Turbine Control System Market Size (2024 – 2030)

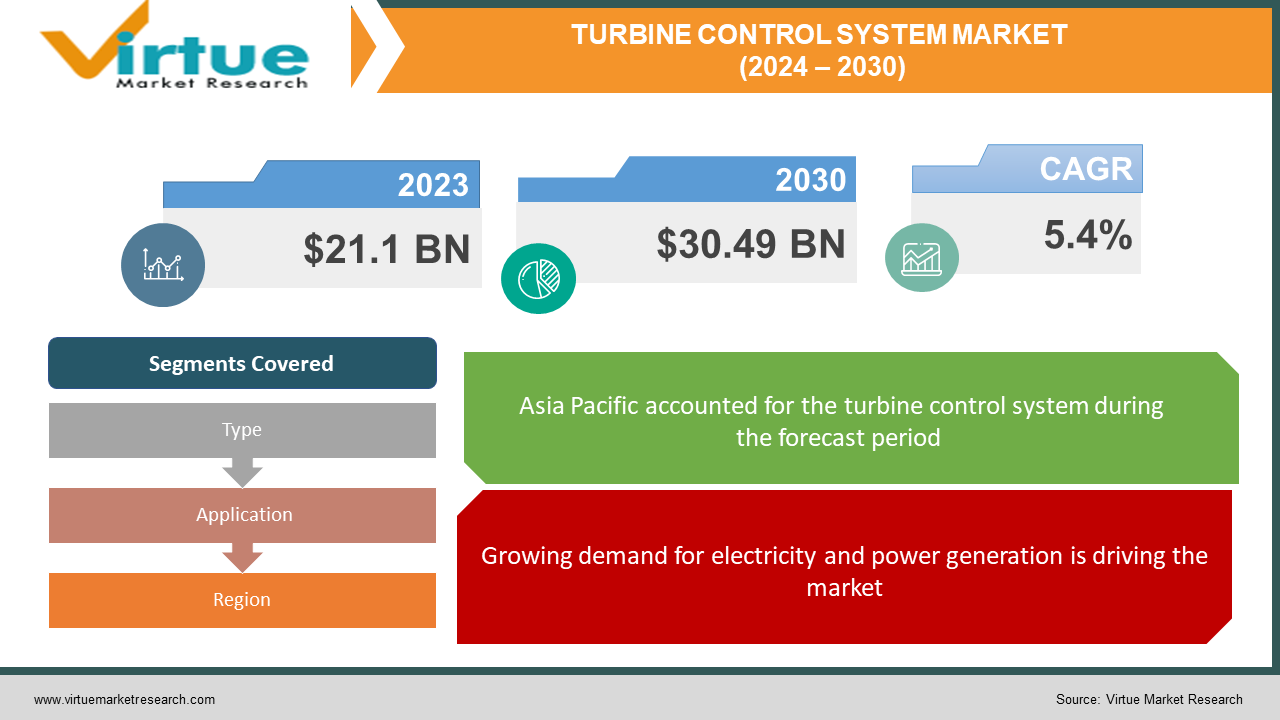

The Global Turbine Control System Market t was valued at USD 21.1 billion in 2023 and will grow at a CAGR of 5.4% from 2024 to 2030. The market is expected to reach USD 30.49 billion by 2030.

A Global Turbine Control System (GTCS) isn't a single system itself, but rather a broad term encompassing numerous control systems dedicated to managing various kinds of turbines around the world. These systems play a crucial role in ensuring their efficient and safe operation.

Key Market Insights:

The global turbine control system market is revving up, expected to reach a value of $30.49 billion by 2032, driven by surging demand for efficiency and automation. Key players like Honeywell, Siemens, and GE Power are innovating with digital technologies, replacing analog systems for enhanced performance and safety. Gas turbines hold the dominant share, but wind and hydropower are gaining traction. Asia Pacific leads the pack, followed by North America and Europe, fueled by infrastructure development and renewable energy push. Stringent emission regulations and rising fuel costs are pushing operators towards efficiency-boosting control systems, creating lucrative opportunities for market growth. However, integration challenges and cybersecurity concerns demand attention for sustained progress. In brief, the global turbine control system market is poised for a dynamic ride, fueled by advancements, regional growth, and sustainability demands.

Global Turbine Control System Market Drivers:

Growing demand for electricity and power generation is driving the market

A surging global population and burgeoning economies spark a voracious appetite for electricity. To satisfy this demand, power generation needs an efficiency and reliability overhaul. Enter advanced turbine control systems, poised to become the maestros of this energy orchestra. These sophisticated systems, unlike their outdated counterparts, wield digital magic, leveraging AI and IoT to optimize performance, squeeze out every drop of fuel efficiency, and minimize harmful emissions. This translates to cost savings for operators and cleaner air for all. As countries tighten emission regulations and renewable energy sources like wind and solar gain traction, the demand for adaptable control systems skyrockets. From modernizing aging infrastructure to ensuring stable grids, these technological marvels are set to play a pivotal role in powering a sustainable future. In short, the rising electricity tide is lifting the boats of advanced turbine control systems, propelling them towards a future brimming with opportunity.

Modernization of aging infrastructure is driving the market

Across the globe, power plants, once titans of industry, stand creaking with age. Their control systems, relics of analog dials and clunky relays, struggle to keep pace with the demands of a modern grid. But modernization beckons, offering a cost-effective lifeline through advanced turbine control systems. Upgrading isn't just a facelift; it's a strategic move, breathing new life into these aging giants. Imagine turbines, once sluggish and unpredictable, responding with the agility of racecars guided by digital maestros. Real-time data whispers instructions, AI algorithms analyze and predict, and IoT sensors monitor every beat. Downtime shrinks, efficiency soars and fuel savings translate to green and competitive gains. These silent heroes of sustainability also bolster grid stability, ensuring a steadier flow of electricity for all. Challenges exist – integration demands planning, cybersecurity needs vigilance – but the rewards far outweigh them. By embracing this technological leap, power plants can defy age, become champions of efficiency and sustainability, and write a new chapter in their stories, powering a brighter energy future

Growing demand for renewable energy is driving the market

Wind turbines, once clunky giants, now dance with precision thanks to these digital conductors, maximizing energy capture from fickle breezes. Solar panels, once static collectors, now dynamically adjust to the sun's whims, their output meticulously managed by control systems that predict cloud cover and optimize generation. These systems aren't just passive observers; they actively orchestrate the renewable orchestra, smoothing out fluctuations and ensuring seamless integration with the grid. From managing the collective roar of wind farms to coaxing every last photon from solar arrays, turbine control systems are the invisible hand behind the renewable revolution, paving the way for a cleaner, greener future. In this dynamic landscape, adaptability is key, and control systems are evolving rapidly, embracing AI and big data to further optimize output and navigate the complexities of integrating multiple renewable sources. The future of energy is undoubtedly green, and turbine control systems are the unsung heroes conducting the symphony of this sustainable tomorrow.

Market Opportunities:

The Global Turbine Control System (GTCS) market presents exciting opportunities driven by rising energy demand, renewable energy growth, and digitalization trends. Demand for efficient power generation fuels the adoption of advanced GTCS solutions, particularly in developing economies and renewable energy sectors like wind and hydro. Focus on sustainability opens doors for emissions reduction technologies integrated with GTCS. Additionally, digitalization and the Industrial Internet of Things (IIoT) unlock opportunities for remote monitoring, predictive maintenance, and data-driven optimization, creating value for both equipment manufacturers and end users. Emerging markets like miniaturized control systems for small turbines and cybersecurity solutions for connected systems hold further potential. However, competition is intense, so innovation and strategic partnerships will be key for players to capture market share in this dynamic and promising landscape.

TURBINE CONTROL SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bharat Heavy Electricals Limited (BHEL) (India)., Rockwell Automation, Mitsubishi Heavy Industries Ltd, Mitsubishi Electric Corporation, Yokogawa Electric Corporation, Komatsu Ltd., China National Heavy Machinery Corporation (China), Siemens Energy |

Turbine Control System Market Segmentation - By Type

-

Gas turbine control systems

-

Steam turbine control systems

-

Wind turbine control system

-

Hydro turbine control systems

While gas turbine control systems reign supreme currently, powering plants, pipelines, and industries, the landscape is shifting. Steam turbines hold strong in traditional power generation, but face pressure from cleaner options. Wind turbines, with dedicated control systems, are surging thanks to renewable energy goals, while hydro remains steady, managing dams and electricity. Looking ahead, renewables like wind and their specialized control systems are expected to see the fastest growth, potentially challenging gas turbine dominance in the long run.

Turbine Control System Market Segmentation - by Application

-

Power generation

-

Oil and gas

-

Aerospace

-

Marine

Power generation reigns supreme in the turbine control system kingdom, its crown studded with utilities, independent producers, and industrial giants. This segment devours the largest share, driven by constant demand for reliable electricity. In close pursuit is the oil and gas sector, utilizing these systems across pipelines, compression stations, and various operations, both upstream and down. However, amidst these titans, aerospace takes flight with a more specialized use, focusing on aircraft engines and auxiliary power units. While crucial for safety and efficiency, its demand pales in comparison to its land-based counterparts. Finally, the marine industry navigates with the least reliance on these systems, using them for ship propulsion and power generation, but often relying on alternative solutions for smaller vessels and specific applications. So, while power generation takes the gold medal, oil and gas secure the silver, aerospace claims a bronze with limited demand, and marine takes a distant fourth, charting its course with diverse solutions.

Turbine Control System Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Across the globe, the turbine control system market dances to different tunes. Asia Pacific pirouettes to the fastest beat, its growth fueled by a booming economy and ambitious infrastructure investments. Here, modernization and renewable energy are hot trends, with wind and solar control systems gaining momentum. North America, a seasoned player, focuses on efficiency upgrades within its mature market, seeking to squeeze more power from aging giants. Europe, driven by strict regulations and green goals, witnesses steady growth across all segments, with gas turbines holding strong. In the Middle East and Africa, the rhythm of development propels the demand for power generation and infrastructure, creating opportunities for diverse control systems. Finally, Latin America, swaying to the beat of renewable ambitions and grid modernization, shows promising growth potential, although its pace lags behind the frontrunners. So, while Asia Pacific sets the fastest pace, Latin America takes a more measured step, each region playing its unique tune in the global turbine control system symphony.

COVID-19 Impact Analysis on the Global Turbine Control System Market

COVID-19 initially dealt a blow to the Global Turbine Control System (GTCS) market. Disrupted supply chains, delayed projects, and plummeting energy demand led to reduced investments in new power plants and turbine upgrades, hindering market growth. However, the resilience of renewable energy, particularly in China, mitigated the impact. The pandemic unexpectedly accelerated digitalization, creating opportunities for remote monitoring and data-driven optimization solutions. Moreover, the post-pandemic focus on sustainable energy could stimulate demand for advanced control systems equipped with emission-reduction capabilities. While the initial impact was significant, the GTCS market exhibits signs of recovery and adaptation. Looking ahead, long-term prospects remain positive, but navigating this dynamic landscape requires agility and innovation. Players who embrace digitalization, prioritize cybersecurity, and develop eco-friendly solutions will be well-positioned to capitalize on emerging opportunities and shape the future of the GTCS market.

Latest trends/Developments

The Global Turbine Control System (GTCS) market is energized by innovation and adaptation. Driven by digitalization, AI, and sustainability concerns, the future unfolds with exciting trends. Industrial Internet of Things (IIoT) integration unleashes real-time data analysis, predictive maintenance, and remote monitoring, empowered by AI for optimized performance, issue anticipation, and improved decision-making, attracting significant investments. Meanwhile, increased connectivity necessitates robust cybersecurity solutions to safeguard critical infrastructure from cyberattacks, leading manufacturers to prioritize secure communication protocols and data encryption for reliable and safe operations. Finally, growing environmental anxieties propel demand for eco-friendly control systems, with emission reduction technologies like carbon capture and storage gaining traction alongside solutions aimed at optimizing fuel efficiency and renewable energy integration. This evolving landscape demands innovation and agility from players to capitalize on these promising opportunities and shape the future of the GTCS market.

Key Players:

-

Bharat Heavy Electricals Limited (BHEL) (India)

-

Rockwell Automation

-

Mitsubishi Heavy Industries Ltd

-

Mitsubishi Electric Corporation

-

Yokogawa Electric Corporation

-

Komatsu Ltd.

-

China National Heavy Machinery Corporation (China)

-

Siemens Energy

Chapter 1. Turbine Control System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Turbine Control System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Turbine Control System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Turbine Control System Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Turbine Control System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Turbine Control System Market – By Application

6.1 Introduction/Key Findings

6.2 Power generation

6.3 Oil and gas

6.4 Aerospace

6.5 Marine

6.6 Y-O-Y Growth trend Analysis By Application

6.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Turbine Control System Market – By Type

7.1 Introduction/Key Findings

7.2 Gas turbine control systems

7.3 Steam turbine control systems

7.4 Wind turbine control system

7.5 Hydro turbine control systems

7.6 Y-O-Y Growth trend Analysis By Type

7.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Turbine Control System Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Application

8.1.3 By Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Application

8.2.3 By Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Application

8.3.3 By Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Application

8.4.3 By Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Application

8.5.3 By Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Turbine Control System Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Bharat Heavy Electricals Limited (BHEL) (India)

9.2 Rockwell Automation

9.3 Mitsubishi Heavy Industries Ltd

9.4 Mitsubishi Electric Corporation

9.5 Yokogawa Electric Corporation

9.6 Komatsu Ltd.

9.7 China National Heavy Machinery Corporation (China)

9.8 Siemens Energy

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Turbine Control System Market t was valued at USD 21.1 billion in 2023 and will grow at a CAGR of 5.4% from 2024 to 2030. The market is expected to reach USD 30.49 billion by 2030.

Modernization of aging infrastructure, growing demand for renewable energy, and Growing demand for electricity and power generation are the reasons that are driving the market.

Based by Type it is divided into four segments – Gas turbine control systems, Steam turbine control systems, Wind turbine control systems, Hydro turbine control systems

Asia-Pacific is the most dominant region for the Global Turbine Control System Market.

Bharat Heavy Electricals Limited (BHEL) (India), Rockwell Automation, Mitsubishi Heavy Industries Ltd, Mitsubishi Electric Corporation etc.