TV Studio Content Market Size (2024 – 2030)

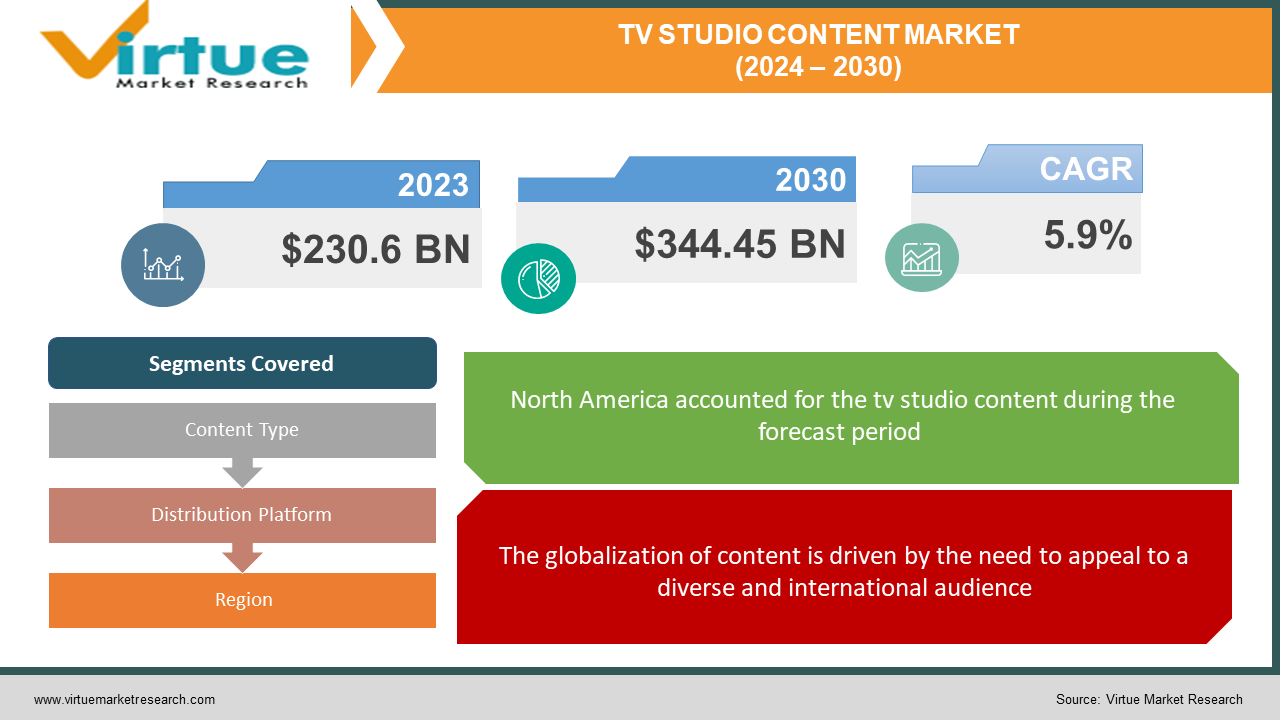

The Global TV Studio Content Market was valued at USD 230.6 Billion in 2023 and is projected to reach a market size of USD 344.45 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

The TV Studio Content Market is a vibrant and dynamic industry experiencing steady growth. The market is witnessing significant growth in emerging regions like Asia Pacific and Latin America, driven by rising disposable incomes and increasing access to the internet. This global expansion presents new avenues for TV studios to broaden their reach and market their content.TV studios and streaming services have been investing significantly in original content to attract and retain subscribers. This trend has led to an increase in the production of high-quality series, documentaries, and films. The market has become more globalized, with content creators and studios aiming to appeal to diverse international audiences. Many platforms are creating and acquiring content from various regions to cater to a broader viewer base. The market has become more globalized, with content creators and studios aiming to appeal to diverse international audiences. Many platforms are creating and acquiring content from various regions to cater to a broader viewer base. The industry has witnessed increased competition among streaming services, traditional broadcasters, and other content providers. Additionally, there has been a trend of mergers and acquisitions as companies seek to strengthen their positions in the market. Consumer preferences have been shifting towards on-demand and personalized content. This change has led to a decline in traditional cable and satellite TV subscriptions, with more viewers opting for streaming services that offer flexibility and a vast library of content. Challenges include rising production costs, content saturation, and the need to continually innovate to capture audience attention. Opportunities lie in the potential for new revenue streams, partnerships, and the exploration of emerging markets.

Key Market Insights:

Streaming services have continued to dominate the TV studio content market. Platforms like Netflix, Amazon Prime Video, Hulu, and Disney+ have become major players, investing heavily in original content production. These services often bypass traditional TV networks, providing viewers with on-demand access to a vast library of content.The emphasis on original content production has grown significantly. Streaming services and TV studios are allocating substantial budgets to create high-quality series, documentaries, and films. Original content not only attracts subscribers but also differentiates platforms in a highly competitive market. The industry is continually evolving with technological advancements. Higher resolution formats like 4K and 8K, Virtual Reality (VR), and Augmented Reality (AR) are being integrated into content creation. These technologies enhance the overall viewer experience and provide new avenues for creative storytelling. Korean thrillers, Turkish historical dramas, and Japanese anime are finding huge international audiences, inspiring studios to experiment with diverse storytelling styles. Global content fosters cultural understanding and breaks down barriers, creating a more interconnected viewing experience. International formats are being adapted for local markets, retaining core elements while adding cultural nuances. Studios are producing a wider range of genres and formats to cater to diverse tastes and viewing habits. Studios are increasingly focused on reducing their environmental footprint through green production practices and eco-conscious storytelling. Studios are experimenting with new distribution models, bypassing traditional gatekeepers and connecting directly with audiences.

TV Studio Content Market Drivers:

The globalization of content is driven by the need to appeal to a diverse and international audience.

Globalization of content allows for more diverse cultural representation in the media. TV studios and content creators recognize the importance of reflecting a variety of cultures, perspectives, and lifestyles in their content to appeal to a broad and international audience. Content producers aim to create content that transcends cultural boundaries, making it universally appealing. By doing so, they can access a larger audience globally and expand their market reach. Streaming platforms leverage their global presence to offer content that resonates with viewers from different regions. Content creators and production companies are increasingly engaging in cross-border collaborations. This involves partnerships between studios from different countries to co-produce content. Such collaborations bring together diverse talents, creative perspectives, and resources to produce content with global appeal. Streaming services play a significant role in the globalization of content. Platforms like Netflix, Amazon Prime Video, Disney+, and others have a global reach, allowing them to distribute content to audiences in multiple countries simultaneously. This has led to the widespread availability of content regardless of geographic location. International co-productions involve collaborations between production companies from different countries to create content. This strategy allows for the sharing of production costs, talent, and resources, resulting in content that can cater to a broader audience. The rise of global distribution platforms facilitates the dissemination of content to audiences worldwide. Digital platforms and streaming services provide a direct route for content creators to reach international viewers without the need for traditional broadcast networks

The increasing focus on original content production is a crucial driver.

One of the primary reasons for original content investments is to differentiate a platform or network from its competitors. Exclusive and original programming attracts subscribers or viewers, providing a competitive edge in a crowded market. This is especially true for streaming services that rely on a vast library of exclusive content to retain and attract subscribers. Original content investments provide creators with the financial backing and creative freedom to explore innovative storytelling and production techniques. This can lead to groundbreaking narratives, unique visual styles, and the introduction of new talent to the industry. Investing in original content allows companies to own the intellectual property rights to the content they produce. This ownership is crucial for long-term value, as it enables content to be monetized across various channels, including international licensing, merchandise, and syndication. Creating high-quality original content contributes to brand building and reputation enhancement. A strong portfolio of original programming establishes a brand identity for a streaming service or network and can positively influence how it is perceived by both audiences and industry peers. Investing in original content attracts top-tier talent in the entertainment industry. Established actors, directors, writers, and producers are often drawn to projects that offer creative freedom and the potential for widespread recognition. This, in turn, helps in talent retention and strengthens relationships with industry professionals. Streaming platforms often use data analytics to understand viewer preferences and behavior. This data-driven approach guides original content investments by identifying genres, themes, and formats that are likely to resonate with the target audience, optimizing the return on investment. Original content investments can be leveraged across various platforms and media. For example, content created for a streaming service may have promotional tie-ins with merchandise, video games, and other forms of entertainment, creating a synergistic approach to content monetization.

Technological advancements play a crucial role in shaping the landscape of the TV and entertainment industry.

The transition to higher resolution formats, such as 4K and 8K, has significantly improved the visual quality of TV content. This enhancement in resolution provides viewers with sharper images, more vibrant colours, and an overall enhanced viewing experience. VR and AR technologies have opened new possibilities for immersive storytelling. TV studios are exploring these technologies to create interactive and engaging content. VR allows viewers to experience narratives in a more immersive and three-dimensional environment. HDR technology enhances the contrast and colour accuracy of TV displays, resulting in more realistic and visually stunning images. This technology contributes to a more dynamic and captivating viewing experience. Innovations in camera technologies, such as higher frame rates and improved sensors, enable filmmakers and TV producers to capture high-quality footage. These advancements allow for more creative cinematography and contribute to the overall production quality of TV content. Cloud-based solutions have revolutionized the production workflow. Collaborative tools, remote editing, and cloud storage enable content creators to work more efficiently, especially in distributed and remote production environments. The field of animation and computer-generated imagery (CGI) has advanced significantly. Realistic animations and special effects are now commonplace in TV shows, bringing fantastical elements to life and enabling creators to explore imaginative worlds. The adoption of new broadcasting standards, such as ATSC 3.0 (Next Gen TV), allows for more efficient content delivery, improved reception, and interactive features. This standard supports 4K broadcasting, personalized content delivery, and enhanced emergency alerts. The rollout of 5G networks is transforming the way content is delivered and consumed. Higher data speeds and lower latency contribute to smoother streaming experiences, facilitating the growth of mobile viewing and the widespread adoption of streaming services. Technological advancements have enabled interactive TV experiences and second-screen applications. Viewers can engage with content in real-time, participate in polls, and access additional information on their smartphones or tablets while watching TV. These technological advancements continue to reshape the TV and entertainment industry, offering new creative possibilities, improving efficiency in production workflows, and enhancing the overall viewer experience.

TV Studio Content Market Restraints and Challenges:

Rising production costs represent a significant challenge in the TV studio content market.

Audience expectations for high-quality content have increased. Viewers now anticipate cinematic production values, sophisticated visual effects, and top-tier talent, which contribute to elevated production costs. Meeting or exceeding these expectations is essential for attracting and retaining viewers. Acquiring renowned actors, directors, writers, and producers often comes with high fees. A-list talent can demand substantial salaries, especially for exclusive contracts with streaming platforms or network series. These costs significantly contribute to the overall budget of a production. While technological advancements enhance the viewing experience, they also contribute to rising production costs. The adoption of higher resolution formats (4K, 8K), advanced camera technologies, special effects, and virtual/augmented reality requires substantial investments in equipment, expertise, and post-production processes. The creation of compelling and unique scripts is crucial for successful TV content. Acquiring intellectual property rights, developing original ideas, or adapting existing content can involve substantial upfront costs in securing the necessary licenses and rights. The choice of shooting locations and the construction of elaborate sets contribute significantly to production expenses. Costs associated with securing and transforming locations, building intricate sets, and ensuring the authenticity of the production setting can be substantial. The complexity of TV productions necessitates insurance coverage to mitigate risks related to accidents, equipment damage, and unforeseen circumstances. Insurance premiums can be a considerable component of production costs. As industry standards evolve, TV studios often need to invest in keeping pace with the latest trends. This includes staying updated on visual styles, special effects, and technological innovations, which can involve additional training and equipment investments.

Competition from streaming services is a significant challenge faced by traditional television networks and has reshaped the dynamics of the TV studio content market.

The rise of streaming services has contributed to the phenomenon of cord-cutting, where viewers opt to cancel traditional cable or satellite subscriptions in Favor of streaming platforms. This has led to a decline in traditional TV subscriptions and an erosion of the audience base for linear television channels. Streaming services offer on-demand content, allowing viewers to watch what they want, when they want. This flexibility contrasts with traditional TV schedules, leading to the popularization of binge-watching culture, where viewers consume entire seasons or series in one sitting. Streaming services heavily invest in original content to attract and retain subscribers. This includes exclusive series, films, and documentaries produced or commissioned by the streaming platforms. The emphasis on original content has become a key differentiator and a draw for subscribers. Streaming platforms use sophisticated algorithms to analyse viewer preferences and offer personalized content recommendations. This personalized approach enhances the viewer experience, making it more tailored to individual tastes compared to the traditional linear TV model. Streaming services are platform-agnostic, allowing viewers to access content on a variety of devices, including smart TVs, smartphones, tablets, and computers. This flexibility in device compatibility further contributes to the popularity of streaming services among diverse consumer demographics. As audiences shift to streaming platforms, traditional linear TV channels experience a decline in viewership. This, in turn, affects advertising revenue, as advertisers may prefer platforms with larger and more engaged audiences. To address the competition from streaming services, traditional TV networks may need to adapt their business models, invest in digital strategies, and explore ways to enhance viewer engagement.

TV Studio Content Market Opportunities:

Opportunities lie in expanding content distribution globally. TV studios can capitalize on the growing demand for diverse and culturally relevant content in international markets. Tailoring content to specific regions and forming strategic partnerships can enhance global reach. Continued investment in original content presents an ongoing opportunity. TV studios can differentiate themselves by producing high-quality, innovative, and unique content that attracts and retains viewers. This includes developing compelling series, films, documentaries, and other original programming. Collaborations between TV studios, production companies, and international partners offer opportunities to pool resources, share expertise, and create content with broader appeal. Co-productions can also facilitate entry into new markets and bring diverse perspectives to content creation. The integration of emerging technologies such as Virtual Reality (VR), Augmented Reality (AR), and 5G connectivity, provides opportunities for immersive storytelling and enhanced viewer experiences. TV studios can explore these technologies to create innovative content and engage audiences in new ways. Leveraging data analytics for audience insights allows TV studios to understand viewer preferences. Personalized content recommendations and targeted advertising based on user behavior can enhance viewer satisfaction and engagement, creating opportunities for content customization. Integrating content with digital and social media platforms provides opportunities for increased visibility, audience engagement, and marketing. TV studios can leverage social media for promotions, audience interaction, and creating fan communities around their content. TV studios can explore diverse revenue streams beyond traditional advertising. This includes subscription models, pay-per-view options, merchandise sales, and partnerships. Diversifying revenue sources helps studios withstand changes in the advertising landscape.

TV STUDIO CONTENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Content Type, Distribution Platform, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sony Pictures Television, Viacom CBS, ABC Studios, Warner Bros. Television Group, Amazon Studios, CBS Studios, NBCUniversal, MGM Television, Lionsgate Television, BBC Studios |

Global TV Studio Content Market Segmentation: By Content Type

-

Scripted

-

Unscripted

-

Animated

-

Educational

-

Sports

Scripted narratives, encompassing dramas, comedies, and miniseries, currently rule the market with a commanding 60% share. These shows, powered by compelling characters and intricate storylines, offer viewers emotional journeys and intellectual escapes. The enduring popularity of scripted content lies in its ability to connect with us on a deeper level, making it a reliable cash cow for studios. Unscripted shows, including reality and game shows, with a 30% share. These live-in-the-moment experiences tap into our voyeuristic tendencies and offer thrills, laughs, and drama in real-time. Their unscripted nature and lower production costs compared to scripted giants make them attractive propositions for studios looking for quick returns. While animation often holds a smaller market share of around 5%, its influence is undeniable. Children's cartoons and adult animation alike are seeing explosive growth, fueled by streaming platforms and their global reach. The ability to cater to diverse demographics and explore fantastical worlds without geographical limitations makes animation a potent force with a bright future.

Global TV Studio Content Market Segmentation: by Distribution Platform

-

Traditional TV

-

Streaming Platforms

-

Pay-per-view

-

Mobile Apps

-

International Distribution

Traditional TV is still a heavyweight, broadcast networks and cable channels hold a 34% market share, albeit steadily declining. This loyal but aging audience offers stability, particularly for live events and sports. With a combined 42% market share, Netflix, Disney+, Amazon Prime Video, and others are the new dominant force. Their subscription-based model caters to diverse niches and powers binge-watching culture, making them the platform of choice for many viewers, especially younger demographics. Offering premium content like blockbuster movies and boxing matches, pay-per-view accounts for a smaller 8% share. While lucrative for individual events, its reliance on specific attractions limits its overall reach. Content designed for on-the-go consumption captures a 7% share. News, comedy sketches, and short-form documentaries thrive on these platforms, especially among millennials and Gen Z. International Distribution reaching beyond national borders, this segment holds a 9% share. Adapting content and catering to cultural nuances unlocks vast audiences but requires careful navigation of regulations and market preferences. Traditional TV, while still dominant, faces the challenge of cord-cutting and aging viewers. It must innovate, embrace hybrid models, and attract younger audiences to maintain its hold. Streaming Platforms reign supreme, fueled by content diversity and personalization. Their battle for subscriber loyalty will drive further investment in original content and technological advancements.

Global TV Studio Content Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest and most mature region in the TV studio content market, accounting for 35% of global revenue. The United States is the dominant market in North America, followed by Canada. The North American market is characterized by a high level of competition, with major players such as Disney, Netflix, and Warner Media vying for market share. Europe is the second-largest region in the TV studio content market, accounting for 30% of global revenue. The United Kingdom is the dominant market in Europe, followed by Germany. The European market is characterized by a diverse range of languages and cultures, which poses a challenge for content creators. However, the market is also home to several large media companies, such as BBC and Sky, which are investing heavily in original content. Asia Pacific is the fastest-growing region in the TV studio content market. The region is expected to grow at a CAGR of 6.5% over the next five years, driven by factors such as rising disposable incomes and increasing internet penetration. China is the dominant market in Asia Pacific, followed by India. The Asian market is characterized by a strong demand for local content, which presents a significant opportunity for regional TV studios. Latin America and Middle East and Africa are smaller but still important markets in the TV studio content market. These regions are expected to grow at a steady pace over the next few years. Brazil is the dominant market in Latin America, followed by Mexico. Turkey is the dominant market in the Middle East and Africa, followed by South Africa.

COVID-19 Impact Analysis on the Global TV Studio Content Market.

Lockdowns and social distancing measures brought productions to a screeching halt, disrupting filming schedules and delaying releases. Studios faced financial losses due to canceled projects, halted advertising revenue, and declining box office returns. Travel restrictions and health concerns limited the availability of actors, crew, and other personnel. With new productions stalled, broadcasters struggled to fill airtime, leading to reruns and filler content. Viewers' habits changed as they stayed home, increasing demand for streaming services and specific content genres. With people confined to their homes, streaming platforms like Netflix and Disney+ saw a surge in subscriptions and viewership, creating a demand for fresh content. Studios embraced virtual production techniques, utilizing green screens and computer-generated imagery to film remotely and minimize risks. The pandemic fueled creative experimentation, with shorter seasons, remote interviews, and audience-interactive formats gaining traction. The pandemic has accelerated the pre-existing trends in the TV studio content market, such as the rise of streaming, the demand for diverse content, and the importance of technological innovation. Studios that adapt to these changes and embrace new storytelling methods will be best positioned to thrive in the post-pandemic landscape.

Latest Trends/ Developments:

Technology is rapidly transforming the storytelling landscape. Virtual reality, augmented reality, and artificial intelligence are opening new avenues for immersive and interactive experiences. TV studios are embracing these advancements, creating mind-blowing content that blurs the lines between reality and fiction. Audiences are fragmenting, with viewers seeking niche content that caters to their specific interests. This presents a challenge for TV studios, but also an opportunity. By understanding and catering to niche demographics, studios can build loyal fanbases and stand out in the crowded marketplace. TV studios are harnessing the power of data analytics to understand audience preferences, predict trends, and optimize their content creation and marketing strategies. By analyzing viewing habits and social media engagement, studios can tailor their shows to what viewers truly want, increasing their chances of success. Local stories are crossing borders like never before, with Korean dramas like "Squid Games" and Turkish soap operas captivating audiences worldwide. This opens vast new markets for TV studios, allowing them to cater to diverse tastes and tap into previously untapped revenue streams. The trend of creating content with international appeal persisted. TV studios are increasingly engaging in international co-productions, collaborations, and acquisitions to diversify their content offerings and cater to a global audience. TV studios are increasingly leveraging social media platforms for marketing, promotion and audience engagement. Interactive campaigns, behind-the-scenes content, and real-time interactions with fans became integral parts of content promotion strategies.

Key Players:

-

Sony Pictures Television

-

Viacom CBS

-

ABC Studios

-

Warner Bros. Television Group

-

Amazon Studios

-

CBS Studios

-

NBCUniversal

-

MGM Television

-

Lionsgate Television

-

BBC Studios

Chapter 1. TV Studio Content Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. TV Studio Content Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. TV Studio Content Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. TV Studio Content Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. TV Studio Content Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. TV Studio Content Market– By Content Type

6.1 Introduction/Key Findings

6.2 Scripted

6.3 Unscripted

6.4 Animated

6.5 Educational

6.6 Sports

6.7 Y-O-Y Growth trend Analysis By Content Type

6.8 Absolute $ Opportunity Analysis By Content Type , 2024-2030

Chapter 7. TV Studio Content Market– By Distribution Platform

7.1 Introduction/Key Findings

7.2 Traditional TV

7.3 Streaming Platforms

7.4 Pay-per-view

7.5 Mobile Apps

7.6 International Distribution

7.7 Y-O-Y Growth trend Analysis By Distribution Platform

7.8 Absolute $ Opportunity Analysis By Distribution Platform , 2024-2030

Chapter 8. TV Studio Content Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Content Type

8.1.3 By Distribution Platform

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Content Type

8.2.3 By Distribution Platform

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Content Type

8.3.3 By Distribution Platform

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Content Type

8.4.3 By Distribution Platform

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Content Type

8.5.3 By Distribution Platform

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. TV Studio Content Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Sony Pictures Television

9.2 Viacom CBS

9.3 ABC Studios

9.4 Warner Bros. Television Group

9.5 Amazon Studios

9.6 CBS Studios

9.7 NBCUniversal

9.8 MGM Television

9.9 Lionsgate Television

9.10 BBC Studios

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global TV Studio Content Market was valued at USD 230.6 Billion in 2023 and is projected to reach a market size of USD 344.45 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Audiences are fragmenting, and studios are catering to specific niches with targeted content. From true-crime documentaries to dramas and esport competitions, there's something for everyone. Local content with global appeal is breaking barriers, fostering cultural exchange and expanding audience reach. Studios are adopting eco-friendly practices and incorporating sustainability themes into their content, aligning with audience values and promoting environmental responsibility.

North America holds the largest market share (around 35%).

Asia Pacific is projected to become the fastest-growing region.

Increased competition and technological advancements push production costs higher, squeezing margins for studios. Complexities in content distribution and rights management across multiple platforms pose challenges for studios. Finding and retaining skilled writers, directors, and actors in a competitive landscape can be difficult.