UAE Renewable Energy Market Size (2025-2030)

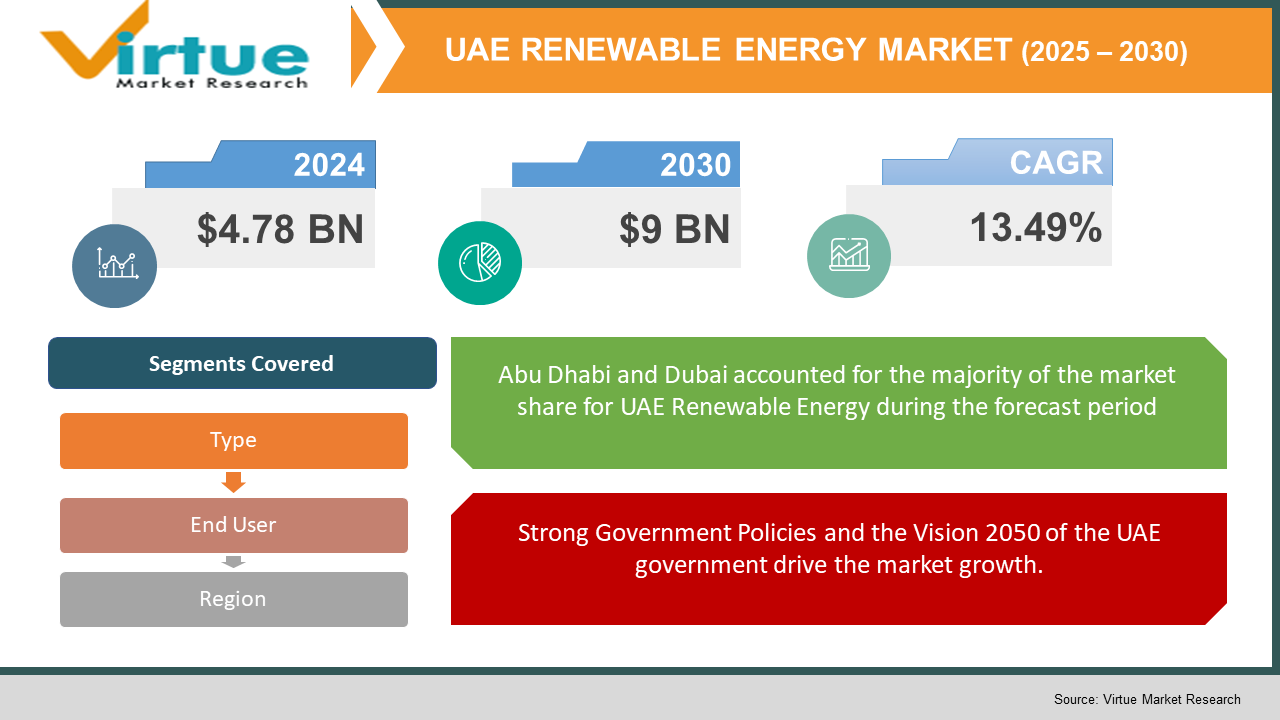

The UAE Renewable Energy Market was valued at USD 4.78 billion in 2024 and is projected to reach a market size of USD 9 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 13.49%.

Renewable energy is produced from naturally renewable resources such as sunshine, wind, and water. The UAE is focusing its renewable energy growth on solar and wind. The government has ambitious plans to increase the share of renewable energy in the overall energy mix to 50% by 2050. This push for renewable energy is accompanied by a series of initiatives and investments, including establishing mega-scale solar parks and wind farms in the country. The country's geographical location, the intensity of sunlight, and the support of the government position the UAE as a good destination for investment in renewable energy. Moreover, increasing awareness of environmental sustainability and declining costs of renewable technology increase the adoption of clean energy solutions in the UAE. Notwithstanding intermittency and grid integration issues, the renewable energy sector in the UAE continues to grow, offering enormous opportunities for investors, businesses, and the economy as a whole.

Key Market Insights:

- The United Arab Emirates is a nation that gets a significant amount of sunlight. The nation is well located geographically, with solar irradiance of about 2,285 kWh/m2. It boasts one of the highest rates of solar exposure in the world. In addition, the technology there has matured to the point where the cost of deploying solar power has decreased.

- The country's solar PV capacity totalled approximately 2439 MW in 2020, a 34% rise from last year's numbers. The figures will skyrocket at a rapid pace in the near term with imminent solar projects and boost the proportion of renewables in the power generation portfolio.

- The deal with Enerwherewill in 2021 is anticipated to save Al-Barrak 30% of carbon emissions from mining processes through solar power, which was previously done through diesel generators.

UAE Renewable Energy Market Drivers:

Strong Government Policies and the Vision 2050 of the UAE government drive the market growth.

One of the largest impetuses for the UAE renewable energy sector is the high level of government support for sustainability, spearheaded by efforts like the UAE Energy Strategy 2050 and the Net-Zero by 2050 Strategic Initiative. The government has ambitious goals to make 50% of its overall energy mix clean by 2050, drastically cutting down on fossil fuel dependence. Feed-in tariffs, tax credits, and green financing instruments have been incentivizing public and private sector investments in renewable energy projects. Moreover, regulatory changes, including the introduction of corporate Power Purchase Agreements (PPAs), enable companies to buy renewable energy directly, further stimulating market growth. Massive projects such as the Mohammed bin Rashid Al Maktoum Solar Park and the Al Dhafra Solar Project are among the country's main indicators of meeting these sustainability objectives. The proactive initiatives of the UAE government, supported by an attractive investment environment, have established the country as a regional frontrunner in renewable energy, making it appealing to local and foreign investors alike.

The declining cost of solar and wind power, making them more competitive than traditional fossil fuels drives the market positively.

The other big mover of the UAE renewable energy sector is the falling price of solar and wind energy, which is becoming more competitive compared to conventional fossil fuels. Improved technology in solar photovoltaic (PV) cells, battery storage technology, as well as wind turbine performance, has made the cost per kilowatt-hour of renewable energy very low. The UAE has established world records for low-cost solar power generation, with the Al Dhafra Solar Plant achieving a record tariff of $0.0135 per kWh, one of the lowest-cost solar power projects in the world. The ongoing decline in costs, thanks to technological advancements and economies of scale, has promoted the mass adoption of renewables by industries, commercial buildings, and residential estates. Besides, as the prices of global energy change, renewables give a fixed and predictable option, thus promoting energy security for the UAE. With the growing affordability of battery storage technology and smart grid technology, the viability of renewables is also being augmented, providing a steady power supply even without sunlight or wind, thus speeding up the transition of the country toward clean power.

UAE Renewable Energy Market Restraints and Challenges:

One of the major challenges facing the UAE renewable energy market is grid integration and energy storage limitations.

One of the biggest challenges currently facing the UAE renewable energy sector is grid integration and energy storage constraints. With the country accelerating the development of its solar and wind power capacity, maintaining a stable and reliable electricity grid is a major challenge. Compared to traditional power plants that offer a constant energy output, renewable sources such as solar and wind are intermittent energy sources producing electricity only when there is sunshine or wind. This volatility will create imbalances in power supply leading to instability in the grid. The UAE is also investing in battery energy storage systems (BESS) and pumped hydro storage, but mass deployment of these technologies is still costly and technically challenging. Moreover, incorporating decentralized renewable energy sources into the current power infrastructure involves enhancing transmission and distribution networks, which requires huge capital investment. Without effective energy storage and grid renewal, the true potential of renewable energy cannot be achieved, thus the UAE needs to implement its smart grid infrastructure and develop advanced storage to make a transition to a future of sustainable energy smooth.

UAE Renewable Energy Market Opportunities:

The UAE renewable energy sector offers huge opportunities for development, investment, and innovation, fueled by sound government policies, growing private sector engagement, and global pressure for sustainability. The green hydrogen production is the most promising opportunity with the UAE planning to become one of the major exporters of hydrogen to Europe and Asia based on big-ticket projects championed by Masdar and ADNOC. Solar and wind energy growth also presents promising opportunities, with steady investments in PV and CSP technology, and inshore and offshore wind developments. The rise in corporate PPAs is yet another prominent segment as companies and sectors look for cheaper renewable power supplies to ensure carbon neutrality targets are achieved. In addition to that, energy storage technology, such as new battery technologies and pumped hydro storage, offers an expanding market for investors wishing to maximize grid stability and improve energy distribution. The UAE's emphasis on waste-to-energy projects and circular economy projects also presents new opportunities for sustainable waste management technologies. Also, the innovations in smart grid technologies, AI-based energy management, and blockchain-based energy trading are creating opportunities for digital transformation in the renewable industry. With robust government support, public-private collaborations, and a resolve to reach net-zero emissions by 2050, the UAE continues to be a very enticing location for investments in renewable energy and technological developments.

UAE RENEWABLE ENERGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.49% |

|

Segments Covered |

By Type, end user, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UAE |

|

Key Companies Profiled |

Yellow Door Energy, MASE, Enerwhere, Engie SA, Canadian Solar Inc., Akuo Energy SAS, Masdar, and Environmena Power Systems LLC |

UAE Renewable Energy Market Segmentation:

UAE Renewable Energy Market Segmentation: By Type

- Hydro Power

- Wind Power

- Solar Power

- Bioenergy

- Others

The UAE renewable energy sector is segmented into hydropower, wind, solar, bioenergy, and others, each playing differently in the country's transition to clean energy. Solar energy dominates the market with the geographical advantage of high solar irradiance in the UAE, presenting itself as an ideal place for big photovoltaic and CSP installations. Dubai's Mohammed bin Rashid Al Maktoum Solar Park and Noor Abu Dhabi Solar Plant are two of the largest solar power projects in the world, leading the country's renewable energy drive. Wind energy, not as developed as solar, is gaining momentum, especially along the coast and deserts where the wind conditions are favourable for generating power. The UAE has been developing offshore and onshore wind projects to diversify its energy mix. Hydropower is restricted, with the arid nature of the UAE and the lack of large water bodies, but projects like the Hatta Hydroelectric Plant attempt to leverage pumped-storage technology to generate electricity. Organic waste and biomass bioenergy are being promoted as green alternatives, especially from waste-to-energy plants like the Sharjah Waste-to-Energy project by Bee'ah and Masdar. Other renewable energies like geothermal and hydrogen are being pursued actively, with hydrogen production seeing increased investment as the UAE seeks to become a global green hydrogen hub.

UAE Renewable Energy Market Segmentation: By End User

- Industrial

- Residential

- Commercial

The UAE renewable energy industry serves different end users, which are divided into industrial, residential, and commercial categories. The industrial segment is the biggest consumer of renewable energy due to the demand for green production processes and affordable power solutions. Manufacturing, oil and gas, and other energy-intensive sectors are increasingly adopting solar and wind power to lower operational costs and carbon footprints. The UAE government’s push for industrial sustainability, including initiatives like the UAE Energy Strategy 2050, has encouraged industries to shift towards renewables. The residential sector is experiencing a rise in distributed solar energy generation, with homeowners installing rooftop solar panels to benefit from net metering policies and lower electricity costs. Dubai’s Shams Initiative and Abu Dhabi’s solar rebate programs are facilitating this transition by incentivizing residential solar adoption. Commercial building space, such as malls, offices, and hotels, is also adopting renewable energy as part of company sustainability initiatives. With the expansion of the UAE's tourism and property business, green building projects and LEED buildings are integrating renewable energy solutions to increase efficiency and meet the country's carbon neutrality targets. Companies are increasingly coming on board with solar power purchase agreements (PPAs) and energy efficiency measures to lower their dependency on fossil fuels and build a positive brand image in a socially responsible market.

UAE Renewable Energy Market Segmentation: Regional Analysis:

- UAE

Regionally, the UAE's renewable energy industry is expanding in Abu Dhabi, Dubai, Sharjah, and other emirates, contributing to the nation's ambitious clean energy goals. Abu Dhabi, being the capital and an energy hub, paces the market with massive solar farms, including the Noor Abu Dhabi project, which has a capacity of 1.2 GW. The emirate is also leading the charge in the hydrogen economy, with Masdar spearheading efforts to produce green hydrogen and export ammonia. Dubai is rapidly growing its solar energy capability under its Clean Energy Strategy 2050, aiming to produce 100% of its electricity from renewable sources by mid-century. The Mohammed bin Rashid Al Maktoum Solar Park is the centrepiece of this shift, which integrates photovoltaic, CSP, and battery storage technology. Sharjah, which is committed to environmental sustainability, is leading the way in waste-to-energy initiatives, with Bee'ah's waste-to-energy facility turning municipal solid waste into clean electricity. Ras Al Khaimah and Fujairah are also investing in smaller-scale solar and wind projects, leveraging land and natural resources to promote local renewable energy adoption. The UAE's country-wide focus on renewables is supported by strategic public-private collaborations, government incentives, and policy environments that encourage sustainable energy projects in every region. With each emirate bringing its unique contribution, the UAE is establishing itself as a world leader in the shift to a low-carbon, renewable-powered future.

COVID-19 Impact Analysis on the UAE Renewable Energy Market:

The COVID-19 pandemic impacted the UAE renewable energy industry both positively and negatively, creating temporary disruptions but eventually solidifying the nation's focus on clean energy. During the initial stages of the pandemic, lockdowns, supply chain disruptions, and financial volatility resulted in project delays, higher costs, and reduced construction activities. Solar and wind energy projects experienced logistical issues caused by the limitation of material imports and labour constraints. Nonetheless, as the UAE shifted to the crisis, its government hastened its investment in renewable energy as part of the economic recovery plan. The pandemic underscored the requirement for sustainability and energy security, thus boosting investments in solar, wind, and green hydrogen schemes. The leadership of the UAE continued to be focused on its Energy Strategy 2050 to ensure that major projects like the Mohammed bin Rashid Al Maktoum Solar Park and the Noor Abu Dhabi Solar Plant continued to proceed according to plan. Furthermore, declining prices of renewable energy and the rising competitiveness of clean energy solutions amid the pandemic also inspired businesses and industries to shift toward cleaner forms of energy. The pandemic served as a driver for digitalization and intelligent energy management, with greater use of AI, IoT, and remote monitoring systems in renewable energy operations. Although the immediate effect was financial slowdowns and project delays, the long-term consequence of COVID-19 has been a strengthened focus on renewable energy as a central pillar of the UAE's post-pandemic economic resilience and sustainability objectives.

Latest Trends/ Developments:

The UAE renewable energy sector is experiencing fast growth, fueled by technology advancements, government policies, and increasing emphasis on sustainability. Among the most notable trends is growth in solar energy, especially via utility-scale developments like the Mohammed bin Rashid Al Maktoum Solar Park reaching 5 GW capacity by 2030. The UAE is also advancing strongly in green hydrogen production, with the likes of the Masdar-led green hydrogen pilot plant in Abu Dhabi putting the country in a position to become a world hydrogen hub. Another important evolution is the integration of energy storage technologies, such as large-scale battery systems and pumped hydro storage, to maintain grid stability and optimize the use of renewable energy. Corporate PPAs are also on the rise, with companies increasingly investing in direct procurement of renewable energy to achieve sustainability targets. Waste-to-energy projects are also increasing, as in the case of the Sharjah Waste-to-Energy plant, as part of circular economy efforts. The UAE is also looking into floating solar farms and offshore wind energy opportunities to diversify its renewable mix. Digitalization is also taking centre stage, with AI, blockchain, and IoT-based smart grids improving efficiency, monitoring, and energy distribution. With robust government policies, investor appetite, and technological innovation, the UAE continues to lead the renewable energy shift, reaffirming its pledge to reach net-zero emissions by 2050.

Key Players:

- Yellow Door Energy

- Everywhere

- MASE

- Akuo Energy SAS

- Masdar

- Engie SA

- Beta Green Solar Energy Systems Installation LLC

- Canadian Solar Inc.

- Electricite de France SA

Chapter 1. UAE RENEWABLE ENERGY MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. UAE RENEWABLE ENERGY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. UAE RENEWABLE ENERGY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. UAE RENEWABLE ENERGY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. UAE RENEWABLE ENERGY MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. UAE RENEWABLE ENERGY MARKET – By Type

6.1 Introduction/Key Findings

6.2 Hydro Power

6.3 Wind Power

6.4 Solar Power

6.5 Bioenergy

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. UAE RENEWABLE ENERGY MARKET – By End User

7.1 Introduction/Key Findings

7.2 Industrial

7.3 Residential

7.4 Commercial

7.5 Y-O-Y Growth trend Analysis By End User

7.6 Absolute $ Opportunity Analysis By End User , 2025-2030

Chapter 8. UAE RENEWABLE ENERGY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.2. By Type

8.1.3. By End User

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. UAE RENEWABLE ENERGY MARKET – Company Profiles – (Overview, Packaging Type Type Type Type Portfolio, Financials, Strategies & Developments)

9.1 Yellow Door Energy

9.2 Everywhere

9.3 MASE

9.4 Akuo Energy SAS

9.5 Masdar

9.6 Engie SA

9.7 Beta Green Solar Energy Systems Installation LLC

9.8 Canadian Solar Inc.

9.9 Electricite de France SA

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The UAE Renewable Energy Market was valued at USD 4.78 billion in 2024 and is projected to reach a market size of USD 9 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 13.49%.

The declining cost of solar and wind power, making them more competitive than traditional fossil fuels drives the market positively.

Based on Service Provider, the UAE Renewable Energy Market is segmented into Integrated Service Providers, Wind Energy Providers, Polymer Providers, Equipment Manufacturers, and Service Providers.

Abu Dhabi and Dubai are the most dominant region for the UAE Renewable Energy Market.

Yellow Door Energy, MASE, Enerwhere, Engie SA, Canadian Solar Inc., Akuo Energy SAS, Masdar, and Environmena Power Systems LLC are the key players in the UAE Renewable Energy Market