Turkey Residential Real Estate Market Size (2025-2030)

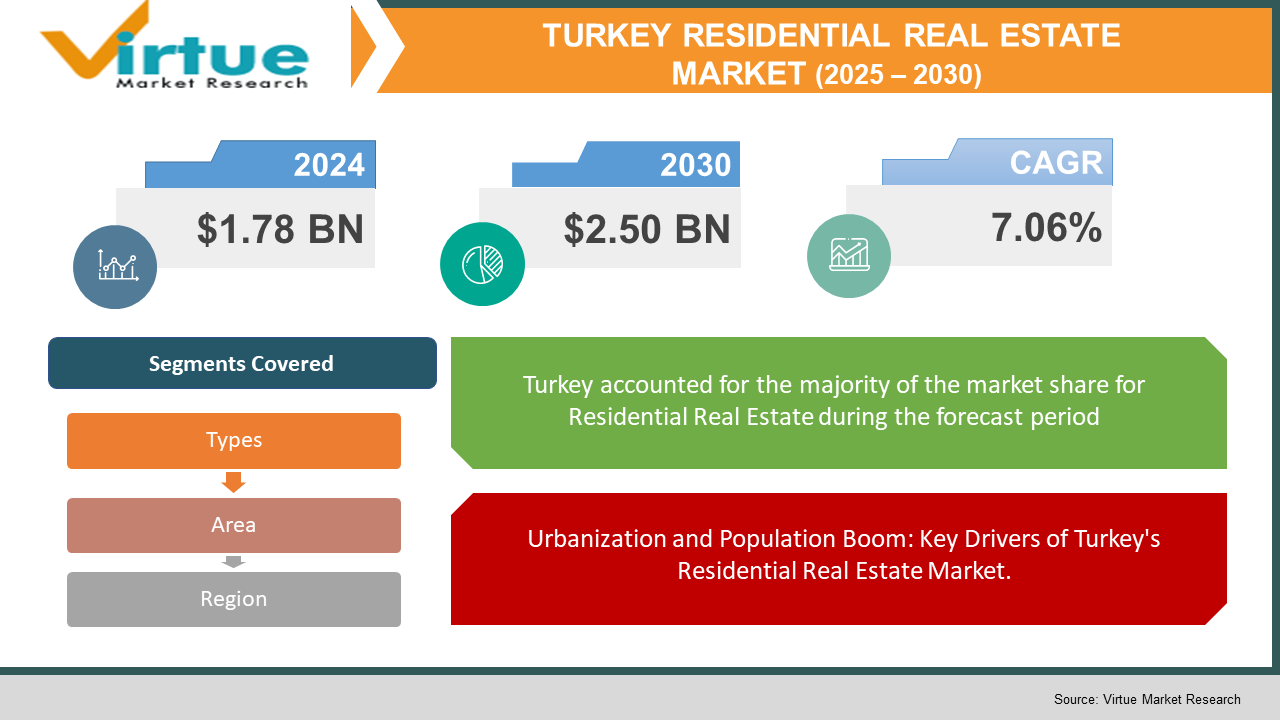

The Turkey Residential Real Estate Market was valued at USD 1.78 billion and is projected to reach a market size of USD 2.50 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.06%.

The increasing demand for housing in major cities like Istanbul, Ankara, and Izmir drives real estate investment, with luxury developments, urban regeneration projects, and affordable housing initiatives reshaping the market. Foreign investment in Turkey’s real estate sector has surged due to government incentives and citizenship programs, making it a hotspot for international buyers. A 2023 report by the Turkish Statistical Institute revealed that residential property sales to foreign buyers accounted for 5.8% of total transactions, with Russians, Iranians, and Iraqis being the top investors. The demand for seaside properties in Antalya and Bodrum is rising, particularly among European and Middle Eastern buyers.

Key Market Insights:

- Mortgage interest rates and inflation continue to influence housing affordability, increasing rental demand in urban areas. The rise of smart homes and eco-friendly residential projects is also shaping future developments, with buyers showing a preference for sustainable, energy-efficient properties.

- A report by the Turkish Statistical Institute found that Istanbul accounted for 17% of all residential property sales, maintaining its position as the most in-demand city for real estate investment.

- According to CBRE Turkey, the demand for rental properties increased by 27% in 2023, driven by rising mortgage rates and affordability challenges in urban centres.

- A survey by the Central Bank of Turkey indicated that housing prices increased by 35% year-on-year, with new residential projects in Istanbul’s Basaksehir and Antalya’s Konyaalti experiencing the highest price appreciation.

- A Knight Frank study (2022) revealed that Turkey ranked among the top 10 global markets for foreign real estate investment, with buyers benefiting from lower property costs compared to European counterparts and a favorable exchange rate.

- Foreign investment in Turkey’s real estate sector has increased, with Russians, Iranians, and Iraqis leading property purchases, particularly in coastal cities like Antalya and Bodrum.

Turkey Residential Real Estate Market Drivers:

Urbanization and Population Boom: Key Drivers of Turkey's Residential Real Estate Market.

Turkey’s rapid urbanization and population growth are key drivers of the residential real estate market. Major cities like Istanbul, Ankara, and Izmir are witnessing an influx of residents, leading to increased demand for housing, infrastructure development, and new residential projects. The government has been investing in urban regeneration initiatives, replacing old housing stock with modern, earthquake-resistant buildings to accommodate the growing population. The rise of smart cities and modern residential complexes is transforming urban living, with developers focusing on integrated communities that offer green spaces, smart home technology, and sustainability features. Middle-income families and young professionals are seeking affordable housing options in suburban areas, while high-net-worth individuals are investing in luxury waterfront properties and gated communities. As Turkey’s economy continues to recover, increased disposable income, lower unemployment rates, and financial incentives for homebuyers are further stimulating the real estate sector. Additionally, the citizenship-by-investment program, which grants Turkish citizenship to foreigners who purchase property worth at least $400,000, has attracted significant global interest, particularly from Middle Eastern and Asian investors.

Because of recent economic turmoil, Turkey is also on the lookout for larger foreign investment which has meant very lucrative deals are offered in the residential real estate sector to entice foreign investors.

Turkey’s strategic location, affordable property prices, and government-backed real estate policies have made it an attractive destination for foreign buyers. International investors, particularly from Russia, Iran, Iraq, and Germany, are purchasing seaside properties in Antalya, luxury apartments in Istanbul, and second homes in Bodrum. The Turkish Citizenship by Investment Program remains a major driver, allowing foreigners to acquire citizenship by investing in real estate. Additionally, tax incentives such as VAT exemptions for foreign buyers and long-term residency permits have contributed to increased demand. Developers are also expanding luxury and branded residential projects, catering to high-net-worth individuals looking for exclusive, high-quality living spaces. The rising number of expatriates, digital nomads, and remote workers in Turkey is further driving demand for rental properties in major cities, boosting the country’s real estate market.

Turkey Residential Real Estate Market Restraints and Challenges:

High Inflation, as interest rates have remained flat has meant the residential market has become very expensive.

Despite strong growth, the Turkey Residential Real Estate Market faces challenges related to economic fluctuations, high inflation, and fluctuating mortgage interest rates. The rising cost of construction materials and land acquisition is leading to higher property prices, making homeownership less affordable for middle-income buyers. Regulatory uncertainties and changes in foreign investment policies may impact market stability. Additionally, while the citizenship-by-investment program has driven foreign demand, future adjustments to this policy could affect investor confidence. Another challenge is regional disparities in real estate demand, with Istanbul and coastal cities experiencing high demand, while inland regions see slower growth. The market also faces oversupply concerns in certain luxury segments, leading to longer property sale cycles and price corrections in specific locations.

Turkey Residential Real Estate Market Opportunities:

Eco-friendly and technology-integrated homes are gaining popularity among buyers looking for energy-efficient, smart-living solutions. Developers incorporating solar energy systems, water recycling technologies, and home automation features into new projects will attract tech-savvy and environmentally conscious buyers, making sustainability a key opportunity in the residential sector. The growing demand for affordable housing presents a major opportunity in Turkey’s real estate market. Government-backed social housing initiatives and low-interest mortgage schemes are helping middle-income families secure homeownership. Developers focusing on cost-effective, high-quality residential units in suburban areas are expected to benefit from increasing demand.

TURKEY RESIDENTIAL REAL ESTATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.06% |

|

Segments Covered |

By Type, area, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Turkey |

|

Key Companies Profiled |

Emlak Konut GYO , KIPTAS , TOKI (Housing Development Administration of Turkey) , Ağaoğlu Group , Sinpaş GYO , Tahincioğlu Real Estate , Dap Yapı , Mesa Mesken , Sur Yapı , Ege Yapı |

Turkey Residential Real Estate Market Segmentation:

Turkey Residential Real Estate Market Segmentation: By type:

- Apartments

- Condos

- Bungalows

- Villa

Apartments dominate Turkey’s residential real estate market, particularly in urban centres like Istanbul, Ankara, and Izmir, where high-rise developments cater to young professionals, expatriates, and investors. These properties offer modern amenities, security, and proximity to commercial hubs, making them ideal for both homebuyers and rental investors. The demand for luxury apartments in branded residences is also rising, particularly among foreign investors looking for prime real estate in Istanbul and Antalya. Condos are becoming a preferred choice in coastal cities, offering buyers a blend of affordability and community living. Popular in areas like Bodrum and Fethiye, condos appeal to retirees, second-home buyers, and digital nomads seeking well-maintained properties with shared amenities such as swimming pools, gyms, and concierge services.

Bungalows are gaining popularity in suburban and holiday destinations, offering spacious layouts, privacy, and green surroundings. These homes are particularly attractive to families and retirees who prioritize peaceful living environments with access to nature. Locations such as Sapanca, Bursa, and Mugla are experiencing increasing demand for bungalow-style homes, driven by buyers looking for vacation homes or permanent residences away from city congestion. Villas remains a premium segment, highly sought after in coastal cities like Antalya, Bodrum, and Cesme, where international buyers and high-net-worth individuals invest in luxury waterfront properties.

Turkey Residential Real Estate Market Segmentation: By Area:

- Urban

- Rural

- Suburban

Urban areas, particularly in Istanbul, Ankara, and Izmir, dominate Turkey’s residential real estate sector, driven by high population density, employment opportunities, and modern infrastructure. Apartments and high-rise condominiums are the most sought-after properties, catering to young professionals, expatriates, and investors looking for proximity to business hubs, public transportation, and social amenities.

Rural areas are gaining traction as buyers seek larger properties, greener surroundings, and quieter lifestyles. Locations such as Bursa, Mugla, and Sapanca are seeing increased demand for bungalows and villas, particularly among retirees, nature lovers, and those seeking vacation homes. With the rise of remote work and flexible lifestyles, more people are relocating to coastal and countryside regions, where they can find spacious homes at lower prices compared to urban centres.

Turkey Residential Real Estate Market Segmentation: By Region:

Turkey's residential real estate market is highly diverse, with distinct trends across different cities and regions. Istanbul, as the country’s economic and cultural hub, remains the most in-demand location for real estate, attracting both domestic and foreign buyers. The city offers a mix of affordable housing in suburban areas and luxury apartments in prime districts like Besiktas, Sisli, and Kadikoy. Other major metropolitan areas, such as Ankara and Izmir, also see strong demand due to job opportunities, infrastructure development, and rising population density.

COVID-19 Impact Analysis on the Turkey Residential Real Estate Market:

The COVID-19 pandemic initially slowed Turkey’s real estate market, with travel restrictions affecting foreign property purchases and construction delays disrupting housing supply. However, as restrictions eased, the market rebounded, driven by low-interest mortgage campaigns and pent-up demand. The shift toward remote work and flexible living arrangements led to increased demand for spacious homes, suburban properties, and vacation residences. Digital property transactions and virtual property tours also became popular, allowing international buyers to invest without physical visits. With economic recovery and government-backed housing initiatives, the post-pandemic real estate sector continues to thrive, with rising rental demand, increased foreign investments, and continued interest in smart and sustainable housing solutions.

Trends/Developments:

High-end developers are launching branded residential projects with concierge services, wellness amenities, and private beach access, targeting international investors and wealthy buyers. Developers are incorporating energy-efficient designs, smart home automation, and green building certifications into new residential projects, catering to eco-conscious buyers.

Government-backed social housing projects and low-interest mortgage schemes are supporting local buyers, helping middle-income families access affordable homeownership opportunities.

With high mortgage rates and affordability challenges, more residents are turning to long-term rentals in urban centres. Investors are capitalizing on this trend by purchasing apartments and condos in prime rental districts, particularly in Istanbul, Ankara, and Izmir, where rental yields remain strong.

Key Players:

- Emlak Konut GYO

- KIPTAS

- TOKI (Housing Development Administration of Turkey)

- Ağaoğlu Group

- Sinpaş GYO

- Tahincioğlu Real Estate

- Dap Yapı

- Mesa Mesken

- Sur Yapı

- Ege Yapı

Chapter 1. TURKEY RESIDENTIAL REAL ESTATE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. TURKEY RESIDENTIAL REAL ESTATE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. TURKEY RESIDENTIAL REAL ESTATE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. TURKEY RESIDENTIAL REAL ESTATE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. TURKEY RESIDENTIAL REAL ESTATE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. TURKEY RESIDENTIAL REAL ESTATE MARKET – By Types

6.1 Introduction/Key Findings

6.2 Apartments

6.3 Condos

6.4 Bungalows

6.5 Villa

6.6 Y-O-Y Growth trend Analysis By Types

6.7 Absolute $ Opportunity Analysis By Types , 2025-2030

Chapter 7. TURKEY RESIDENTIAL REAL ESTATE MARKET – By Area

7.1 Introduction/Key Findings

7.2 Urban

7.3 Rural

7.4 Suburban

7.5 Y-O-Y Growth trend Analysis By Area

7.6 Absolute $ Opportunity Analysis By Area , 2025-2030

Chapter 8. TURKEY RESIDENTIAL REAL ESTATE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. Turkey

8.3.2. By Types

8.3.3. By Area

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Types

8.4.3. By Area

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Types

8.5.3. By Area

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. TURKEY RESIDENTIAL REAL ESTATE MARKET – Company Profiles – (Overview, Packaging Types Portfolio, Financials, Strategies & Developments)

9.1 Emlak Konut GYO

9.2 KIPTAS

9.3 TOKI (Housing Development Administration of Turkey)

9.4 Ağaoğlu Group

9.5 Sinpaş GYO

9.6 Tahincioğlu Real Estate

9.7 Dap Yapı

9.8 Mesa Mesken

9.9 Sur Yapı

9.10 Ege Yapı

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Turkey offers affordable property prices, a strong rental market, and government-backed incentives, including citizenship by investment programs and VAT exemptions for foreign buyers. The country’s strategic location and growing economy also make it a prime destination for real estate investment

Istanbul, Ankara, and Izmir lead the market due to job opportunities, infrastructure development, and high rental demand. Coastal cities like Antalya, Bodrum, and Fethiye are also popular among foreign investors and retirees looking for seaside properties.

With rising mortgage rates and affordability challenges, demand for long-term rental properties has increased, especially in Istanbul and major urban centres. Investors are seeing strong rental yields in prime locations, making rental properties a profitable asset.

The Turkish government offers low-interest mortgage programs, affordable housing initiatives, and tax benefits for first-time homebuyers. Foreign buyers can also benefit from citizenship by investment programs for properties valued at $400,000 or more.

Trends include smart and sustainable housing, increasing foreign investments, growing demand for luxury villas, and urban regeneration projects. Buyers are also seeking eco-friendly developments and technology-integrated homes in major cities and coastal areas