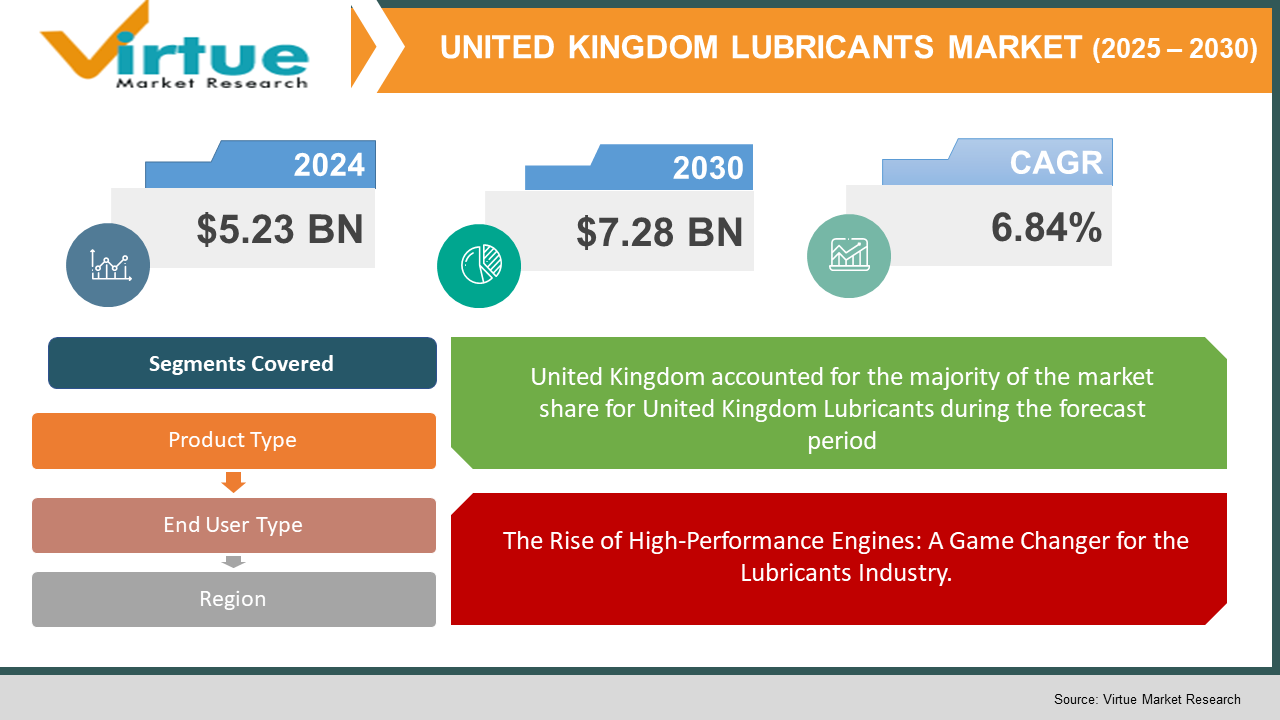

United Kingdom Lubricants Market Size (2025-2030)

The United Kingdom's Lubricants Market was valued at USD 5.23 billion and is projected to reach a market size of USD 7.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.84%.

A lubricant is any oil or grease which is used to reduce friction between any two machines working closely. The lubricant market is relatively stable in the United Kingdom, but recent events such as the pandemic and global energy crisis coupled with climate change has made sustainability a key focus of this market. To maintain its market position, the industry is expected to refocus its attention on sustainability and maintainability. As a result, new lubricant products that emphasise sustainability and environmental friendliness are expected to increase in number. Manufacturers of lubricants are probably going to spend money on R&D to produce lubricants that are less harmful to the environment.

Key Market Insights:

- The UK lubricants market has experienced significant transformations, with a growing emphasis on sustainability and eco-friendly manufacturing. In 2022, the market stabilised, setting the stage for future growth.

- British Petroleum (BP) has announced that it will sell its lubricants business and a stake in Lightsource BP for $20 Billion. This comes as the company is looking at major restructuring of its balance sheet.

- Major players such as Shell, BP Plc (Castrol), and ExxonMobil dominate the UK lubricants market, collectively holding over 50% market share. Their extensive product portfolios and strong distribution networks contribute to this dominance.

- Shell has actively engaged in sponsorship deals to enhance its brand visibility and promote its products. The company has been deeply involved in motorsports, sponsoring teams such as BRM, Ferrari, McLaren, Hyundai Motorsport, Lotus, and others over the years. Its advertisements showcasing various products are widely broadcast on television and the internet, as well as featured in magazines, newspapers, and billboards.

- The partnership between Just Eat Takeaway.com and Lovehoney Group to offer sexual wellbeing products, including lubricants, indicates a diversification trend in the market, blending food delivery services with self-care products.

- The construction sector's growth since 2022, driven by new projects and maintenance work, has increased the demand for construction equipment lubricants. This trend underscores the sector's influence on lubricant consumption.

United Kingdom Lubricants Market Drivers:

The Rise of High-Performance Engines: A Game Changer for the Lubricants Industry.

The growing demand for high-performance engines across industries such as automotive, metalworking, and manufacturing has significantly influenced the lubricants market. As industries continue to push the limits of machinery efficiency and durability, the need for advanced lubricants capable of withstanding extreme operating conditions has surged. In the automotive sector, the rise of high-performance vehicles, including sports cars and heavy-duty commercial trucks, requires specialized lubricants that offer superior thermal stability, reduced friction, and extended engine life. Similarly, the metalworking industry depends on high-performance lubricants to ensure precision, reduce tool wear, and enhance productivity in machining processes. At the same time, increasing environmental concerns and stringent emission regulations have prompted companies to innovate and invest in sustainable lubricant solutions. Many lubricant manufacturers are now focusing on bio-based and synthetic alternatives that offer lower environmental impact while maintaining superior performance. Governments worldwide are also implementing policies that encourage the use of eco-friendly lubricants, further driving market growth. The intersection of these factors has led to a shift in research and development efforts, with companies striving to create lubricants that not only enhance engine performance but also contribute to sustainability goals. As a result, the lubricants market is poised for steady growth in the coming years.

The UK economy post Brexit had a significant economic downturn and is finally in the improvement stage, there has also been an increase in the rise of Automotive sales which is also increasing the demand for lubricants.

Following Brexit, the UK economy experienced a period of economic downturn due to trade disruptions, supply chain issues, and reduced investor confidence. However, in recent years, the economy has shown signs of recovery, driven by policy adjustments, increased foreign trade agreements, and domestic market resilience. The improvement stage is reflected in key economic indicators, including rising consumer spending and industrial activity. One sector that has particularly benefited from this recovery is the automotive industry. The rise in vehicle sales, both new and used, has led to an increased demand for automotive lubricants, essential for engine efficiency and longevity. As more consumers and businesses invest in vehicles, the need for high-quality lubricants, including synthetic and eco-friendly options, continues to grow. This trend is expected to further strengthen the UK lubricants market in the coming years.

United Kingdom Lubricants Market Restraints and Challenges:

Due to global volatility there has been greater price volatility in the cost of Raw materials which has meant more uncertain pricing, environmental regulation can also become a problem in this market.

The UK lubricants market faces several restraints and challenges that could impact its growth trajectory. One of the primary concerns is the fluctuating cost of raw materials, particularly base oils and additives, which are heavily influenced by global crude oil prices. Price volatility can lead to increased production costs and reduced profit margins for manufacturers. Additionally, stringent environmental regulations pose challenges for lubricant producers, requiring continuous innovation to develop sustainable and eco-friendly alternatives. Compliance with UK and EU regulatory frameworks, such as restrictions on certain additives and emissions targets, adds complexity to production processes.

United Kingdom Lubricants Market Opportunities:

The UK lubricants market presents several promising opportunities for growth and innovation. One of the most significant drivers is the increasing demand for high-performance and synthetic lubricants. As industries move towards efficiency and sustainability, there is a rising preference for low-viscosity, energy-efficient lubricants that enhance machinery lifespan and reduce maintenance costs.

UNITED KINGDOM LUBRICANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.84% |

|

Segments Covered |

By Product Type, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

united kingdom |

|

Key Companies Profiled |

Shell, BP (Castrol), ExxonMobil, TotalEnergies, Fuchs Petrolub, and Valvoline |

United Kingdom Lubricants Market Segmentation:

United Kingdom Lubricants Market Segmentation: By Product Type:

- Engine Oil

- Greases

- Hydarulic Fluid

- Metalworking Fluid

Engine oil is the largest segment in the UK lubricants market, driven by the strong demand from the automotive sector. As vehicle ownership rises, both for personal and commercial use, the need for high-quality engine oils that enhance fuel efficiency and reduce emissions continues to grow. Synthetic and semi-synthetic engine oils are gaining traction due to their superior performance, longer drain intervals, and compliance with environmental regulations.

Greases play a crucial role in industrial applications, offering superior lubrication for heavy machinery, bearings, and high-friction components. The UK’s manufacturing and construction industries are major consumers, ensuring steady demand. Hydraulic fluids are essential for machinery operation in sectors like aerospace, construction, and logistics, where efficiency and reliability are critical. With advancements in industrial automation, demand for high-performance hydraulic fluids with enhanced thermal stability and anti-wear properties is increasing. Metalworking fluids, used extensively in machining and fabrication processes, are witnessing innovation, with bio-based and low-toxicity variants emerging as environmentally friendly alternatives in the UK market.

United Kingdom Lubricants Market Segmentation: By End User Type:

- Automotive

- Heavy Equipment

- Power Generation

- Metalworking Industry

The automotive industry is the largest end-user of lubricants in the UK, driven by the increasing vehicle fleet and rising consumer preference for high-performance and fuel-efficient engine oils. Passenger cars, commercial vehicles, and two-wheelers all require a range of lubricants, including engine oils, transmission fluids, and greases, to ensure optimal performance and longevity. Additionally, the shift toward hybrid and electric vehicles (EVs) has led to the development of specialized lubricants for battery cooling and EV drivetrains. With stringent emissions regulations, the demand for low-viscosity, synthetic lubricants that improve fuel efficiency and reduce carbon footprints is on the rise.

The heavy equipment sector, including construction, agriculture, and mining, relies heavily on high-performance lubricants to maintain machinery durability under extreme conditions. Hydraulic fluids, gear oils, and greases are essential for reducing wear and tear in these industries. Similarly, the power generation sector depends on turbine oils, compressor oils, and transformer oils to maintain efficiency and operational reliability. As the UK transitions to renewable energy, bio-lubricants are gaining traction for wind turbines and hydroelectric plants. The metalworking industry also plays a significant role in lubricant demand, using cutting fluids, coolants, and metal-forming oils to enhance machining precision and reduce tool wear. Eco-friendly metalworking fluids are becoming more prominent due to environmental regulations and worker safety considerations.

United Kingdom Lubricants Market Segmentation: By Region

UK’s stringent environmental regulations have accelerated the adoption of bio-based and synthetic lubricants, reducing dependency on conventional petroleum-based products. Moreover, the rise of electric vehicles (EVs) is reshaping the market, prompting lubricant manufacturers to develop specialized fluids for EV cooling and drivetrain efficiency. The manufacturing sector, particularly in precision engineering and metalworking, continues to drive demand for high-performance hydraulic fluids, greases, and metalworking fluids. With the UK government’s push towards net-zero emissions by 2050, sustainability-driven innovations in the lubricants sector are expected to accelerate further.

COVID-19 Impact Analysis on the United Kingdom Lubricants Market:

The COVID-19 pandemic had a significant impact on the UK lubricants market, primarily due to disruptions in supply chains and reduced industrial and automotive activity. Nationwide lockdowns, travel restrictions, and economic slowdowns led to a sharp decline in vehicle usage, reducing the demand for automotive lubricants. Manufacturing plants and construction projects faced temporary shutdowns, affecting the consumption of industrial lubricants such as hydraulic fluids and metalworking fluids. The aviation sector, another major consumer of lubricants, saw a drastic reduction in operations, further slowing market growth. Additionally, delays in raw material procurement and fluctuating crude oil prices created challenges for lubricant manufacturers, forcing them to adjust production strategies. However, as the economy gradually recovered post-pandemic, the lubricants market showed resilience. The resumption of industrial activities, increasing vehicle sales, and growth in e-commerce logistics contributed to a steady rebound in lubricant demand. The shift towards digitalization also accelerated online sales of lubricants, as consumers and businesses sought convenient purchasing options.

Trends/Developments:

With the UK government’s push for EV adoption and the ban on new petrol and diesel car sales by 2035, lubricant manufacturers are developing specialized fluids for electric powertrains. EVs require different lubrication needs, such as thermal management fluids for batteries and transmission lubricants for electric drivetrains. Companies investing in EV-compatible lubricants are positioning themselves for future market dominance.

ExxonMobil has been integrating digital tools and AI-driven analytics into its lubricant services. The company’s Mobil Serv Lubricant Analysis offers predictive maintenance solutions, helping industries monitor lubricant performance and machinery health in real-time. This digital transformation is enhancing efficiency for UK-based manufacturers, reducing downtime, and optimizing lubricant usage.

Shell has been actively investing in sustainable and low-carbon lubricant solutions to align with the UK’s environmental goals. The company introduced its Shell Naturelle range of biodegradable lubricants, catering to industries such as construction and marine, where eco-friendly solutions are in high demand.

Key Players:

- Shell plc

- BP plc (Castrol)

- ExxonMobil Corporation

- TotalEnergies SE

- Fuchs Petrolub SE

- Chevron Corporation

- Valvoline Inc.

- Morris Lubricants

- Petro-Canada Lubricants

- Gulf Oil International

Chapter 1. UNITED KINGDOM LUBRICANTS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. UNITED KINGDOM LUBRICANTS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. UNITED KINGDOM LUBRICANTS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. UNITED KINGDOM LUBRICANTS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. UNITED KINGDOM LUBRICANTS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. UNITED KINGDOM LUBRICANTS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Engine Oil

6.3 Greases

6.4 Hydarulic Fluid

6.5 Metalworking Fluid

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. UNITED KINGDOM LUBRICANTS MARKET – By End User Type

7.1 Introduction/Key Findings

7.2 Automotive

7.3 Heavy Equipment

7.4 Power Generation

7.5 Metalworking Industry

7.6 Y-O-Y Growth trend Analysis By End User Type

7.7 Absolute $ Opportunity Analysis By End User Type , 2025-2030

Chapter 8. UNITED KINGDOM LUBRICANTS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.2. By Product Type

8.1.3. By End User Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. UNITED KINGDOM LUBRICANTS MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Shell plc

9.2 BP plc (Castrol)

9.3 ExxonMobil Corporation

9.4 TotalEnergies SE

9.5 Fuchs Petrolub SE

9.6 Chevron Corporation

9.7 Valvoline Inc.

9.8 Morris Lubricants

9.9 Petro-Canada Lubricants

9.10 Gulf Oil International

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The UK lubricants market is valued at 5.23 Billion USD, with steady growth driven by the automotive, industrial, and power generation sectors

Key industries include automotive, heavy equipment, power generation, metalworking, and manufacturing, all requiring specialized lubricants for efficiency and durability.

The rise of EVs is driving demand for specialized fluids, such as EV transmission lubricants and battery cooling fluids, prompting manufacturers to innovate.

Major players include Shell, BP (Castrol), ExxonMobil, TotalEnergies, Fuchs Petrolub, and Valvoline, among others

Key trends include the rise of bio-based lubricants, increasing EV lubricant innovation, digitalization in predictive maintenance, and market consolidation through acquisitions and partnerships.

v