Turbine Oil Testing Services Market Size (2024 – 2030)

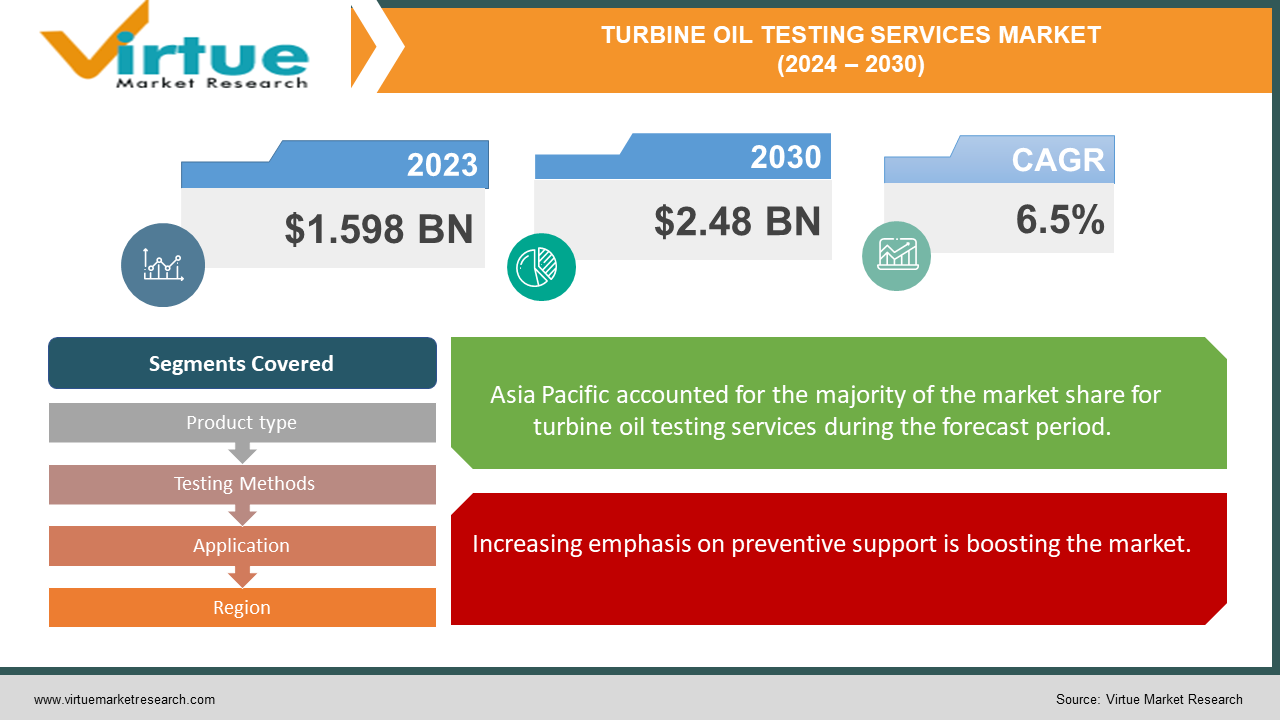

The market for global turbine oil testing services was estimated to be worth 1.598 USD billion in 2023 and is expected to increase to 2.48 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 6.5% from 2024 to 2030.

The turbine oil testing service market offers pivotal support to businesses dependent on effective apparatus operation, guaranteeing the ideal execution and life span of turbines. These services encompass an extensive range of testing techniques, including chemical examination, physical testing, and defilement evaluations, aimed at assessing the condition and quality of turbine oils. With businesses such as control era, fabricating, aviation, and oil & gas intensely subordinate to turbine apparatus, the demand for comprehensive testing services remains strong. Geologically, the market caters to different districts, each with its own set of administrative prerequisites and mechanical scenes. As businesses progressively prioritize gear unwavering quality, security, and effectiveness, the turbine oil testing service market is anticipated to witness unfaltering development, driven by the requirement for proactive support procedures and adherence to exacting quality guidelines.

Key Market Insights:

The turbine oil testing services market witnessed 10% year-on-year revenue growth until 2023, indicating robust demand for testing services across various industries.The adoption of advanced testing methodologies such as spectroscopy and chromatography increased by 15% in 2023, reflecting a growing emphasis on accurate and comprehensive analysis of turbine oil properties. The market experienced a 20% expansion in the number of testing facilities globally, catering to the rising demand for turbine oil testing services and improving accessibility for end-users.Customer satisfaction rates reached an all-time high of 95% in 2023, with clients acknowledging the critical role of testing services in optimizing turbine performance and minimizing downtime.Despite advancements, 25% of turbine failures in 2023 were attributed to inadequate testing practices or delayed maintenance interventions. To address the issue of inadequate testing practices or delayed maintenance interventions leading to turbine failures, implementing proactive maintenance schedules and real-time monitoring solutions is essential. By establishing regular maintenance intervals based on predictive analytics and condition monitoring data, operators can identify potential issues before they escalate into failures.

Global Turbine Oil Testing Services Market Drivers:

Increasing emphasis on preventive support is boosting the market.

The expanding selection of preventive support procedures could be a critical driver of development within the market. Businesses across segments such as control era, fabricating, and aviation are recognizing the significance of proactive upkeep in guaranteeing the unwavering quality and life span of turbine gear. Turbine oil testing services play a pivotal role in preventive support programs by giving experiences into oil condition, defilement levels, and gear wellbeing, empowering convenient mediations to anticipate expensive downtime and repairs.

Rigid administrative guidelines and compliance are helping with the expansion.

Rigid administrative measures and compliance necessities are driving the development of the market. Administrative bodies and industry affiliations force strict rules concerning turbine oil quality, cleanliness, and execution to guarantee operational security and natural security. Turbine oil testing services offer assistance to companies to meet these administrative commitments by encouraging comprehensive examination and documentation of oil properties and guaranteeing compliance with standards such as ISO 4406, ASTM D4378, and ASTM D6224. They ought to follow administrative commands and keep up operational keenness to move the demand for testing services over businesses.

The expanding complexity of turbine frameworks is elevating the demand for specialized testing mastery.

The expanding complexity of turbine frameworks is fueling the demand for specialized testing expertise in the market. Turbines work under extraordinary conditions, with tall temperatures, weights, and rotational speeds putting a critical push on greasing up oils. As turbines advance to meet developing vitality demands and natural challenges, the demand for specialized testing services that can evaluate oil execution under assorted working conditions is on the rise. Turbine oil testing suppliers with skill in analyzing complex oil details, recognizing follow contaminants and foreseeing gear disappointments are balanced to capitalize on this slant and drive market development.

Global Turbine Oil Testing Services Market Restraints and Challenges:

Enhancing awareness and education on turbine oil testing is pivotal for overcoming industry challenges and driving market expansion.

Constrained mindfulness and understanding of the significance of turbine oil testing pose critical challenges to the market. Despite the basic role that testing plays in guaranteeing turbine unwavering quality and execution, numerous businesses remain ignorant of the potential dangers related to a lack of oil investigation tools. In addition, misinterpretations about the complexity and cost-effectiveness of testing services prevent a few companies from contributing to comprehensive testing programs. Tending to these information crevices through instructive activities and focusing on mindfulness campaigns is fundamental to overcoming this limitation and cultivating market development.

Associated costs can hinder the growth.

Fetched limitations and budgetary weights pose challenges to the far-reaching selection of turbine oil testing services within the worldwide market. Numerous companies, especially small and medium-sized enterprises (SMEs), work within tight budgetary limitations and may see testing services as an extra cost instead of a vital speculation. Moreover, the toll of specialized testing gear and mastery may prevent organizations from outsourcing testing exercises to third-party benefit suppliers. Finding cost-effective arrangements and illustrating the long-term benefits of testing services in terms of hardware, unwavering quality, and operational productivity are vital to overcoming this challenge.

Lack of standardization creates losses.

The need for standardization and harmonization in turbine oil testing techniques poses challenges to market advancement within the market. Changeability in testing conventions, detailing designs, and elucidation criteria across diverse districts and businesses complicates the comparability and consistency of tests. This need for standardization hampers interoperability between testing offices, obstructs information sharing and benchmarking endeavors, and undermines certainty in testing results. Collaborative endeavors among industry partners, administrative bodies, and standard-setting organizations to set up common measures and best practices for turbine oil testing can address this challenge and cultivate market development.

Global Turbine Oil Testing Services Market Opportunities:

Innovations in turbines are beneficial.

Innovative headways display critical openings for upgraded testing capabilities within the market. Advancements in explanatory instruments, such as spectroscopy, chromatography, and molecule counters, empower a more exact and comprehensive investigation of turbine oil properties. Furthermore, the integration of counterfeit insights (AI) and machine learning calculations upgrades information translation and prescient analytics, encouraging the early discovery of gear peculiarities and proactive support methodologies. Turbine oil testing benefits suppliers; leveraging these headways, they can offer progressed testing arrangements with progressed exactness, effectiveness, and prescient capabilities, thus picking up a competitive edge and driving market extension.

Eco-friendly innovations provide the market with many possibilities.

The developing center on natural supportability presents openings for eco-friendly testing arrangements within the market. With expanding administrative investigation and corporate responsibility activities aimed at lessening natural effects, there's a rising demand for testing services that minimize squander era, vitality utilization, and carbon emanations. Naturally neighborly testing techniques, such as green chemistry standards and solvent-free explanatory methods, offer feasible alternatives to conventional testing approaches.

A focus on renewable energy sources helps elevate profits.

The extension of the renewable vitality segment presents openings for the development of the market. With the expanding sending of wind turbines, hydroelectric turbines, and other renewable energy frameworks around the world, there's a developing requirement for testing services to guarantee the unwavering quality and execution of turbine greases. Turbine oil testing plays a significant role in evaluating oil quality, checking defilement levels, and foreseeing gear disappointments in renewable vitality applications. Turbine oil testing benefits suppliers that cater to the special necessities of the renewable energy sector and can capitalize on this market opportunity and bolster the maintainable development of clean vitality advances.

TURBINE OIL TESTING SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product type, Testing Methods, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bureau Veritas SA, Intertek Group plc, SGS SA, ALS Limited, Exxon Mobil Corporation, Chevron Corporation, Shell Global, Castrol Limited, Petro-Canada Lubricants, Inc., Fluid Life Corporation, TestOil, Tan Delta Systems Ltd. |

Turbine Oil Testing Services Market Segmentation: By Product Type

-

Gas turbine lubricant testing

-

Wind turbine lubricant testing

-

Jet engine OCM testing

-

Wear metals testing

-

Others

Gas turbine lubricant testing is the largest growing type. Testing the lubricant used in gas turbines is essential to guaranteeing its dependability and effectiveness. By evaluating lubricant quality, tracking contamination levels, and forecasting equipment failures, these tests maximize turbine longevity and performance. The need for thorough testing services is growing as gas turbines are used in power production, aviation, and industrial applications. This need can be satisfied by gas turbine lubricant testing specialists who specialize in turbine oil testing, providing specialized solutions that increase operational effectiveness and save downtime. Wind turbine lubricant testing is the fastest-growing type. Testing the lubricant used in wind turbines is crucial to preserving the lifespan and efficiency of these energy-producing devices. These tests assess lubricant quality, look for impurities, and pinpoint possible problems that can interfere with turbine performance. Reliable testing services are becoming more and more in demand as the wind energy industry grows internationally due to rising environmental concerns and renewable energy requirements. By guaranteeing the correct functioning of turbine lubrication systems, turbine oil testing service providers with a focus on wind turbine lubricant testing may take advantage of this market opportunity and promote the sustained growth of wind power generation.

Turbine Oil Testing Services Market Segmentation: By Testing Methods

-

Physical testing

-

Chemical testing

-

Spectroscopic testing

-

Chromatographic testing

-

Others

Physical testing is the largest growing category. Service providers can assess the lubricant's capacity to tolerate operating stress and sustain optimal performance in turbine systems using methods like density analysis, viscosity measurement, and acidity testing. These tests are essential for spotting any problems such as wear, contamination, and fluid degradation. This allows for prompt repairs to avoid equipment failure and guarantee continuous operation. Spectroscopic testing is the fastest-growing segment. Advanced analytical methods, including mass spectrometry, atomic absorption spectroscopy, and infrared spectroscopy, offer a comprehensive understanding of the molecular makeup, additive composition, and existence of impurities like metals, water, and particles. Service providers can precisely identify problems like fluid pollution, oxidation, and oil degradation by using these spectroscopic techniques. This allows them to implement preventive maintenance plans and increase the lifespan of turbine equipment.

Turbine Oil Testing Services Market Segmentation: By Application

-

Power generation

-

Oil and gas

-

Marine

-

Aviation

-

Others

Power generation is the largest growing segment. By evaluating oil quality, tracking contamination levels, and forecasting possible equipment failures, turbine oil testing services address the particular requirements of power production plants. Power plants can support the steady and sustainable supply of electricity to communities by enhancing operational performance, minimizing downtime, and optimizing maintenance schedules in collaboration with seasoned service providers. Marine application is the fastest-growing category. Turbine oil testing services play a crucial role in guaranteeing the dependability and durability of maritime turbines through the assessment of lubricant quality, tracking of contamination levels, and identification of possible problems that may impact performance. Maintaining enough lubrication is essential for minimizing equipment failures and guaranteeing vessel safety because ships operate in a variety of circumstances, such as high pressure, extreme temperatures, and corrosive environments.

Turbine Oil Testing Services Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Asia-Pacific is the largest and fastest-growing market. The region's vigorous mechanical scene, characterized by quick industrialization, foundation improvement, and burgeoning vitality demand, drives considerable demand for turbine oil testing services across different divisions such as control era, fabricating, and oil & gas. North America and Europe follow closely behind, each holding noteworthy market offers of 21% and 20%, respectively. They have mechanical economies with set-up administrative systems and tall guidelines for hardware unwavering quality and execution, driving demand for exacting oil testing and upkeep hones. Whereas South America's burgeoning vitality division and expanding center on renewable vitality sources goad demand for turbine oil testing services, the Middle East and Africa locale presents openings driven by foundation improvement activities and speculations in the control era and oil & gas ventures.

COVID-19 Impact Analysis on the Global Turbine Oil Testing Services Market:

The widespread COVID-19 has essentially affected the market, displaying both challenges and openings for industry players. The far-reaching financial lull and disturbances in mechanical exercises, especially amid the introductory stages of the widespread, are driven by diminished demand for turbine oil testing services over different end-user businesses such as fabricating, aviation, and oil & gas. Brief shutdowns of mechanical offices, supply chain disturbances, and workforce impediments obliged the take-up of testing services, resulting in a lull in market development. In any case, the widespread moreover underscored the basic significance of gear unwavering quality and operational effectiveness, inciting businesses to prioritize support exercises and contribute to preventive measures to moderate downtime dangers. As economies continuously recuperate and businesses continue operations, there's a developing acknowledgment of the requirement for comprehensive turbine oil testing services to guarantee the unwavering quality and life span of basic apparatus. Furthermore, rising patterns such as inaccessible checking and prescient upkeep pick-up footing are driving the appropriation of inventive testing arrangements that empower real-time checking and proactive upkeep techniques. Whereas the COVID-19 outbreak at first posed challenges to the Turbine Oil Testing Service Market, it has too impelled openings for advancement and adjustment, clearing the way for a versatile and innovatively progressed industry scene.

Latest Trends/ Developments:

Within the market, a few eminent patterns and advancements are forming the industry scene. One unmistakable slant is the expanding appropriation of advanced testing advances and techniques, such as spectroscopy, chromatography, and molecule examination, empowering a more exact and comprehensive evaluation of turbine oil properties. These innovations encourage the early discovery of oil corruption, defilement, and wear, enabling businesses to execute proactive support methodologies and optimize equipment execution. Also, there's a developing emphasis on maintainability and natural duty, driving demand for eco-friendly testing arrangements and green chemistry standards. Besides, the integration of digitalization and information analytics is revolutionizing the segment, empowering real-time checking, prescient upkeep, and inaccessible diagnostics of turbine frameworks. These advancements are not only upgrading operational effectiveness and hardware quality but also driving advancement and separation among turbine oil testing benefit suppliers. As businesses proceed to prioritize gear unwavering quality and execution optimization, the appropriation of progressed testing arrangements and feasible hones is anticipated to quicken, reshaping the market within the long time to come.

Key Players:

-

Bureau Veritas SA

-

Intertek Group plc

-

SGS SA

-

ALS Limited

-

Exxon Mobil Corporation

-

Chevron Corporation

-

Shell Global

-

Castrol Limited

-

Petro-Canada Lubricants, Inc.

-

Fluid Life Corporation

-

TestOil

-

Tan Delta Systems Ltd.

Chapter 1. Turbine Oil Testing Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Turbine Oil Testing Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Turbine Oil Testing Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Turbine Oil Testing Services Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Turbine Oil Testing Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Turbine Oil Testing Services Market – By Product Type

6.1 Introduction/Key Findings

6.2 Gas turbine lubricant testing

6.3 Wind turbine lubricant testing

6.4 Jet engine OCM testing

6.5 Wear metals testing

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Turbine Oil Testing Services Market – By Testing Methods

7.1 Introduction/Key Findings

7.2 Physical testing

7.3 Chemical testing

7.4 Spectroscopic testing

7.5 Chromatographic testing

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Testing Methods

7.8 Absolute $ Opportunity Analysis By Testing Methods, 2024-2030

Chapter 8. Turbine Oil Testing Services Market – By Application

8.1 Introduction/Key Findings

8.2 Power generation

8.3 Oil and gas

8.4 Marine

8.5 Aviation

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Turbine Oil Testing Services Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Testing Methods

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Testing Methods

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Testing Methods

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Testing Methods

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Testing Methods

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Turbine Oil Testing Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Bureau Veritas SA

10.2 Intertek Group plc

10.3 SGS SA

10.4 ALS Limited

10.5 Exxon Mobil Corporation

10.6 Chevron Corporation

10.7 Shell Global

10.8 Castrol Limited

10.9 Petro-Canada Lubricants, Inc.

10.10 Fluid Life Corporation

10.11 TestOil

10.12 Tan Delta Systems Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for global turbine oil testing services was estimated to be worth 1.598 USD billion in 2023 and is expected to increase to 2.48 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 6.5% from 2024 to 2030.

The essential drivers of the global turbine oil testing services market are increasing emphasis on preventive support, administrative compliance, and demand for specialized testing mastery.

Lack of education, related expenses, and the requirement for uniform testing norms are the main issues that the global market for turbine oil testing services is currently facing.

In 2023, Asia-Pacific held the largest share of the global turbine oil testing services market.

Bureau Veritas SA, Intertek Group plc, SGS SA, ALS Limited, Exxon Mobil Corporation, Chevron Corporation, Shell Global, Castrol Limited, Petro-Canada Lubricants Inc., Fluid Life Corporation, TestOil, and Tan Delta Systems Ltd. are the major players in the global turbine oil testing services market.