Tire Market Size (2025–2030)

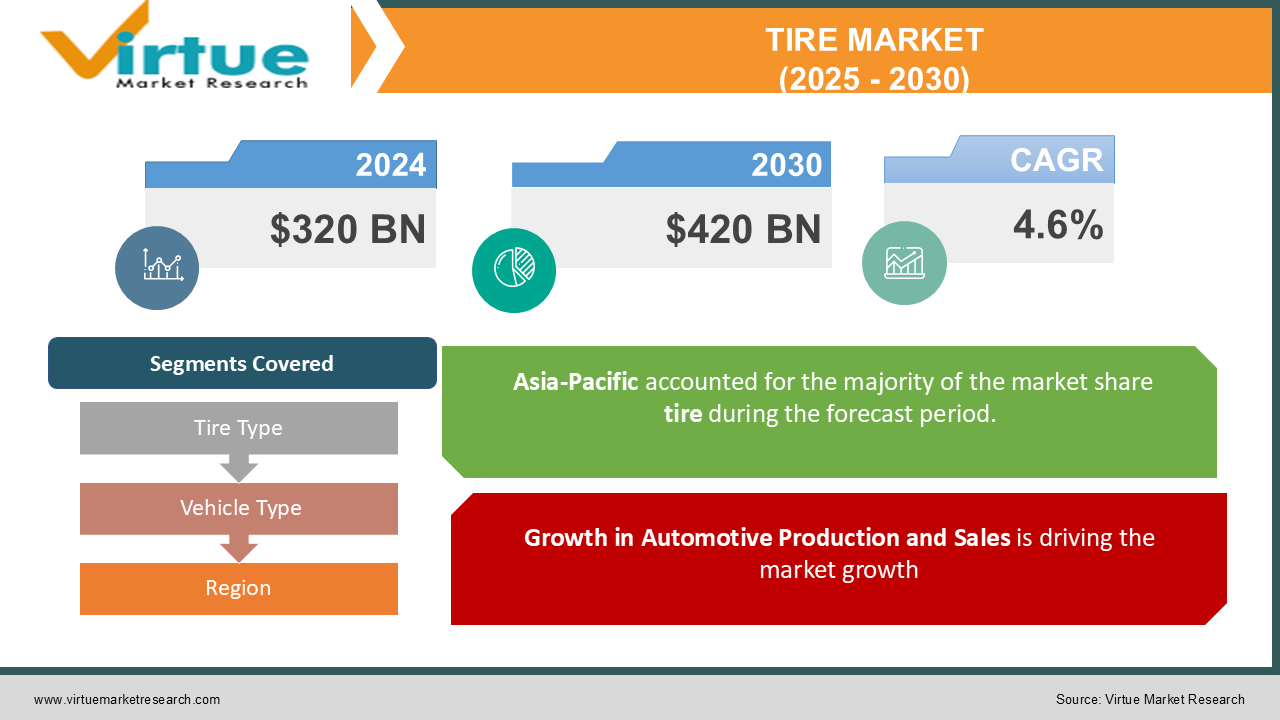

The Global Tire Market was valued at USD 320 billion in 2024 and is projected to reach USD 420 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030.

Tires are an integral part of vehicles, ensuring safety, stability, and efficiency in performance. Their demand is primarily driven by the growth of the automotive industry, increasing vehicle ownership, and advancements in tire technology.

The market encompasses a wide variety of tires catering to different vehicle types such as passenger cars, commercial vehicles, two-wheelers, and off-the-road (OTR) vehicles. With the rapid adoption of electric vehicles (EVs) and the focus on fuel efficiency, manufacturers are developing advanced tire solutions, such as low-rolling resistance tires and smart tires. Additionally, the rise in automotive aftermarket sales and the demand for replacement tires contribute significantly to market growth. The increasing emphasis on sustainability and eco-friendly products has led to innovations such as recycled and retreaded tires, creating new for growth in the tire industry.

Key Market Insights

-

Passenger cars dominate the market in terms of tire demand, followed by commercial vehicles and two-wheelers. Radial tires account for the largest share of the market, due to their enhanced durability, comfort, and fuel efficiency.

-

The Asia-Pacific region leads the global tire market, driven by increasing automotive production and vehicle ownership.

-

The replacement tire segment is experiencing steady growth due to increased wear and tear from rising vehicle usage.

-

Advancements in smart tires with integrated sensors for real-time monitoring are gaining traction, particularly in premium vehicle segments. Rising concerns about environmental sustainability have led to an increased focus on retreading and recycling tires. Increasing government regulations on tire labeling and performance standards are encouraging innovation and quality improvements.

Global Tire Market Drivers

Growth in Automotive Production and Sales is driving the market growth

The increasing production and sales of vehicles worldwide remain the primary driver of the tire market. With improving economic conditions, particularly in developing countries, vehicle ownership is on the rise, leading to a surge in demand for both OEM (original equipment manufacturer) and replacement tires. Passenger cars and two-wheelers constitute the largest segments of tire consumption, driven by urbanization and the need for personal mobility. Additionally, the expansion of commercial vehicle fleets for logistics and transportation activities contributes significantly to tire demand. The rise of electric vehicles (EVs) is another major factor. EV-specific tires, which require unique attributes such as lower rolling resistance and noise reduction, are becoming increasingly popular, opening new avenues for tire manufacturers.

Technological Advancements in Tires is driving the market growth

Advancements in tire technology are transforming the industry, with innovations such as smart tires, low rolling resistance tires, and self-sealing tires. Smart tires equipped with sensors enable real-time monitoring of pressure, temperature, and wear, enhancing safety and performance. The demand for fuel-efficient tires with lower rolling resistance is growing, particularly due to rising fuel costs and environmental awareness. These tires not only improve mileage but also reduce carbon emissions, aligning with global sustainability goals. Moreover, the development of all-season tires and run-flat tires is gaining popularity among consumers, offering enhanced convenience and reliability. Such technological innovations are expected to further drive market growth.

Growing Replacement Tire Market is driving the market growth

The replacement tire market is witnessing significant growth, driven by increased vehicle usage and the need for periodic tire replacement. Consumers are increasingly opting for high-quality replacement tires to ensure safety and performance, especially in regions with extreme weather conditions. Additionally, the rise of e-commerce platforms for tire sales has made it easier for consumers to access a wide range of options, further boosting the replacement market. Manufacturers are focusing on offering durable and cost-effective tires to cater to this growing demand.

Global Tire Market Challenges and Restraints

Volatility in Raw Material Prices is restricting the market growth

The tire industry is heavily reliant on raw materials such as natural rubber, synthetic rubber, and carbon black. Fluctuations in the prices of these materials, driven by supply-demand imbalances, geopolitical issues, and environmental factors, pose a significant challenge to tire manufacturers. High raw material costs directly impact the production cost of tires, reducing profit margins for manufacturers. Additionally, the dependency on imports for raw materials in certain regions further exacerbates the issue, making the industry vulnerable to currency fluctuations and trade restrictions.

Environmental Concerns is restricting the market growth

The environmental impact of tire production and disposal is a growing concern. Tire manufacturing involves the use of non-renewable resources and generates significant emissions, contributing to environmental degradation. Furthermore, discarded tires are a major source of waste, with limited recycling options. Governments worldwide are implementing stringent regulations on tire manufacturing and disposal, pushing manufacturers to adopt eco-friendly practices. While this creates opportunities for sustainable innovations, it also increases production costs and operational complexity for manufacturers.

Market Opportunities

The global tire market presents significant opportunities for growth, particularly in the areas of sustainability, innovation, and emerging markets. The rising adoption of electric vehicles has created a demand for specialized tires tailored to EV-specific needs such as low rolling resistance, enhanced durability, and noise reduction. Manufacturers who can cater to this growing segment stand to gain a competitive edge. Additionally, the shift toward sustainable practices is opening new avenues for recycled and retreaded tires. Retreading, in particular, is gaining popularity as a cost-effective and eco-friendly alternative, especially in the commercial vehicle segment. Innovations in recycling technologies are also expected to enhance the viability of recycled tires, reducing the environmental impact of tire disposal. Emerging markets in Asia-Pacific, Latin America, and Africa offer immense growth potential due to rising automotive production, urbanization, and increasing disposable incomes. Manufacturers investing in these regions can capitalize on the growing demand for both OEM and replacement tires. The integration of smart tire technologies represents another promising opportunity. With increasing adoption in premium vehicles and commercial fleets, smart tires equipped with sensors for real-time monitoring and predictive maintenance are expected to revolutionize the industry.

TIRE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Tire Type, Vehicle Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Michelin, Bridgestone Corporation, Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Hankook Tire & Technology, Yokohama Rubber Co., Ltd., Sumitomo Rubber Industries, Ltd., Apollo Tyres Ltd., CEAT Limited |

Tire Market Segmentation - By Tire Type

-

Radial Tires

-

Bias Tires

Radial tires dominate the market due to their superior performance characteristics, such as enhanced durability, fuel efficiency, and comfort. These tires are widely used in passenger cars and commercial vehicles, particularly in developed regions. Bias tires, on the other hand, are commonly used in off-the-road (OTR) applications and certain two-wheelers.

Tire Market Segmentation - By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

-

Two-Wheelers

-

Off-the-Road (OTR) Vehicles

Passenger cars account for the largest share of the tire market, driven by increasing vehicle ownership and the growth of electric and hybrid vehicles. Commercial vehicles represent the second-largest segment, with demand fueled by logistics and transportation activities. Two-wheelers and OTR vehicles also contribute significantly to the market, particularly in developing regions.

Tire Market Segmentation - By Region

-

Asia-Pacific

-

North America

-

Europe

-

Latin America

-

Middle East & Africa

The Asia-Pacific region leads the global tire market, accounting for the largest share in 2023. This dominance is attributed to high automotive production and sales in countries like China, India, and Japan. The region's growing middle-class population, urbanization, and expanding logistics sector further contribute to tire demand. North America and Europe are mature markets, with steady demand driven by replacement tire sales and advancements in tire technology. Emerging markets in Latin America and Africa offer significant growth potential due to increasing vehicle ownership and infrastructure development.

COVID-19 Impact Analysis

The COVID-19 pandemic presented a complex scenario for the tire market, marked by both challenges and opportunities. Initially, the global lockdowns and subsequent decline in automotive production led to a significant drop in OEM tire sales. Supply chain disruptions further exacerbated the situation, as manufacturers faced difficulties in procuring raw materials and components. However, as economies gradually reopened and people returned to their daily routines, the replacement tire segment witnessed a surge in demand. The increased reliance on personal vehicles for commuting and essential travel boosted the sales of passenger car and two-wheeler tires. The pandemic also accelerated the adoption of e-commerce platforms in the tire industry. Online sales channels provided consumers with convenient access to a wider range of tire options, enabling them to compare prices, read reviews, and make informed purchasing decisions from the comfort of their homes. This shift towards online shopping is expected to continue even post-pandemic, reshaping the traditional retail landscape for tires.

Latest Trends/Developments

The rise of electric vehicles (EVs) is driving innovation in EV-specific tires with low rolling resistance and enhanced durability. Increasing adoption of smart tire technologies, including sensors for real-time monitoring and predictive maintenance. Growing focus on sustainability has led to advancements in retreading and recycling technologies, reducing the environmental impact of tire disposal. Development of fuel-efficient tires to meet stringent emission standards and consumer demand for cost-effective solutions. Expansion of online tire retailing platforms, enabling easier access for consumers and fostering competition among manufacturers. Sustainability is a major focus, with tire manufacturers developing eco-friendly tires made from recycled materials and designed to improve fuel efficiency. Advancements in tire technology, such as self-sealing and airless tires, are gaining traction, promising increased safety and durability. The rise of electric vehicles (EVs) is reshaping the market, as EV tires require specific characteristics to optimize performance and range. Additionally, connected tire technology is emerging, enabling real-time monitoring of tire pressure and tread wear, enhancing safety and maintenance. The market is also witnessing a shift towards premium and high-performance tires, driven by increasing consumer demand for better handling and comfort

Key Players

-

Michelin

-

Bridgestone Corporation

-

Goodyear Tire & Rubber Company

-

Continental AG

-

Pirelli & C. S.p.A.

-

Hankook Tire & Technology

-

Yokohama Rubber Co., Ltd.

-

Sumitomo Rubber Industries, Ltd.

-

Apollo Tyres Ltd.

-

CEAT Limited

Chapter 1. Tire Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Tire Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Tire Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Tire Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Tire Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Tire Market – By Tire Type

6.1 Introduction/Key Findings

6.2 Radial Tires

6.3 Bias Tires

6.4 Y-O-Y Growth trend Analysis By Tire Type

6.5 Absolute $ Opportunity Analysis By Tire Type, 2025-2030

Chapter 7. Tire Market – By Vehicle Type

7.1 Introduction/Key Findings

7.2 Passenger Cars

7.3 Commercial Vehicles

7.4 Two-Wheelers

7.5 Off-the-Road (OTR) Vehicles

7.6 Y-O-Y Growth trend Analysis By Vehicle Type

7.7 Absolute $ Opportunity Analysis By Vehicle Type, 2025-2030

Chapter 8. Tire Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Tire Type

8.1.3 By Vehicle Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Tire Type

8.2.3 By Vehicle Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Tire Type

8.3.3 By Vehicle Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Tire Type

8.4.3 By Vehicle Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Tire Type

8.5.3 By Vehicle Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Tire Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Michelin

9.2 Bridgestone Corporation

9.3 Goodyear Tire & Rubber Company

9.4 Continental AG

9.5 Pirelli & C. S.p.A.

9.6 Hankook Tire & Technology

9.7 Yokohama Rubber Co., Ltd.

9.8 Sumitomo Rubber Industries, Ltd.

9.9 Apollo Tyres Ltd.

9.10 CEAT Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global tire market was valued at USD 320 billion in 2024 and is expected to reach USD 420 billion by 2030, growing at a CAGR of 4.6%.

Key drivers include growth in automotive production, technological advancements in tires, and the growing replacement tire market.

The market is segmented by tire type (radial, bias) and vehicle type (passenger cars, commercial vehicles, two-wheelers, off-the-road vehicles).

The Asia-Pacific region dominates, driven by high automotive production and growing demand for passenger and commercial vehicles.

Leading players include Michelin, Bridgestone, Goodyear, Continental, and Pirelli.