Trusted Platform Module Market Size (2024-2030)

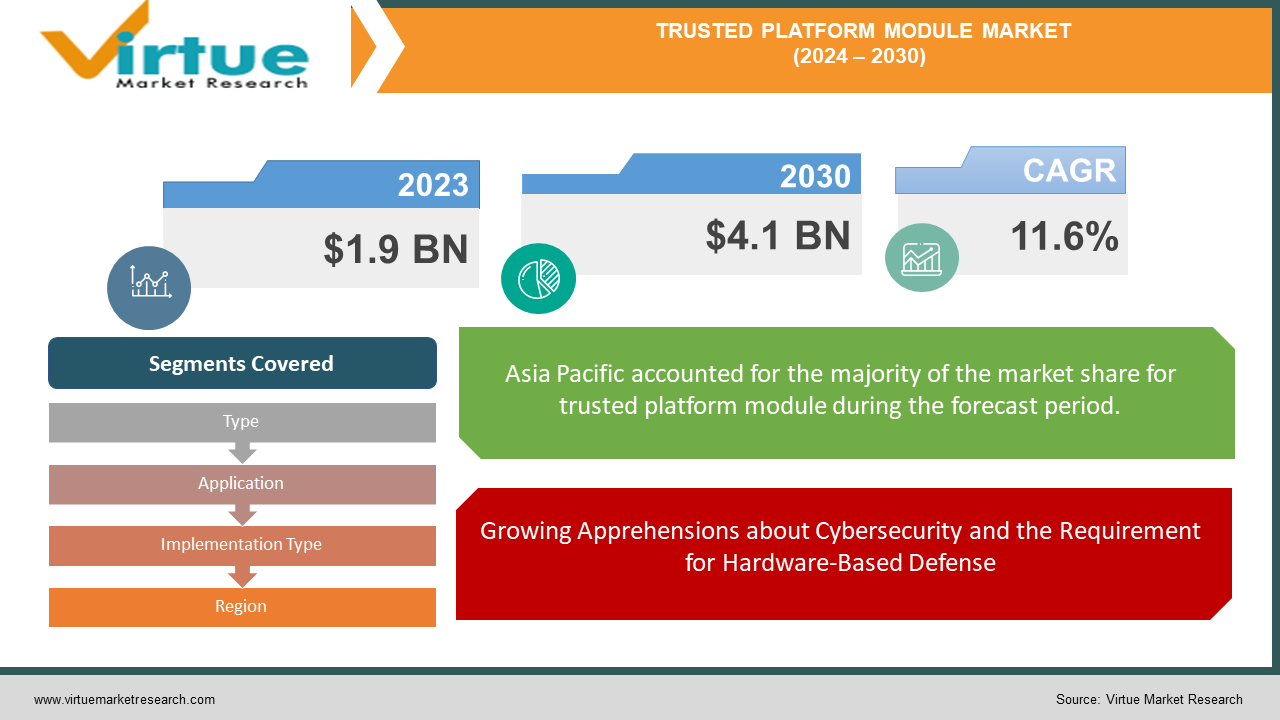

Global Trusted Platform Module Market was valued at USD 1.9 billion in 2023 and is projected to reach a market size of USD 4.1 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 11.6%.

The growing insecurity of our digital ecosystem is the premise driving the burgeoning Trusted Platform Module (TPM) sector. The need for improved security solutions grows as a result of the increase in cyberattacks and the ever-growing network of connected devices (phones, laptops, and Internet of Things). TPMs can help in this situation. They operate as an inbuilt hardware-based shield that provides cryptographic keys with a safe sanctuary and streamlines secure boot-up processes. To ensure the integrity and trust of our increasingly digital world, TPMs are essential because they provide an extra layer of security to protect data and prevent unwanted access.

Key Market Insights:

The market for Trusted Platform Modules (TPM) is surging due to concerns about cybersecurity. TPMs prevent unwanted access by protecting private information and securing boot procedures.

The rapid expansion of the IoT sector, with an estimated 75 billion devices by 2025, further fuels the demand for TPMs.

Additionally, advancements in TPM technology, including TPM 2.0, offer enhanced security features and improved compatibility with modern computing systems, reinforcing the TPM market's role in protecting data across various industries.

Global Trusted Platform Module Market Drivers:

Growing Apprehensions about Cybersecurity and the Requirement for Hardware-Based Defense:

Everyone is more mindful of security now because cyberattacks and data breaches are a constant threat to both individuals and enterprises. By offering a strong layer of hardware-based security to go along with conventional software solutions, TPMs allay this worry. TPMs become an indispensable tool in the battle against cybercrime by protecting private information, eliminating unwanted access, and guaranteeing platform integrity.

The Regulatory Environment Promoting TPMs and Data Protection as Compliance Enablers:

To preserve consumer privacy and information security, governments everywhere are passing stronger laws requiring robust data protection safeguards. Trusted Platform Modules are essential for guaranteeing adherence to these rules. Their features, such as encryption and secure boot, fully comply with the regulations outlined by different data protection legislation. Businesses show their dedication to data security and obtain a major competitive edge by implementing TPMs.

The Growing Need for Secure Device Connectivity and the Internet of Things (IoT):

The Internet of Things' rapid expansion has changed the way gadgets communicate and connect. But increased connectivity calls for reliable and expandable security measures. These networked devices have a safe foundation thanks to TPMs. They can be included in Internet of Things devices to safeguard private information, guarantee safe authentication, and stop illegal access. TPMs become a crucial part of protecting these networked devices as the Internet of Things ecosystem grows.

Cloud Adoption and the Requirement for Secure Systems in the Cloud:

Strong security measures are required to protect data stored on and accessed through cloud platforms due to the growing popularity of cloud computing. For cloud-based systems, Trusted Platform Modules provide important security characteristics. Integrating them with cloud infrastructure can improve security, guarantee data integrity, and stop unwanted access. To secure these cloud-based environments, TPMs will become increasingly important as cloud adoption increases.

Global Trusted Platform Module Market Restraints and Challenges:

Growth Potential of the Trusted Platform Module Market Faces Compatibility, Cost, and Awareness Obstacles.

The market for Trusted Platform Modules is being driven by the increasing demand for strong security as a result of cyberattacks, more stringent laws governing data protection, and the growth of cloud computing and the Internet of Things (IoT). However, there are still obstacles in the way of the industry's potential. These difficulties include onerous upfront expenditures that put a burden on budgets, especially for smaller enterprises, incompatibilities that impede integration with current infrastructure, and low user knowledge of the useful security features and data protection advantages provided by TPMs. To genuinely flourish in the TPM market, these cost pressures, compatibility issues, and knowledge gaps must be addressed.

Global Trusted Platform Module Market Opportunities:

The market for Trusted Platform Modules (TPM) is booming, driven by the pressing demand for strong security. The constant fear of cyberattacks, more stringent data protection laws, and the rapid expansion of cloud computing and the Internet of Things (IoT) are the main causes of this demand. In our interconnected world, TPMs play a powerful role in security by providing a multifaceted solution to security issues.

First and foremost, TPMs improve security solutions by adding a strong layer of hardware-based protection. They guarantee platform integrity, protect private information, and stop illegal access. This presents TPMs as an essential weapon in the battle against cybercrime, opening up a sizable market expansion opportunity as companies and organizations place a high priority on strong security.

Second, TPMs are essential to maintaining adherence to the more stringent data protection laws that have been implemented by governments across the globe. The protection of customer privacy and information security is the goal of this legislation. Because TPMs have characteristics like secure boot and encryption capabilities, they fully meet these needs. Businesses looking to comply with these changing requirements create a profitable potential for TPM adoption and market expansion, as data privacy regulations continue to gain traction.

TRUSTED PLATFORM MODULE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.6% |

|

Segments Covered |

By Type, Application, Implementation Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Intel Corporation, Microsoft Corporation, AMD (Advanced Micro Devices), Infineon Technologies AG, Nuvoton Technology Corporation, STMicroelectronics |

Trusted Platform Module Market Segmentation: By Type

-

TPM 1.2

-

TPM 2.0

As the largest and fastest-growing segment, TPM 2.0 dominates the Trusted Platform Module (TPM) market. With enhanced key management, greater encryption, and secure boot capabilities, TPM 2.0 provides a comprehensive security suite in contrast to its predecessor, TPM 1.2, which had fewer security features. These cutting-edge capabilities firmly establish TPM 2.0 as the industry leader by properly matching the ever-increasing security requirements of contemporary devices and systems.

Trusted Platform Module Market Segmentation: By Application

-

Mobile Security

-

Automotive

-

Banking

-

Transport

-

Pay TV & ID

-

Wearable Technology

-

Security in Internet of Things (IoT) Connectivity

The largest and fastest-growing sector in the Trusted Platform Module market by application is probably Security in Internet of Things (IoT) Connectivity. Strong security solutions are required due to the IoT ecosystem's rapidly growing number of connected devices, and TPMs provide a safe basis for data protection and communication. Security in IoT Connectivity is positioned as the leader in the TPM market because of this and the constraints of traditional security solutions for the wide range and diversity of IoT devices.

Trusted Platform Module Market Segmentation: By Implementation Type

-

Discrete TPM

-

Integrated TPM (fTPM)

Currently, Discrete TPMs hold the dominant share due to their flexibility and wider compatibility with various devices. Because of their greater interoperability and ability to be upgraded, discrete TPMs presently command a bigger market share.

TPM (fTPM) is the fastest-growing segment. The reason for this fast rise is fTPM's affordability, smaller size (perfect for IoT and mobile), and the trend of directly incorporating security into CPUs. Upgradeability and possible security issues are still considerations for fTPM, but in the long run, its benefits put it in a position to challenge Discrete TPM dominance.

Trusted Platform Module Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

At the moment, TPM sales are mostly concentrated in North America. Strong data security laws, widespread use of cutting-edge technologies like cloud and IoT, and the presence of top TPM manufacturers in the area are some of the reasons for this supremacy.

Asia Pacific is the region with the fastest growth. The TPM market is undergoing rapid expansion. The quick uptake of smartphones and other connected gadgets, a thriving economy, and growing disposable income are the main drivers of this growth. This expansion is further accelerated by government programs that support data security and digitization.

COVID-19 Impact Analysis on the Global Trusted Platform Module Market:

The market for trusted platform modules, or TPMs, has been impacted by the COVID-19 epidemic in several ways. On the one hand, there may have been a benefit to the first spike in remote work methods during lockdowns. Strong security solutions, such as TPMs, may have temporarily become more necessary as a result of employees accessing corporate systems and sensitive data from home networks. The increased need for safe hardware-based protection could have been an advantage for the TPM business.

It is possible, though, that the budgetary limitations that firms encountered during the economic uncertainty of the pandemic offset some of this initial potential development. TPMs and other innovative technologies might have been postponed or reduced when companies cut back on expenditures. The short-term growth trajectory of the market may have been hampered by this.

Latest Trends/ Developments:

Strong security solutions are needed in light of the Internet of Things (IoT) and cloud computing's rapid expansion. The capacity of TPMs to provide a hardware-based security base in these networked ecosystems is making them an increasingly popular option. They guarantee the integrity of the platforms themselves, secure channels of communication, and shield private information from illegal access. For safeguarding the wide variety of devices in the Internet of Things ecosystem and the constantly growing cloud infrastructure, this makes them an ideal match.

Another noteworthy development is the increasing uptake of Integrated TPM (fTPM) platforms. With fTPM, a device's primary CPU gains TPM capability directly, providing a number of benefits. As there is no longer a need for a separate TPM chip, it first lowers production costs for device manufacturers. Second, fTPM's direct processor integration enables a smaller device footprint—a critical feature in the mobile and IoT industries, where space is frequently at a premium. As TPM technology advances, the industry is also actively pursuing cost-reduction techniques through economies of scale.

Key Players:

-

Intel Corporation

-

Microsoft Corporation

-

AMD (Advanced Micro Devices)

-

Infineon Technologies AG

-

Nuvoton Technology Corporation

-

STMicroelectronics

Chapter 1. Trusted Platform Module Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Trusted Platform Module Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Trusted Platform Module Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Trusted Platform Module Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Trusted Platform Module Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Trusted Platform Module Market – By Type

6.1 Introduction/Key Findings

6.2 TPM 1.2

6.3 TPM 2.0

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Trusted Platform Module Market – By Application

7.1 Introduction/Key Findings

7.2 Mobile Security

7.3 Automotive

7.4 Banking

7.5 Transport

7.6 Pay TV & ID

7.7 Wearable Technology

7.8 Security in Internet of Things (IoT) Connectivity

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Trusted Platform Module Market – By Implementation Type

8.1 Introduction/Key Findings

8.2 Discrete TPM

8.3 Integrated TPM (fTPM)

8.4 Y-O-Y Growth trend Analysis By Implementation Type

8.5 Absolute $ Opportunity Analysis By Implementation Type, 2024-2030

Chapter 9. Trusted Platform Module Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Implementation Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Implementation Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Implementation Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Implementation Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Trusted Platform Module Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Intel Corporation

10.2 Microsoft Corporation

10.3 AMD (Advanced Micro Devices)

10.4 Infineon Technologies AG

10.5 Nuvoton Technology Corporation

10.6 STMicroelectronics

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Trusted Platform Module Market was valued at USD 1.9 billion in 2023 and is projected to reach USD 4.1 billion by 2030, growing at a CAGR of 11.6% during the forecast period.

The Trusted Platform Module market thrives on three key drivers: surging cybersecurity concerns, stricter data privacy regulations globally, and the booming growth of interconnected devices and cloud computing, all demanding robust security solutions like TPMs.

Discrete TPM, Integrated TPM (fTPM).

North America currently holds the largest share of the Trusted Platform Module market. This leadership is driven by a combination of factors: robust data security regulations, high adoption of advanced technologies like cloud and IoT, and a strong presence of leading TPM manufacturers within the region itself.

Intel Corporation, Microsoft Corporation, AMD (Advanced Micro Devices), Infineon Technologies AG, Nuvoton Technology Corporation, and STMicroelectronics.