Ultra-High Performance Liquid Chromatography Market Size (2024 – 2030)

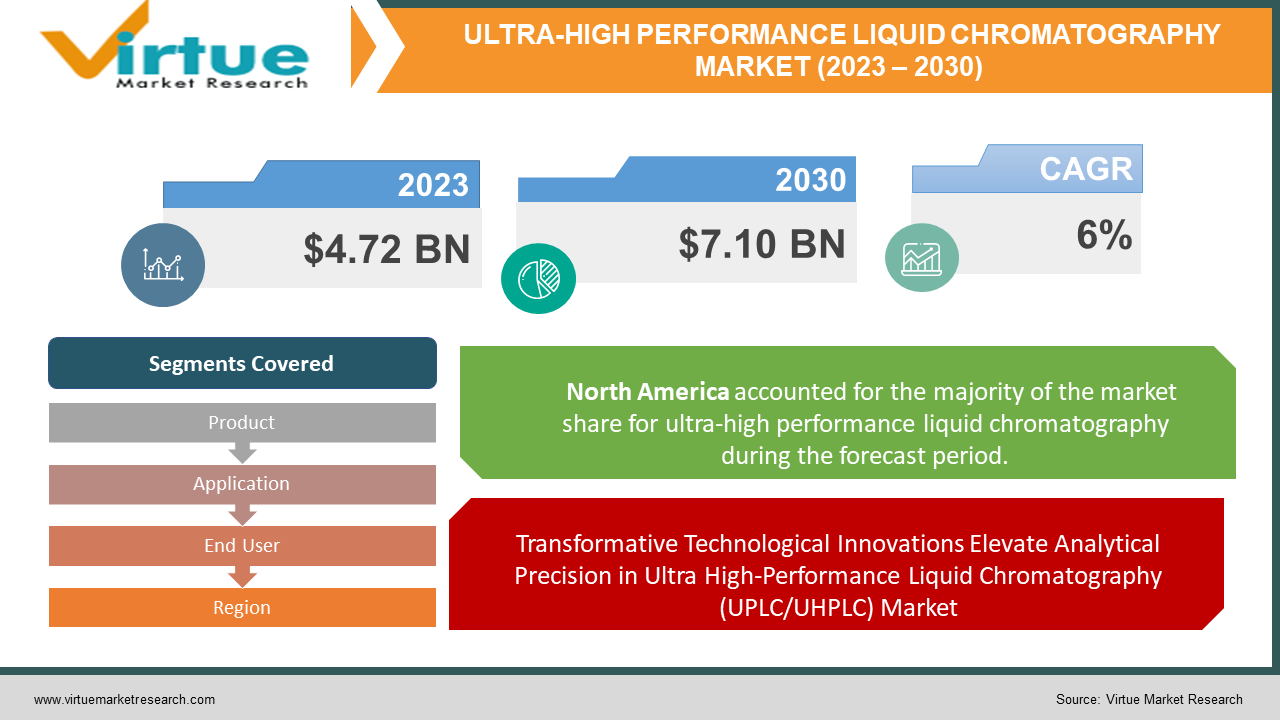

The UPLC Market was valued at USD 4.72 billion in 2023 and is projected to reach a market size of USD 7.10 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6%.

The Ultra High Performance Liquid Chromatography (UPLC/UHPLC) market has undergone a remarkable evolution since its inception. In the past, traditional liquid chromatography methods faced challenges such as longer analysis times and limited resolution. The introduction of UPLC technology revolutionized the field by significantly reducing analysis times, improving efficiency, and enhancing resolution. The present scenario witnesses widespread adoption across various industries, including pharmaceuticals, biotechnology, and academia, due to its ability to provide faster and more accurate separations. Looking ahead, the UPLC market is poised for continued growth, driven by advancements in instrumentation, column technology, and the increasing demand for high-throughput analysis. The future of UPLC promises even greater efficiency, sensitivity, and versatility, positioning it as a pivotal tool in analytical chemistry for years to come.

Key Market Insights:

North America commands a significant position in the UPLC/UHPLC market, contributing over 31% of total revenue in 2023. This is due to well-established research infrastructure, a robust healthcare system, and strategic collaborations among industry players. Early adoption of advanced analytical technologies, like UPLC/UHPLC, further reinforces its market dominance.

The Asia-Pacific region anticipates substantial growth, with a remarkable Compound Annual Growth Rate (CAGR) forecasted between 2023 and 2032. This growth is driven by increased investments in healthcare infrastructure, expanding pharmaceutical and biotechnology sectors, and a growing awareness of UPLC/UHPLC technology benefits.

The instruments segment is a key driver in the UPLC/UHPLC market, capturing over 46% of revenue in 2022. This emphasizes the importance of ongoing technological advancements and innovations in UPLC/UHPLC instruments, with factors such as improved resolution, sensitivity, and speed of analysis fueling demand.

Clinical research takes the lead as a primary application area, generating over 36% of revenue in 2022. This underscores the critical role of UPLC/UHPLC in supporting clinical research activities, driven by the need for rapid and precise analysis of biological samples and the growing complexity of clinical studies.

Forensic end-users are projected to experience moderate growth, with an expected CAGR between 2023 and 2032. This reflects the expanding application of UPLC/UHPLC technologies in forensic analysis, meeting the rising demand for accurate and efficient analytical techniques in forensic laboratories, driven by increasing caseloads and the need for forensic evidence in legal proceedings.

UPLC Market Drivers:

Transformative Technological Innovations Elevate Analytical Precision in Ultra High-Performance Liquid Chromatography (UPLC/UHPLC) Market:

The UPLC/UHPLC landscape is witnessing a paradigm shift driven by groundbreaking technological advancements in high-performance liquid chromatography (HPLC). These innovations have significantly elevated the dependability and robustness of liquid chromatography operations, marking a pivotal moment in the evolution of analytical precision. The introduction of the latest HPLC systems, characterized by multidimensional capabilities, dual-injection systems, and intermediate pressure alternatives, amplifies the versatility of these technologies across a myriad of research applications. As the industry embraces these advancements, the UPLC/UHPLC market is poised for sustained growth, offering unparalleled efficiency and accuracy in analytical processes.

UPLC/UHPLC Emerges as Cornerstone Technology in Drug Discovery: A Surge Fueled by Pharmaceutical and Biotechnology Prowess

The pharmaceutical and biotechnology sectors stand as driving forces propelling the adoption of UPLC/UHPLC technologies. These industries, integral users of HPLC for critical functions like drug development, discovery, and quality control, are steering the trajectory of the UPLC/UHPLC market. The escalating demand within these sectors not only underscores the indispensable role of UPLC/UHPLC in ensuring product quality but also positions it as a linchpin in the pursuit of pharmaceutical advancements. Moreover, major manufacturers extending their product lines for niche applications, from preparative purification to clinical diagnostics, further contribute to the market's expansion, showcasing its pivotal role in diverse domains.

Market Evolution in Overdrive - Specialized HPLC Systems Propel UPLC/UHPLC to New Heights

The UPLC/UHPLC market is experiencing an accelerated evolution propelled by major high-performance liquid chromatography (HPLC) manufacturers extending their product lines for specialized applications. This transformative trend encompasses innovations such as preparative purification, two-dimensional liquid chromatography, amino acid analysis, method development, and clinical diagnostics. Notably, Novasep's introduction of the Hipersep Process M HPLC system in October 2021, tailored for large-scale purification of pharmaceutically vital compounds, serves as a beacon of the market's dynamic adaptability and heightened capabilities. These specialized applications and product line extensions are reshaping the landscape, catering to diverse analytical needs and driving the market forward.

UPLC Resonates with Biopharmaceutical Industry Amid Surge in Protein-based Treatments

In the dynamic realm of biopharmaceuticals, high-performance liquid chromatography (HPLC) is emerging as a cornerstone technology. As protein-based treatments, including bispecific antibodies and antibody-drug conjugates, gain prominence, the biopharmaceutical industry is increasingly embracing HPLC for its unparalleled analytical capabilities. The strategic adoption of HPLC in emerging markets, such as China, India, and Brazil, reflects the industry's commitment to advancing research and development. Fueled by the growing demand for pharmaceutical and biotechnological innovations, these markets present significant growth opportunities, positioning HPLC as a key player in shaping the future of the UPLC/UHPLC market.

UPLC Market Restraints and Challenges:

Challenges and Hurdles in the Ultra High Performance Liquid Chromatography (UPLC/UHPLC) Market: Navigating the Financial Terrain

The UPLC/UHPLC market faces formidable restraints primarily rooted in the substantial costs associated with high-performance liquid chromatography (HPLC) technologies. The evolution of chromatographic methods and materials has led to a dramatic surge in the pricing of HPLC systems, with individual components of advanced chromatography setups costing as much as $1000, and entire systems reaching staggering sums exceeding $35,000. These systems encompass intricate internal mechanics, expensive sensors, and substantial equipment, amplifying their overall financial burden. Additionally, the ongoing operational costs compound as HPLC analysis mandates the utilization of costly mobile phase solvents and consumables, including samples, columns, solvent filters, glassware, and vials. The mobile phase solvents, representing a significant portion of the expenses, necessitate strategic grouping of sample analyses with similar requirements. Despite the challenges posed by the high base cost of these systems and the subsequent operational and maintenance expenses, ongoing efforts by researchers are making strides in developing more cost-effective and efficient chromatography methods, offering a glimmer of optimism in overcoming these financial constraints in the UPLC/UHPLC market.

UPLC Market Opportunities:

The UPLC/UHPLC market is poised for growth opportunities driven by advancements in High-Performance Liquid Chromatography (HPLC) technology. Innovations such as Ultra-Performance Liquid Chromatography (UPLC), Rapid Resolution Liquid Chromatography (RRLC), Ultra-Fast Liquid Chromatography (UFLC), and Nano Liquid Chromatography (Nano LC) have revolutionized analytical precision. UPLC's swift and efficient separations, coupled with automation for speed and accuracy, find applications in drug development, amino acid studies, pesticide detection, herbal item evaluation, and conventional treatment testing. The UFLC approach, performing ten times faster than conventional methods, ensures rapid analysis without compromising accuracy, presenting lucrative growth opportunities for the UPLC/UHPLC market in the coming years.

ULTRA-HIGH PERFORMANCE LIQUID CHROMATOGRAPHY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Product, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Waters Corporation, Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Shimadzu Corporation, Sartorius AG, PerkinElmer, Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Tosoh Bioscience GmbH, Gilson, Inc., Danaher Corporation |

UPLC Market Segmentation: By Product

-

Instruments

-

Consumables

-

Accessories

Largest in this segment is Instruments and fastest growing during the forecast period is Consumables and Accessories. The largest revenue share, exceeding 45.0% in 2022, is attributed to the instruments segment, driven by the increasing demand for advanced UPLC systems for high-performance liquid chromatography applications. These instruments play a pivotal role in achieving swift and efficient separations, meeting the analytical needs of various industries. The growth in Consumables segment is attributed to the ongoing demand for consumable items such as columns, solvents, and sample filters, which are essential for the continuous operation of UPLC systems. The Accessories segment, while integral, follows suit in contributing to the comprehensive UPLC market landscape. Together, these segments reflect the diverse and interconnected components that sustain the UPLC industry's growth and functionality.

UPLC Market Segmentation: By Application

-

Clinical Research

-

Diagnostics

-

Forensics

-

Others

Largest in this segment is Clinical Research and fastest growing during the forecast period is also Clinical Research. Clinical research applications took the lead in 2022, contributing over 35.0% to the revenue share. This surge is fueled by the expanding landscape of clinical trial activities, intensified biopharmaceutical research and development initiatives, and a rising demand for high-throughput analytical techniques. UPLC's advantages in clinical research, such as high analytical specificity, rapid runtimes, the capacity for multi- and mega-parametric tests, and suitability for various compounds, position it as a prominent choice. Meanwhile, Diagnostic applications leverage UPLC's efficacy in identifying and quantifying biomarkers crucial for early disease diagnosis, with its superior ability to distinguish between similar diseases enhancing diagnostic accuracy. Reproducibility and a low coefficient of variation further make UPLC a preferred choice for analyzing metabolites, vitamin D, and HbA1c hemoglobin. The escalating prevalence of chronic diseases is expected to drive rapid expansion in diagnostic applications, while Forensics and other segments contribute to the comprehensive utilization of UPLC across diverse fields.

UPLC Market Segmentation: By End User

-

Diagnostic Centers

-

Forensic Departments

-

Academic and Research Institutions

-

Others

Largest in this segment is Diagnostic Centers and fastest growing during the forecast period is Academic and Research Institutions. Diagnostic Centers dominated in 2022, holding a share surpassing 40.0%. This segment's prominence is attributed to the diverse applications of UPLC methods within these entities, ranging from quality control to drug purity determination and drug candidate characterization. The anticipated growth in this segment is driven by UPLC's compatibility with mass spectrometry, enhancing detection capabilities and selectivity, particularly in biopharmaceutical applications. Concurrently, academic and research institutions are expected to experience the fastest growth rate of 7.2% during the forecast period. This growth is fueled by increased government funding for academic research, enhanced integration of analytical instrumentation in academic teaching, and the pivotal role played by academic institutions in research and development activities. Academic institutions in the U.S., contributing significantly to basic and overall research, showcase a high potential for adopting UPLC infrastructure, paving the way for promising market growth in the foreseeable future.

UPLC Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

Latin America

-

Middle East and Africa

Largest in this segment is North America and fastest growing during the forecast period is Asia-Pacific. This is attributed to the region's advanced healthcare infrastructure, substantial investments in research and development, and the prevalence of major pharmaceutical and biotechnology companies driving the demand for UPLC technologies. Meanwhile, the Asia-Pacific region is propelled by extensive sales of generics and biosimilars in countries like Japan. The robust growth in the Asia-Pacific market is further fueled by the increasing number of pharmaceutical and biotechnology companies in China and India, which rely on UPLC instruments for streamlined drug approvals. Europe, Latin America, and the Middle East and Africa regions also contribute significantly to the UPLC market, each presenting unique opportunities and challenges influenced by factors such as regulatory landscapes, healthcare infrastructure development, and research activities.

COVID-19 Impact Analysis on the UPLC Market:

The imperative role of High-Performance Liquid Chromatography (HPLC) systems emerged in the creation of new treatments, vaccinations, and reliable disease-diagnosis techniques during the pandemic. Notably, HPLC played a crucial role in the analysis and identification of specific components in medication mixtures, exemplified by the novel HPLC-based approach employed in determining the emerging COVID-19 therapeutic option, favipiravir. As concerns regarding SARS-CoV-2 mutations grew, the epidemiological applications of HPLC for characterizing viral proteins corresponding to developing viral serotypes gained traction. These dynamics are poised to exert a favorable impact on the UPLC market's growth during the estimated timeframe, reflecting the resilience and adaptability of the industry in the face of unprecedented challenges.

Latest Trends/ Developments:

The UPLC market is witnessing dynamic trends and developments, with North America poised to dominate, driven by increased government funding for R&D in liquid chromatography techniques and a surge in preclinical activities by pharmaceutical companies. Meanwhile, the Asia-Pacific region is expected to exhibit the highest growth rate, fueled by extensive sales of generics and biosimilars in Japan, where UPLC instruments play a pivotal role in clinical trials. The rising number of pharmaceutical and biotechnology companies in China and India, reliant on UPLC instruments for streamlined drug approvals, significantly contributes to market growth. Noteworthy key players shaping the market include Waters Corporation, known for its focus on innovation in UPLC instrument design and manufacturing, and Shimadzu, a leading player in UPLC instruments in Japan with operations spanning various business segments, showcasing the multifaceted nature of advancements in the UPLC/UHPLC market.

Key Players:

-

Waters Corporation

-

Thermo Fisher Scientific, Inc.

-

Agilent Technologies, Inc.

-

Shimadzu Corporation

-

Sartorius AG

-

PerkinElmer, Inc.

-

Bio-Rad Laboratories, Inc.

-

Merck KGaA

-

Tosoh Bioscience GmbH

-

Gilson, Inc.

-

Danaher Corporation

-

March 2022: PerkinElmer, Inc. acquired ES Industries to add liquid chromatography columns to its consumable portfolio, as key players involved in the market are undertaking strategic initiatives for strengthening their portfolios and expanding their reach in key regions.

-

April 2022: Shimadzu Corporation introduced the LabSolutions MD software tailored for UPLC platforms, aiming to facilitate analytical method development. The introduction of such software products is expected to enhance the adoption of UPLC systems, thereby contributing to the expansion of the market.

Chapter 1. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – By Product

6.1 Introduction/Key Findings

6.2 Instruments

6.3 Consumables

6.4 Accessories

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – By Application

7.1 Introduction/Key Findings

7.2 Clinical Research

7.3 Diagnostics

7.4 Forensics

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – By End User

8.1 Introduction/Key Findings

8.2 Diagnostic Centers

8.3 Forensic Departments

8.4 Academic and Research Institutions

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End User

8.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Application

9.1.4 By By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Application

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Ultra-High Performance Liquid Chromatography (UPLC/UHPLC) Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Waters Corporation

10.2 Thermo Fisher Scientific, Inc.

10.3 Agilent Technologies, Inc.

10.4 Shimadzu Corporation

10.5 Sartorius AG

10.6 PerkinElmer, Inc.

10.7 Bio-Rad Laboratories, Inc.

10.8 Merck KGaA

10.9 Tosoh Bioscience GmbH

10.10 Gilson, Inc.

10.11 Danaher Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

AThe UPLC market was valued at USD 4.72 billion in 2023 and is projected to reach USD 7.10 billion by the end of 2030, with a forecasted CAGR of 6% over the period 2024-2030.

North America holds a prominent position, contributing over 31% of total revenue in 2023, driven by advanced healthcare infrastructure and major pharmaceutical companies. The Asia-Pacific region is anticipated to experience substantial growth, with a remarkable CAGR, fueled by sales of generics, biosimilars, and increased pharmaceutical activities in China and India.

Major trends include the dominance of North America, increased government funding for R&D, and a surge in preclinical activities. The market is witnessing dynamic developments, with key players like Waters Corporation and Shimadzu Corporation driving innovation in UPLC instrument design and technology.

Opportunities for growth are presented by advancements in HPLC technology, including UPLC, such as UFLC, RRLC, and Nano LC. These innovations offer swift and efficient separations, automation for speed and accuracy, and applications in various fields, including drug development and herbal item evaluation.

The UPLC market is segmented by product (instruments, consumables, accessories), application (clinical research, diagnostics, forensics, others), and end user (diagnostic centers, forensic departments, academic and research institutions, others). Instruments constitute the largest segment, capturing over 45.0% of the revenue share.