Unmanned Aerial Vehicles (UAVs) Market Size (2024 – 2030)

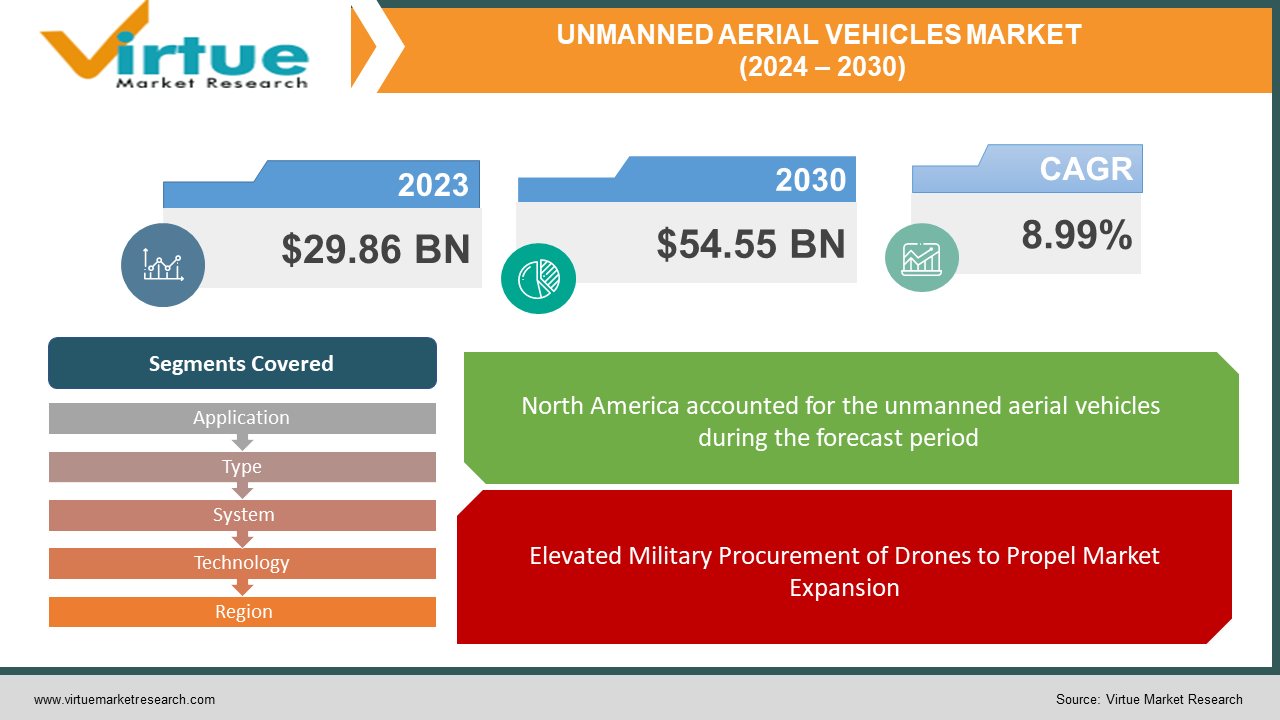

The Global Unmanned Aerial Vehicles (UAVs) Market size was exhibited at USD 29.86 billion in 2023 and is projected to hit around USD 54.55 billion by 2030, growing at a CAGR of 8.99% during the forecast period from 2024 to 2030.

Unmanned aerial vehicles (UAVs) represent a category of aerial transportation devoid of onboard crew or passengers, functioning through remote control, autonomy, or a combination of both. These advanced aircraft find applications in surveillance, assessment, logistics, photography, and various other domains. The imposition of regulations by different nations governing UAV usage directly influences the UAV market. Drones emerge as the most prevalent UAV variant globally. The escalating adoption of intelligent technology for functions like surveillance, analysis, and imaging is anticipated to drive the expansion of UAVs. Defense forces worldwide extensively deploy UAVs, and recent investments by public and private entities aim to develop sophisticated UAVs tailored to their specific requirements. The evolving potential of UAVs for diverse civil and commercial applications has spurred technological advancements, and the civil and commercial segment is poised for substantial growth in the coming decade.

Key Market Insights:

The global UAV market is poised for notable expansion, attributed to the increasing integration of smart technology in agricultural, mining, and construction for surveillance, coupled with the modernization and upgrading initiatives undertaken by security agencies worldwide. UAVs represent the next generation of autonomously propelled or remotely controlled aircraft systems, excluding onboard pilots or passengers. North America leads the UAV market due to shifting security perspectives and the presence of UAV manufacturers across the region. The civil and commercial segment emerges as the predominant consumer globally, expected to sustain its profitability throughout the forecast period.

The global UAV market exhibits fragmentation, with numerous market participants operating globally. These entities strive to enhance their market presence by establishing long-term contracts and agreements with military and law enforcement agencies. Furthermore, market players actively pursue strategies such as acquisitions, agreements, collaborations, partnerships, product development, and launches to gain a competitive edge. Leading companies, including AeroVironment, Inc., Airbus S.A.S., BAE Systems, DJI, Elbit Systems, FLIR Systems, Lockheed Martin, Northrop Grumman, Textron Inc., and others, contribute significantly to the growth of the global UAV market through various developmental initiatives.

Global Unmanned Aerial Vehicles (UAVs) Market Drivers:

Elevated Military Procurement of Drones to Propel Market Expansion

Modern military strategies increasingly prioritize Intelligence, Surveillance, and Reconnaissance (ISR) capabilities over conventional firepower. This shift has fostered a substantial demand for UAVs in the military sector. UAVs, being crewless and operable autonomously or via remote control, play a pivotal role in ISR and offensive operations. Ranging from large UAVs resembling small aircraft carrying missiles to bird-sized autonomous drones, these capabilities are indispensable for militaries, providing a strategic advantage while maintaining ground station safety.

The ongoing Russia-Ukraine conflict exemplifies the pivotal role of UAVs in modern warfare. Both nations, Ukraine and Russia, have strategically deployed drones to gain a tactical advantage. Ukraine has extensively utilized drones from the U.S. and Turkey, such as the Bayraktar B2 drone, in counter-offensives. Simultaneously, Russia has incorporated kamikaze drones from Iran into its indigenous drone arsenal. The substantial use of drones has spurred demand across Europe, North America, and the Asia Pacific. The evolving complexity of electronic warfare further underscores the significance of advancing Unmanned Aerial Vehicle technology.

Surging Demand for UAVs in Commercial Applications to Fuel Market Growth

UAVs and drones are witnessing rapid integration into diverse commercial applications. Organizations increasingly view drones as a cost-effective and efficient means of product delivery, circumventing road traffic and ensuring swift deliveries. Drone flying has become a popular recreational activity, and high-quality cameras with axis stabilization are revolutionizing the film-making and videography industries by enabling seamless aerial shots.

Drones are finding applications in the healthcare sector for tasks like medicine delivery and sample transport. Many countries are incorporating drones into healthcare practices. Additionally, UAVs are utilized in remote sensing, Earth observation operations, and various industries, including oil, energy, and solar, for site inspections. In agriculture, drones are employed to manage crop growth and monitor crop health.

Global Unmanned Aerial Vehicles (UAVs) Market Restraints and Challenges:

Stringent Government Regulations Pose Challenges to Market Growth

Divergent policies across nations govern the usage of UAVs and drones, leading to challenges in their global adoption. Stringent regulations encompass factors such as UAV weight, maximum flight altitude, permitted flight zones, and other operational aspects. Manufacturers must align their products with these regulations, limiting the eligibility of UAVs for commercial use. Visual Line-of-Sight (VLOS) requirements and operator licensing in many countries further constrain commercial UAV usage.

Increasing geopolitical tensions contribute to market deceleration, especially with the prevalent use of camera-equipped UAVs in commercial applications. The susceptibility to cyber-attacks and concerns regarding potential espionage activities raise national security risks. Consequently, some countries have initiated restrictions on specific manufacturers, impeding market growth.

Global Unmanned Aerial Vehicles (UAVs) Market Opportunities:

The global market for Unmanned Aerial Vehicles (UAVs) presents a myriad of lucrative opportunities propelled by technological advancements and diverse applications. The increasing demand for surveillance, reconnaissance, and precision agriculture is poised to drive substantial growth in the UAV market. Major contributions from the defense and security sectors, utilizing UAVs for intelligence gathering and monitoring, will play a pivotal role in expanding the market.

Additionally, the commercial sector is actively exploring UAV applications in parcel delivery, infrastructure inspection, and environmental monitoring. The integration of innovative technologies like artificial intelligence and advanced sensors enhances the versatility and efficiency of UAVs, further fueling the market's potential. Emerging economies embracing UAV technology across various industries contribute significantly to the market's growth trajectory.

As regulatory frameworks evolve to accommodate the expanding UAV landscape, opportunities for market players multiply. Companies that invest in research and development, coupled with strategic collaborations, are strategically positioned to capitalize on the evolving UAV market. This approach unlocks new avenues for growth, shaping the future of aerial technology.

UNMANNED AERIAL VEHICLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.99% |

|

Segments Covered |

By Application, Type, System, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

UAV Solutions, Inc., Lockheed Martin Corporation., Martin UAV, Israel Aerospace Industries Ltd., EMT Ingenieurgesellschaft Dipl.-Ing. Hartmut Euer mbH, Selex ES Inc., BlueBird Aero Systems, Northrop Grumman Corporation, Dassault Aviation SA, General Atomics, Boeing, AeroVironment, Inc., BAE Systems, Airbus DS GmbH |

Global Unmanned Aerial Vehicles (UAVs) Market Segmentation: By Application

-

Military & Defense

-

Civil & Commercial

-

Logistics & Transportation

-

Construction & Mining

-

Others

The military & defense segment emerges as the market leader, commanding the largest revenue share throughout the forecast period. The global unmanned aerial vehicle market is segmented based on technology into military & defense, civil & commercial, logistics & transportation, construction & mining, and others. Within these segments, the military & defense category holds dominance, primarily driven by the escalating demand for tactical and strategic UAVs for military applications. Various nations are increasing their acquisitions of specialized UAVs, such as Medium Altitude Long Endurance (MALE) and High-Altitude Long Endurance (HALE) UAVs, driven by needs such as border monitoring, surveillance, and security operations. The foreseeable future anticipates a surge in demand, fueled by significant operations in these domains.

Global Unmanned Aerial Vehicles (UAVs) Market Segmentation: By Type

-

Fixed Wing

-

Rotary Wing

-

Hybrid

The fixed-wing segment is experiencing noteworthy Compound Annual Growth Rate (CAGR) advancement throughout the forecast period. In terms of type, the global unmanned aerial vehicle market is categorized into fixed-wing and rotary-wing. Among these, the fixed-wing segment is observing substantial CAGR growth over the forecast period. The fixed-wing segment further divides into CTOL and VTOL. Fixed-wing UAVs with Vertical Takeoff and Landing (VTOL) capability find applications in diverse commercial and military flying missions. Their ability to operate without the need for launchers or runways, thanks to vertical takeoff and landing, allows them to function in various environments. The fixed-wing structure enhances endurance, enabling VTOL fixed-wing UAVs to cover larger areas swiftly and at high speeds compared to multirotor UAVs.

Global Unmanned Aerial Vehicles (UAVs) Market Segmentation: By System

-

UAV Airframe

-

UAV Payloads

-

UAV Avionics

-

UAV Propulsion

-

UAV Software

The avionics segment is anticipated to drive rapid revenue growth in the global unmanned aerial vehicle market throughout the forecast period. Based on the system, the global unmanned aerial vehicle market is segmented into airframe, payloads, avionics, propulsion, and software. Among these, the avionics segment is poised for accelerated growth due to the integration of automated flight management systems, advanced electronics, and path control. Businesses are concentrating on enhancing their Global Navigation Satellite System (GNSS)-based navigation systems to ensure flight efficiency. This innovation will enhance drones' capabilities in object detection, collision avoidance, and automatic flight control, particularly crucial for wartime missions, logistics & transportation, and disaster relief operations. The software system is expected to become more precise and fully equipped with real-time detection of airspeed, altitude, and position in the coming years, driving the growth of software systems.

Global Unmanned Aerial Vehicles (UAVs) Market Segmentation: By Technology

-

Remotely Operated

-

Semi-autonomous

-

Fully-autonomous

The fully autonomous segment is projected to exhibit the highest CAGR in the market during the forecast period. In terms of technology, the global unmanned aerial vehicle market is divided into remotely operated, semi-autonomous, and fully autonomous. Among these, the fully autonomous segment experienced the highest CAGR growth over the forecast period. It encompasses a command delivery system and flight planning system where the route of flight and operating range are predetermined. Operating without ground operator orders, fully autonomous UAVs are in complete control. The use of remote sensing technology for various applications will drive the highest CAGR in the autonomous categories throughout the projection period. Beyond the Visual Line of Sight (BVLS), drones precisely control the drone at lower elevations to obtain data via remote sensing.

Global Unmanned Aerial Vehicles (UAVs) Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America maintains its dominance, holding the largest market share throughout the forecast period. The region's preeminence is attributed to the military's increasing utilization of drones in aerial mapping, forest monitoring, and infrastructure surveys. As one of the leading global producers of military UAVs, the United States significantly influences this dominance, exporting to numerous nations. The region's continued leadership is anticipated due to its extensive deployment of UAVs for municipal welfare and the engagement of major companies, with the U.S. expected to play a pivotal role in expanding the regional market. Leading market providers worldwide are rooted in the U.S., and the substantial deployment of UAVs in the defense sector reinforces the region's leading position. Consequently, it is predicted that North America will account for the largest market share throughout the study.

Asia-Pacific's market is poised to exhibit the fastest growth during the forecast period. The expansion of the UAV market in Asia-Pacific is correlated with higher military expenditures, especially in defense and homeland security, aimed at enhancing defense capabilities. Political conflicts in the region have led to increased drone deployment for border security, a significant factor propelling the growth of the Asia-Pacific UAV industry. China, in collaboration with the Russian defense sector, is actively developing small unmanned aerial vehicles (UAVs) and is expected to contribute significantly to the growth of the regional market. The Asia-Pacific region's market is expected to be driven by a substantial increase in Original Equipment Manufacturer (OEM) output for UAV drones during the forecast period.

COVID-19 Impact on the Global Unmanned Aerial Vehicles (UAVs) Market:

The COVID-19 pandemic has influenced various market conditions, including the UAV market. Traditionally used by militaries for missions like line security, UAVs found trial applications by governments and law enforcement agencies. However, the pandemic brought disruptions to the UAV market. The industry faced challenges due to intermittent lockdowns, social distancing protocols, and shortages of raw materials and staff, leading to production halts in 2020. The resurgence of a second wave further hindered UAV production, and a recovery to pre-COVID-19 production levels or normalcy in the UAV supply chain might take over six months.

Recent Trends and Innovations in the Global Unmanned Aerial Vehicles (UAVs) Market:

On July 26, 2023, The National Survey Authority (NSA) inaugurated a new UAV at the Ministry of Defence, offering a modern and efficient approach to streamline survey and exploration operations, saving time and effort.

On July 26, 2023, Northrop Grumman Corp., Aeronautics Systems, secured a $19.9 million contract to upgrade MQ-8C UAV, enhancing its capabilities for the Navy's tactical unmanned air vehicle system. The enhancements are slated for completion by May 2026.

On July 23, 2023, Russian engineers announced the development of advanced technology for their Joker line of First Person View (FPV) drones. The technology includes a hibernation mode allowing the UAV to remain dormant for weeks before executing its mission, minimizing susceptibility to Electronic Warfare (EW) jamming.

Key Players:

-

UAV Solutions, Inc.

-

Lockheed Martin Corporation

-

Martin UAV

-

Israel Aerospace Industries Ltd.

-

EMT Ingenieurgesellschaft Dipl.-Ing. Hartmut Euer mbH

-

Selex ES Inc.

-

BlueBird Aero Systems

-

Northrop Grumman Corporation

-

Dassault Aviation SA

-

General Atomics

-

Boeing

-

AeroVironment, Inc.

-

BAE Systems

-

Airbus DS GmbH

Chapter 1. Unmanned Aerial Vehicles (UAVs) Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Unmanned Aerial Vehicles (UAVs) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Unmanned Aerial Vehicles (UAVs) Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Unmanned Aerial Vehicles (UAVs) MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Unmanned Aerial Vehicles (UAVs) Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Unmanned Aerial Vehicles (UAVs) Market– By Application

6.1 Introduction/Key Findings

6.2 Military & Defense

6.3 Civil & Commercial

6.4 Logistics & Transportation

6.5 Construction & Mining

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Unmanned Aerial Vehicles (UAVs) Market– By Type

7.1 Introduction/Key Findings

7.2 Fixed Wing

7.3 Rotary Wing

7.4 Hybrid

7.5 Y-O-Y Growth trend Analysis By Type

7.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Unmanned Aerial Vehicles (UAVs) Market– By System

8.1 Introduction/Key Findings

8.2 UAV Airframe

8.3 UAV Payloads

8.4 UAV Avionics

8.5 UAV Propulsion

8.6 UAV Software

8.7 Y-O-Y Growth trend Analysis End-Use Industry

8.8 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Unmanned Aerial Vehicles (UAVs) Market– By Technology

9.1 Introduction/Key Findings

9.2 Remotely Operated

9.3 Semi-autonomous

9.4 Fully-autonomous

9.5 Y-O-Y Growth trend Analysis By Technology

9.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 10. Unmanned Aerial Vehicles (UAVs) Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Application

10.1.2.1 By Type

10.1.3 By System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Application

10.2.3 By Type

10.2.4 By System

10.2.5 By Technology

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Application

10.3.3 By Type

10.3.4 By System

10.3.5 By Technology

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Application

10.4.3 By Type

10.4.4 By System

10.4.5 By Technology

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Application

10.5.3 By Type

10.5.4 By System

10.5.5 By Technology

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Unmanned Aerial Vehicles (UAVs) Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 UAV Solutions, Inc.

11.2 Lockheed Martin Corporation

11.3 Martin UAV

11.4 Israel Aerospace Industries Ltd.

11.5 EMT Ingenieurgesellschaft Dipl.-Ing. Hartmut Euer mbH

11.6 Selex ES Inc.

11.7 BlueBird Aero Systems

11.8 Northrop Grumman Corporation

11.9 Dassault Aviation SA

11.10 General Atomics

11.11 Boeing

11.12 AeroVironment, Inc.

11.13 BAE Systems

11.14 Airbus DS GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Unmanned Aerial Vehicles (UAVs) Market size is valued at USD 29.86 billion in 2023.

The worldwide Global Unmanned Aerial Vehicles (UAVs) Market growth is estimated to be 8.99% from 2024 to 2030.

The Global Unmanned Aerial Vehicles (UAVs) Market is segmented By Application (Military & Defense, Civil & Commercial, Logistics & Transportation, Construction & Mining, Others), By Type (Fixed Wing, Rotary Wing, Hybrid), By System (UAV Airframe, UAV Payloads, UAV Avionics, UAV Propulsion, UAV Software), By Technology (Remotely Operated, Semi-autonomous, Fully-autonomous).

The Global Unmanned Aerial Vehicles (UAVs) Market anticipates future trends and opportunities driven by evolving technologies, expanding applications in defense, commercial sectors, and precision agriculture. Innovations in AI, advanced sensors, and strategic collaborations are poised to unlock new avenues, shaping the UAV market's dynamic and promising future.

The COVID-19 pandemic significantly impacted the Global Unmanned Aerial Vehicles (UAVs) Market, causing disruptions in production due to lockdowns, social distancing measures, and raw material shortages. The industry witnessed a decline in UAV manufacturing, affecting supply chains and delaying the return to pre-pandemic production scales.