UAV Drones Market Size (2024 – 2030)

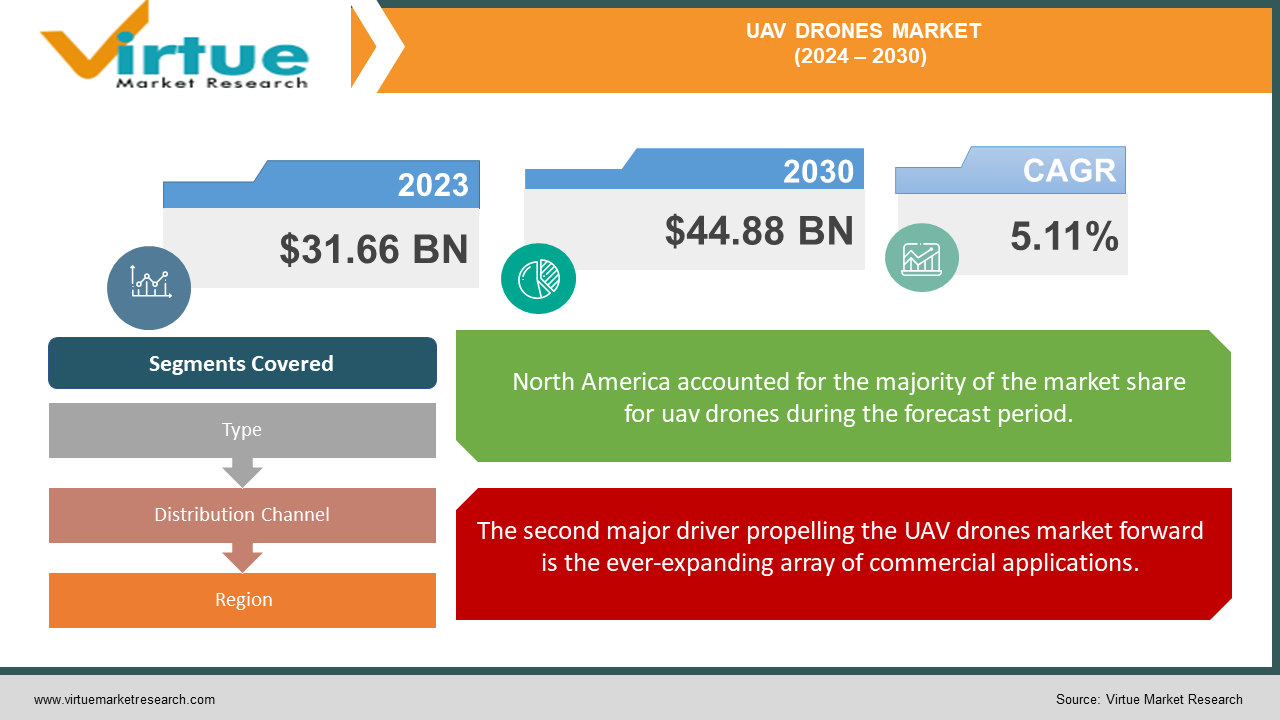

The Global UAV Drones Market was valued at USD 31.66 Billion in 2024 and is projected to reach a market size of USD 44.88 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.11%.

The unmanned aerial vehicle (UAV) drones market has taken flight in recent years, soaring to new heights as these versatile flying machines capture the imagination of industries and consumers alike. No longer confined to military applications, drones have buzzed their way into numerous sectors, from agriculture to real estate, and emergency services to entertainment. In 2023, the global UAV drones market resembles a bustling beehive of activity, with manufacturers, software developers, and service providers all vying for a slice of this airborne pie. The skies are abuzz with innovation as companies push the boundaries of what's possible with these nimble flying machines. Consumer drones have become the new must-have gadget for tech enthusiasts and amateur photographers, allowing everyday users to capture breathtaking aerial footage that was once the exclusive domain of helicopter-mounted cameras. Meanwhile, in the commercial sphere, drones are revolutionizing industries in ways that were scarcely imaginable a decade ago. Farmers now employ drone-mounted sensors to monitor crop health and optimize irrigation, turning vast fields into precision-managed operations. Real estate agents offer virtual property tours that feel like something out of a sci-fi film, with drones providing sweeping aerial views of luxury estates. In the world of logistics, companies are experimenting with drone delivery services that promise to revolutionize last-mile fulfillment. The construction industry has embraced drones for site surveys and progress monitoring, while search and rescue teams leverage their ability to access hard-to-reach areas. Even the film industry has gotten in on the action, with drones providing dynamic shots that add cinematic flair to productions both big and small.

Key Market Insights:

The percentage of construction companies using drones is 57%.

The number of registered drone pilots in the USA is 315,000. Number of drones registered for commercial use in Europe is 420,000.

The percentage of insurance companies using drones for inspections is 32%. Number of drone-related jobs created worldwide is 128,000.

The percentage of real estate agents using drones is 44%.

The percentage of drones sold with obstacle avoidance technology is 65%. Number of drones used in search and rescue operations globally is 12,000.

The percentage of news organizations using drones for reporting is 37%.

Number of countries developing drone air traffic management systems is 28.

The average annual growth rate of commercial drone fleets is 32%.

The Number of drones used for infrastructure inspection is 95,000.

UAV Drones Market Drivers:

The relentless march of technological progress has been the wind beneath the wings of the UAV drones market, propelling it to new heights with each passing year.

At the heart of this technological revolution lies the miniaturization of components. What was once bulky and cumbersome has become sleek and lightweight, allowing drones to achieve feats of aerial agility that were once the stuff of science fiction. Microprocessors have shrunk while simultaneously growing more powerful, enabling onboard systems to process vast amounts of data in real time. This computational muscle has given birth to drones that don't just fly, but think on the wing, making split-second decisions to navigate complex environments. Battery technology has made leaps and bounds, extending flight times from mere minutes to hours. The dream of long-endurance drones is becoming a reality, opening up applications that were previously impractical due to limited air time. Coupled with advances in rapid charging and even solar-powered options, these improvements are pushing the boundaries of what drones can achieve in a single mission.

The second major driver propelling the UAV drones market forward is the ever-expanding array of commercial applications.

In the realm of agriculture, drones have emerged as the farmer's new best friend. These aerial assistants provide a bird's-eye view of vast fields, employing multispectral imaging to assess crop health, detect pest infestations, and optimize irrigation. The precision that drones bring to modern farming is nothing short of revolutionary, allowing for targeted interventions that reduce resource usage while maximizing yields. As the global population grows and the need for efficient food production becomes more pressing, the role of drones in agriculture is set to become even more crucial. The construction and infrastructure sectors have embraced drones with open arms. From initial land surveys to progress monitoring and final inspections, drones have become an indispensable tool on job sites around the world. They provide accurate, up-to-date 3D models of construction projects, allowing managers to track progress, identify potential issues, and make informed decisions in real time. For infrastructure maintenance, drones equipped with high-resolution cameras and thermal sensors can inspect bridges, power lines, and wind turbines, detecting problems before they become critical and reducing the need for dangerous manual inspections.

UAV Drones Market Restraints and Challenges:

At the forefront of these challenges is the regulatory landscape, which often resembles a patchwork quilt of varying rules and restrictions. Governments worldwide are grappling with how to integrate drones into their airspace safely and effectively. The result is a hodgepodge of regulations that can vary dramatically from one country to another, or even between different regions within the same country. This regulatory uncertainty creates significant hurdles for drone manufacturers and operators, who must navigate a complex and often changing set of rules. The lack of global standardization hampers international operations and complicates the development of universal drone technologies. Privacy concerns cast a long shadow over the drone industry. The ability of drones to access vantage points that were previously unreachable has raised alarm bells among privacy advocates and the general public alike. The fear of "eyes in the sky" watching our every move has led to pushback against drone usage in many areas, particularly in urban environments. Balancing the beneficial applications of drones with the public's right to privacy remains a delicate tightrope walk for the industry.

UAV Drones Market Opportunities:

One of the most promising areas of opportunity lies in the realm of urban air mobility. As cities become more congested and traditional transportation networks strain under the weight of growing populations, drones offer a tantalizing solution. The development of passenger drones or "flying taxis" could revolutionize urban transportation, providing a new dimension of mobility that bypasses ground-based traffic altogether. While significant regulatory and technological hurdles remain, the potential market for urban air mobility is enormous, with some estimates placing its value in the hundreds of billions of dollars by the mid-2030s. The integration of drones into smart city ecosystems presents another exciting opportunity. Drones can play a crucial role in urban management, from monitoring traffic flows and air quality to supporting law enforcement and emergency services. As cities worldwide invest in becoming "smarter," the demand for drone-based solutions is likely to soar. Companies that can develop comprehensive drone systems that integrate seamlessly with other smart city technologies will be well-positioned to capitalize on this trend. In the world of logistics and e-commerce, the last-mile delivery problem continues to vex companies. Drone delivery services offer a potential solution, promising faster, more efficient, and potentially more environmentally friendly delivery options.

UAV DRONES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.11% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DJI Technology Co., Ltd.,Parrot Drones SAS,Yuneec International, 3D Robotics, Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing, Amazon (Prime Air), Intel Corporation, Ehang, AeroVironment, Inc., Autel Robotics, Skydio |

UAV Drones Market Segmentation: By Types

-

Fixed-Wing Drones

-

Rotary-Wing Drones

-

Hybrid Drones

-

Nano Drones

-

Multi-Rotor Drones

Multi-rotor drones continue to dominate the market, largely due to their versatility, ease of use, and relatively low cost. These drones, which include quadcopters, hexacopters, and octocopters, are popular across various sectors, from consumer photography to professional cinematography, industrial inspections, and short-range delivery applications. Their ability to hover precisely and maneuver in tight spaces makes them ideal for many commercial and consumer applications, solidifying their position as the market leader.

The hybrid drone segment is experiencing rapid growth, fueled by its unique combination of the hovering capabilities of rotary-wing drones and the long-range efficiency of fixed-wing models. This versatility makes hybrid drones increasingly attractive for applications requiring both vertical takeoff and landing (VTOL) and extended flight times. Industries such as precision agriculture, long-range surveying, and delivery services are driving the adoption of hybrid drones, appreciating their ability to cover large areas while still accessing confined spaces.

UAV Drones Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retail

-

Specialty Stores

Specialty stores remain the dominant distribution channel for UAV drones. These stores offer expertise, hands-on demonstrations, and after-sales support that many customers, especially in the professional and high-end consumer segments, value highly. Specialty stores provide a tactile experience, allowing customers to see and often test drones before purchase. They also offer personalized advice and customization options, which are particularly important for commercial and industrial drone applications.

The online retail channel is experiencing the most rapid growth in the UAV drones market. This surge is driven by the increasing comfort of consumers with online purchases, even for high-value items like drones. Online platforms offer a wide selection, competitive pricing, and the convenience of home delivery, making them particularly attractive to tech-savvy drone enthusiasts. The ability to compare specifications, read reviews, and access detailed product information online also contributes to the channel's growth.

UAV Drones Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America dominates the UAV drone's industry, accounting for 35% of the worldwide market. This supremacy is not a stroke of luck, but the outcome of a perfect storm of forces that have catapulted the area to the forefront of drone technology and usage. The United States, a technical powerhouse with some of the world's leading drone manufacturers and software developers, is at the center of North America's drone dominance. Silicon Valley, with its unique ecosystem of venture capital, tech expertise, and entrepreneurial spirit, has served as a breeding ground for drone entrepreneurs, encouraging ideas that have spread around the world.

The Asia-Pacific region is emerging as the rocket booster of the global UAV drones market, propelling forward with a growth rate that outpaces all other regions. This surge is driven by a confluence of factors that have transformed the region into a hotbed of drone innovation and adoption. At the forefront of this growth is China, a drone manufacturing powerhouse that has leveraged its manufacturing prowess and growing technological capabilities to flood the global market with affordable, yet increasingly sophisticated drones. Chinese companies like DJI have become household names in the consumer drone market, while also making significant inroads into commercial applications.

COVID-19 Impact Analysis on the UAV Drones Market:

In the initial stages of the pandemic, the drone market experienced turbulence as global supply chains were disrupted. Many drone manufacturers, particularly those relying on components from China, faced production delays and increased costs. This supply chain shock rippled through the industry, causing temporary shortages and price fluctuations in certain drone models. However, as the world grappled with lockdowns and social distancing measures, the unique capabilities of drones suddenly came into sharp focus. Drones emerged as valuable tools in the fight against the pandemic, showcasing their versatility and potential in ways that captured public imagination and accelerated adoption across various sectors. One of the most visible applications was in public safety and healthcare. Drones were deployed to enforce social distancing measures, broadcast public health messages, and even deliver medical supplies and COVID-19 test kits to remote or quarantined areas. These high-profile use cases not only demonstrated the practical benefits of drone technology but also helped to improve public perception and acceptance of drones in everyday life. The pandemic also accelerated the adoption of drones in the logistics and e-commerce sectors. As online shopping surged and contactless delivery became a priority, companies ramped up their exploration of drone delivery services. While widespread drone delivery is still on the horizon, the pandemic undoubtedly fast-tracked development and testing in this area.

Latest Trends/ Developments:

The UAV drones' market is a hotbed of innovation, with new trends and developments emerging at a dizzying pace. Like a swarm of drones constantly adapting to their environment, the industry is continuously evolving, pushing the boundaries of what's possible in the realm of unmanned aerial systems. One of the most significant trends is the rise of artificial intelligence and machine learning in drone technology. AI is being integrated into every aspect of drone operations, from navigation and obstacle avoidance to data analysis and decision-making. This trend is giving birth to a new generation of "smart drones" capable of performing complex tasks with minimal human intervention. For instance, AI-powered drones can now autonomously inspect industrial equipment, identifying potential issues and generating detailed reports without human guidance. Swarm technology is another exciting development that's capturing the imagination of the industry. Inspired by the collective behavior of insects, drone swarms consist of multiple UAVs working in concert to achieve a common goal. This technology has potential applications in areas such as search and rescue operations, where a swarm of drones could quickly cover a large area, or in entertainment, creating spectacular aerial light shows. The integration of 5G technology with drones is opening up new possibilities for real-time data transmission and remote operations. 5G's high bandwidth and low latency enable drones to stream high-quality video and sensor data in real time.

Key Players:

-

DJI Technology Co., Ltd.

-

Parrot Drones SAS

-

Yuneec International

-

3D Robotics

-

Lockheed Martin Corporation

-

Northrop Grumman Corporation

-

Boeing

-

Amazon (Prime Air)

-

Intel Corporation

-

Ehang

-

AeroVironment, Inc.

-

Autel Robotics

-

Skydio

Chapter 1. UAV Drones Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. UAV Drones Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. UAV Drones Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. UAV Drones Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. UAV Drones Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. UAV Drones Market – By Types

6.1 Introduction/Key Findings

6.2 Fixed-Wing Drones

6.3 Rotary-Wing Drones

6.4 Hybrid Drones

6.5 Nano Drones

6.6 Multi-Rotor Drones

6.7 Y-O-Y Growth trend Analysis By Types

6.8 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. UAV Drones Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Retail

7.5 Specialty Stores

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. UAV Drones Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. UAV Drones Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DJI Technology Co., Ltd.

9.2 Parrot Drones SAS

9.3 Yuneec International

9.4 3D Robotics

9.5 Lockheed Martin Corporation

9.6 Northrop Grumman Corporation

9.7 Boeing

9.8 Amazon (Prime Air)

9.9 Intel Corporation

9.10 Ehang

9.11 AeroVironment, Inc.

9.12 Autel Robotics

9.13 Skydio

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Smaller, more portable drones are becoming increasingly available.

Governments are grappling with ensuring safe drone operations, leading to complex regulations.

DJI Technology Co., Ltd., Parrot Drones SAS, Yuneec International, 3D Robotics, Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing, Amazon (Prime Air).

North America is the most dominant region in the market, accounting for approximately 40% of the total market share.

Asia-Pacific is the fastest-growing region in the market.