United Kingdom Butter and Ghee Market Size (2025-2030)

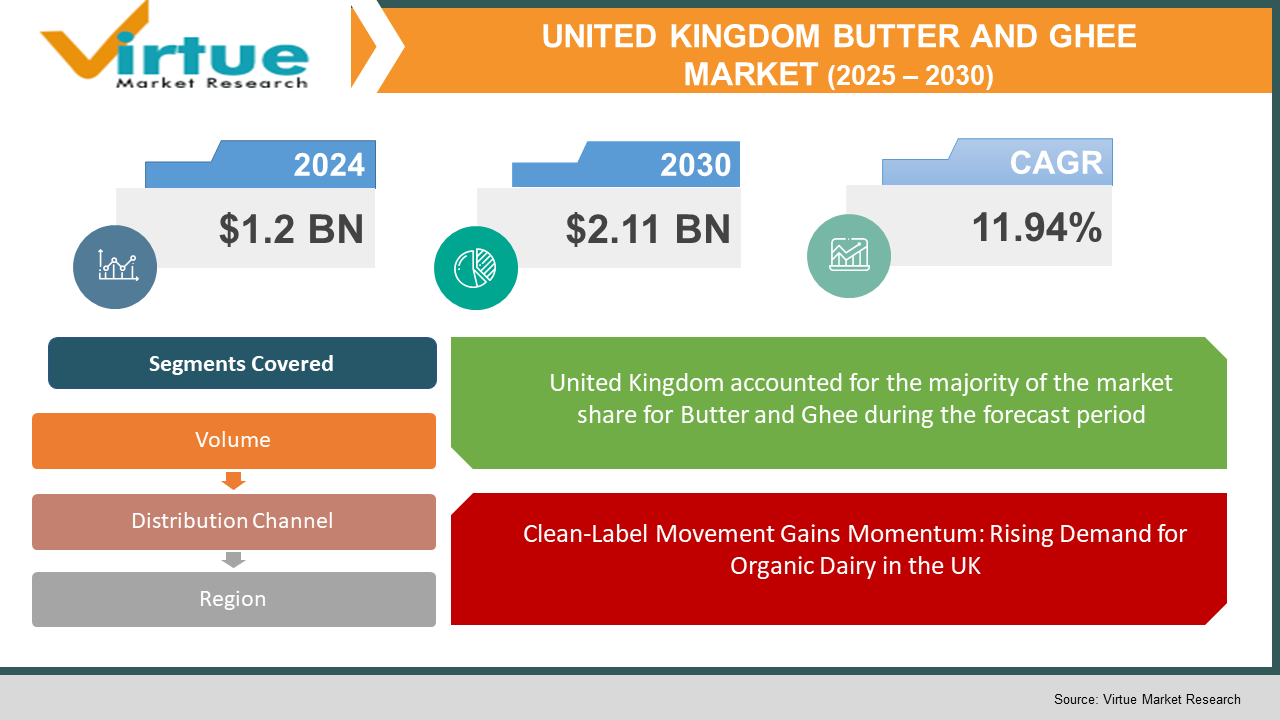

The United Kingdom Butter and Ghee Market was valued at USD 1.2 billion in 2024 and is projected to reach a market size of USD 2.11 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.94%.

The United Kingdom's butter and ghee market is expressing steady growth, driven by evolving consumer preferences, increasing demand for organic and grass-fed dairy products, and the rising influence of global culinary trends. Butter remains a staple in British households, widely used in baking, cooking, and spreads, while ghee is gaining traction due to its perceived health benefits and growing popularity in Ayurvedic and high-fat diets. The market is further supported by the expansion of premium and specialty dairy products, with consumers seeking clean-label, lactose-free, and sustainable options. Despite fluctuating dairy prices and shifting dietary trends, the market continues to evolve, with retail innovations, e-commerce expansion, and product diversification playing a crucial role in shaping its future.

Key Market Insights:

- The United Kingdom's butter and ghee market has been witnessing a steady increase in demand, driven by changing consumer preferences toward natural, organic, and grass-fed dairy products. Over 56% of the UK's butter and ghee imports come from Ireland, highlighting the strong trade relationship between the two nations. Additionally, domestic butter production continues to support the market, with a focus on premium, artisanal, and organic offerings. The trend toward health-conscious eating has led to a rise in low-salt and lactose-free butter alternatives, catering to consumers with dietary restrictions and wellness-oriented lifestyles.

- Ghee, traditionally consumed by South Asian and Middle Eastern communities in the UK, is now gaining wider acceptance among health-conscious consumers. With the rising influence of Ayurvedic and ketogenic diets, sales of ghee have surged, particularly in urban areas such as London, Birmingham, and Manchester. Recent reports indicate that online sales of ghee have increased by over 35% in the past three years as more consumers shift toward digital grocery shopping and specialty e-commerce platforms.

- Supermarkets and hypermarkets remain the dominant distribution channels, accounting for a significant share of retail butter and ghee sales. However, e-commerce is the fastest-growing segment, with a projected growth rate exceeding 10% annually, as brands leverage direct-to-consumer sales, subscription services, and digital marketing strategies. Additionally, private-label butter brands are gaining popularity, with retailers offering affordable, high-quality alternatives to well-established brands.

UK Butter and Ghee Market Drivers:

Clean-Label Movement Gains Momentum: Rising Demand for Organic Dairy in the UK

Consumers in the UK are highly opting for organic, grass-fed, and minimally processed dairy products, driving demand for high-quality butter and ghee. Health-conscious individuals seek natural, additive-free options that provide superior nutritional benefits, such as higher omega-3 fatty acids and conjugated linoleic acid (CLA) found in grass-fed dairy. This shift is further supported by growing concerns over artificial additives, pesticides, and antibiotics in conventional dairy, prompting brands to expand their organic and clean-label product lines to cater to evolving consumer preferences.

Expanding Awareness of Ghee as a Healthy Fat in Keto, Paleo, and Ayurvedic Diets

The rising popularity of high-fat, low-carb diets like keto and paleo, as well as the increased adoption of Ayurvedic nutrition, has remarkably contributed to the growth of ghee consumption in the UK. Once primarily used by South Asian communities, ghee has now gained mainstream acceptance as a lactose-free, shelf-stable alternative to butter and other cooking oils. Studies indicate a 35% rise in ghee sales through online platforms, highlighting its growing consumer base. Additionally, fitness enthusiasts and nutrition-conscious buyers are incorporating ghee into their diets due to its digestive benefits, high smoke point, and rich vitamin content, further fueling demand.

Increasing Demand for Premium and Artisanal Butter in Baking and Gourmet Cooking

The UK’s long-standing love for baking, patisserie, and gourmet cuisine has contributed to a rise in demand for premium, artisanal, and specialty butter varieties. Home baking trends, amplified by influencers, cooking shows, and digital content, have led to increased sales of European-style cultured butter, flavored butter with herbs, and high-fat content butter preferred by professional chefs and home bakers alike. This trend is particularly strong in urban centers such as London, Edinburgh, and Manchester, where consumers are willing to pay a premium for high-quality and ethically sourced butter products.

E-commerce and Direct-to-Consumer Sales Revolutionizing the Dairy Retail Landscape

The rise of online grocery shopping and direct-to-consumer (DTC) dairy brands is reshaping the way consumers purchase butter and ghee in the UK. With digital platforms witnessing a 40% increase in dairy product sales, companies are focusing on subscription models, specialty food delivery services, and personalized online shopping experiences to attract and retain customers. The availability of niche, imported, and organic butter and ghee brands through e-commerce platforms has allowed consumers to access a broader range of products, including internationally sourced grass-fed butter and Ayurvedic ghee varieties, driving further market expansion.

UK Butter and Ghee Market Restraints and Challenges:

Fluctuating Dairy Prices, Regulatory Constraints, and Changing Consumer Dietary Preferences

The UK butter and ghee market faces challenges due to fluctuating dairy prices, which are driven by global supply chain disruptions, feed costs, and environmental factors affecting milk production. Price volatility can impact both producers and consumers, leading to inconsistent retail pricing and potential shifts toward cheaper alternatives like margarine and plant-based spreads. Additionally, strict UK and EU regulations on dairy farming, labeling, and import policies create hurdles for manufacturers, particularly for imported ghee products that must comply with food safety and quality standards. Changing dietary preferences, including the rising popularity of vegan and plant-based diets, also pose a challenge, as some consumers opt for dairy-free butter alternatives, impacting traditional butter and ghee consumption.

UK Butter and Ghee Market Opportunities:

The UK butter and ghee market presents significant opportunities influenced by the rising demand for functional dairy products, sustainable packaging innovations, and the rapid growth of e-commerce. Consumers are increasingly seeking high-nutrient, fortified, and digestive-friendly butter and ghee options, such as probiotic-infused butter and vitamin-enriched ghee, creating opportunities for brands to introduce health-focused dairy products. Sustainability is another key driver, with growing interest in carbon-neutral dairy farming, biodegradable packaging, and ethical sourcing pushing companies to adopt eco-friendly production practices. Additionally, the surge in online grocery shopping and direct-to-consumer sales provides brands with new distribution channels, allowing them to reach a broader audience through digital platforms, specialty food delivery services, and subscription models.

UNITED KINGDOM BUTTER AND GHEE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.94% |

|

Segments Covered |

By volume, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom |

|

Key Companies Profiled |

Arla Foods, Ornua Co-operative Limited, Fonterra Co-operative Group, Saputo Inc |

UK Butter and Ghee Market Segmentation:

United Kingdom Butter and Ghee Market Segmentation: By Volume:

- Imports

- Exports

Imports remain the dominant segment in the UK butter and ghee market, accounting for over 56% of total consumption, with Ireland serving as the largest supplier due to its high-quality, grass-fed dairy production and strong trade ties with the UK. The reliance on imports is driven by growing consumer demand for organic and premium butter varieties, as well as limited domestic dairy production capacity.

While exports remain a smaller portion of the market, they are experiencing steady growth as British butter and ghee brands gain international recognition for their quality and craftsmanship. The fastest-growing export destinations include European nations, the Middle East, and North America, where demand for premium British dairy products is increasing. Artisanal and specialty butter brands, particularly those focusing on organic, grass-fed, and sustainable dairy, are leading the export surge as international consumers seek high-quality, ethical dairy alternatives. The growing popularity of British cuisine and baking culture worldwide is further fueling demand for UK-produced butter in both retail and food service sectors.

United Kingdom Butter and Ghee Market Segmentation By Distribution Channel:

- Retail Store

- Supermarkets

- Hypermarkets

Supermarkets dominate the UK butter and ghee market, accounting for the highest share of sales, as they offer a wide variety of brands, including private-label, organic, and premium options. Consumers prefer supermarkets due to their convenience, competitive pricing, and accessibility, with major chains like Tesco, Sainsbury’s, and Morrisons playing a key role in distribution. The availability of promotional offers, bulk purchasing options, and dedicated dairy sections further strengthen supermarkets’ dominance in the market.

Retail stores, including independent grocers and specialty dairy shops, cater to consumers looking for artisanal, organic, and imported butter and ghee varieties. These stores are particularly popular in urban areas and multicultural neighborhoods, where the need for international dairy products and specialty ghee brands is high. Hypermarkets, such as Costco and ASDA, are the fastest-growing segment, driven by increasing consumer preference for bulk purchasing, wholesale discounts, and premium product availability, making them a key distribution channel for both household and food service buyers.

Market Segmentation: Regional Analysis:

The UK butter and ghee market is widely distributed across all regions, with major urban centers like London, Birmingham, and Manchester driving demand due to diverse consumer preferences, high multicultural populations, and strong retail networks. Scotland and Wales also contribute significantly, with a growing preference for organic and grass-fed butter options supported by local dairy farming industries. The southeastern region, including London, remains the largest consumer hub, with high demand for premium, imported, and specialty dairy products.

COVID-19 Impact Analysis on the UK Butter and Ghee Market:

The COVID-19 pandemic had a mixed impact on the UK butter and ghee market, with initial disruptions in dairy supply chains, fluctuating demand, and shifting consumer purchasing behaviors. Panic buying during lockdowns led to a surge in butter sales, especially for home baking and cooking, as consumers spent more time indoors. However, the closure of restaurants, bakeries, and food service establishments temporarily reduced bulk demand, affecting overall market dynamics. Ghee sales experienced a boost among health-conscious consumers, driven by its long shelf life and perceived immunity-boosting properties. Additionally, the pandemic accelerated the shift toward e-commerce and direct-to-consumer dairy sales, as consumers increasingly opted for online grocery shopping and doorstep delivery services, a trend that continues to influence the market today.

Latest Trends/ Developments:

The UK butter and ghee market is experiencing a surge in demand for organic, grass-fed, and clean-label dairy products as consumers become more conscious of nutrition, sustainability, and ethical sourcing. Brands are responding by launching premium, additive-free butter and ghee variants, catering to health-conscious buyers and those following keto, paleo, and Ayurvedic diets. Additionally, flavored and infused butter options, such as garlic, herb, and truffle butter, are gaining popularity among home chefs and gourmet cooking enthusiasts. The rise of veganism and plant-based diets has also led to the introduction of dairy-free butter alternatives, challenging traditional dairy products while pushing established brands to innovate.

E-commerce and direct-to-consumer (DTC) sales are rapidly transforming the distribution landscape, with online dairy sales growing significantly through supermarket delivery services, specialty food websites, and subscription-based models. Digital platforms are allowing smaller and artisanal dairy brands to expand their reach, offering niche and international butter and ghee products directly to consumers. Sustainability has become a focal point, with companies investing in carbon-neutral dairy farming, recyclable packaging, and ethical sourcing practices to align with growing environmental concerns.

Key Players:

- Arla Foods

- Ornua Co-operative Limited

- Fonterra Co-operative Group

- Saputo Inc.

- Müller UK & Ireland Group

- Westland Dairy Company

- FrieslandCampina

- Yeo Valley

- Ghee Easy

- Purity Farms

Chapter 1. UNITED KINGDOM BUTTER AND GHEE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. UNITED KINGDOM BUTTER AND GHEE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. UNITED KINGDOM BUTTER AND GHEE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. UNITED KINGDOM BUTTER AND GHEE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. UNITED KINGDOM BUTTER AND GHEE MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. UNITED KINGDOM BUTTER AND GHEE MARKET – By Volume

6.1 Introduction/Key Findings

6.2 Imports

6.3 Exports

6.4 Y-O-Y Growth trend Analysis By Volume

6.5 Absolute $ Opportunity Analysis By Volume , 2025-2030

Chapter 7. UNITED KINGDOM BUTTER AND GHEE MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Retail Store

7.3 Supermarkets

7.4 Hypermarkets

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. UNITED KINGDOM BUTTER AND GHEE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K.

8.1.2. By Volume

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. UNITED KINGDOM BUTTER AND GHEE MARKET– Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

9.1 Arla Foods

9.2 Ornua Co-operative Limited

9.3 Fonterra Co-operative Group

9.4 Saputo Inc.

9.5 Müller UK & Ireland Group

9.6 Westland Dairy Company

9.7 FrieslandCampina

9.8 Yeo Valley

9.9 Ghee Easy

9.10 Purity Farms

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The United Kingdom Butter and Ghee Market was valued at USD 1.2 billion in 2024 and is projected to reach a market size of USD 2.11 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.94%.

. Rising consumer demand for organic dairy, premium butter, and health-focused ghee products

Based on Volume, the United Kingdom Butter and Ghee Market is segmented into Imports and Exports.

United Kingdom is the most dominant region for the United Kingdom Butter and Ghee Market.

Arla Foods, Ornua Co-operative Limited, Fonterra Co-operative Group, Saputo Inc. are the leading players in the United Kingdom Butter and Ghee Market.