growth potential, even though some may see a reduction in demand. Numerous businesses have shut down as a result of the COVID-19 pandemic. Maximum workers were asked to leave their industrial facilities and were not permitted. As a result, automation became more necessary. However, because many facilities lacked the necessary infrastructure for automation, the market marginally shrank, but it is anticipated to rebound in the next years with prosperous chances.

MARKET DRIVERS

Expansion of automation is driving growth in Upstream Production Automation Market

The increased demand for automation is what is fuelling the expansion of the Upstream Production Automation sector. The industry has seen first-hand how crucial automation is, particularly in situations where a human workforce is unable to perform consistently well. For instance, due to their distinct operational environment, offshore Upstream Production industries benefited substantially from automation. Despite being regularly manned, many offshore platforms are evacuated prior to hurricanes. Because they could minimise or completely eliminate production losses caused by manually operated platforms being shut down during an evacuation, many automation projects were justified. Automated platforms have proven their potential to continue operating in production for significantly extended periods of time producing significant verifiable cost savings. So, it is anticipated that the integration of automation in the Upstream Production Automation industry will be profitable in the forthcoming years.

Cloud computing is driving growth in Upstream Production Automation Market

The Upstream Production Automation sector is anticipated to take an evolutionary rather than a revolutionary approach to digital transformation when compared to other sectors. However, developments with immense potential for the Upstream Production Automation industry are being driven by technological advancements in areas like the cloud, social media, big data, and analytics. Cloud computing can increase business agility by removing the barriers between corporate business function silos. Businesses will be able to analyse enormous amounts of structured and unstructured data from multiple sources, produce real-time insights, and foster innovation thanks to big data and analytics.

MARKET RESTRAINTS

Labour shortage is restraining growth in Upstream Production Automation Market

The length of time it takes to develop enough engineering skills to meet the variety of disciplines required in a typical industrial automation oil & gas project is a major concern in the business. The majority of qualified analyzer engineers work in the systems integration level, compared to a small number working in the Engineering, Procurement, and Construction (EPC) level and almost none working in front-end engineering design (FEED). Professionals with the necessary skills to operate the process equipment that makes up components and solutions are constantly needed. Personnel with competence, relevant experience, and process analytical tool knowledge are necessary for the proper use of analytical equipment.

UPSTREAM PRODUCTION AUTOMATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By offering, technology, and region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd, Honeywell International Inc, Rockwell Automation Inc, Mitsubishi Corporation, Schneider Electric SE

|

This research report on the global Upstream Production Automation Market has been segmented and sub-segmented based on offering, technology, and region.

Upstream Production Automation market segmentation – By Offering

-

Hardware

-

Software

-

Services

The market is segmented into hardware, software, and services through the offering. In terms of product offerings, the hardware sector amassed a respectable market share, but the software sector is projected to experience a significant growth rate in the years to come.

Upstream Production Automation market segmentation – By Technology

-

Supervisory control and data acquisition (SCADA)

-

Programmable logic controllers (PLCs)

-

Distributed control systems (DCS)

-

Machine execution systems (MES)

-

Enterprise resource planning (ERP)

-

Product lifecycle management (PLM)

-

Others

Based on technology, the market is divided into supervisory control and data acquisition (SCADA), programmable logic controllers (PLCs), distributed control systems (DCS), machine execution systems (MES), enterprise resource planning (ERP), product lifecycle management (PLM), and other technologies.

In terms of technology, Distributed Control Systems are anticipated to hold the maximum share of revenue in the forecasted years. It is integrated as a controlled architecture consisting of a supervisory control overlooking multiple, integrated systems that are in charge of managing the features of a localized process. One of the significant uses of DCS is in industrial processes including oil and gas refineries, oil production, etc. One of the primary drivers of DCS includes the rise in the use of renewable and nuclear energy resources for power generation and the promotion of the industrial internet of things (IIoT) for real-time decision-making processes. Moreover, it is flexible enough to incorporate various hardware solutions to impart a comprehensive solution. It also has the capacity to integrate traditional SIMATIC ET 200 distributed I/O stations as well as use modern smart devices with the IoT technology.

Upstream Production Automation market segmentation – By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

Cisco estimates that 50 billion assets will adopt IoT, and the Upstream Production Automation industry is anticipated to take advantage of this trend. A dynamic global business, Upstream Production Automation faces difficulties managing costs, getting the most out of present assets, and increasing uptime. The development of connected businesses as a result of technological advancements is assisting the Upstream Production Automation sector in attaining operational excellence. In order to ensure that operations are optimised, the sector has been implementing a variety of automation technologies.

Upstream Production Automation market segmentation – By Company

While social media platforms enhance consumer interactions by creating these connections in a quick, direct, and affordable way, mobile technology opens up new business opportunities. The amount of data that businesses can access will significantly expand as a result of the sensors' falling cost and the emergence of the industrial internet of things (IoT). The potential to massively improve these technologies' capabilities, far exceeding their effectiveness when used alone, exists. A new degree of linked intelligence is currently being introduced to Upstream Production Automation operations as a result of these combined effects. Beyond boosting productivity, digitalization can make it possible for companies to communicate with customers more effectively. For Upstream Production Automation firms, big data and analytics, IoT, and mobile devices are swiftly rising to the top of the digital trend list.

-

ABB Ltd

-

Honeywell International Inc

-

Rockwell Automation Inc

-

Mitsubishi Corporation

-

Schneider Electric SE

NOTABLE HAPPENINGS IN THE UPSTREAM PRODUCTION AUTOMATION MARKET IN THE RECENT PAST:

-

Emerson released two new Rosemount 628 Universal Gas Sensors in July 2019 to detect oxygen and carbon monoxide depletion in addition to the current ability to watch out for hydrogen sulphide. These series of extensions address a wider variety of dangerous scenarios that the Rosemount 928 Wireless Gas Monitor platform can be used to monitor.

Chapter 1. UPSTREAM PRODUCTION AUTOMATION MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. UPSTREAM PRODUCTION AUTOMATION MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.UPSTREAM PRODUCTION AUTOMATION MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. UPSTREAM PRODUCTION AUTOMATION MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. UPSTREAM PRODUCTION AUTOMATION MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. UPSTREAM PRODUCTION AUTOMATION MARKET – By Offering

6.1. Hardware

6.2. Software

6.3. Services

Chapter 7. UPSTREAM PRODUCTION AUTOMATION MARKET – By Technology

7.1. Supervisory control and data acquisition (SCADA)

7.2. Programmable logic controllers (PLCs)

7.3 Distributed control systems (DCS)

7.4 Machine execution systems (MES)

7.5 Enterprise resource planning (ERP)

7.6 Product lifecycle management (PLM)

7.7 Others

Chapter 8. UPSTREAM PRODUCTION AUTOMATION MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Download Sample

Choose License Type

2500

4250

5250

6900